- Home

- »

- Animal Health

- »

-

South Africa Veterinary Medicine Market, Industry Report, 2030GVR Report cover

![South Africa Veterinary Medicine Market Size, Share & Trends Report]()

South Africa Veterinary Medicine Market Size, Share & Trends Analysis Report By Animal Type, By Product (Biologics, Pharmaceuticals, Medicated Feed Additives), By Mode Of Delivery, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-811-1

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

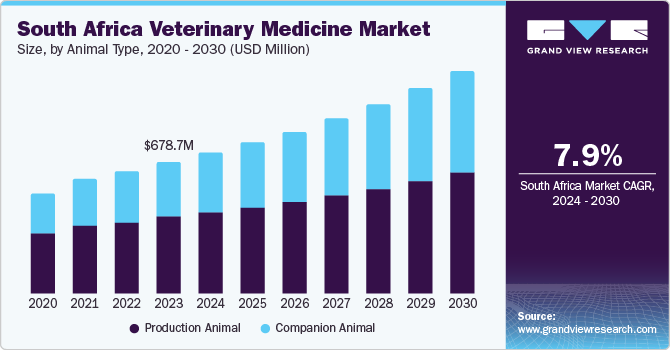

The South African veterinary medicine market size was estimated at USD 678.69 million in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. The market is primarily driven by growing support initiatives to improve animal health and the rising prevalence of zoonotic and animal diseases in South Africa. Similarly, increasing pet ownership and rising poultry disease outbreaks like bird flu/high pathogenicity avian influenza (HPAI) are also driving the market growth.

In recent years, the country has experienced rapid developments in the regulatory environment related to veterinary medicines. The authorities are attempting to ensure that the approval of new veterinary drugs is completed in a structured and thorough manner. These steps are taken owing to increasing disease outbreaks among the veterinary population and an increase in illicit veterinary drug sales in the country.

South Africa is largely dependent on its poultry sector when it comes to total animal production. According to data published by the South African Poultry Association (SAPA), in 2022, poultry accounted for over 17% of the country's agricultural gross value. Additionally, it is estimated that the poultry sector contributes to almost 40% of South Africa's animal product gross value. Out of the poultry population, over 74% are used in meat production and 26% in egg production. Such dependence on the poultry sector increases demand for medicines, such as vaccines, anti-infectives, medicated feed additives, parasiticides, etc., to ensure healthy meat or eggs produced from these chickens.

South Africa recently faced bird flu outbreaks across various major poultry-producing areas. According to a November 2023 SAPA report, to avoid the spread of bird flu, over 8.5 million chickens (approximately 20-30% of the country's total poultry stock) were culled by the authorities. This included over 2.5 million broiler breeder chickens and 6 million layer chickens, creating a supply shortage in the country. However, the authorities quickly took the necessary steps such as ensuring ample availability of veterinary medicines and timely import of poultry products to circumvent the supply shortage.

Such situations drive the demand for veterinary drugs like vaccines, antibiotics, and medicated feed additives, among others, by increasing the emphasis on preventive measures, boosting treatment rates for recovering the poultry stock, ensuring quality control of imported products, etc.

Furthermore, another driving factor for this market in South Africa is the growing support initiatives from all around the globe to improve animal health in the country. As recently as April 2024, the World Veterinary Association (WVA), in collaboration with the South African Veterinary Association (SAVA), conducted the 39th Annual WVA Congress in South Africa. This initiative was aimed at boosting the market in the country by enhancing global exposure, enabling knowledge exchange among the industry participants and creating networking opportunities, as well as attracting veterinary practitioners, researchers, veterinary medicine manufacturers, and other industry professionals from across the globe to encourage collaborative steps to advance veterinary care in the country, thus driving demand for advanced veterinary medicines.

Furthermore, as per a December 2023 article published by the South African Veterinary Council (SAVC), veterinarians and veterinary nurses were reinstated among the country's critical skills list. This step was taken to address the country's major shortage of veterinary professionals by streamlining the process for foreign professionals to work there. This strategy drives the market by attracting additional veterinarians to South Africa and potentially leading to the establishment of additional veterinary facilities. This will naturally increase demand for veterinary medicines as the penetration of veterinary care will reach even more population, boosting the market. The country currently has 60-70 veterinary professionals per million people, significantly lower than the standardized international rules.

Market Concentration & Characteristics

Global industry players that offer veterinary medicine are attempting to expand into the South African market through distributors. They are introducing their product range by assessing the country's demand. Some global companies are trying to capture the South African veterinary medicine market share by acquiring domestic distributors.

