- Home

- »

- Medical Devices

- »

-

South Korea Endoscopy Devices Market, Industry Report, 2030GVR Report cover

![South Korea Endoscopy Devices Market Size, Share & Trends Report]()

South Korea Endoscopy Devices Market Size, Share & Trends Analysis Report By Product (Endoscopes, Operative Devices), By Application (Laparoscopy, Arthroscopy, Bronchoscopy, Laryngoscopy), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-208-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

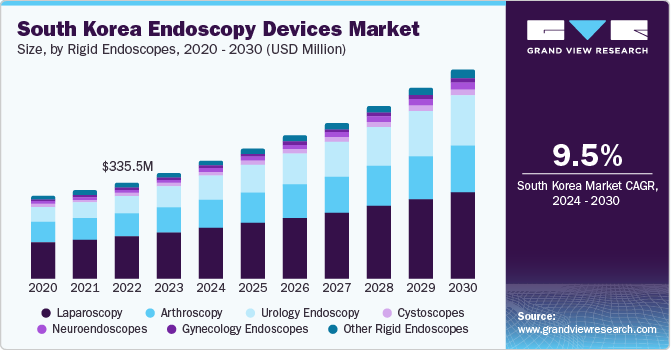

The South Korea endoscopy devices market size was estimated at USD 368.09 million in 2023 and is projected to register a compound annual growth rate (CAGR) of 9.48% from 2024 to 2030. The growth in minimally invasive surgical technologies is expected to boost the demand for endoscopic procedures. The emergence of capsule endoscopes and robot-assisted endoscopy has increased the demand for minimally invasive endoscopic surgeries (MIS). Innovations in endoscopic visualization systems and operative devices is anticipated to drive the market further. The increasing number of healthcare facilities, including hospitals, oncology specialty clinics, and cancer centers, is leading to a rise in the need for endoscopy devices. Furthermore, advancements in healthcare infrastructure and adoption of technologically advanced endoscopy systems is anticipated to bolster the market growth.

The adoption of endoscopy devices for clinical diagnosis and therapeutic interventions across various diseases is rising. These devices enable minimally invasive surgeries, leading to quicker patient recovery and fewer post-operative complications. By utilizing smaller incisions and minimizing muscle disruption, endoscopic procedures help preserve tissue integrity, thereby reducing complications for both patients and healthcare providers. Furthermore, they offer cost-effective alternatives to open surgeries, resulting in shorter hospital stays, faster recovery times, and reduced blood loss during procedures.

Since the introduction of the National Health Insurance Service (NHIS) in 1989, per capita healthcare expenditure in South Korea has been increasing. According to OECD Health at Glance, in 2023, South Korea spends USD 4,570 on healthcare per capita. Despite this, healthcare costs in Korea are acknowledged as being relatively low for healthcare providers. Consequently, this focus on quality and cost reduction in medical care is crucial from an economic perspective, as it allows consumers to purchase healthcare services according to their requirements while simultaneously ensuring providers are compensated sufficiently to maintain and improve their services, thus positively impacting the growth of the healthcare market.

South Korea has one of the highest life expectancies in the world, according to a BBC report in 2019, leading to an increase in the geriatric population in the country. According to Statistics Korea news article published in March 2023, the geriatric population in the country is forecasted to exceed 10 million individuals in 2024 and would increase by 5.4% compared to 2023. However, the early detection and management of geriatric ailments is still in development due to infrastructural and regulatory shortcomings. To address the diverse healthcare needs of the elderly, an integrated care approach is crucial. This approach involves coordinating various healthcare services, including preventive and rehabilitative measures, to ensure comprehensive and personalized care for older adults.

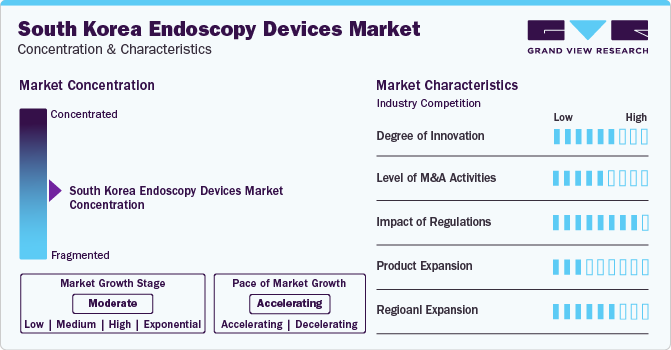

Market Concentration & Characteristics

The market growth is moderate, and the market growth is accelerating. The market is moderately competitive, and key players contribute to this competitive landscape with strategic initiatives, product development, research and development, and regional expansion to propel market growth.

