- Home

- »

- Consumer F&B

- »

-

Soup Market Size, Share And Growth Analysis Report, 2030GVR Report cover

![Soup Market Size, Share & Trends Report]()

Soup Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Canned, Dried, UTH), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online), By Region And Segment Forecasts

- Report ID: GVR-2-68038-902-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soup Market Summary

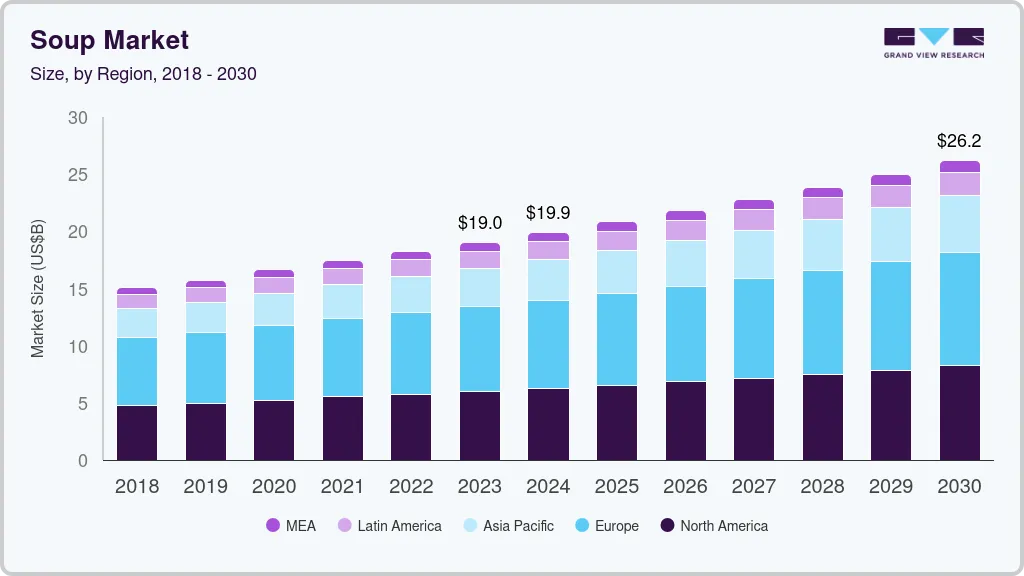

The global soup market size was estimated at USD 19.05 billion in 2023 and is expected to reach USD 26.21 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. Soups are rich in vitamins, minerals, nutrients, and protein, increasing consumer preference for convenience foods for busy lifestyles.

Key Market Trends & Insights

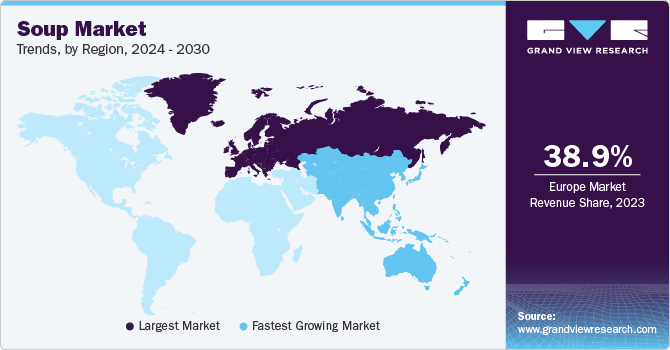

- The Europe region dominated the market with a revenue share of 38.9% in 2023.

- The UK market is anticipated to witness significant growth over the forecast period.

- By product, the dried segment accounted for the largest market revenue share of 59.5% in 2023.

