- Home

- »

- Clothing, Footwear & Accessories

- »

-

Snow Apparel Market Size, Share & Trends Report, 2030GVR Report cover

![Snow Apparel Market Size, Share & Trends Report]()

Snow Apparel Market Size, Share & Trends Analysis Report By Product (Top Wear, Bottom Wear), By Application (Skiing, Snowboarding, Hiking), By Price Point, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-072-4

- Number of Report Pages: 161

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Snow Apparel Market Size & Trends

The global snow apparel market size was valued at USD 17.39 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. The increasing popularity of snow sports and the subsequent rise in participation have been key drivers for the growth of snow apparel. This driver is supported by various factors that highlight the growing interest and engagement in winter sports activities. One of the significant factors contributing to the increasing popularity of snow sports is the sense of adventure and thrill they offer. Skiing, snowboarding, and ice climbing offer unique and exhilarating experiences, attracting individuals seeking excitement and outdoor challenges. The allure of conquering snow-covered mountains, gliding down slopes, and navigating through pristine landscapes has captured the attention of a diverse range of enthusiasts.

The growing interest in snow sports is evident in surveys and statistics that depict the rise in participation. According to a survey by Snowsports Industries America (SIA), interest in snow sports has been steadily increasing. The survey revealed that 25.1 million people in the U.S. participated in snow sports during the 2019/2020 winter season, representing a 1.9% increase compared to the previous year. This upward trend indicates a rising fascination with snow sports and their associated apparel. In addition to the U.S., snow sports participation has witnessed growth on a global scale. The 2022 International Report on Snow & Mountain Tourism highlighted that during the 2020-21 winter season, Europe reported over 150 million ski visits. This figure underscores the popularity of snow sports in Europe, with countries such as Switzerland, Austria, France, and Italy being renowned destinations for winter sports enthusiasts.

The appeal of European ski destinations extends beyond national visitors, as foreign skier visitations greatly surpass domestic numbers. This can be attributed to a diverse range of ski resorts with varying terrains, breathtaking landscapes, and well-developed infrastructure. These factors make Europe an attractive destination for skiers from around the world. Additionally, China has experienced a significant surge in winter sports interest in recent years. In the 2020-21 season alone, China recorded over 17.86 million visits to ski resorts, further indicating the global growth of snow sports. The higher number of foreign skier visits in Europe and China is expected to provide growth opportunities and will drive the snow apparel industry worldwide in the years to come.

The increasing number of snow sports-related tournaments, competitions, and events is expected to significantly impact snow apparel sales worldwide. These events provide a platform for athletes and enthusiasts to showcase their skills, attract a large audience, and create a heightened demand for specialized snow apparel. Major sporting events like the Winter Olympics, Winter X Games, and FIS World Cup play a pivotal role in driving snow apparel sales. These global competitions bring together the world's top athletes in skiing, snowboarding, and freestyle skiing. The extensive media coverage and public attention generated by these events create a significant market opportunity for snow apparel brands. Athletes become ambassadors for specific brands, and their performances influence consumer preferences. For instance, during the Winter Olympics, athletes are often seen wearing branded snow apparel, leading to increased brand visibility and consumer interest.

In addition to competitive events, recreational snow sports events, and festivals also play a significant role in driving snow apparel sales. These events, such as snowboarding festivals, ski resort events, and winter sports expos, create a vibrant atmosphere that attracts both participants and spectators. Attendees often seek the latest snow apparel trends and innovations, leading to increased sales for exhibitors and participating brands. These events also serve as a platform for new product launches, allowing brands to showcase their latest offerings to a captivated audience.

However, climate change and irregular snowfall significantly restrain the growth of the snow apparel market. As global temperatures rise and weather patterns become more unpredictable, the availability of consistent and sufficient snowfall in traditional snow sports regions is being affected. This has implications for the demand and usage of snow apparel. One of the notable impacts of climate change on the snow apparel industry is the reduction in the duration and quality of winter seasons. Warmer temperatures lead to earlier snow melts and later snowfalls, resulting in shorter winter periods for snow sports enthusiasts. This limited window of opportunity for engaging in snow activities directly impacts the demand for snow apparel.

