- Home

- »

- Next Generation Technologies

- »

-

Software-defined Wide Area Network Market Size Report, 2030GVR Report cover

![Software-defined Wide Area Network Market Size, Share & Trends Report]()

Software-defined Wide Area Network Market (2022 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Organization Size, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-011-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Software-defined Wide Area Network Market Summary

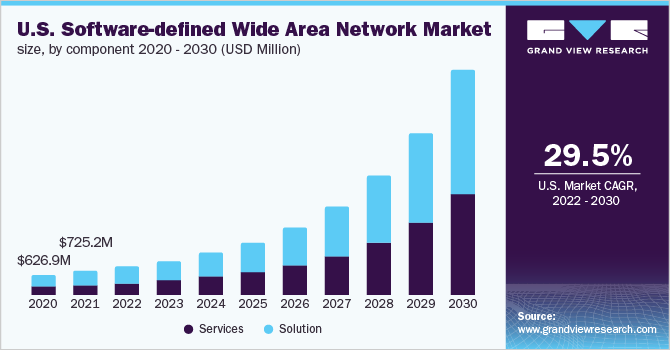

The global software-defined wide area network market size was estimated at USD 2.9 billion in 2021 and is projected to reach USD 30.4 billion by 2030, growing at a CAGR of 30.9% from 2022 to 2030. A software-defined wide area network (SD-WAN) links and expands business networks across large geographical areas.

Key Market Trends & Insights

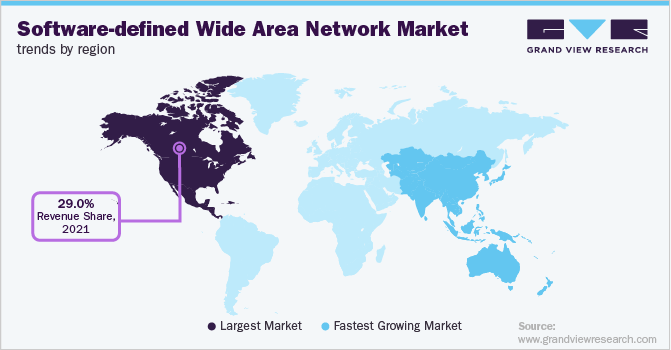

- In terms of region, North America was the largest revenue generating market in 2021.

- Asia Pacific is expected to register the fastest CAGR from 2022 to 2030.

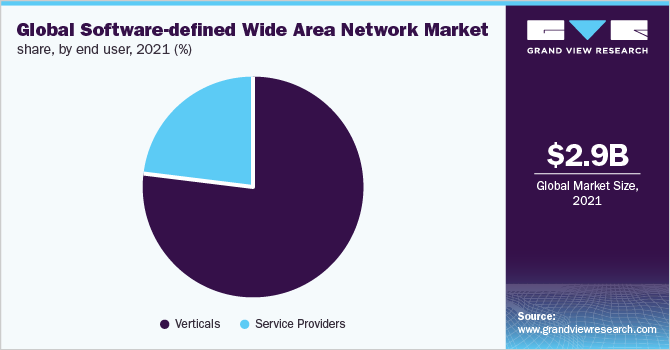

- In terms of end use, the verticals segment dominated the market in 2021 and accounted for a revenue share of 76.0%.

- The service providers segment is anticipated to register significant growth over the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 2.9 Billion

- 2030 Projected Market Size: USD 30.4 Billion

- CAGR (2022-2030): 30.9%

- North America: Largest market in 2021

The growth of the SD-WAN market can be attributed to its ability to simplify WAN, reduce operating costs, increase bandwidth efficiency, and have seamless compatibility with the cloud. Moreover, SD-WAN offers significantly better application performance without sacrificing security and data privacy. Additionally, the growing adoption of cloud-based services, and software-as-a-service (SaaS) among enterprises, is driving the need for better connectivity, which is expected to fuel the market’s growth.

