- Home

- »

- Pharmaceuticals

- »

-

Smoking Cessation And Nicotine De-addiction Market Report, 2030GVR Report cover

![Smoking Cessation And Nicotine De-addiction Market Size, Share & Trends Report]()

Smoking Cessation And Nicotine De-addiction Market Size, Share & Trends Analysis Report By Type (Nicotine Replacement Therapy), By Form, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-908-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

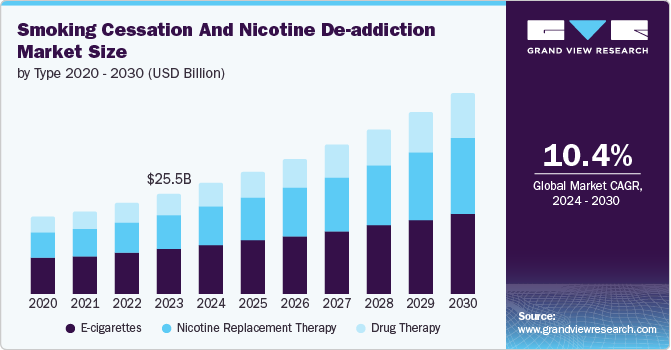

The global smoking cessation and nicotine de-addiction market size was valued at USD 25.46 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. The factors responsible for the market growth are the increasing prevalence of diseases caused due to smoking products. With governments taking initiatives in order to spread awareness about the downside of smoking, consumers are shifting to smoking cessation products in order to quit smoking. Furthermore, the key market players are also investing in development of cessation and de-addiction products, which has resulted in the growth of this industry.

Individuals who smoke are aware of the harmful effects of smoking on human body and serious illness caused due to smoking. Serious illnesses such as lung cancer, respiratory diseases and cardiac diseases are caused due to smoking and nicotine addiction. This has resulted in the rise in the number of consumers opting for cessation products in order to quit smoking and tobacco consumption.

Governments are also trying to regulate smoking and nicotine addiction by implementing stringent rules and spreading awareness through various campaigns such as imposing age limit for smoking, banning smoking in public areas and printing advertisements of warnings on tobacco and smoking products. Furthermore, government imposes heavy taxes on tobacco products which results upward market growth of this industry.

Moreover, urbanization and changing lifestyles and rise in the disposable income of population has further attributed to the market growth. Key players are investing heavily in developments of new products such as gums, sprays, and inhalers helping them penetrate the untapped market with younger population preferring range of options for cessation and reduce the urge to use tobacco products.

Type Insights

The E-cigarettes segment dominated the market in 2023 with a share of 45.3% in 2023 as e-cigarettes is considered as an alternative to the cigarettes as they do not produce carbon monoxide or tar which are toxic for the human health. Key market players promotes as an alternative to cigarettes that might help the consumers to reduce their addiction of tobacco products. Therefore, these factors attribute to the market growth of this segment.

The Nicotine Replacement Therapy (NRT) segment is expected to witness a fastest CAGR of 12.1% over the forecast period. NRT segment is further segmented into nicotine lozenges, nicotine gums, nicotine sprays, and nicotine inhalers. The market is growing due to the increased awareness of smoking addictions and the alternative which can be used to reduce the nicotine cravings. Therefore, the increased demand of these products in order to reduce nicotine addiction has attributed in the market growth of this segment.

Form Insights

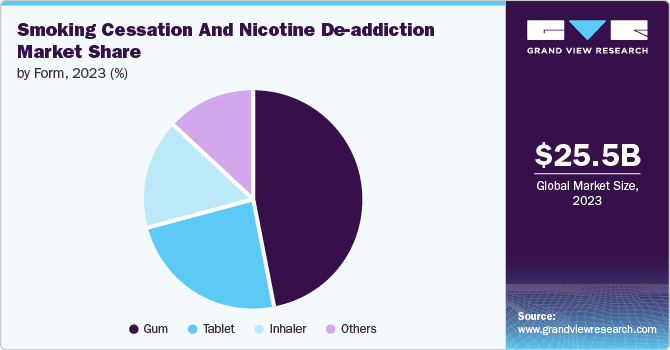

The gum segment dominated the market in 2023 with a share of 46.8% in 2023 as it is consumed in order to manage nicotine cravings. The gum provides nicotine which helps consumers to gradually reduce the nicotine addiction. Major companies are investing in this category as gums are accessible and user-friendly and can be consumed anywhere. With growing awareness about the nicotine, companies are innovatively advertising their products emphasizing on the accessibility and advantages of gum in order to reduce nicotine consumption.

The inhaler segment is expected to grow at the significant CAGR over the forecast period due to the effectiveness of inhalers as they provide quick delivery of nicotine which aids in managing the nicotine addiction. Inhalers also provide nicotine delivery without any irritation or discomfort as compared to skin patches or other products. Furthermore, this segment is also growing positively due to the heavy investments of key market players in de-addiction products as they are diversifying their range of products to increase their market penetration.

Distribution Channel Insights

The drug stores and retail pharmacies segment dominated the market in 2023 with a share of 45.2% in 2023 due to their accessibility and strong presence in the market. Drug stores and retail pharmacies provide access to many NRTs such as gums, patches, and inhalers under one roof conveniently to the consumers. The widespread presence of these stores across areas further aids in the positive market growth of this segment.

The online segment is anticipated to grow at the fastest CAGR over the forecast period. The market growth of this segment is attributed to the rise in digitization with consumers preferring online platforms to order products. Consumers can browse and compare products online and order them directly to their address. Online stores also provide discrete packaging which ensure package is delivered safely and privately to the consumers. Therefore, these factors attribute to the market growth of this segment.