Product Insights

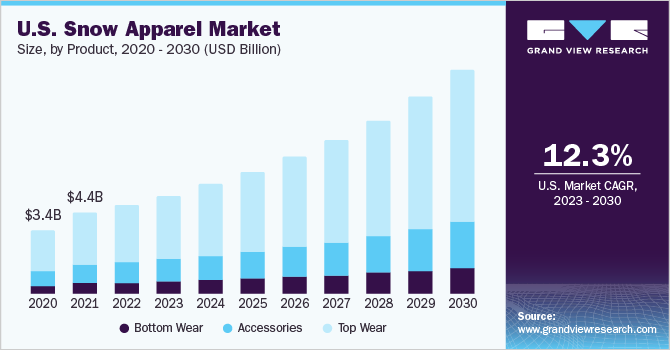

The top wear segment accounted for a share of over 65% in 2022. Top wear snow apparel is designed to provide warmth and protection against the cold, wind, and snow during winter activities such as skiing, snowboarding, and snowshoeing. These types of apparel include jackets, base layers, hoodies, sweaters, and turtlenecks. Jackets are the outermost layer and are designed to be waterproof, breathable, and insulated to keep the wearer warm and dry in cold and wet conditions. Base layers are worn closest to the skin, are more breathable, and are designed to provide warmth and wick away moisture. Hoodies and sweaters provide added warmth and insulation, and turtlenecks offer added coverage and protection against the cold.

Accessories are anticipated to grow at a CAGR of 10.4% over the forecast period from 2023 to 2030. Snow apparel accessories include handwear, headwear, and packs. The market drivers for snow apparel accessories include the growing demand for safety and comfort during snow sports, as well as technological advancements that allow for the integration of features such as touchscreen compatibility, adjustable vents, and built-in speakers. Additionally, the rise of online retailing has made it easier for consumers to access a wide range of snow apparel accessories from anywhere in the world.

Application Insights

The skiing segment accounted for a share of over 65% in 2022. Skiing has become an increasingly popular activity in recent years, especially among younger generations. As a result, skiing apparel, including jackets, pants, and gloves, has increased in demand. Moreover, The National Ski Areas Association (NSAA) reported record visitation at U.S. ski areas for the 2021-22 season, a total of 61 million skier visits. This is an increase of 3.5% over last season’s national number. Moreover, skiing apparel manufacturers are constantly leveraging new technologies to enhance the durability, breathability, and comfort of their products. For instance, some ski jackets now feature integrated heating systems to provide additional warmth on cold days. In December 2022, Helly Hansen introduced the Odin collection, which includes a range of jackets, pants, and other apparel, all designed with advanced materials and technologies to protect skiers in harsh weather conditions.

The snowboarding segment is expected to grow with a CAGR of 14.1% over the forecast period. Snowboarding apparel provides protection, warmth, and comfort to riders in cold and sometimes harsh weather conditions. Jackets, pants, and layers are the mostly used snowboarding apparel. The market for snowboarding apparel is driven by various factors, including the growth of the snow sports industry, advancements in technology and materials, and changing consumer preferences in terms of style, design, functionality, and sustainability. For example, consumers may prefer more fashionable apparel, or they may prioritize functionality and performance features such as breathability, waterproofing, and insulation.

Price Point Insights

The top wear priced between USD 101 to USD 200 accounted for a share of over 32% in 2022. The price point of snow apparel varies depending on the quality, features, and brand. Generally, snow apparel falls under the higher-priced category due to the specialized materials and technology required for warmth, waterproofing, and breathability. Consumers are willing to pay a premium for high-performing and fashionable snow apparel. However, there is also a demand for more affordable options. Factors governing this market include quality and performance, brand reputation, fashion trends, and technological advancements. Consumers mostly prefer top-wear snow apparel priced between $101 and $300 as these mid-range products offer a good balance of features, such as water resistance, breathability, and insulation, without being too expensive. It also allows consumers to invest in quality gear without breaking the bank.