The South Korea endoscopy devices market is characterized by a high degree of innovation owing to the increasing research and development by market participants as well as regulatory bodies and academic institutions. In July 2022, Olympus Innovation Ventures completed its first investment by participating in a Series A funding round of Virgo Surgical Video Solutions. The company develops endoscopic platforms powered by Artificial Intelligence (AI) that enhance clinical workflow and improve patient care outcome.

Market players in the South Korea endoscopy devices market are adhering to merger and acquisition activities to increase their product portfolio and aid product capabilities. For instance, in February 2023, Olympus Corporation acquired Taewoong Medical, a Korea-based manufacturer of medical devices such as gastrointestinal (GI) metallic stents. The acquisition aimed to strengthen the company’s GI EndoTherapy product portfolio capabilities and contribute to improving patient outcomes through comprehensive solutions.

The Ministry of Food and Drug Safety (MFDS) in South Korea is crucial in regulating medical devices. In August 2022, the MFDS updated the regulations for innovative medical devices and their designation, benefiting endoscopic device manufacturers in the market.

Market participants strive for new features to drive product expansions, investing in heavy research and development. For instance, the “see-and-treat" TRUCLEAR hysteroscope by Smith & Nephew exemplifies a vital technological advancement in this market.

Key market players consider regional expansion an important strategy for market sustenance and growth. In February 2023, KARL STORZ expanded its acquired AventaMed, a company based in Ireland, demonstrating their commitment to being a pioneering partner for ENT surgeons, providing cutting-edge endoscopic treatment options.

Product Insights

Endoscopy visualization components led the market revenue share at 36.07% in 2023. This is attributable to the country’s substantial investment in research and development, resulting in innovative medical devices. High-definition cameras, improved light sources, and precise monitors within these components contribute to more accurate diagnoses and better procedural outcomes.

The endoscopes segment is anticipated to grow at a lucrative CAGR over the forecast period. Disposable endoscopes are single-use devices vital in preventing cross-contamination and reducing hospital-acquired infections. Various initiatives in the country promote the adoption of disposable endoscopes, and major industry players are investing in their development. Moreover, novel product development in the segment is anticipated to drive market growth in the foreseeable future.

Application Insights

The gastrointestinal (GI) endoscopy segment led the market revenue share with 55.52%. South Korea faces a relatively high incidence of gastrointestinal diseases, including gastric cancer, colorectal cancer, and inflammatory bowel diseases. According to Annals of Coloproctology, in 2022, the country records approximately 29,030 new colorectal cancer cases annually and the mortality rate of colorectal cancers rose from 8.78 per 100,000 individuals in 2000 to 17.27 per 100,000 individuals in 2022. Thus, GI endoscopy is crucial in diagnosing and managing these conditions, driving the segment growth.

The urology endoscopy (cystoscopy) segment is expected to grow fastest over the forecast period, owing to demographic changes and technological advancements. The growing elderly demographic necessitates increased urinary examinations, and the advancement of cystoscopy equipment plays a pivotal role in meeting this demand. The market is expected to be driven by an escalating demand for cystoscopes in urology, an increase in research and development activities aimed at creating advanced cystoscopes and ureteroscopes, and their increased usage during the pandemic. These factors are projected to stimulate market growth in the future.

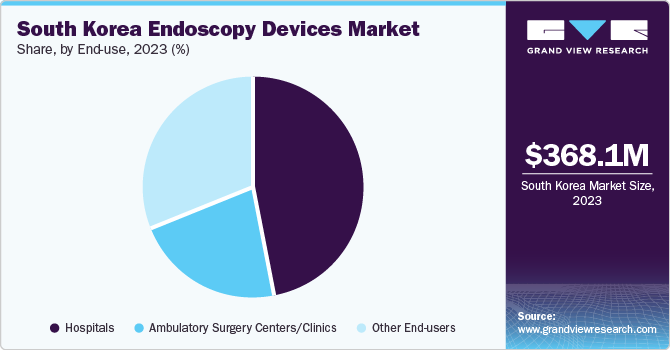

End-use Insights

Hospitals dominated the market share, with a revenue share of 46.73% in 2023. This is attributable to the increasing number of surgeries performed in hospitals and the robust healthcare infrastructure, particularly associated with hospitals, in the country. Furthermore, the high cost of technologically advanced procedures that rely on endoscopic devices can restrict their accessibility to hospitals. In order to maintain the quality of patient care, these endoscopic devices require regular upkeep, which hospitals ensure due to their stringent regulatory operations.