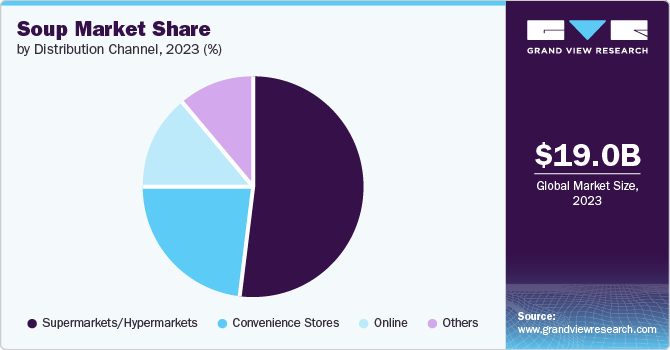

- By distribution channel, the supermarkets/hypermarkets segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19.05 Billion

- 2030 Projected Market Size: USD 26.21 Billion

- CAGR (2024-2030): 4.7%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Rising health consciousness and demand for natural ingredients have increased the demand for organic and healthy soup varieties, further fueling market expansion.Consumer's busy lives have driven the demand for convenient and equipped-to-consume soup options. Single-serve and microwavable soup cups, bowls, and pre-packaged soup mixes have increased convenience and accessibility. Cup soups allow consumers to enjoy a hot, satisfying meal with minimal preparation time. The demand for these soups is rising as they provide single-serve options during office time, travel, or at home in less time and less preparation. For instance, in April 2024, Nissin launched a limited-edition Collagen Hotpot Cup Noodles. It is available in Don Don Donki outlets and major supermarkets in Singapore. It includes rich chicken broth enhanced with a smooth and creamy collagen texture.

Expansion in retail channels, including online platforms, has increased the accessibility and reach of soup products. Traditional retail outlets such as supermarkets, hypermarkets, and convenience stores continue to stock various soup brands, offering consumers convenient access during shopping. Overall, the combination of convenience, health awareness, innovation, and market accessibility continues to drive significant growth in the soup market.

Aging populations worldwide are turning to soups as a convenient and nourishing meal option that supports their changing dietary needs. With a focus on heart health, bone strength, and cognitive function, manufacturers are innovating to meet consumer's specific nutritional requirements. The soft texture and ease of preparation make soups particularly consumable for seniors facing challenges such as reduced appetite or difficulty chewing. As this population continues to grow, the demand for nutritious and easy-to-digest soups is expected to drive significant expansion in the market.

Product Insights

The dried segment accounted for the largest market revenue share of 59.5% in 2023. The Growing demand for convenient and prepared-to-eat food alternatives, specifically in busy city populations, offers a significant opportunity for producers to innovate and expand their product services. Additionally, growing fitness recognition amongst purchasers has accelerated interest in nutritious and natural substances in packaged foods, developing area for dried soup products made with healthy components. For instance, in April 2022, Nissin Foods Singapore introduced a limited-edition flavor called Fish Head Curry Cup Noodles, based on the popular local fish head curry dish. The cup noodles feature a mild spicy curry soup base with stewed fish umami, lemongrass fragrance, and hints of creamy coconut milk. The soup is available at major supermarkets, Don Don Donki stores, and online platforms.

The UHT (ultra-high temperature) segment is expected to register the fastest CAGR during the forecast period. The growth of UHT soups is driven by long-shelf-life ingredients that don’t require refrigeration, making them ideal for busy lifestyles and reducing meal waste. The growing awareness of health and wellness among consumers has driven the demand for UHT soups, as manufacturers offer products with reduced salt, sugar, and preservatives, meeting the preferences of health-conscious individuals.

Distribution Channel Insights

The supermarkets/hypermarkets segment dominated the market in 2023. Supermarkets/hypermarkets offer various soup varieties from different brands and nutritional needs, providing consumers with vast choices and convenient shopping in the same place. The convenience of one-stop shopping allows busy consumers to check for fresh and packaged soup options conveniently located under one roof. These retail formats offer promotional deals, discounts, and package deal offers on soups that attract customers, increasing product sales.