WANs use network links such as wireless, broadband, virtual private networks (VPNs), multiprotocol label switching (MPLS), and the internet to allow employees to work remotely and access corporate applications, servers, and resources regardless of their location. While SD-WAN monitors the performance of all these WAN connections and manages traffic, ensuring high-speed and optimizing connectivity of all the networks. According to a report published by Palo Alto Networks, a cybersecurity company, 60% of companies are expected to implement SD-WAN to enhance support for cloud applications and agility by 2024. The adoption of SD-WAN is increasing due to its ability to decrease costs and improve the overall user experience.

In August 2022, a multi-cloud infrastructure automation software provider HashiCorp, Inc., published its 2022 State of Cloud Strategy Survey. According to the survey, 87% of respondents from across the globe stated that they rely on cloud platforms for centralized operations in their organizations. As more and more enterprises opt for the cloud and subscribe to software-as-a-service (SaaS), they benefit by accessing many applications centrally through the cloud. As a result, traditional WAN is insufficient for organizations; hence they are opting for SD-WAN to improve their network management, business productivity, and customer satisfaction and, ultimately, to improve profitability, propelling the market’s growth.

With traditional approaches such as MPLS, traffic created in the branch is backhauled to a centralized data center. This large volume of data can lower application performance and hinder the user experience. At the same time, SD-WAN makes traffic management easier and directs it across the network. Moreover, MPLS is not designed to handle large volumes of WAN traffic resulting from cloud applications. SD-WAN can handle these higher volumes, making it a superior choice compared to MPLS, which bodes well for the adoption and growth of the SD-WAN market.

Despite the significant benefits provided by SD-WAN, it has yet to be fully adopted due to its complex deployment and slower performance. SD-WAN networks are immune to slower performance, and enterprises must rely heavily on IT staff to deploy and maintain this highly technical and complex SD-WAN. Failing to do so can lead to calling for help from outside and can become costly. However, businesses are using advanced technologies to eliminate the kinks in adopting this technology. As such, companies are integrating SD-WAN solutions with artificial intelligence for IT operations (AIOps) to automate manual tasks, which is expected to drive the market’s growth over the forecast period.

COVID-19 Impact Analysis

The COVID-19 pandemic played a vital role in driving the adoption of SD-WAN among enterprises. Whether ready or not, enterprises had to accelerate their digital transformation strategies due to stay-at-home directives amid the pandemic. As remote workforces grew, it strained the enterprise’s infrastructure and disrupted business continuity. The pandemic caused enterprises to re-evaluate their operations and seek new ways to improve performance and efficiency. Amid this chaos, enterprises sought the help of SD-WAN to provide efficiency and connectivity to their remote workers. According to a WAN Manager Survey published by TeleGeography, 43% of enterprise WAN managers installed SD-WAN in 2020-2021, compared to 18% in 2018. The growth in the adoption of SD-WAN during the pandemic is expected to be sustained over the forecast period.

Component Insights

The solution segment dominated the market in 2021 and accounted for a revenue share of more than 57.0%. The SD-WAN solution segment has been further sub-segmented as hardware and software. SD-WAN is a technology that uses hardware and software components to create a link between the central network and various other branch offices and data centers. The software component of SD-WAN refers to a cloud computing technology that is useful for the data centers based at the headquarters, while hardware relates to devices such as SD-WAN routers and controllers. The benefits of cost efficiency, enhanced productivity, and improved performance provided by SD-WAN solutions contribute to the segment’s growth.

The services segment is anticipated to register the fastest growth over the forecast period. The services segment has been further bifurcated by managed services and professional services. SD-WAN is a complex technology that needs scheduled maintenance from technology specialists, and failing to do so can result in higher incurred costs. SD-WAN providers often provide additional services to deploy, integrate, and maintain the software. Managed services include managing data centers, networks, infrastructure backup, recovery, and security. The professional services include integration & deployment of the software, support & consulting, and training. Opting for SD-WAN services can decrease the overhead IT costs for enterprises. It can eliminate the hassle of maintaining the software over its lifecycle, contributing to the professional services segment growth.