Ambulatory Surgery Centers (ASCs)/clinics are anticipated to grow at the fastest rate from 2024 to 2030. The reduced time needed for endoscopy, the minimal discomfort due to the advent of keyhole surgeries, and the quick recovery time are crucial elements expected to boost the need for endoscopic surgeries in ASCs and clinics, influencing the market positively.

Key South Korea Endoscopy Devices Company Insights

The market is fragmented, with prominent players accounting for a large percentage. Some key companies operating in the South Korea endoscopy devices market include Olympus Corporation; PENTAX Medical; KARL STORZ SE & Co. KG; and FUJIFILM Holdings Corporation.

Mergers & acquisitions, funding & investments in R&D, and development of new products or product modifications are among key strategies market participants are adopting to gain a competitive edge. Strategic alliances play a crucial role in market expansion for several companies in the country.

Key South Korea Endoscopy Devices Companies:

- Olympus Corporation

- FUJIFILM Holdings Corporation

- KARL STORZ SE & Co. KG

- Stryker Corporation

- Medtronic plc

- Conmed Corporation

- Boston Scientific Corporation

- Smith & Nephew plc

- Richard Wolf GmbH

Recent Developments

-

In January 2023, PENTAX Medical, a division of HOYA Group, secured CE certification for two of its latest advancements that ensure compatibility with their recent endoscope models.

-

In February 2022, Korean startup Mediintech focused on developing smart endoscopes for the digestive system, raised 8 billion won (about USD 6.6 million) in Series A round investment from Atinum Investment, Smilegate Investment, and Future Play for its smart endoscope innovation.

-

In November 2021, Fujifilm launched the ColoAssist PRO, a real-time endoscope visualization system that aims to help endoscopists perform efficient, accurate and comfortable colonoscopies.

South Korea Endoscopy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 403.56 million

Revenue forecast in 2030

USD 694.83 million

Growth rate

CAGR of 9.48% from 2024 to 2030

Actual data

2016 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use

Country scope

South Korea

Key companies profiled

Olympus Corporation; FUJIFILM Holdings Corporation; KARL STORZ SE & Co. KG; Stryker Corporation; Medtronic plc; Conmed Corporation; Boston Scientific Corporation; Smith & Nephew plc; Richard Wolf GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South Korea Endoscopy Devices Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the South Korea endoscopy devices market report based on product, application and end-use:

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Capsule Endoscopes

-

Robot Assisted Endoscopes

-

-

Endoscopy Visualization Systems

-

Standard Definition (SD) Visualization Systems

-

2D systems

-

3D systems

-

-

High Definition (HD) Visualization Systems

-

2D systems

-

3D systems

-

-

-

Endoscopy Visualization Component

-

Camera Heads

-

Insufflators

-

Light Sources

-

High Definition Monitors

-

Suction Pumps

-

Video Processors

-

-

Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

-

Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Gastrointestinal (GI) Endoscopy

-

Laparoscopy

-

Obstetrics/Gynecology Endoscopy

-

Arthroscopy

-

Urology Endoscopy (Cystoscopy)

-

Bronchoscopy

-

Mediastinoscopy

-

Otoscopy

-

Laryngoscopy

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers/Clinics

-

Other End-users

-

Frequently Asked Questions About This Report

b. The South Korea endoscopy devices market size was estimated at USD 368.09 million in 2023 and is expected to reach USD 403.56 million in 2024.

b. The South Korea endoscopy devices market is expected to grow at a compound annual growth rate of 9.48% from 2024 to 2030 to reach USD 694.83 million by 2030.

b. Endoscopy visualization systems dominated the South Korea endoscopy devices market with a share of 36.1% in 2023. This is attributable to the increasing preference for HD visualization systems by medical professionals in the diagnosis & treatment of complex diseases.

b. Some key players operating in the South Korea endoscopy devices market include Olympus Corporation; FUJIFILM Holdings Corporation; KARL STORZ SE & Co. KG; Stryker Corporation; Medtronic plc; Conmed Corporation; Boston Scientific Corporation; Smith & Nephew plc; Richard Wolf GmbH

b. Key factors that are driving the South Korea endoscopy devices market growth include a significant increase in the prevalence of age-related diseases, a rise in demand for endoscopy devices in diagnostic & therapeutic procedures, and increasing adoption of minimally invasive surgeries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."