- Home

- »

- Sensors & Controls

- »

-

Soil Moisture Sensor Market Size And Share Report, 2030GVR Report cover

![Soil Moisture Sensor Market Size, Share & Trends Report]()

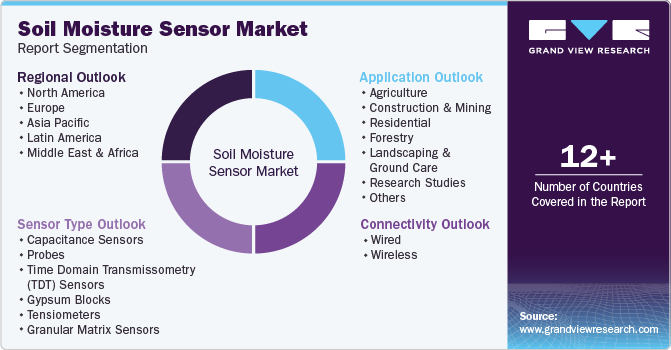

Soil Moisture Sensor Market (2024 - 2030) Size, Share & Trends Analysis Report By Sensor Type (Capacitance sensors, Probes), By Connectivity (Wired, Wireless), By Application (Agriculture, Construction & Mining), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-056-9

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soil Moisture Sensor Market Summary

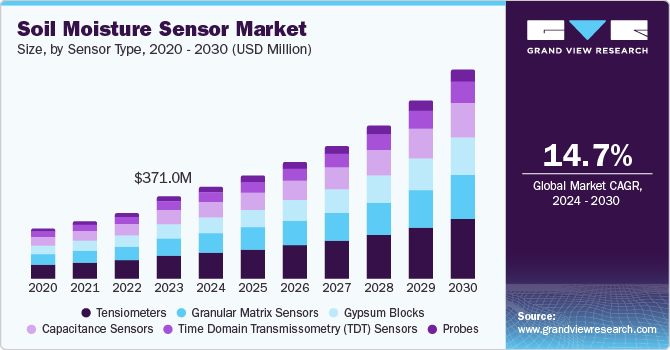

The global soil moisture sensor market size was estimated at USD 371.0 million in 2023 and is projected to reach USD 940.5 million by 2030, growing at a CAGR of 14.7% from 2024 to 2030. The increasing adoption of these sensors by the agricultural sector to enhance the farm’s productivity and reduce water consumption is expected to drive market growth over the forecast period.

Key Market Trends & Insights

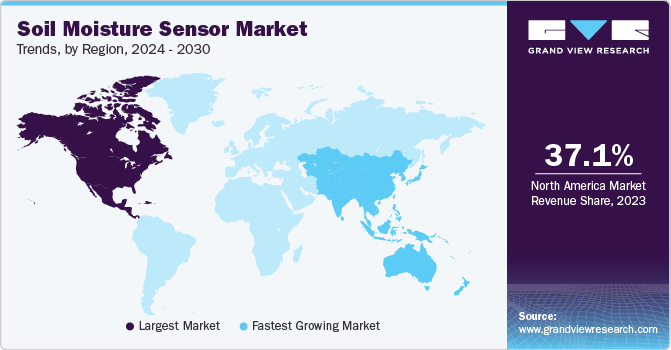

- The market in North America held a significant market share of 37.1% in 2023.

- The growth of the market in the U.S. is driven by the nation's highly developed agricultural sector.

- Based on sensor type, tensiometers held the largest market share of 28.4% in 2023 in the market due to their reliability and accuracy in measuring soil water potential.

- In terms of connectivity, wired soil moisture sensors held the largest market share of 54.3% in 2023.

