- Home

- »

- Communications Infrastructure

- »

-

Social Commerce Market Size, Share & Growth Report, 2030GVR Report cover

![Social Commerce Market Size, Share & Trends Report]()

Social Commerce Market Size, Share & Trends Analysis Report By Business Model, By Product Type, By Platform/Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-318-0

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

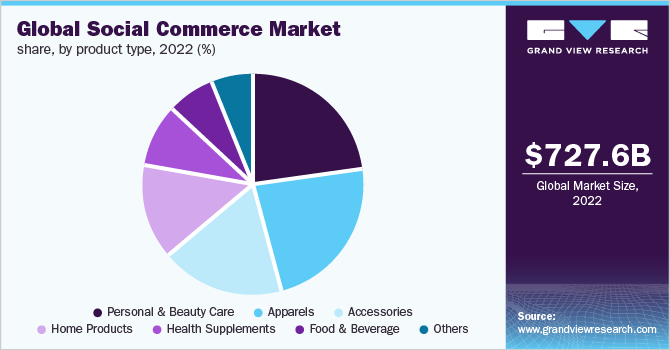

The global social commerce market size was valued at USD 727.63 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 31.6% from 2023 to 2030. Increased adoption of social media, average time spent on these platforms during the pandemic, and ease of buying products online are expected to drive the market growth. Social commerce integration with social media platforms to drive and/or process online purchases has led to new forms of shopping in collaboration with virtual environments.

By allowing customers to shop and checkout directly via social media platforms, social commerce eliminates unnecessary additional steps and helps streamline buying process. The market is expected to gain traction owing to a penetration of a smooth shopping process and product discovery and checkout. Moreover, the increased number of interested buyers from different social media platforms such as Pinterest, Snapchat, Facebook, and Instagram are also expected to drive market growth over the forecast period.

Social commerce enabled the convergence of content shopping, sharing, payments, and messaging features. Seamless access to social media networking sites coupled with a high level of impulse buying, especially amongst Gen Z and millennials, has created huge potential for several brands/sellers to increase their sales, which will lead to attracting new customers.

Moreover, social commerce has given merchants/brands the power to merge social media and e-commerce sites, thereby providing a huge branding opportunity. This has led to enhanced social media presence and has allowed brand awareness to stay in the minds of customers through daily engaging content.

Social commerce has become a democratizing force as it has opened new avenues of opportunities for small businesses and individuals. Social buyers are more likely to buy from a small business when shopping through social commerce in comparison to that of e-commerce sites. Several factors support this trend, including the fact that individuals are spending an increasing amount of time on social media platforms. Studies suggest that an average individual spends over two hours on a social media platform each day and is likely to buy from a brand that they have not encountered previously.

A shift in consumer preference is one of the significant factors driving the social commerce market growth. Along with innovations in mobile technology, consumers have become accustomed to immediate communication and now look forward to instant customer service. Additionally, consumers are looking for new avenues to engage with brands using the latest technology, with younger generations seen dominating the social commerce charge. As per the global web index report, the usage of social commerce is comparatively high among millennials and generation Z, who are prone to purchase over 60% from social media platforms.

COVID-19 compelled users to spend more time on the social media platform, which pushed retailers to increase their investments in advertisements. This, in turn, has led brands to extend their reach to new customers and varied product categories. Furthermore, pandemic-induced lockdowns and restrictions in 2020 triggered a behavior shift among in-store buyers, including non-digital communities. Users began to lean toward online shopping as social distancing became the norm. Customers became more comfortable and confident while spending time and money in a digital environment, thereby paving the way for social commerce market growth.

Despite the market being estimated to record significant growth in coming years owing to benefits mentioned above, increasing concerns among users over data collection and potential use of personal information by social media platforms are emerging as possible restraint for market growth. While advances in technology are helping to predict the market, any misuse of customer-related data can lead to losses and potential liabilities for both consumers and sellers.

Social media users are apprehensive about illegal access to data as many social media sites are not shielded against the risk of cyberattacks. Security concerns are expected to be a short-term hindrance as retailers/vendors are working collectively with third-party payment platforms to offer a safer and more secure payment environment to consumers.

Market Dynamics

An exponential rise in the user base of social networking sites such as Facebook, Twitter, Instagram, LinkedIn, and YouTube is encouraging companies to reach their consumers through these platforms. Moreover, a convergence of content sharing, shopping, payments, and messaging features has enabled the proliferation of social commerce. Social commerce has led to new forms of shopping in collaboration with online environments. Therefore, the rising adoption of e-commerce and social media platforms for shopping and information exchange is expected to fuel market growth.

