- Home

- »

- Advanced Interior Materials

- »

-

Southeast Asia Pipes Market Size & Share Report, 2020-2028GVR Report cover

![Southeast Asia Pipes Market Size, Share & Trends Report]()

Southeast Asia Pipes Market Size, Share & Trends Analysis Report By Product, By Application (Plumbing, Drainage/Sanitary, HVAC), By End-use (Residential, Commercial), By Country, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-502-8

- Number of Report Pages: 97

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

Report Overview

The Southeast Asia pipes market size was estimated at USD 19.1 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.3 % from 2020 to 2028. Growth in the infrastructure development in the region spurred by FDI inflow due to the “China plus one” policy adopted by major downstream companies is expected to drive the demand for pipes in the region, which is further expected to drive market growth.

Stringent covid restrictions imposed in key economies such as Indonesia, Malaysia, the Philippines, and Thailand resulted in the temporary closure of many non-essential industries and construction sites. In addition, the construction sector witnessed a downfall in several countries, leading to a decline in demand for pipes in key construction applications, thereby limiting the industry growth.

The rise in awareness of sanitization, demand for pure drinking water, and rise in investments in hospital buildings post the COVID-19 pandemic are factors likely to improve the macroeconomic indices of the Southeast Asian countries in the coming years. In addition, the market is also expected to witness a revival on account of the restart of the construction activities in 2021, in the region.

The construction and industrial sector are the major application areas propelling the demand for pipes in the market. Factors such as stable exchange rates, rapid industrialization, fast-paced infrastructural developments, subdued oil prices, and a moderate inflation rate drive the overall economic growth in emerging economies in the region, consequently driving the demand for pipes in residential and commercial spaces.

Plastics have progressively displaced multiple materials, especially in the piping or tubing industry. Rising construction activities on account of increasing population, industrialization, and urbanization across the region are expected to result in the growth of the market over the forecast period.

Pipe manufacturers tend to opt for recyclable raw materials to curb pollution and reduce their recycling burden. For instance, Wavin, a prominent market player, offers pipes produced from 50% recyclable raw materials using its Recycore technology. A majority of the manufacturers of plastic and plastic pipes exhibit similar trends in investment, acquisition, expansion, product launches, and geographic expansions.

Product Insights

The steel and alloy pipes segment dominated the market and accounted for the largest revenue share of 37.2% in 2020. This is attributed to widespread applications of these pipes in multiple industries including manufacturing, transportation, construction, oil and gas, and HVAC. In addition, the growing usage of steel and its alloys as a substitute for metals such as cast iron and lead due to problems of corrosion and health issues related to them is expected to drive the demand for steel and alloy pipes.

Steel and alloy pipes are used in various application industries such as manufacturing, transportation, Liquified Natural Gas (LNG), desalination, and nuclear power owing to their properties such as anti-corrosion, less reactivity, high strength, and tough texture. The growth of these application industries in Southeast Asian countries is expected to drive the demand for steel and alloy pipes over the forecast period.

Polypropylene (PP) pipes are used in several applications including chemical drainage systems, industrial and process piping applications, and hot and cold-water distribution, due to lightweight piping material with high chemical resistance, corrosion resistance, and high durability. PP-R pipes are the most widely used PP pipes due to internal pressure resistance at high temperatures which makes them the material of choice in chemical and food processing industries.

The growing adoption of copper pipes in applications such as HVAC, sprinklers, CNG and LNG distribution, medical gas distribution and storage, and water supply is attributed to their properties such as flexibility, corrosion resistance, and lightweight. The adoption of copper pipes is rising in kitchens and bathroom accessories due to their aesthetic appeal.

Application Insights

The drainage/sanitary segment dominated the market and accounted for the largest revenue share of 35.5% in 2020. This is attributed to the construction of several water supply projects, wastewater water treatment projects, and drainage and sewerage projects in many parts of Southeast Asia. Furthermore, grants by several foreign agencies including for the development of drainage and sanitary infrastructure in these countries are expected to benefit market growth.