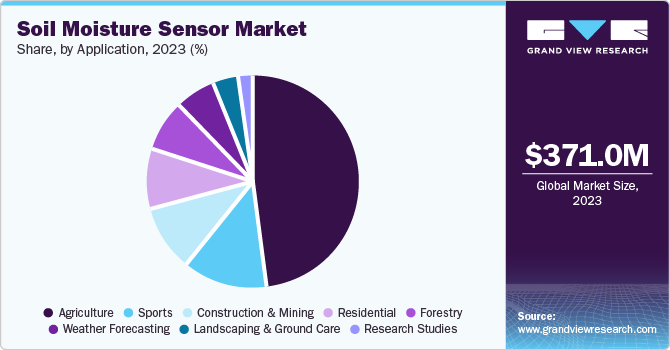

- On the basis of application, the agriculture segment dominated the market in 2023 and accounted for a market share of 48.3%.

Market Size & Forecast

- 2023 Market Size: USD 371.0 million

- 2030 Projected Market Size: USD 940.5 million

- CAGR (2024-2030): 14.7%

- North America: Largest market in 2023

Moreover, this product also helps in avoiding irrigation issues through constant monitoring, which in turn is spurring the growth of the market. The introduction of new technologies that aid residential owners in monitoring the soil moisture condition of potted plants, vegetable gardens, and lawns is also expected to drive market demand.

The demand for low-cost sensors such as tensiometers and granular matrix sensors, especially in the residential sector, used for maintaining lawns, is driving the growth of the market. These products play a crucial role in maintaining lush green lawns, which, in turn, is driving their adoption in the residential segment. The use of soil moisture sensors by weather forecasters to offer accurate weather readings and forecasts is another prominent factor driving market demand. The segment is estimated to register considerable growth during the forecast period.

The increasing demand for soil moisture sensors in the building and construction sectors is also estimated to drive market growth in the coming years. This product is extensively preferred before initiating the construction project for wetland detection. The imminent need for the measurement of water content at construction sites is driving market growth. On the flip side, the lack of awareness among farmers regarding the benefits offered by sensors, lack of availability of skilled labor, and preference for traditional farming practices, especially in emerging economies, is hampering the overall growth of the market.

North America held the largest market share in 2023 owing to the relatively greater adoption of mechanized farming practices and a multitude of research & development efforts in the field of wireless sensor technology. Additionally, the farmers in the region have relatively greater awareness regarding the benefits associated with the use of moisture sensors. In addition, the farmers have been receiving ample support to adopt mechanized farming practices from organizations like the Environmental Protection Agency (EPA), the Nature Conservancy, and the National Research Council, among others.

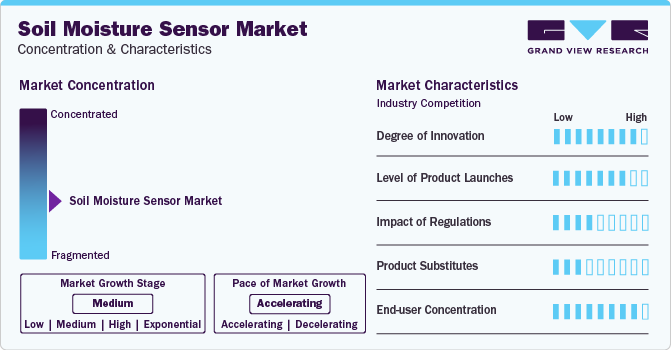

Market Concentration & Characteristics

The degree of innovation in the soil moisture sensor market can be classified as moderate. Technological advancements are steadily improving the accuracy, reliability, and ease of use of soil moisture sensors. Innovations include the integration of wireless connectivity, enabling real-time data transmission and remote monitoring for more efficient agricultural management. Additionally, the development of sensors with enhanced durability and longer battery life addresses practical challenges faced by end-users. However, while there are significant improvements, the pace of groundbreaking innovation is slower compared to more dynamic tech sectors. The target market displays a moderate level of innovation, with ongoing enhancements making these tools increasingly valuable for precision agriculture and water conservation efforts.