An increasing number of businesses are turning to social commerce to cater to old and potential new customers. Several factors are contributing to this trend, including the fact that individuals are spending an increasing amount of time on social media platforms; studies suggest that an average individual likely spends over two hours on social media platforms every day. Additionally, these platforms act as efficient marketing tools, giving an impetus to a steady rise in online shopping through social media platforms as they allow customers to make their purchases in a more interactive manner as compared to conventional e-commerce platforms.

Providing a platform for establishing personalized customer journeys through social interactions, social commerce platforms are attracting businesses of all sizes. For a long period, social media acted as a platform for users to window-shop before moving to e-commerce sites such as Amazon.com and Walmart to make a purchase. However, social media platforms are now allowing brands to build communities, relationships, and trust with customers. Visual-first platforms such as Instagram and Pinterest have played a pivotal role in bringing about this change by providing the seamless integration of e-commerce products.

Business Model Insights

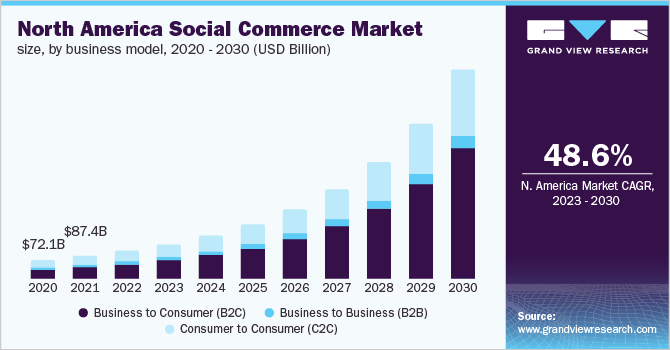

B2C segment has dominated with a market share of 55.97% in 2022 owing to factors such as a shift in consumer behavior mindset and rising adoption of digital mode, which contribute to the growing demand for business-to-consumer (B2C) business model. Social commerce platforms allow customers to easily observe, select, and order a product while evaluating the same by checking reviews written by other users.

C2C segment is likely to grow at a CAGR of 27.6% during the forecast period. C2C business model refers to websites that act as intermediaries between customers. This model enables sellers to be the buyers and buyers to be the sellers. Customers can interchange their roles based on their requirements. The B2B segment is expected to witness steady growth in the coming years.

Various companies and businesses generally use this model to sell their product and services to other buyer companies. The B2B model caters to niche markets too, such as pet stores or pet foods, and fulfills the requirements of customers. WeChat Business is one of the most recent mobile social network businesses that utilize business and personal relationships to enhance customer relationships.

Platform/Sales Channel Insights

Video Commerce dominated the market with a share of 42.5% in 2022. The segment is expected to witness considerable growth, expanding at a CAGR of 33.6% in the coming years. In recent times, live-stream shopping has grown immensely and has enticed viewers to buy from a live shopping event. For instance, in December 2021 Walmart Inc. entered into a partnership with TikTok and underwent a first pilot test that facilitated a live-streaming shopping experience.

Live to sell as a marketing method has facilitated sales conversion rate and buyer experience. It helps enhance the time spent by the customers on the seller’s social pages and easily attracts new customers. As live streaming matures throughout the Asia Pacific region and develops in Western countries, with TikTok’s short-form video boom, every major player now has some iteration of this format such as YouTube Short, Snapchat Spotlight, and Instagram Reels to name a few. This, in turn, is expected to generate ample opportunity to drive engagement, thereby driving the segment growth.

Product Type Insights

In 2022, the apparel segment led the market, accounting for a revenue share of 23.4%. The clothing and apparel business is the most significant business than any other products online as it has considerable popularity and demand on social media platforms. During the COVID-19 pandemic, as people were online for most of the time, fashion retailers discovered new ways to cultivate shopping experiences, engage influencers/creators, and connect in new ways.

For instance, Express, a U.S.-based fashion retailer empowered regular shoppers and influencers to become the Style Editors", set up Express storefronts, and be rewarded for driving sales and drawing new customers.

Personal and beauty care segment is estimated to grow at the highest CAGR of 36.2% during the forecast period. Shoppers buy online because they have a clear understanding of what the user experience will be after purchasing a product. Personal and beauty care brand marketers and owners prioritize data for their customer targeting and product development.