The online segment is expected to witness the fastest CAGR over the forecast period. The increasing adoption of e-commerce platforms allows consumers to purchase a variety of soups conveniently from the comfort of their homes and eliminates the need for physical store visits, allowing busy consumers and families time-saving solutions for meal preparation. Advancements in logistics have improved the efficiency of online soup delivery and ensuring products arrive fresh and in optimal condition, driving the growth of this segment in the market. For instance, in November 2023, The Peninsular Export Company introduced SAARRU, India's native soup with regional variants. It provides three varieties of soup blends based on regional cuisine such as Chicken soup masala, Mutton soup masala, and Chicken coriander rasam masala. It is available in both the B2B and B2C markets across Tamil Nadu and also available on SAARRU's e-commerce website and other ecommerce platforms such as Jiomart and Flipkart.

Regional Insights

North America market is expected to witness significant growth over the forecast period in 2023. The soup market in North America is experiencing significant growth due to rising health consciousness and the demand for convenient meal options. Consumers are increasingly buying nutritious and ready-to-eat solutions, driving the demnad of premium, organic, and functional soups. Innovations in flavors, sustainable packaging, and the introduction of culturally diverse soup varieties further fuel market growth. Additionally, The trend towards clear labled products, with transparent ingredient lists, also aids in fulfilling the demand of health-conscious consumers.

U.S. Soup Market Trends

The U.S. market is expected to witness significant growth over the forecast period. The increasing demand for health-focused products leads to a preference for organic, low cholesterol, low-sodium, and high-protein and nutritious soups. The rise in online grocery shopping expanded the availability and variety of soups to consumers and the increasing number of single-person households, raising the demand for single-serving soup options. For instance, In July 2022, Upton's Naturals launched three new soup flavors in the U.S. market. The new lineup includes flavors like Chick & Wild Rice, Crimson Lentil, and Minestrone, providing plant-based protein and only 180-300 calories a bowl. It contains no added colors, preservatives, or flavors and is completely free of cholesterol and trans fat.

Europe Soup Market Trends

The Europe region dominated the market with a revenue share of 38.9% in 2023. The climate in Europe also plays a role in the growth of the soup market. In colder northern European countries, such as Scandinavia and parts of Eastern Europe, the long winter seasons demand warming and comforting food options such as soups. Soups are a convenient meal but also a comforting and nourishing choice during colder months, driving seasonal consumption patterns in the European market.

The UK market is anticipated to witness significant growth over the forecast period. The changing dietary habits and increasing health awareness among UK consumers have driven demand for convenient and nutritious meal options such as soups. Consumers increasingly buy soups lower in salt, sugar, and preservatives for fit and healthy living. Moreover, the growing preference for plant-based and vegetarian diets has driven the demand for vegetable-based soups, perceived as healthier alternatives to meat-based options. In January 2023, Heinz UK launched vegan canned products such as Creamy Tomato Soup and Beanz & Sausages. The vegan creamy tomato soup is made with fermented soy instead of dairy, used in the original version. These plant-based alternatives were introduced in response to consumer demand for more plant-based options from Heinz.

Germany's strong culinary traditions and demand for quality food products contribute to the growth of the soup market. Consumers prefer soups with regional flavors and locally sourced ingredients, leading to a trend towards locally produced foods. The widespread availability of soups in supermarkets, hypermarkets, and specialty stores ensures accessibility and visibility, encouraging regular consumption. As these trends continue to fulfill consumer preferences, the soup market is expected to increase, driven by convenience, health consciousness, and a commitment to culinary excellence.

Asia Pacific Soup Market Trends

Asia Pacific region is anticipated to witness the fastest CAGR over the forecast period. Rising disposable incomes and urbanization have increased the demand for convenient and ready-to-eat food options, including soups. Including a strong cultural tradition of soup consumption as part of daily meals, Asian soups often hold symbolic and nutritional importance and are frequently linked to health and fitness practices. In many Asia Pacific households, soups are a daily ritual enjoyed for their comforting and therapeutic qualities. These factors combined are driving the demand for soup market in this region.