Deployment Insights

The on-premise deployment segment dominated the market in 2021 and accounted for a revenue share of more than 65.0%. An on-premise SD-WAN architecture is when an enterprise has an SD-WAN box, such as a router, performing real-time traffic management at each site. The on-premise deployment is suitable for companies hosting all their applications onsite without any cloud applications. The on-premise deployment provides a range of benefits, such as real-time traffic shaping, lower monthly costs, improved performance of all WAN apps, and improved data recovery by having better connectivity backup. Thus, several benefits of the on-premise SD-WAN deployment are expected to propel the growth of the segment.

The cloud deployment segment is anticipated to register the fastest growth over the forecast period. In a cloud-based SD-WAN architecture, the solution offers an onsite functionality connecting to a cloud. With this deployment, enterprises can take advantage of the on-premise architecture capabilities, such as multi-circuit balancing and real-time traffic shaping, along with increased performance and reliability of cloud applications through cloud deployment. The overall improvement of the network, lower interruptions, and high compatibility with cloud applications provided by cloud deployment are driving the segment’s growth.

Organization Size Insights

The large enterprises segment dominated the market in 2021 and accounted for more than 71.0% revenue share. Large enterprises are adopting SD-WAN solutions to bring more speed, security, and agility to their large networks. Large enterprises usually have their offices in larger numbers of locations spanning a geographically wide area. These multi-location enterprises require SD-WAN solutions for flexible, secure WAN connectivity that can be scaled up to many locations. Moreover, SD-WAN eliminates several challenges faced by large enterprises, such as operational complexity, compromised security, cloud adoption, and expensive bandwidth, propelling the adoption of SD-WAN among large enterprise segments.

The SMEs segment is anticipated to register the fastest growth over the forecast period. SD-WAN technology gives SMEs the crucial tools to move into the digital era and handle higher volumes of data required for cloud-based applications and software-as-a-service subscriptions. Additionally, SMEs that commonly experience issues with network congestion are suitable candidates for SD-WAN. With numerous WAN connections for continuous traffic, SD-WAN addresses these issues and improves network performance during periods of high traffic density. Such advantages of SD-WAN are growing their adoption among SMEs.

End-user Insights

The verticals segment dominated the market in 2021 and accounted for a revenue share of over 76.0%. SD-WAN is useful for companies from any vertical that rely on its network for productivity. Various industry verticals can leverage multiple benefits of SD-WAN. For example, the retail vertical can benefit from SD-WAN as they have various locations, and they need to be able to connect to those locations into a singular network. The manufacturing industry vertical can leverage SD-WAN to experience a higher level of connectivity with their equipment. While healthcare companies can be connected via SD-WAN to share highly secure information and review their healthcare data. The end uses of SD-WAN in various industries are expected to propel the segment’s growth over the forecast period.

The service providers segment is anticipated to register significant growth over the forecast period. With the continuous and rapid growth in internet penetration and digitization across industries, providing internet to multiple end-users is a strenuous process. Service providers can leverage SD-WAN to streamline their services and reduce the complexities and risks of network transformation. Service providers use SD-WAN to aggregate bandwidths from multiple transport technologies and provide a single managed resource. This allows service providers to simplify operations and enhance viability and security, driving the segment’s growth.

Regional Insights

North America dominated the SD-WAN market in 2021 and accounted for more than 29.0% of revenue. The regional market's growth can be attributed to many prominent players, such as Cisco Systems, Inc. and Oracle Corporation, among others. The growing adoption of cloud-based ecosystems and SaaS business models is propelling the market's growth. Moreover, the large influxes of IT investment and a generally more technologically inclined and receptive customer base present in the region are contributing to the growth of the SD-WAN market in the region.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The rapid 5G rollout and government initiatives to digitalize business processes are pushing Asian businesses to adopt strong networks and other broadband services. The region houses a large number of start-ups that are using advanced and cutting-edge technology catering to a larger customer base. SD-WAN providers are expected to leverage these opportunities in the regional market, which will likely contribute to the region's growth over the forecast period.