The market is populated by a wide array of product substitutes. Apart from leading global players, many domestic players compete by offering cheaper and generic alternatives to customers. This market is also facing a looming threat of illicit veterinary drugs, that can harm the health of animals and the adoption of legitimate veterinary drugs.

The market is witnessing M&A Activities, where the global leaders are attempting to increase their influence on the country market by acquiring their distribution partners. This strategy helps companies to utilize the distributor's established networking and provides them with a direct presence in the market instead of an indirect one.

The degree of innovation can mainly be seen in the research and development of biological therapies for animals. These therapies include vaccines, stem-cell therapies, personalized therapies, etc. Also, manufacturers are focusing on developing veterinary medicines that are more palatable to ensure proper animal compliance.

South Africa is known to have very stringent rules and processes due to the presence of a dual registration system for the approval of veterinary medicines. Data protection and integrity are areas for improvement for the regulatory authorities in the country. The approvals of veterinary medicines are known to cause long delays, and lack of financial resource availability is a major barrier to the market. These factors are expected to inhibit market growth by limiting the scope for product innovation.

Animal Type Insights

The production animal segment held the highest market share of over 58% in 2023. This can be attributed to an increasing number of regional disease outbreaks. In January 2024, a report published by the South African Department of Agriculture, Land Reform, and Rural Development states that the country has experienced over 215 Foot & Mouth Disease (FMD) outbreaks since 2022. Furthermore, according to an April 2024 publication by the Food & Agriculture Organization (FAO), there have been about 87 outbreaks of high pathogenicity avian influenza (HPAI) in South Africa since October 2023 in species like poultry and ostrich, among others. Such outbreaks increase the demand for veterinary medicines to help in the treatment and management of such diseases, boosting the market to lucrative growth.

The companion animal segment is estimated to expand with the highest CAGR over the forecast period, owing to the country's rising popularity of pet adoption. According to a 2024 article published by Dogster, 45% of South African adults own some or other type of pet, and around USD 2,000 is spent annually on pet care in the country. This highlights the expanding demand for pet medicines in the country, driving the market with the highest growth rate.

Product Insights

The pharmaceuticals segment held the highest market share in 2023. This high market share can be attributed to the vast array of products available in this segment and their application across several animal ailments. For example, parasiticides are the most commonly used pharmaceuticals due to the frequent infestation of parasites such as fleas and ticks. Furthermore, drugs like anti-infectives, anti-inflammatory, and analgesics are the primary line of animal treatment before shifting to more advanced treatments like vaccines and stem-cells.

Medicated feed additives segment is expected to growth with the highest growth rate over the forecast period. This growth is due to their palatability and ease of animal compliance, increasing their adoption among a variety of animals. These factors ensure that animals consume the feed additives without any barrier and reduce the requirement of additional measures to deliver necessary medication & nutrition. In South Africa, animal production largely depends on poultry, followed by livestock, swine, etc. Considering the large populations of these livestock, medicine delivery by means of feed is the most efficient way to ensure swift intake of a number of essential nutrients.

Mode of Delivery Insights

The parenteral segment held the highest market share over 45% in 2023 and the highest CAGR over the forecast period, owing to its various advantages over other delivery modes. Some of these are fast onset of action, circumvention of first-pass metabolism, higher drug bioavailability, accurate control over the drug dosage, and reduction in drug interactions, among others. Additionally, other delivery modes, like oral & topical, face a compliance issue from the animals, i.e., they might not easily intake the required dosage, which may lead to wastage of the drug. But in the parenteral mode of delivery, the drug or medicine is directly administered into the system of the animal via injection, eliminating the compliance barrier and ensuring rapid delivery of the medicine to its intended location.

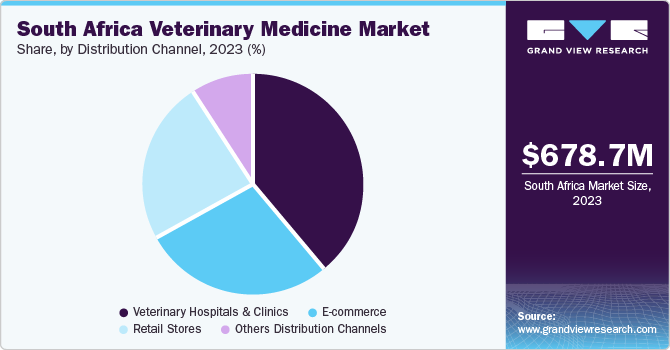

Distribution Channel Insights

The veterinary hospitals & clinics segment held the highest market share over 38% in 2023. This can be attributed to these facilities offering on-site pharmacies, ensuring all the required medications are available. Since products like vaccines & pharmaceuticals are generally prescription-only medications in veterinary medicine, these channels are the first preference of the animal owners for procuring the required medications. Apart from the on-site pharmacies, these settings also conduct health camps to ensure penetration of animal care, ensuring a lucrative procurement of medications in the hospitals & clinics to avoid shortage. Many industry participants often conduct such camps by collaborating with these hospitals and clinics.