The Chinese market is expected to witness significant growth over the forecast period. The soup market in China is growing rapidly due to rising health consciousness and the increasing demand for convenient meal options. Traditional Chinese medicinal soups are an integral part of Chinese medicine, valued for their health benefits and comfort. The aging population is increasingly consuming soups rich in traditional medicinal ingredients, catering to the dietary needs of older adults, which is driving the demand for soups. For instance, in August 2023, Haofood unveiled vegan pork mince soup dumplings. The soup dumplings are filled with peanut-based pork mince. The soup has a black truffle flavor, and the dumplings include protein and dietary fiber and are free of trans fats.

Key Soup Company Insights

The Soup Market is witnessing substantial growth in the coming years, driven by way of numerous key techniques and factors. Market players are increasingly focusing on product innovation and development to fulfill evolving customer needs and options.

-

The Campbell Soup Company offers a variety of products, including canned soups, stocks, broths, and sauces. Its product lineup also features snacks such as Goldfish crackers and Milano cookies, beverages such as V8 juices, and pasta sauces under the Prego brand.

-

Nestle is food & beverage company which operates in various segments including baby food, bottled water coffee, dairy products, and others. The brand also includes Nescafe, KitKat, and Purina. Nestle emphasizes nutrition, health, and wellness in its product offerings.

Key Soup Companies:

The following are the leading companies in the soup market. These companies collectively hold the largest market share and dictate industry trends.

- Associated British Foods plc

- Baxters Food Group Limited

- Campbell Soup Company

- Conagra Brands, Inc.

- General Mills, Inc.

- Hindustan Unilever Limited

- Nestlé S.A

- Ottogi Co., Ltd

- Premier Foods Group Limited

- The Kraft Heinz Company

Recent Development

-

In November 2023, CJ CheilJedang improved its collaboration with three major Shinsegae Group retailers - SSG.com, Emart, and Gmarket - by establishing the collaboration’s first together planned retail products. CJ CheilJedang unveiled Plantable soup dishes and seaweed soup for the first time on SSG.com, Emart, and Gmarket.

-

In June 2022, Soupologie launched a new product line called Souper Cubes in the UK market, offering consumers frozen cubes of fresh soup in convenient portions. Each package contains six 150g frozen cubes, equivalent to three total servings of soup. The Souper Cubes range currently includes two popular flavors, Pea & Leak and Carrot & Turmeric.

-

In August 2022, Yeo Valley first moved outside the dairy category by launching new soup and dip ranges. This expansion is part of Yeo Valley's commitment to providing a wider range of natural and healthy food options for both people and the planet. The soup range includes a variety of flavors, such as Cream of Parsnip & Thyme, Parsnip & Thyme, vegetable-included soups, such as Cream of Vegetable and Leek, Potato & Mature Cheddar. These soups are packaged in 400g pots and are designed to be convenient for on-the-go consumption.

Soup Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.91 billion

Revenue forecast in 2030

USD 26.21 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; New Zealand; South Korea; Brazil; Argentina; South Africa;

Key companies profiled

Campbell Soup Company; Nestlé S.A; Baxters Food Group Limited; General Mills, Inc.; Conagra Brands, Inc.; Premier Foods Group Limited; The Kraft Heinz Company; Hindustan Unilever Limited; Ottogi Co., Ltd; Associated British Foods plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soup Market Report Segmentation

This report forecasts revenue growth on a global, regional and country level and analyzes the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global soup market report by product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Canned

-

Dried

-

UHT

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soup market size was estimated at USD 19.05 billion in 2023 and is expected to reach USD 19.91 billion in 2024.

b. The global soup market is expected to grow at a compounded annual growth rate of 3.0% from 2024 to 2030 to reach USD 26.21 billion by 2030.

b. Dried products dominated the global soup market with a share of 59.8% in 2023. This is attributed to high consumption of packed, convenience, and healthy processed food in the working population.

b. Some of the key operating players in the soup market include Associated British Foods PLC,TSC Foods, Campbell Soup Company, Bear Creek Country Kitchens LLC, Nestlé (Switzerland), and Baxters Food Group Limited.

b. Key factors that are driving the market growth include increasing demand for convenience food and growing awareness regarding health benefits of soups.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.