Soap And Detergent Market Summary

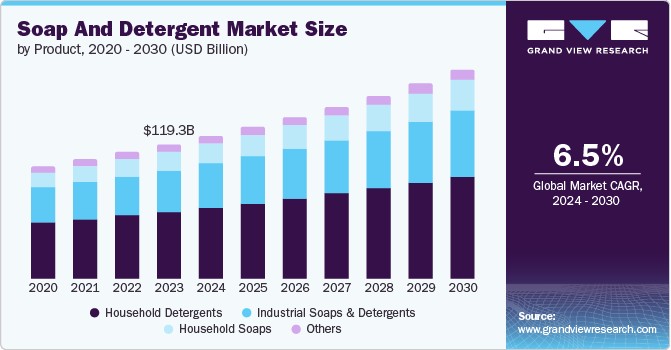

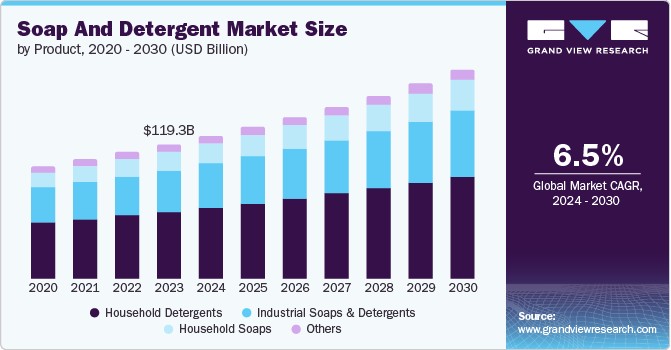

The global soaps and detergents market size was estimated at USD 119.34 billion in 2023 and is projected to reach USD 185.09 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The growth is driven by various factors such as increasing population, changing lifestyle and rising awareness in hygiene and cleanliness.

Key Market Trends & Insights

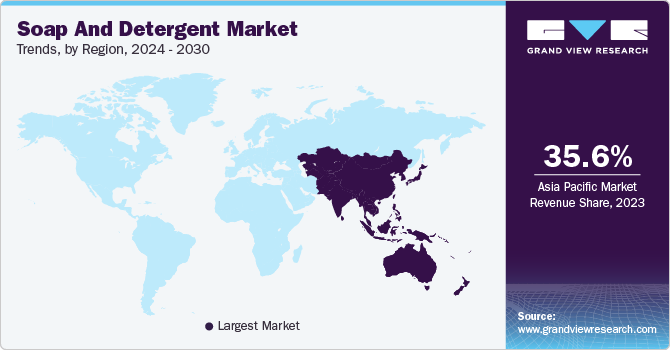

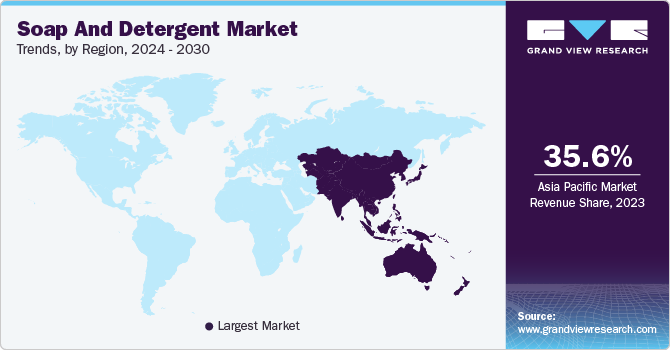

- Asia Pacific dominated the soaps and detergents market and accounted for the largest revenue share of 35.6% in 2023.

- China soaps and detergents market held a substantial market share in 2023.

- By product, household detergents dominated the market and accounted for a share of 50.1% in 2023.

- By form, liquid accounted for the largest market revenue share of 82.6% in 2023.

