- Home

- »

- Clothing, Footwear & Accessories

- »

-

Snow Sports Apparel Market Size And Share Report, 2030GVR Report cover

![Snow Sports Apparel Market Size, Share & Trends Report]()

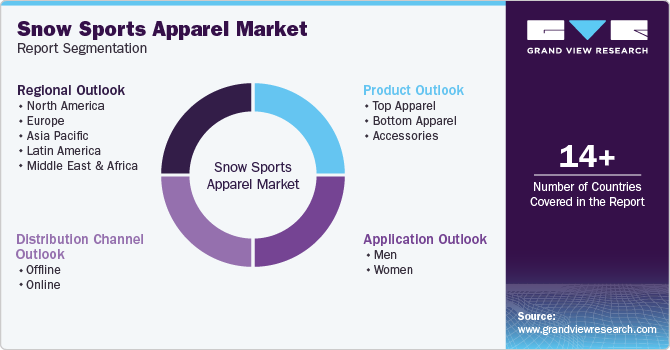

Snow Sports Apparel Market Size, Share & Trends Analysis Report By Product (Top Apparel, Bottom Apparel, Accessories), By Application (Men, Women), By Distribution Channel (Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-623-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Snow Sports Apparel Market Size & Trends

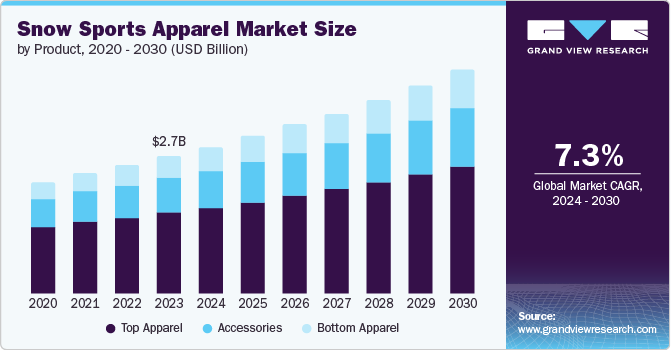

The global snow sports apparel market size was valued at USD 2.65 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. This growth can be attributed to the increasing popularity of winter sports such as skiing and snowboarding, which is leading to higher demand for specialized apparel. Also, advancements in fabric technology are resulting in more comfortable and durable snow sports clothing, attracting more consumers. The growing trend of outdoor recreational activities and fitness consciousness among people is also contributing to the market growth. Moreover, the expansion of e-commerce platforms is making it easier for consumers to access a wide range of snow sports apparel, further fueling the market growth.

Technological advancements have led to the development of innovative materials that enhance moisture-wicking and insulation properties. This, in turn, influences consumer preferences. By ensuring comfort and performance in extreme conditions, these advancements empower enthusiasts to focus on pushing their athletic limits rather than garment design. Furthermore, these innovations are fostering the emergence of new fashion trends on the slopes, further contributing to market expansion.

Rising environmental awareness presents a unique opportunity for industries to develop innovative and ethical production practices. This includes utilizing recyclable materials and pursuing eco-friendly solutions with a focus on long-term sustainability. This shift in the market landscape fosters increased competition, opening doors for new entrants with disruptive products. There is a growing trend of collaborations between fashion designers, snow sports brands, and athletes, all aiming to expand their market share through these sustainable practices. This heightened competition ultimately benefits consumers by driving significant market growth and a more comprehensive range of environmentally responsible options.

Product Insights

Top apparel products accounted for 59.0% of revenue in 2023. The growing popularity of winter sports, fueled by government initiatives in various countries, has spurred competition and participation. This has led to a heightened focus on safety, driving demand for protective gear, particularly shell tops. Many brands cater to this demand by offering fashion-forward shells crafted from the latest performance fabrics. Furthermore, advancements in material technology have allowed us to expand our offerings to include winter sports-adjacent products, such as water-resistant apparel suitable for synthetic ice rinks.

The accessories segment is anticipated to witness the fastest growth, with a CAGR of 7.6% from 2024 to 2030. This surge can be attributed to strategic collaborations between lifestyle brands and snow apparel brands. These partnerships are yielding innovative products that boast cross-functional applications and customizable features. This expanded product range, encompassing gloves, helmets, goggles, socks, and more, caters to a broader consumer base and fuels segment demand.

Application Insights

The men segment held the 62.8% market revenue share in 2023. This dominance likely stems from men's historically larger participation rate in snow sports. There's a well-established culture of men's skiing and snowboarding, reflected in sponsorships, media portrayals, and participation in professional leagues.

Women’s applications are expected to grow at a CAGR of 7.7% from 2024 to 2030. This surge can be attributed to the growing movement encouraging female participation in snow sports. Also, rising disposable incomes among women allow them to invest in proper winter sports apparel. Brands are recognizing this shift and creating stylish, high-performance women's snow apparel, further fueling the segment's growth.