The growth of the HVAC application segment in the market is expected to be driven by growth in the commercial and industrial construction industries in countries such as Singapore, Thailand, Philippines, Indonesia, and Malaysia. Growth in industries, such as hospitality, healthcare, retail, and pharmaceuticals, is expected to drive the growth of the HVAC industry in Southeast Asia, which, in turn, is expected to create new growth avenues in the market for pipes in the coming years.

The growing demand for pipes in other applications, such as fluid transportation, cable protection, electrical appliances, and oil well casing, can be attributed to the growth in industries such as power generation, transportation, food processing, oil and gas, automobile, and renewable energy generation. In addition, investments by governments in countries, such as Malaysia, Singapore, Thailand, and Vietnam, toward setting up power generation plants and rail and road networks are expected to benefit market growth.

Growth in the e-commerce sector in several countries including Singapore, Malaysia, Thailand, and Indonesia has led to the construction of several cold storage warehouses, thus leading to rising demand for pipes in the HVAC industry. In addition, growing investments in the region for the development of the e-commerce delivery infrastructure are expected to drive market growth.

End-use Insights

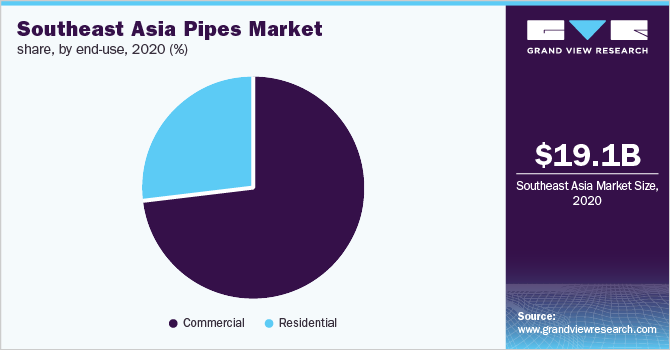

The commercial end-use segment dominated the Southeast Asia pipes market and accounted for the largest revenue share of about 72.9% in 2020. This is attributed to rising government investments in the development of water infrastructure projects, industrial facilities for power generation, refrigerant plants, and drainage systems. In addition, the development of new drainage and sewerage systems in partnership with private players and foreign agencies in Southeast Asian countries is expected to benefit market growth.

The demand for pipes in the commercial construction industry is expected to rise over the forecast period owing to the government’s emphasis on the development of water infrastructure projects, industrial facilities for power generation, and refrigerant plants. Investments in partnership with foreign agencies for the development of proper drainage and sewerage systems are expected to create growth avenues in the market.

The residential end-use segment is expected to be driven by increasing investments by government and private players toward the construction of residential housing units for the growing population in several countries including Singapore, Indonesia, and Malaysia. The construction of affordable rental homes in Myanmar and Thailand is expected to create growth opportunities in the market.

The residential construction industry is expected to witness growth on account of the affordable housing schemes by governments in several countries. For instance, in April 2021, the Thailand government announced the construction of 100,000 homes under the National Housing Authority’s house-rental project for the low-income sector.

Country Insights

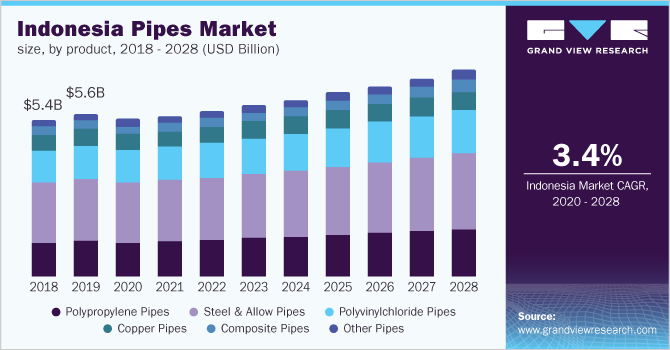

Indonesia dominated the market and accounted for the largest revenue share of 28.3% in 2020. This is attributed to the construction of water treatment, drainage, and sewerage projects by the government in partnership with several private players. In addition, mass construction of residential complexes by the government as per the 2020-24 mid-term development plan is expected to create new growth opportunities in the Indonesian pipes market.