The e-commerce segment dominated in terms of CAGR over the forecast period. This distribution channel offers convenience and accessibility to animal owners. The pet or the livestock owner can easily order the medications from the comfort of their home or farm. Online stores and e-commerce platforms offer a variety of products at competitive prices, giving customers the choice to choose the product as per their requirements. E-commerce also helps veterinary facilities procure medications at their requirement and convenience without directly contacting the sales executive of the manufacturers.

Key South Africa Veterinary Medicine Company Insights

Market players are using multiple strategies to improve their market presence. Global leaders are engaging in initiatives to ensure the penetration of various veterinary medicines into the South African market. The players are launching various initiatives like vaccination programs, training programs for veterinarians, and donation activities to combat the most prevalent animal diseases. These programs generally cover multiple countries from the Sub-Saharan region of Africa, like Nigeria, Uganda, and South Africa, among others.

Key South Africa Veterinary Medicine Companies:

- Zoetis Inc.

- Boehringer Ingelheim International Gmbh

- Merck & Co., Inc.

- Elanco

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Phibro Animal Health Corporation

- Virbac

- Bimeda Corporate

- Bupo Animal Health

Recent Developments

-

In March 2023, Zoetis received an investment of USD 15.3 million from the Bill & Melinda Gates Foundation for developing innovative solutions for improving health and productivity in livestock from Sub-Saharan Africa. This investment will expand the company’s African Livestock Productivity and Health Advancement (A.L.P.H.A.) initiative to improve animal health by ensuring ample supply of veterinary pharmaceuticals, biologics, etc.

-

In June 2023, Dechra Pharmaceuticals signed a USD 5.6 billion buyout deal with Swedish private equity firm, EQT.

-

In August 2022, Merck Animal Health, through its Afya Program, and in collaboration with completed donation of 5 million rabies vaccines doses in South Africa.

-

In March 2022, Elanco launched a new initiative in Sub-Saharan countries like South Africa, Nigeria, Uganda, among others. This initiative focused on creating sustainable solutions for treatment of diseases in livestock animals of the region.

-

In August 2022, Bimeda Corporate acquired a leading animal health product distributor in South Africa, Afrivet Southern Africa Proprietary Limited. This acquisition was done to increase the company’ geographic footprint as well as expand into newer sectors of the animal health products industry.

South Africa Veterinary Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 726.69 million

Revenue forecast in 2030

USD 1,145.29 million

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, mode of delivery, distribution channel, country

Country scope

South Africa

Key companies profiled

Zoetis Inc.; Boehringer Ingelheim International Gmbh; Merck & Co., Inc.; Elanco; Dechra Pharmaceuticals PLC; Ceva Santé Animale; Phibro Animal Health Corporation; Virbac; Bimeda Corporate; Bupo Animal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South Africa Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the South Africa veterinary medicine market report based on animal type, product, mode of delivery, distribution channel, and country.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animal

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Others (Fish, Camel, Yak)

-

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Tablet

-

Powder

-

-

Parenteral

-

Topical

-

Others (Ophthalmic, Otic, Intranasal, Rectal, etc.)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Retail Stores

-

Others Distribution Channels

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South Africa

-

Frequently Asked Questions About This Report

b. The South Africa veterinary medicine market size was estimated at USD 678.69 million in 2023 and is expected to reach USD 726.69 million in 2024.

b. The South Africa veterinary medicine market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 1,145.29 million by 2030.

b. Pharmaceuticals accounted for the dominant share of the South Africa veterinary medicine market by product in 2023, owing to the availability of a large number of products in this category and the rapid adoption of pharmaceuticals such as parasiticides & anti-infectives for animals.

b. Some key players operating in the South Africa veterinary medicine market include MSD; Ceva; Zoetis; Boehringer Ingelheim International GmbH; Virbac; Elanco; Bimeda Corporate; Phibro Animal Health Corporation; Dechra Pharmaceuticals Plc; and Bupo Animal Health (Pty) Ltd, among others.

b. Key factors that are driving the South Africa veterinary medicine market growth include growing support initiatives to improve animal health, the rising prevalence of zoonotic and animals diseases in South Africa, increasing pet ownership, and rising poultry disease outbreaks like bird flu/high pathogenicity avian influenza (HPAI).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."