The target market experiences a moderate level of product launches, reflecting steady but not overwhelming growth. Companies in this sector regularly introduce new models that offer incremental improvements in accuracy, durability, and ease of use. Innovations in soil moisture sensors often focus on integrating wireless connectivity and IoT capabilities, allowing for more efficient real-time monitoring and data collection. While there is consistent interest in enhancing these sensors, the market does not see the rapid, frequent launches typical of more fast-paced tech industries. Many new products aim to cater to specific agricultural needs, such as sensors optimized for different soil types or crop requirements. This steady stream of product introductions helps farmers and researchers improve irrigation practices and water management. Overall, the moderate level of product launches supports ongoing advancements and the adoption of soil moisture sensing technologies.

The impact of regulation in the target market can be classified as low. Regulatory requirements for these sensors primarily focus on ensuring accuracy and reliability for agricultural and environmental monitoring. Unlike heavily regulated industries, soil moisture sensors face minimal compliance burdens, allowing for easier market entry and innovation. While there are some standards related to environmental impact and data integrity, these do not significantly hinder product development or deployment. Moreover, supportive policies promoting sustainable agriculture and water conservation can positively influence market growth. Overall, the regulatory environment is favorable, with a low impact on the advancement and adoption of soil moisture sensor technologies.

The impact of product substitutes in the target market can be classified as low. Soil moisture sensors provide specific, real-time data that is crucial for precision agriculture and is not easily replicated by other methods. While traditional techniques like manual soil sampling and observation exist, they need more accuracy, efficiency, and real-time monitoring capabilities of soil moisture sensors. Emerging technologies, such as remote sensing and satellite imagery, offer supplementary data but cannot replace the detailed, on-the-ground insights provided by soil moisture sensors. Additionally, the integration of IoT and wireless connectivity in soil moisture sensors further reduces the viability of substitutes. Overall, the unique advantages and advancements of soil moisture sensors result in a low impact from product substitutes in the market.

The end-user concentration in the target market can be classified as moderate. This market serves a variety of sectors, including agriculture, horticulture, landscaping, and environmental monitoring, resulting in a diverse customer base. In agriculture, large-scale farms and agribusinesses are significant users of soil moisture sensors, leveraging them for precision irrigation and crop management. For instance, companies like Monsanto and John Deere incorporate these sensors into their smart farming solutions. However, there are also numerous small and medium-sized farms, research institutions, and gardening enthusiasts using these sensors, diversifying the user base. While large agricultural enterprises represent a substantial portion of the market, the presence of various other end-users ensures a balanced distribution, contributing to moderate end-user concentration.

Sensor Type Insights

Tensiometers held the largest market share of 28.4% in 2023 in the market due to their reliability and accuracy in measuring soil water potential, which is crucial for effective irrigation management. They are widely used in agriculture because they provide real-time data on soil moisture levels, helping farmers optimize water usage and improve crop yields. Additionally, tensiometers are relatively affordable and easy to install, making them accessible to a broad range of users, from large-scale agribusinesses to small farms. Their proven track record and long-standing presence in the market have established them as a trusted technology among end-users. Moreover, tensiometers are highly effective in various soil types and climates, further enhancing their appeal. The combination of accuracy, cost-effectiveness, and ease of use has led to their dominance in the target market.

Capacitance sensors is expected to register the fastest CAGR over the forecast period due to their advanced technology and versatility. These sensors offer high accuracy and rapid response times, which are crucial for real-time soil moisture monitoring and efficient water management. Their ability to provide continuous, automated measurements without significant maintenance has made them increasingly popular among modern agricultural practices and precision farming. Additionally, the integration of IoT and wireless connectivity in capacitance sensors allows for seamless data collection and remote monitoring, appealing to tech-savvy farmers and large agribusinesses. The growing emphasis on sustainable agriculture and water conservation has also driven the adoption of these sensors, as they help optimize irrigation and reduce water waste. Thus, technological advancements, ease of integration, and alignment with modern agricultural needs have contributed to the rapid growth of capacitance sensors in the target market.