Using social commerce beauty brands creates the scope for a rich global audience and international markets without acquiring or hiring local sellers and distributors. Sellers on social commerce platforms are offering cashback, discounts, same-day or next-day deliveries, EMI options, click & collect options, and many more services that make online shopping easier and more lucrative online shopping than offline buying.

Regional Insights

Asia Pacific accounted for a 70.3% market share in 2022. It is expected to grow steadily over the forecast period owing to factors such as rising investments in telecommunication infrastructure, a proliferation of smartphones, and widespread reach of social media websites such as Facebook, Instagram, and Twitter. Moreover, growing number of smartphones and social media users in countries like China mainly contribute immensely to the regional market growth.

North America emerged as the second-largest regional segment in the social commerce market in 2022. It is expected to grow at a significant CAGR of nearly 29.3% during the forecast period. The e-commerce and social commerce landscapes in the U.S. are a lot more fragmented in comparison to developing countries. This region displays a significant difference in consumer attitudes and subsequent behavior. This continues to govern the growth of social media consumption, digital shopping, payments, and concerns about online privacy as well.

Key Companies & Market Share Insights

Companies are entering into organic and inorganic growth strategies such as solution/ product launches & developments, geographical expansion, mergers & acquisitions, and partnerships to stay ahead in the competitive market scenario. For instance, in April 2021, Pinterest entered into a partnership with Shopify, Inc., an e-commerce solution provider, to expand its social commerce presence internationally. The partnership allows the former to provide a Pinterest platform in 27 countries, including the U.K., Austria, Brazil, Italy, France, Germany, Australia, Spain, and Switzerland. Some prominent players in the global social commerce market include:

-

Etsy, Inc.

-

Fashnear Technologies Private Limited (Meesho)

-

Meta Platforms, Inc. (Facebook)

-

Pinduoduo Inc.

-

Pinterest, Inc.

-

Poshmark

-

Roposo

-

Snap, Inc.

-

Taobao

-

TikTok (Douyin)

-

Trell Shop

-

Twitter, Inc.

-

WeChat (Weixin)

-

Xiaohongshu

-

Yunji Sharing Technology Co., Ltd.

Social Commerce Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 913.90 billion

Revenue forecast in 2030

USD 6,243.94 billion

Growth Rate

CAGR of 31.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Business model, product type, platform/sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Australia; Indonesia; Singapore; South Korea; Thailand; Philippines; Vietnam; Malaysia; Brazil; Mexico; Rest of Europe; Rest of Asia Pacific; Rest of Latin America

Key companies profiled

Etsy, Inc.; Fashnear Technologies Private Limited (Meesho); Meta Platforms, Inc. (Facebook); Pinduoduo Inc.; Pinterest, Inc.; Poshmark, Roposo, Snap, Inc.; Taobao; TikTok (Douyin); Trell Shop; Twitter, Inc.; WeChat (Weixin); Xiaohongshu; Yunji Sharing Technology Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Social Commerce Market Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global social commerce market report based on business model, product type, platform/sales channel, and region:

-

Business Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business to Consumer (B2C)

-

Business to Business (B2B)

-

Consumer to Consumer (C2C)

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal & Beauty Care

-

Apparels

-

Accessories

-

Home Products

-

Health Supplements

-

Food & Beverage

-

Others

-

-

Platform/Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Video Commerce (Live stream + Prerecorded)

-

Social Network-led Commerce

-

Social Reselling

-

Group Buying

-

Product Review Platforms

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

Singapore

-

South Korea

-

Thailand

-

Philippines

-

Vietnam

-

Malaysia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global social commerce market size was estimated at USD 727.63 billion in 2022 and is expected to reach USD 913.90 billion in 2023.

b. The global social commerce market is expected to grow at a compound annual growth rate of 31.6% from 2023 to 2030 to reach USD 6,243.94 billion by 2030.

b. Asia Pacific region dominated the global social commerce market with a share of 70.32% in 2022. This is attributed to rising investments in the telecommunication infrastructure, growing demand for smartphones, and the widespread reach of social media websites such as Facebook, Twitter, and Instagram.

b. Some key players operating in the social commerce market include Facebook Inc.; Etsy Inc.; Pinterest Inc.; LinkedIn Corp.; Cisco; and Tencent Holdings Ltd.

b. Key factors driving the social commerce market growth include increasing social media advertising, a rising generation Z population, a growing number of social media platforms, and ease of shopping on social media.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."