Foreign investment in the development of drainage and sewerage systems in Vietnam is expected to create growth opportunities in the market. For instance, in February 2020, JICA signed a grant agreement with the government of Vietnam to provide an aid of about USD 17.4 billion for the Trenchless Sewerage Pipe Rehabilitation project in Ho Chi Minh City.

Key Companies & Market Share Insights

Regional pipe manufacturers operate their business through joint ventures with key international players in a bid to harness the high growth potential of the market. Vesbo Asia Pte Ltd holds investments from Arcon Germany and Novaplast Turkey. The company uses raw materials produced by plastic giants such as SABIC, Borealis, and Lyondell Basell.

The major pipe manufacturers in the region include Wavin Asia Pacific, George Fischer Pte Ltd., UHM Co., Ltd., and Vesbo Asia Pte Ltd. Presence of globally recognized plastic manufacturers such as ExxonMobil Corporation, Chevron Phillips Chemicals Asia Pte. Ltd., and HMC Polymers and steel manufacturers including Nippon Steel Corporation, Essar Steel, and POSCO are considered an advantage for the pipe manufacturers owing to the immediate raw material availability. Some of the prominent players in the Southeast Asia pipes market include:

-

Kobelco

-

Thai Premium Pipe Co., Ltd.

-

George Fischer Pte., Ltd.

-

Binh Minh Plastics

-

Vesbo Asia Pte., Ltd.

-

Bina Plastic Industries Sdn. Bhd.

-

Wavin Asia Pacific

Southeast Asia Pipes Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 19.5 billion

Revenue forecast in 2028

USD 24.8 billion

Growth rate

CAGR of 3.3% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, country

Regional scope

Southeast Asia

Country scope

Indonesia; Vietnam; Thailand; Malaysia; Singapore; Rest of Southeast Asia

Key companies profiled

Kobelco; Thai Premium Pipe Co., Ltd.; George Fischer Pte., Ltd.; Binh Minh Plastics; Vesbo Asia Pte., Ltd.; Bina Plastic Industries Sdn. Bhd.; Wavin Asia Pacific

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Southeast Asia pipes market report on the basis of product, application, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Polypropylene Pipes

-

Steel & Alloy Pipes

-

Polyvinylchloride Pipes

-

Copper Pipes

-

Composite Pipes

-

Other Pipes

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Plumbing

-

Drainage/Sanitary

-

HVAC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Residential

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2017 - 2028)

-

Indonesia

-

Vietnam

-

Thailand

-

Malaysia

-

Singapore

-

Rest of Southeast Asia

-

Frequently Asked Questions About This Report

b. The Southeast Asia pipes market size was estimated at USD 19.1 billion in 2020 and is expected to reach USD 19.5 billion in 2021.

b. The Southeast Asia pipes market is expected to grow at a compound annual growth rate of 3.3% from 2020 to 2028 to reach USD 24.8 billion by 2028.

b. Steel & alloy pipes dominated the Southeast Asia pipes market with a revenue share of over 35% in 2020. This is attributable to the high demand for the product from commercial and residential construction in the region.

b. Some of the key players operating in the Southeast Asia pipes market include Kobelco, Thai Premium Pipe Co., Ltd., George Fischer Pte., Ltd., Binh Minh Plastics, Vesbo Asia Pte., Ltd., Bina Plastic Industries Sdn. Bhd., Wavin Asia Pacific.

b. Key factors that are driving the Southeast Asia pipes market growth include increasing infrastructural development and a rise in the demand for the product in the aftermarket.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."