Key Companies & Market Share Insights

The SD-WAN market can be described as fragmented, with many significant players contributing toward the market revenue. The vendors operating in the software-defined wide area network market are mainly adopting expansion, partnerships, and product launches to cater to the increased demand and sustain the market's competitive landscape. The key players in the market are using advanced technologies to offer their clients cloud-compatible solutions, along with designated service providers, to integrate, deploy, and maintain the software over its lifecycle.

Vendors are entering into partnerships and collaborations to provide innovative solutions to customers. For instance, in November 2022, International Business Machines (IBM) Corporations collaborated with Colt Technology Services. With this collaboration, the companies launched a new Industry 4.0 lab in the U.K. With this partnership, Colt Technology Services will provide its Colt Edge computing platform and cloud SD-WAN technology, while IBM will contribute its axiom application suite and cloud satellite hybrid cloud. Such initiatives are expected to fuel innovation and development in the market. Some of the prominent players in the software-defined wide area network market include:

-

Cisco Systems, Inc.

-

Oracle Corporation

-

Hewlett Packard Enterprise Company.

-

Nokia Corporation

-

VMware, Inc.

-

Huawei Technologies Co., Ltd.

-

Juniper Networks, Inc.

-

Fortinet, Inc.

-

Citrix Systems, Inc.

-

Ciena Corporation

-

Epsilon Telecommunications

-

Telefonaktiebolaget LM Ericsson

-

BT

-

NEC Corporation

-

Tata Communications

Software-defined Wide Area Network Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.5 billion

Revenue forecast in 2030

USD 30.4 billion

Growth rate

CAGR of 30.9% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia

Key companies profiled

Cisco Systems, Inc.; Oracle Corporation; Hewlett Packard Enterprise Company.; Nokia Corporation; VMWare, Inc.; Huawei Technologies Co., Ltd.; Juniper Networks, Inc.; Fortinet, Inc.; Citrix Systems, Inc.; Ciena Corporation; Epsilon Telecommunications; Telefonaktiebolaget LM Ericsson; BT; NEC Corporation; Tata Communications

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software-defined Wide Area Network Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global software-defined wide area network market report based on component, deployment, organization size, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Software

-

Hardware

-

-

Services

-

Managed Services

-

Professional Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-user Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Service Providers

-

Verticals

-

IT & Telecom

-

BFSI

-

Manufacturing

-

Retail

-

Healthcare

-

Government

-

Transport & Logistics

-

Energy & Utilities

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global software-defined wide area network market size was estimated at USD 2.9 billion in 2021 and is expected to reach USD 3.5 billion in 2022.

b. The global software-defined wide area network market is expected to grow at a compound annual growth rate of 30.9% from 2022 to 2024 to reach USD 30.4 billion by 2030.

b. The North America dominated the SD-WAN market with a share of 29.0% in 2021. The regional market's growth can be attributed to many prominent players, such as Cisco Systems, Inc. and Oracle Corporation, among others.

b. The key industry participants include Cisco Systems, Inc., Oracle Corporation, Hewlett Packard Enterprise Company., Nokia Corporation, VMware, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Fortinet, Inc., Citrix Systems, Inc., Ciena Corporation, Epsilon Telecommunications, Telefonaktiebolaget LM Ericsson, BT, NEC Corporation, Tata Communications.

b. ThThe growth of the SD-WAN market can be attributed to its ability to simplify WAN, reduced operating costs, increase bandwidth efficiency, better and seamless compatibility with the cloud. Moreover, SD-WAN offers significantly better application performance without sacrificing security and data privacy. Additionally, the growing adoption of cloud-based services, and software-as-a-service (SaaS) among enterprises, is driving the need for better connectivity, which is expected to fuel the market’s growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.