- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Soybean Meal Market Size, Share And Growth Report, 2030GVR Report cover

![Soybean Meal Market Size, Share & Trends Report]()

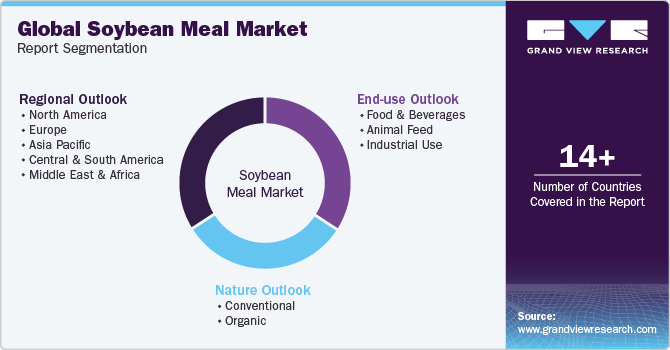

Soybean Meal Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (Conventional, Organic), By End-use (Food & Beverages, Animal Feed, Industrial Use), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-184-1

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soybean Meal Market Summary

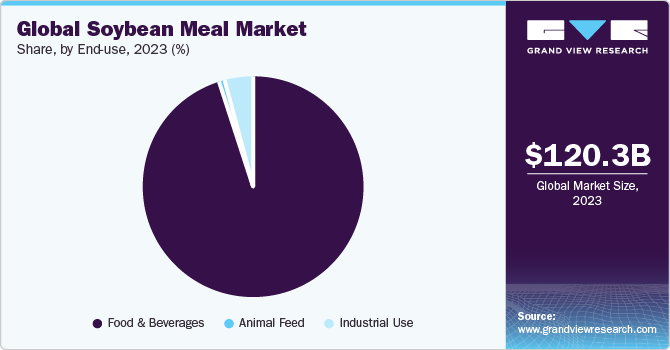

The global soybean meal market size was estimated at USD 120.34 billion in 2023 and is expected to reach USD 162.91 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. The increasing global demand for protein-rich animal feed, particularly in the growing livestock and poultry industries is driving the growth of the market.

Key Market Trends & Insights

- Asia Pacific dominated the overall soybean meal market in 2023 and is anticipated to grow at the fastest CAGR of 5.09% from 2024 to 2030.

- China accounted for the largest share of the soybean meal market in the Asia Pacific region in 2023.

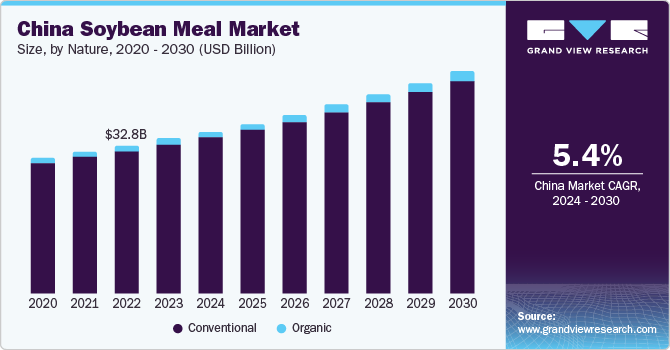

- By nature, the conventional segment accounted for the largest revenue share in 2023.

- By end-use, the animal feed segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 120.34 Billion

- 2030 Projected Market Size: USD 162.91 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

Soybean meal, a byproduct of soybean processing, is valued for its high protein content and nutritional qualities. The expanding population and rising incomes contribute to higher meat consumption, fueling the need for protein-rich animal feed.

In addition, the versatility of soybean meal in various feed formulations and its cost-effectiveness further propel its demand. Sustainability concerns and the desire for plant-based protein sources also contribute to the market’s growth as soybean meals are a key component in vegetarian and vegan diets. Furthermore, the global population is increasing and with it the demand for food. Soybean meal is a versatile ingredient that can be used in a variety of food products, including meat substitutes, baked goods, and snacks. As such, the demand for soybean meal is expected to increase in the coming years as food manufacturers seek out sustainable and cost-effective sources of protein.

Moreover, the changes in weather patterns are affecting the supply of soybeans and other crops. Droughts, floods, and other extreme weather events can damage crops and reduce yields, which can lead to higher prices for soybean meal and other agricultural commodities. There is growing interest in sustainable agriculture and reducing the environmental impact of food production. Soybean meal is seen as a more sustainable alternative to other sources of protein, such as meat, which requires more resources to produce. As such, soybean meal demand may continue to grow as consumers and food manufacturers seek out more sustainable options.

Market Concentration & Characteristics

The degree of innovation in the soybean meal market has been significant in recent years. Several factors have contributed to this innovation. Firstly, there have been advancements in technology and agricultural practices, leading to improved methods of soybean cultivation and processing. These advancements have resulted in higher yields and better-quality soybean meal. Furthermore, the increasing awareness of sustainability and environmental concerns has driven innovation in the soybean meal market. Companies are now focusing on developing sustainable sourcing practices, reducing waste, and improving the overall sustainability of their operations.