Connectivity Insights

Wired soil moisture sensors held the largest market share of 54.3% in 2023. Wired soil moisture sensors offer reliability and accuracy, which has established them as a trusted solution for farmers and agricultural professionals. The wired sensors often boast a longer lifespan compared to their wireless counterparts, reducing the need for frequent replacements and maintenance. Additionally, wired systems typically offer robust connectivity, ensuring stable and consistent data transmission even in challenging environments. Their compatibility with existing infrastructure and equipment further contributes to their popularity among users. Moreover, the affordability of wired sensors appeals to a wide range of customers, especially those with budget constraints. The simplicity of installation and setup simplifies the adoption process, making wired soil moisture sensors the preferred choice for many users in the agricultural sector.

Wireless soil moisture sensors registered the fastest CAGR over the forecast period, primarily due to their convenience and flexibility. Wireless sensors offer easy deployment, allowing users to place them in various locations without the constraints of wiring infrastructure. This flexibility enables more comprehensive monitoring of soil moisture levels across large or difficult-to-access areas, optimizing irrigation strategies. Furthermore, advances in wireless technology have enhanced data transmission rates and reliability, ensuring real-time monitoring and timely decision-making. The scalability of wireless systems also appeals to users looking to expand their monitoring networks without significant additional infrastructure costs. Additionally, the increasing adoption of IoT and cloud-based solutions has bolstered the demand for wireless sensors, enabling remote access to data and insights from anywhere, at any time. Moreover, the growing focus on precision agriculture and sustainable farming practices has driven the uptake of wireless soil moisture sensors, as they enable more efficient water usage and resource management.

Application Insights

Soil moisture sensors find applications across an array of industries and verticals, including agriculture, construction and mining, residential, forestry, landscaping and ground care, research studies, sports, and weather forecasting. The agriculture segment dominated the market in 2023 and accounted for a market share of 48.3% due to its crucial role in optimizing crop yield and resource management. Soil moisture sensors are integral to precision agriculture practices, enabling farmers to make data-driven decisions regarding irrigation scheduling and water conservation. With increasing awareness of the importance of water efficiency in agriculture, the demand for soil moisture sensors continues to grow within this segment. Increasing the use of sensors in agricultural lands has enabled farmers to reduce water consumption and increase overall food production. These benefits are expected to drive segment demand. Moreover, increasing the focus of the government on water conservation to improve the quality of crops is driving the market demand.

The sports segment is expected to garner the fastest CAGR from 2024 to 2030, owing to its applications in optimizing athletic performance and turf management. Soil moisture sensors are increasingly utilized in sports fields, golf courses, and recreational areas to maintain optimal playing conditions and turf health. These sensors enable groundskeepers and turf managers to monitor soil moisture levels accurately, preventing overwatering or underwatering, which can affect turf quality and player safety. Additionally, the adoption of sensor-based irrigation systems in sports facilities has surged, driven by the desire to conserve water and reduce operational costs. The integration of soil moisture data with weather forecasts and irrigation schedules further enhances water management efficiency, ensuring sustainable maintenance practices. Moreover, the increasing emphasis on environmental sustainability in sports management has spurred the uptake of soil moisture sensors as part of broader efforts to reduce water usage and chemical inputs. Lastly, advancements in sensor technology have made these solutions more cost-effective and easier to deploy, contributing to their rapid adoption in the sports sector.

Regional Insights

The market in North America held a significant market share of 37.1% in 2023. The North America region has a significant presence in technologically advanced agriculture industries, where precision farming practices are widely adopted. North America faces challenges related to water scarcity and irrigation efficiency, driving the demand for soil moisture sensors as a means to optimize water usage. Furthermore, robust investment in research and development has led to the introduction of innovative sensor technologies tailored to the region's agricultural needs. Additionally, government initiatives promoting sustainable farming practices have further fueled the adoption of soil moisture sensors among growers. Moreover, a mature market ecosystem comprising established sensor manufacturers, distributors, and service providers has facilitated widespread adoption and market dominance in North America.