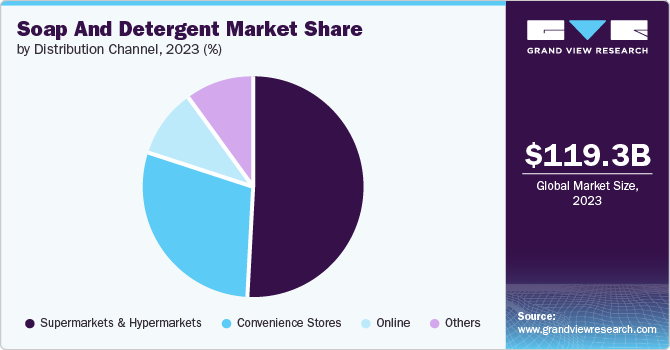

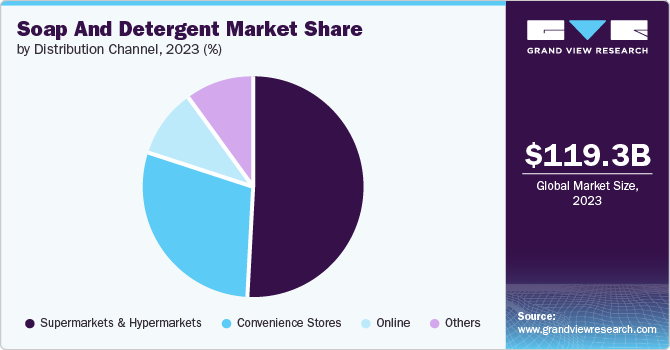

- By distribution channel, supermarkets and hypermarkets segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 119.34 Billion

- 2030 Projected Market Size: USD 185.09 Billion

- CAGR (2024-2030): 6.5%

- Asia Pacific: Largest market in 2023

Moreover, rising consumer demand for personal care products that are environment friendly is accelerating the market growth. Furthermore, the rising disposable income is changing consumer buying preference towards premium products.

Soaps and detergents are essential consumer goods due to their wide spread use. Consumers are spending heavily due to the rising disposable income and changing preference towards consumer goods. Consumers are more aware of the importance of hygiene, contributing to increasing demand for soft on skin, natural and chemical free soaps and detergents. Moreover, use of natural ingredients-based soaps and detergents is rising due to increasing awareness about benefits of organic and herbal based products.

Product Insights

Household detergents dominated the market and accounted for a share of 50.1% in 2023 owing to rising usage of detergents in laundry and household cleaning products. Household detergents are essential for everyday tasks such as washing clothes, laundry and dish cleaning. One of the major factors driving the market is rising installation of washing machines especially in emerging nations, which is accelerating the household detergent market.

The household soaps segment is anticipated to witness the fastest CAGR during the forecast period, owing to increasing population and rising consumer focus on hygiene and cleanliness. Household soaps are essential parts of our daily lifestyle and maintaining personal hygiene such as handwashing and bathing.

Form Insights

Liquid accounted for the largest market revenue share of 82.6% in 2023 owing to its convenience and effectiveness in removing dirt and stain. Laundry liquids help in removing the toughest stain and offer effective cleaning results.

The bar segment is expected to grow rapidly during the forecast period. The growth can be attributed to rising demand for personal care products and easy accessibility of bar soaps. The rising demand for natural and organic products is likely to propel market growth as these bars are chemical free. Furthermore, the demand for anti-bacterial is expected to grow in the coming years as these soaps play a crucial role in maintaining body hygiene and preventing infections.

Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the market in 2023. Supermarkets and hypermarkets offer a wide range of products under one roof, providing convenience and saving time and efforts of consumers. Supermarkets and hypermarkets offer a vast selection of soaps and detergents from various brands to meet the consumer needs at one place. Moreover, the promotional offers and competitive prices attract consumers to shop from supermarkets.

The online segment is projected to grow at the fastest CAGR of 7.1% during the forecast period, owing to growing trend of online shopping and availability of wide variety of items. Online sales offer several benefits such as home delivery, convenience and product reviews which help consumer to make purchase decision.

Regional Insights

North America was identified as a lucrative region for the soaps and detergents market owing to high demand for premium quality and rising consumer awareness towards hygiene and cleanliness. Moreover, rising adoption of skin friendly products along with products made up of natural ingredients is driving the market growth.

U.S. Soaps And Detergents Market Trends

The U.S. soaps and detergents market dominated the North America market in 2023 owing to rising demand for natural and organic soaps and detergents.

Europe Soaps And Detergents Market Trends

Europe soaps and detergents market held a substantial market share in 2023 owing to increasing demand for luxury personal care products. The market is driven by growing demand for organic and skin-friendly soaps and detergents which is likely to fuel market expansion during the forecast period.