Distribution Channel Insights

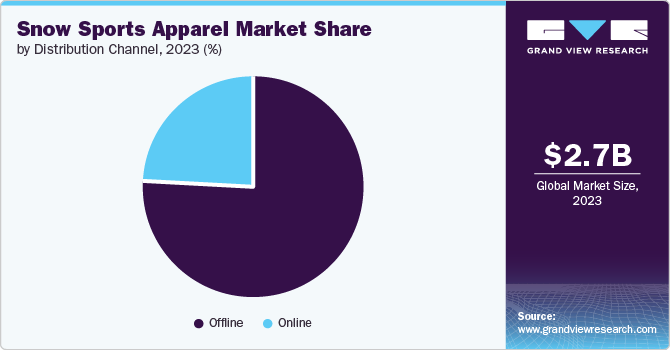

The offline segment dominated the market in terms of revenue share in 2023. Snow sports apparel is a very particular category, with specific technical requirements for warmth, waterproofing, and breathability. Customers often prefer the ability to try on clothes, feel the fabrics, and get expert advice from salespeople in person before making a purchase. Additionally, particular winter sports enthusiasts may enjoy the atmosphere and experience of visiting a specialty store, surrounded by like-minded individuals and the buzz of the upcoming season.

Online distribution channels are projected to witness the fastest CAGR of 7.9% from 2024 to 2030. This rapid growth indicates a growing preference for the convenience of online shopping. Consumers are increasingly comfortable purchasing winter sports apparel online, due to factors like improved product descriptions, detailed sizing information, and generous return policies. Additionally, the rise of online retailers specializing in snow sports gear offers a wider selection of brands and products than many local stores can carry.

Regional Insights

The North American snow sports apparel market dominated and accounted for the largest revenue share of over 38.15% in 2023. This dominance can be attributed to a well-established winter sports culture with popular destinations like Aspen and Whistler, a robust tourism sector encompassing various snow attractions, and favorable economic conditions characterized by high disposable income. These elements collectively drive significant growth within the market.

U.S. Snow Sports Apparel Market Trends

The U.S. snow sports apparel market dominated North America in 2023. This dominance can be attributed to robust competition within the U.S. market fosters continuous innovation in material science, design, and product functionality. This focus on technological advancement translates into a wider range of high-performance apparel options for consumers. Additionally, U.S. brands excel at implementing effective marketing strategies, successfully driving consumer demand and propelling significant market growth.

Europe Snow Sports Apparel Market Trends

Europe's snow sports apparel market was identified as a lucrative region in 2023. The factors behind this are the surging popularity of snow sports and evolving fashion trends. The confluence of these factors creates significant demand for innovative products that cater to both performance and aesthetics. This presents substantial opportunities for industry players to capitalize on and drive robust market growth within the region.

The UK snow sports apparel market is expected to grow rapidly in the coming years due to effective marketing strategies and brand promotion. These strategies influence consumer preferences towards the product and increase demand, which makes this a major driving force for the market in the region.

Asia Pacific Snow Sports Apparel Market Trends

The Asia Pacific snow sports apparel market is anticipated to witness significant growth in the upcoming years. The increasing popularity of winter sports like skiing and snowboarding is attracting a new generation of enthusiasts. Government investment in developing winter sports infrastructure, including resorts and artificial ski slopes, is creating more opportunities for people to participate in these activities. Finally, rising disposable income and growing urbanization in countries like China and India are leading to a greater interest in leisure activities, with winter sports being one of the beneficiaries.

China snow sports apparel market held a substantial market share in 2023. The 2022 Beijing Winter Olympics ignited a national passion for winter sports, significantly increasing participation. Also, China's growing middle class has more disposable income to spend on leisure activities and related equipment. The government initiatives to expand winter sports infrastructure, like new ski resorts, are creating a more accessible winter sports environment, further fueling market growth.

Key Snow Sports Apparel Company Insights

Some of the key companies in the global snow sports apparel market include Adidas, kering, Amer Sports, and many more. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Snow Sports Apparel Companies:

The following are the leading companies in the snow sports apparel market. These companies collectively hold the largest market share and dictate industry trends.

- VF Corporation

- Columbia Sportswear Company

- KERING

- Amer Sports

- Adidas Group

- DESCENTE LTD

- Decathlon

- Lafuma

- Goldwin Inc.

- Rossignol Group

Recent Developments

-

In March 2024, Snowsports Merchandising Corporation (SMC) and Sports Specialists Ltd (SSL) finalized their merger, creating Winter Sports Retailers, Inc. (WSR). This consolidation established WSR as the nation's largest network of specialty retailers, bringing significant opportunities for collaboration and resource sharing.

-

In November 2023, UNIQLO renewed its official supplier contract with the Swedish Ski Association, providing upgraded competition apparel for the mogul skiing team.

Global Snow Sports Apparel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.83 billion

Revenue forecast in 2030

USD 4.31 billion

Growth Rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, Tanzania

Key companies profiled

VF Corporation; Columbia Sportswear Company; KERING; Amer Sports; Adidas Group; DESCENTE LTD; Decathlon; Lafuma; Goldwin Inc.; Rossignol Group;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Snow Sports Apparel Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global snow sports apparel market report based on product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Apparel

-

Insulated Shell

-

Shell

-

Fleece

-

Soft Shell

-

-

Bottom Apparel

-

Insulated Shell

-

Shell

-

Others

-

-

Accessories

-

Handwear

-

Baselayer

-

Headwear

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Tanzania

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."