U.S. Soil Moisture Sensor Market Trends

The growth of the market in the U.S. is driven by the nation's highly developed agricultural sector, which strongly emphasizes technology adoption, including precision farming practices. The country also faces diverse climatic conditions and water management challenges across its regions, driving the demand for advanced soil moisture monitoring solutions. Furthermore, the presence of major sensor manufacturers, research institutions, and government support for agricultural innovation further boosts the market growth in the U.S.

Asia Pacific Soil Moisture Sensor Market Trends

The Asia Pacific region is projected to register the fastest CAGR of 16.1% over the forecast period. The governments in the region are promoting sustainable agricultural practices, leading farmers to invest in advanced technologies for water management. For instance, initiatives such as China's "Sponge City" project and India's National Mission for Sustainable Agriculture encourage the use of soil moisture sensors for efficient water utilization. Additionally, the expanding awareness about the impact of climate change on agricultural productivity has prompted farmers to adopt precision farming techniques, further boosting the demand for soil moisture sensors. Moreover, technological advancements and the availability of affordable sensors have made them more accessible to farmers across the region, contributing to the market's rapid growth. Furthermore, collaborations between local governments, research institutions, and sensor manufacturers have facilitated innovation and the development of tailored solutions, further driving market expansion in the Asia-Pacific region.

China soil moisture sensor market held the largest market share of 29.0% in 2023. China's extensive agricultural sector, coupled with government initiatives promoting precision agriculture and water efficiency, drives significant demand for soil moisture sensors. Additionally, China's robust manufacturing capabilities and the presence of numerous sensor technology companies further bolster its market leadership. Furthermore, the country's increasing focus on environmental sustainability and resource management drives the demand for soil moisture sensors.

Europe Soil Moisture Sensor Market Trends

Europe occupies the second-largest share in the market due to several contributing factors. The region's extensive agricultural sector, characterized by diverse climates and soil types, necessitates precise water management solutions, driving the demand for soil moisture sensors. Additionally, the stringent environmental regulations and sustainability initiatives across European countries encourage the adoption of technologies for efficient resource utilization, including soil moisture sensors. Moreover, Europe's emphasis on research and innovation fosters the development of advanced sensor technologies, further propelling market growth. Furthermore, increasing awareness among farmers about the benefits of precision agriculture and the role of soil moisture sensors in optimizing crop yields also contributes to Europe's significant market share.

The soil moisture sensor market in UK is growing due to thecountry's advanced agricultural sector and emphasis on sustainable farming practices drive substantial demand for soil moisture sensors. For instance, initiatives such as the UK's Countryside Stewardship scheme encourage farmers to adopt technologies for efficient water management. Additionally, the UK's commitment to environmental sustainability and compliance with regulations related to water conservation further boosts the adoption of soil moisture sensors in various applications. Furthermore, the presence of leading sensor manufacturers and research institutions in the UK ecosystem solidifies its position as a leader in the European market.

Key Soil Moisture Sensor Company Insights

Some of the key companies operating in the market include The Toro Company and Irrometer Company, Inc., among others.

-

The Toro Company designs, manufactures and markets a range of irrigation system supplies, turf maintenance equipment, and snow removal equipment for commercial and residential gardens, sports fields, public parks, golf courses, and agricultural fields. The company manufactures its products in the U.S., Germany, Mexico, Australia, Italy, Romania, Poland, China, and the U.K. and sells them worldwide.

-

Irrometer Company, Inc. is a manufacturer of soil moisture monitoring and sensing devices used to help companies make better irrigation scheduling decisions. The company helps optimize irrigation and improve conservation with simple, affordable, and reliable global solutions for growers and researchers. The company’s product line includes soil moisture sensors, reading tools, automation tools, and lysimeters.

Spiio, Inc. and Caipos GmbH are some of the emerging market companies in the target market.