The UK soaps and detergents market accounted for the largest revenue share in 2023. The growth can be attributed to rising awareness among consumers for hygiene and. The region encompasses consumers with a high standard of living who are ready to invest in products that offer convenience.

Soaps and detergents market in Germany is expected to grow rapidly during the forecast period driven by the rising adoption of organic and eco-friendly soaps and detergents that is gentle to skin and fabrics.

Asia Pacific Soaps And Detergents Market Trends

Asia Pacific dominated the soaps and detergents market and accounted for the largest revenue share of 35.6% in 2023 and is anticipated to witness the fastest CAGR of 7.6% during the forecast period, owing to rapid urbanization and increasing per capita income. The changing lifestyle patterns and consumer preferences towards quality personal care products are driving the demand.

China soaps and detergents market held a substantial market share in 2023, owing to rising population and rapid urbanization in the country. Furthermore, the rising attention to hygiene and cleanliness has accelerated the growth in the country.

The soaps and detergents market in India is expected to witness significant growth during the forecast period, owing to rising disposable income and vast population. The rising disposable income contributes to increasing demand for premium products. Moreover, the rising adoption of natural and organic products in soaps and detergents such as neem, turmeric, and aloevera is likely to propel the market growth.

Key Soap And Detergent Company Insights

Some of the key companies in the soaps and detergents market include Unilever plc; Procter & Gamble; Colgate-Palmolive Company; Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Soaps And Detergents Companies:

The following are the leading companies in the soaps and detergents market. These companies collectively hold the largest market share and dictate industry trends.

- Ecolab Inc.

- Unilever plc

- Church & Dwight Co.

- Procter & Gamble

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- Lion Corp.

- Reckitt Benckiser Group PLC

- The Clorox Company

- Amway

Recent Developments

-

In April 2024, Procter and Gamble launched Tide Evo. The laundry detergent is in the form of a tile and is expected to offer superior cleaning power.

-

In January 2024, Karnataka Soap and Detergents Limited (KSDL) launched products under “Mysore Sandal Wave”, which includes 3 types of shower gels, 10 types of Mysore sandal soaps, hand wash, six novelties of soap kits and mineral water.

Soaps And Detergents Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 126.49 billion

|

|

Revenue forecast in 2030

|

USD 185.09 billion

|

|

Growth Rate

|

CAGR of 6.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, form, distribution channel, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Saudi Arabia.

|

|

Key companies profiled

|

Ecolab Inc.; Unilever plc; Church & Dwight Co.; Procter & Gamble; Henkel AG & Co. KGaA; Colgate-Palmolive Company; Lion Corp.; Reckitt Benckiser Group PLC; The Clorox Company; Amway;

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

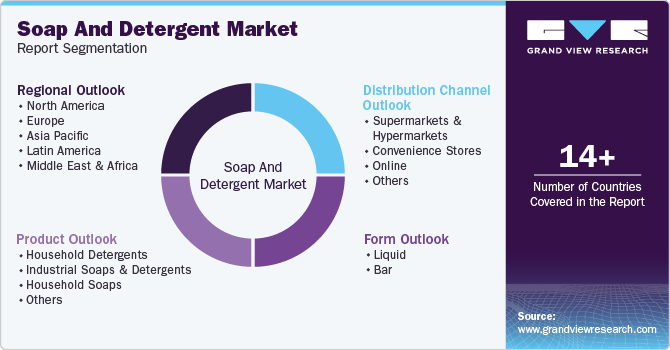

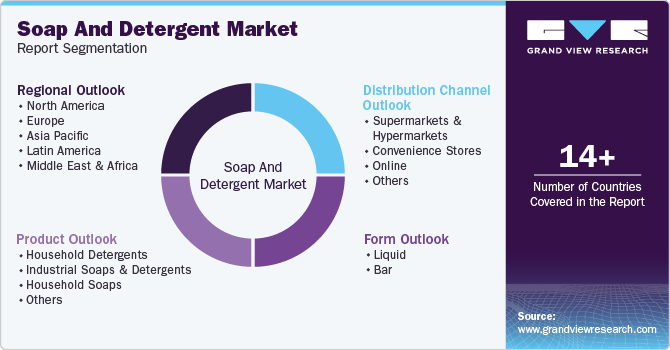

Global Soap And Detergent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soaps and detergents market report based on product, form, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)