Regional Insights

North America dominated the smoking cessation and nicotine de-addiction market with a market share of 40.3% in 2023. It is attributable to the presence of key market players in the region and their increased investment in the development of nicotine management products. There is a rise in the population willing to quit smoking. This is due to the increased awareness about smoking hazards and alternative to tobacco products done by governments and healthcare institutes has further attributed to the market growth of this region.

U.S. Smoking Cessation And Nicotine De-addiction Market Trends

U.S. dominated thesmoking cessation and nicotine de-addiction market in 2023 with a market share of 83.0% due to the rising awareness of nicotine de-addiction and cessation products. The increased awareness has led to willingness of adopting the nicotine de-addiction products. The increase in trend of quitting smoking and adopting to alternate options such as E-cigarettes has further attributed to the upward market growth of this country.

Europe Smoking Cessation And Nicotine De-addiction Market Trends

Europe smoking cessation and nicotine de-addiction market was identified as a lucrative region in this industry as it had a market share of 28.8% in 2023. Rising awareness about cessation and nicotine de-addiction and initiatives taken by government are responsible for the market growth in this region. Increased use of NRT products such as gums and patches among teenagers has further attributed to the market growth in this region.

UK smoking cessation And nicotine de-addiction market is expected to grow rapidly due to the initiatives taken by governments and healthcare organizations in order to spread awareness about smoking cessation and nicotine de-addiction. Furthermore, key market players are introducing de-addiction products with trendy advertisements. These factors attribute to the market growth in this country.

Asia Pacific Smoking Cessation And Nicotine De-addiction Market Trends

Asia Pacific smoking cessation and nicotine de-addiction market is anticipated to grow with a CAGR of 13.8% during the forecast period. The market growth is attributed to the presence of established healthcare infrastructure and awareness spread by governments regarding smoking addiction and knowledge about cessation and nicotine de-addiction products. Furthermore, the rise in disposable income has resulted in indviduals seeking for effective methods of quitting the smoking addiction. Therefore, these factors are responsible for the upward market growth in this region.

China smoking cessation and nicotine de-addiction market held a substantial market share due to strong presence of manufacturing companies and well spread distribution channel. The market growth is also attributed due to low manufacturing cost and availability of cheap labour in the country.

Key Smoking Cessation And Nicotine De-addiction Company Insights

Some of the major companies in the global smoking cessation and nicotine de-addiction market are Rusan Pharma Ltd, Dr. Reddy’s Laboratories Ltd, Zydus Group, British American Tobacco Plc. Companies are focusing on launching nicotine products which are appealing to consumers in order to manage nicotine craving. Companies are also launching NRTs with trending packaging and different flavours.

-

Imperial Brand plc is a British multinational tobacco company that sells tobacco products and alternative nicotine products.

-

Perrigo Company is a private over the counter pharmaceutical company. The company manufactures and sells healthcare products, prescription drugs, active pharmaceutical ingredients.

Key Smoking Cessation And Nicotine De-Addiction Companies:

The following are the leading companies in the smoking cessation and nicotine de-addiction market. These companies collectively hold the largest market share and dictate industry trends.

- Rusan Pharma Ltd

- Dr. Reddy’s Laboratories Ltd

- Imperial Brands Plc

- Zydus Group.

- British American Tobacco Plc

- Perrigo Company Plc

- Johnson and Johnson Inc

- NJOY, LLC

- Cipla Ltd

- GlaxoSmithKline Plc.

Recent Developments

-

In June 2023, Imperial Brand Plc, a tobacco and nicotine company announced the acquisition of nicotine pouches from TJP Labs in order to enter the U.S. market.

-

In June 2023, Altria Group, Inc announced the acquisition of NJOY LLC. NJOY e-vapor products are to be marked by NJOY, a wholly owned subsidiary of Altria.

Smoking Cessation And Nicotine De-addiction Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.11 billion

Revenue forecast in 2030

USD 50.90 billion

Growth Rate

CAGR of 10.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Rusan Pharma Ltd, Dr. Reddy’s Laboratories Ltd, Imperial Brands Plc, Zydus Group, Inc., British American Tobacco Plc, Perrigo Company Plc, Johnson and Johnson Inc, NJOY, LLC, Cipla Ltd, GlaxoSmithKline Plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smoking Cessation And Nicotine De-addiction Market Report Segmentation

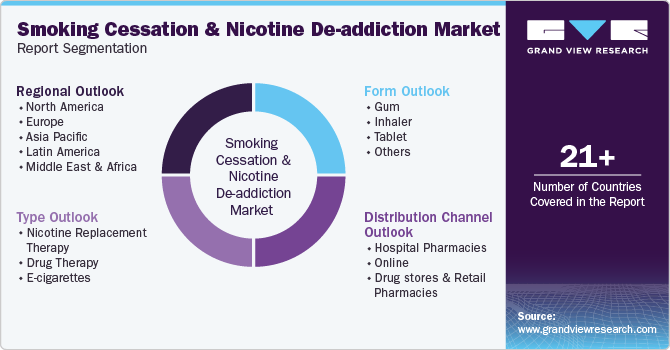

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smoking cessation and nicotine de-addiction market report based on type, form, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Nicotine Replacement Therapy

-

Nicotine Lozenges

-

Nicotine Gums

-

Nicotine Sprays

-

Nicotine Inhalers

-

-

Drug Therapy

-

E-cigarettes

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Gum

-

Inhaler

-

Tablet

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Online

-

Drug stores and Retail Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."