-

Spiio, Inc. designs and manufactures a wireless irrigation system for monitoring plant data analytics. The system consists of an app integrated with a smart irrigation controller and a wireless soil moisture sensor. It helps reduce irrigation system maintenance costs and measures light data salinity, temperature, and soil moisture, enabling users to make real-time data-driven decisions hassle-free.

-

Caipos GmbH manufactures and delivers software and equipment for wireless soil moisture and climate monitoring. The company’s products include rain and water level monitoring stations, soil moisture sensors, internet-based personal weather stations, and wireless sensor networks.

Key Soil Moisture Sensor Companies:

The following are the leading companies in the soil moisture sensor market. These companies collectively hold the largest market share and dictate industry trends.

- The Toro Company

- METER Group, Inc. USA

- Campbell Scientific, Inc.

- Stevens Water Monitoring Systems Inc.

- IMKO Micromodultechnik GmbH

- Irrometer Company, Inc.

- Delta-T Devices Ltd

- GroPoint

- Sentek

- Spectrum Technologies, Inc.

- Acclima, Inc.

- Smartrek Technologies inc

- Caipos GmbH

- Spiio

- Plaid Systems LLC

Recent Developments

-

In November 2023, Delta-T Devices Ltd. and SAF Tehnika announced a partnership to integrate Delta-T's WET150 multiple parameter soil sensor into the Aranet wireless network solution by SAF Tehnika for horticulture. The WET150 sensor offers accurate soil moisture, temperature, and electrical conductivity measurements, enhancing growers' ability to monitor growing conditions remotely in real-time, leading to improved yields, crop quality, and water efficiency.

-

In September 2023, The Toro Company and Lowe’s announced a strategic partnership to offer Toro’s full lineup of outdoor power equipment at Lowe’s stores across the U.S. and online in spring 2024. This collaboration aimed to provide customers with access to The Toro Company’s portable power equipment, walk mowers, zero-turn riding mowers, and snow blowers, enhancing Lowe’s industry-leading outdoor power selection.

Soil Moisture Sensor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 413.4 million

Revenue forecast in 2030

USD 940.5 million

Growth Rate

CAGR of 14.7% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sensor type, connectivity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

The Toro Company; METER Group, Inc. USA; Campbell Scientific, Inc.; Stevens Water Monitoring Systems Inc.; IMKO Micromodultechnik GmbH; Irrometer Company; Inc.; Delta-T Devices Ltd.; GroPoint; Sentek; Spectrum Technologies, Inc.; Acclima, Inc.; Smartrek Technologies Inc.; Caipos GmbH; Spiio; Plaid Systems LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soil Moisture Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global soil moisture sensor market report based on sensor type, connectivity, application, and region.

-

Sensor Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Capacitance sensors

-

Probes

-

Time Domain Transmissometry (TDT) Sensors

-

Gypsum blocks

-

Tensiometers

-

Granular matrix sensors

-

-

Connectivity Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Agriculture

-

Construction and Mining

-

Residential

-

Forestry

-

Landscaping and Ground Care

-

Research Studies

-

Sports

-

Weather Forecasting

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soil moisture sensor market size was estimated at USD 371.0 million in 2023 and is expected to reach USD 413.4 million in 2024.

b. The global soil moisture sensor market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 940.5 million by 2030.

b. North America dominated the soil moisture sensor market with a share of 37.1% in 2023. This is attributable to the greater adoption of these sensors across the agriculture and sports segments in the region.

b. Some key players operating in the soil moisture sensor market include The Toro Company (U.S.), Campbell Scientific Inc. (U.S.), Spiio (U.S.), Sentek (Australia), METER Group, Inc. USA (U.S.); Irrometer Company, Inc. (U.S.); Acclima Inc. (U.S.); IMKO Micromodultechnik GmbH.

b. Key factors that are driving the market growth include increasing adoption of soil moisture sensors among farmers to enhance the farm’s productivity and reduce water consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.