The accessories price segment in the range of USD 51 to USD 100 is anticipated to grow at a CAGR of 13.9% over the forecast period. In terms of the price range, consumers may prefer gloves and mittens that fall in the mid-range category, typically priced between $50 and $100. These gloves and mittens are often made with high-quality materials, such as GORE-TEX, and feature additional insulation and waterproofing technologies to keep hands warm and dry in cold and wet conditions. Some consumers may also be willing to invest in high-end gloves and mittens with advanced features and technologies, such as touchscreen compatibility, wrist guards, and heated elements. These products can be priced at $100 or higher. For instance, Outdoor Research Lucent Heated Sensor Gloves are equipped with battery-powered heating elements for added warmth and comfort in extremely cold conditions. These gloves are priced at around $359, reflecting their advanced technology and specialized features.

Distribution Channel Insights

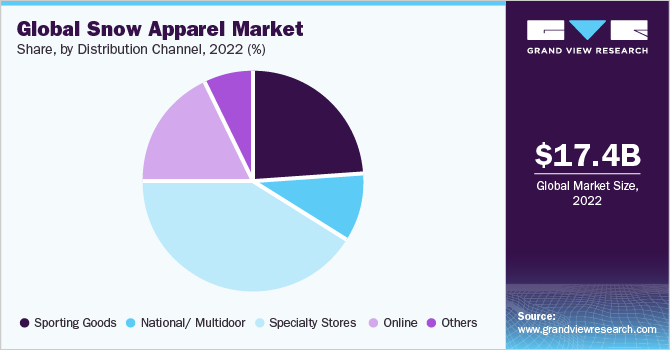

The specialty stores accounted for a share of over 40% of the global revenue in 2022. Specialty stores are one of the major distribution channels in this market due to the wide availability of diverse skiing and snowboarding apparel and accessories at these stores. Recreational skiers and snowboarders mostly prefer to shop offline because it offers a hands-on experience, allowing consumers to ensure that the clothing and accessories are a proper fit, effective, and comfortable. In addition, specialty stores offer a more personalized shopping experience and are staffed with knowledgeable salespeople who can provide expert advice on the best snow apparel based on the customer's needs. This includes recommendations on the right fit, features, and materials based on the individual's activity level and specific requirements.

The sales through the online channel are projected at a CAGR of 14.9% over the forecast period The e-commerce has become increasingly popular due to the convenience it offers shoppers. With just the click of a button, buyers can explore a wide variety of options from a single platform, making online shopping an attractive alternative to traditional brick-and-mortar stores. In addition, benefits such as doorstep delivery and substantial discounts are drawing more and more consumers to shop on online portals.

Key players are increasingly launching e-commerce websites to capitalize on the rising popularity of online shopping among the young population. Many niche players are also setting up shop online and offering high-quality snow apparel for various sports. These players give tough competition to other established names in the market, such as The North Face; Arc'teryx; Patagonia Inc; and Salomon.

Regional Insights

Europe held a share of over 45% of the global market in 2022. The region welcomes a vast number of tourists owing to its picturesque landscape and numerous resorts providing proper facilities for snow activities, which will lead to an increased demand for snow apparel during the forecast period. Consumers are increasingly looking for snow apparel that is not only functional but also stylish and durable which has led to a rise in demand for high-quality snow apparel made from advanced materials that offer better protection against harsh weather conditions.

The market in North America is anticipated to grow with a CAGR of 12.5% over the forecast period. The snow apparel industry in North America is growing steadily, driven by factors such as an increasing number of winter sports enthusiasts and growing awareness about the benefits of winter sports. The market remains highly competitive, with many established players and new entrants constantly developing new products and technologies to meet the needs of winter sports enthusiasts. In addition, there is a growing emphasis on sustainability and environmental responsibility among snow apparel manufacturers. Many companies are using recycled materials and sustainable production methods to create products that are better for the planet.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of these initiatives include:

-

In 2022 December, Gucci, a Kering brand, continued its focus on the winter season with the Après-Ski campaign for 2022. The campaign featured a selection of pieces designed for mountain leisure and activities. The Après-Ski collection was available at Gucci boutiques and on gucci.com. Moreover, there were numerous pop-ups in popular Alpine destinations like Courchevel, Cortina, Verbier, Courmayeur, and Kitzbühel.

