- Home

- »

- Specialty Polymers

- »

-

Southeast Asia Flame Resistant Fabric For Apparel Market Size Report, 2030GVR Report cover

![Southeast Asia Flame Resistant Fabric For Apparel Market Report]()

Southeast Asia Flame Resistant Fabric For Apparel Market Analysis By Application (Chemical & Petrochemical, Oil & Gas, Manufacturing, Power Generation), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-291-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Report Overview

The Southeast Asia flame resistant fabric for apparel market size was valued at USD 27.0 million in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. The market growth is driven by the increasing awareness and stringent regulations regarding workplace safety are compelling industries such as oil & gas, construction, and manufacturing to adopt flame resistant clothing to protect their workforce. The demand for protective clothing is also rising because of increased industrial activities and infrastructure development in the region. Furthermore, the growing emphasis on worker safety and the implementation of safety standards by governments and organizations are expected to sustain the market’s expansion over the forecast period.

Regulations and safety standards significantly influence Southeast Asia's flame resistant fabric for the apparel market. Key initiatives such as the ASEAN-OSHNET (Occupational Safety and Health Network) guidelines and national regulations in countries including Malaysia, Indonesia, and Singapore have mandated using flame resistant clothing in high-risk industries such as oil & gas, chemical, and manufacturing. For instance, Singapore Standard SS 602:2016 outlines the requirements for protective clothing, including flame resistance, in industrial environments. Additionally, the implementation of international standards such as ISO 11612, which specifies performance requirements for protective clothing against heat and flames, has pushed manufacturers to innovate and improve their product offerings.

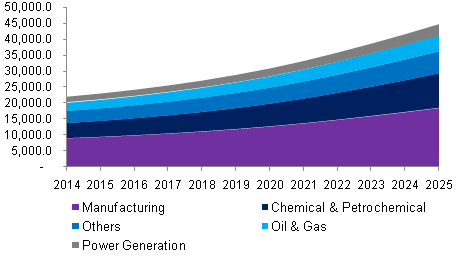

Application Insights

The manufacturing segment accounted for 45.0% of the market revenue in 2023 attributed to the high demand for protective clothing in various manufacturing industries, including automotive, electronics, and machinery. Workers in these sectors are often exposed to hazards such as sparks, molten metal splashes, and high temperatures, necessitating the use of flame resistant fabrics. The stringent safety regulations and standards in place further drive the adoption of these fabrics.

The chemical and petrochemical segment is projected to grow at a CAGR of 6.5% from 2024 to 2030. The growth in this segment is driven by the expansion of the chemical and petrochemical industries in Southeast Asia, fueled by rising investments and the region’s strategic importance in the global supply chain. Moreover, the implementation of stringent safety regulations and standards is expected to boost the demand for advanced flame resistant fabrics.

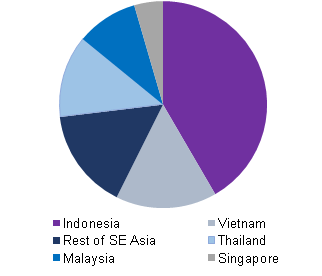

Country Insights

Vietnam Flame Resistant Fabric For Apparel Market Trends

Vietnam flame resistant fabric market is expected to grow at a CAGR of 6.6% due to rapid industrialization and increased focus on worker safety. The government's stringent safety regulations and growing industrial base are driving the demand for protective apparel.

Malaysia Flame Resistant Fabric For Apparel Market Trends

The flame resistant fabric for apparel market in Malaysia is projected to grow steadily from 2024 to 2030.This growth can be attributed to the nation's robust industrial sector and stringent safety regulations. The Malaysian government has implemented comprehensive workplace safety guidelines that mandate the use of flame resistant clothing in potentially dangerous work environments. Furthermore, Malaysia's strategic efforts to attract foreign investments and promote industrial activities are anticipated to sustain the demand for protective apparel throughout the projected period.

Indonesia Flame Resistant Fabric For Apparel Market Trends

Indonesia held a 15.7% revenue share in the market in 2023, reflecting its substantial industrial base and the critical need for worker safety in high-risk sectors. The country’s large-scale industries, including oil & gas, mining, and manufacturing, are major consumers of flame resistant fabrics. Additionally, the growth of the construction and infrastructure sectors is contributing to the increased demand for flame resistant apparel.

Key Companies & Market Share Insights

Some of the major companies in the Southeast Asia flame resistant fabric for apparel market include DuPont, 3M Company, Huntsman, Honeywell, and Ansell. These companies are focusing on expanding their product portfolios through technological advancements, strategic collaborations, mergers, and acquisitions. Additionally,these companies are continuously investing in research and development to introduce new and improved flame resistant fabrics that meet the evolving safety standards and requirements of Southeast Asian industries.

-

DuPont is a key player in the Southeast Asian flame resistant fabric market, known for its innovative solutions such as Nomex and Kevlar. Due to their excellent heat and flame resistance properties, these materials are widely used in protective clothing for industries such as oil and gas, chemicals, and manufacturing.

-

Ansell provides various protective clothing solutions, including flame resistant apparel. Their products are designed to meet stringent safety standards and are widely used in oil & gas, chemical, and manufacturing industries.

Key Southeast Asia Flame Resistant Fabric For Apparel Companies:

- E.I. du Pont de Nemours

- Huntsman Corporation

- Ansell Limited

- 3M Company

- Solvay S.A.

- Royal TenCate NV

- Teijin Limited

- TOYOBO Co., Ltd

- Milliken & Company

- Klopman International

Recent Developments

-

In April 2023, The Government of India introduced two Quality Control Orders (QCOs) for 31 items within the textiles sector. This move, spearheaded by the Ministry of Textiles, emphasized the importance of the Bureau of Indian Standards (BIS) mandatory certification for technical textiles. The QCOs aim to reinforce the quality and standards of technical textiles.

-

In August 2024, Vietnam National Textile and Garment Group (Vinatex) and Coats announced a strategic partnership to introduce a new line of flame-retardant fabrics. This expansion marks a departure from the highly competitive conventional textile and garment sector, positioning Vinatex to capitalize on the growing demand for specialized materials in niche markets.

Southeast Asia Flame Resistant Fabric For Apparel Market Scope

Report Attribute

Details

Market size value in 2024

USD 28.6 million

Revenue forecast in 2030

USD 42.2 million

Growth rate

CAGR of 6.7% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Key companies profiled

E.I. du Pont de Nemours, Huntsman Corporation, Ansell Limited, 3M Company, Solvay S.A., Royal TenCate NV, Teijin Limited, TOYOBO Co., Ltd, Milliken & Company, Klopman International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Flame Resistant Fabric For Apparel Market Segmentation

This report forecasts revenue & volume growth of the Flame Resistant Fabric For Apparel market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report based on application:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical & Petrochemical

-

Oil & Gas

-

Manufacturing

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Singapore

-

Vietnam

-

Malaysia

-

Indonesia

-

Thailand

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."