-

In April 2022, The North Face launched its campaign for autumn/winter in New Zealand and Australia. In the "It's More Than A Jacket" campaign, North Face debuted five collections that paid homage to the brand's DNA. The Nuptse, the brand's most iconic insulation garment, was made available in a version composed of 100% recycled textiles as part of the campaign.

-

In February 2022, Burton Snowboards launched its Analog Winter 2022 Collection, which pushes the limits of design and function in snowboarding and outerwear clothing.

Some prominent players in the global snow apparel market include:

-

Columbia Sportswear Company

-

Kering

-

Amer Sports

-

Patagonia, Inc.

-

Decathlon

-

Lafuma

-

GOLDWIN INC.

-

Skis Rossignol S.A.

-

Burton Snowboards

-

Arc’teryx

-

The North Face (VF Corporation)

-

Norrona

-

Ortovox

-

Picture Organic

-

Jones

-

Helly Hansen

-

Dynafit

-

Flylow

- Black Crows

Snow Apparel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.15 billion

Revenue forecast in 2030

USD 41.28 billion

Growth rate

CAGR of 11.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, price point, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Switzerland; Austria; Japan; Australia; South Korea;

Key companies profiled

Columbia Sportswear Company; Kering; Amer Sports; Patagonia, Inc.; Decathlon; Lafuma; GOLDWIN INC.; Skis Rossignol S.A.; Burton Snowboards; Arc’teryx; The North Face (VF Corporation); Norrona; Ortovox; Picture Organic

Jones; Helly Hansen; Dynafit; Flylow; Black Crows

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Snow Apparel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global snow apparel market report based on product, application price point, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Top Wear

-

Insulated Shell

-

Shell

-

Fleece

-

Soft Shell

-

Insulation

-

Base Layer

-

-

Bottom Wear

-

Insulated Shell

-

Shell

-

Base Layer

-

-

Accessories

-

Hand Wear

-

Head Wear

-

Packs

-

Backcountry

-

Air Bags

-

Others

-

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Skiing

-

Snowboarding

-

Hiking

-

Others

-

-

Price Point Outlook (Revenue, USD Million, 2017 - 2030)

-

Top Wear

-

Up to USD 100

-

USD 101 to USD 200

-

USD 201 to USD 300

-

USD 301 to USD 400

-

USD 401 to USD 500

-

USD 501 to USD 600

-

USD 601 to USD 700

-

More than USD 700

-

-

Bottom Wear

-

Up to USD 100

-

USD 101 to USD 200

-

USD 201 to USD 300

-

USD 301 to USD 400

-

USD 401 to USD 500

-

USD 501 to USD 600

-

USD 601 to USD 700

-

More than USD 700

-

-

Accessories

-

Up to USD 50

-

USD 51 to USD 100

-

USD 101 to USD 150

-

More than USD 150

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Sporting Goods

-

National/ Multidoor

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Switzerland

-

Austria

-

-

Asia Pacific

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global snow apparel market size was estimated at USD 17.39 billion in 2022 and is expected to reach USD 19.15 billion in 2023.

b. The global snow apparel market is expected to grow at a compound annual growth rate of 11.4% from 2023 to 2030 to reach USD 41.28 billion by 2030.

b. Europe dominated the snow apparel market with a share of 45% in 2022. This is attributable to the region attracting a large number of tourists due to its stunning landscapes and abundance of resorts that cater to snow activities.

b. Major players in the snow apparel market include Columbia Sportswear Company; Kering; Amer Sports; Patagonia, Inc.; Decathlon; Lafuma; GOLDWIN INC.; Skis Rossignol S.A.; Burton Snowboards; Arc’teryx; The North Face (VF Corporation); Norrona; Ortovox; Picture Organic Jones; and Helly Hansen.

b. The growth of the snow apparel market is propelled by the increasing popularity of snow sports and the growing number of participants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."