Several market players such as The Scoular Company; Kohinoor Feeds and Fats Ltd.; AdamPolSoya; Louis Dreyfus Company B.V.; Perdue Farms; and SimpliSafe, Inc. are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. The most notable regulation is the ban on the use of genetically modified soybeans in many countries. This has led to a decrease in the supply of soybean meal, as many farmers have had to switch to non-GMO soybeans. As a result, prices for soybean meal have increased, making it more expensive for farmers to purchase.

One common substitute is canola meal, which is derived from crushing canola seeds. Canola meal has a similar protein content to soybean meal and can be used in animal feed formulations. It is often used as a replacement or partial replacement for soybean meal in livestock and poultry diets. Another substitute is sunflower meal, which is produced from the byproduct of oil extraction from sunflower seeds. Sunflower meal also contains a significant amount of protein and can be used as a feed ingredient for livestock and poultry. It can be an effective alternative to soybean meal in terms of nutritional value.

Nature Insights

The conventional segment accounted for the largest revenue share in 2023. A conventional soybean meal serves as a widely accepted and cost-effective protein source for both animal feed and various food products. Its affordability and availability make it a preferred choice for industries that rely on soybean products. The well-established supply chain and production infrastructure for conventional soymeal contribute to its continued market dominance. Additionally, the conventional soymeal market benefits from its versatility, being used in a range of applications, including livestock feed, aquaculture, and as an ingredient in processed foods.

The organic segment is anticipated to witness the fastest market growth over the forecast period. Consumers are increasingly seeking healthier and environment-friendly options, and organic soymeal aligns with these preferences. As awareness of the environmental impact of conventional agriculture grows, consumers are willing to pay a premium for organic products. Additionally, the organic soymeal market benefits from a perception of being free from synthetic chemicals and genetically modified organisms (GMOs), catering to health-conscious and environmentally conscious consumers.

End-use Insights

The animal feed segment dominated the market in 2023. The growing awareness of the health benefits of soybean meal in animal diets is contributing toward segment growth. Soybean meal is rich in amino acids, vitamins, and minerals, making it a nutritious choice for animal feed. Consumers are becoming increasingly conscious of the quality of meat and dairy products they consume, and this has led to an increased demand for animal feed ingredients that enhance the nutritional value of livestock.

The food & beverages segment is anticipated to grow at a rapid pace during the forecast period. There is a growing demand for plant-based protein sources, and soybean meal is a popular choice due to its high protein content. As more consumers are adopting vegetarian or vegan diets, the demand for soybean meal as an ingredient in food and beverage products has increased. Additionally, soybean meal is also being used as a substitute for other animal-based protein sources, such as meat and dairy products. This is driven by concerns over the environmental impact of animal agriculture and the desire for more sustainable food options.

Regional Insights

Asia Pacific dominated the overall soybean meal market in 2023 and is anticipated to grow at the fastest CAGR of 5.09% from 2024 to 2030. The growing population and increasing disposable income in the region have led to a greater need for soybean meal as a source of protein and essential nutrients. This trend has significantly contributed to the market’s growth and is expected to continue driving demand in the foreseeable future. Additionally, technological advancements in the production process and the introduction of new products have played a pivotal role in the market’s expansion. These innovations have enhanced production efficiency and product quality, further fueling the growth of the soybean meal market in the APAC region.

China accounted for the largest share of the soybean meal market in the Asia Pacific region in 2023. China’s large and increasing population, combined with rapid urbanization, has escalated the demand for food, including soybeans and their by-products. This demand is further bolstered by rising income levels, allowing for more diversified diets that include protein-rich foods derived from soybeans. The surge in meat consumption, particularly poultry and pork, elevates the need for soybeans as a key component in animal feed.

The North America segment is anticipated to grow at a significant rate during the forecast period. The increasing market for soybean meal in North America is attributable to a lot of factors related to agricultural production, animal husbandry, and evolving consumer and environmental concerns. Primarily, soybean meal’s role as a high-protein ingredient in animal feed is a significant driver, catering to the expanding livestock and poultry industries, notably in chicken and pork production. Concurrently, the burgeoning aquaculture sector is turning to soybean meal as a sustainable and efficient feed option. Advances in agricultural technology have led to enhanced soybean yields in North America, directly increasing the availability of soybean meal.

Key Companies & Market Share Insights

Some key players operating in the market include Kohinoor Feeds and Nordic Soya Ltd..

-

Kohinoor Feeds provides a range of products including soya flakes, refined and crude oil, flour, meal, yellow maize, and white sugar.

-

Nordic Soya Ltd. operates its soybean processing facility in the city of Hamina, located on the southern coast of Finland. The company’s operations are focused on the Finnish market and the broader European region.

The Scoular Company and Wilmar International are some of the emerging market participants in the soybean meal market.

-

The Scoular Company has a significant presence in North America, with operations and facilities across the U.S. and Canada. Additionally, the company has a global reach through its trading and distribution activities.

-

Wilmar International is a leading agricultural company based primarily in Asia and Africa. Originating in Singapore, the company delves into providing varied agricultural solutions, such as ready-to-eat meals, oilseed crushing, flour and rice milling, and edible oils refining.

Key Soybean Meal Companies:

- The Scoular Company

- Kohinoor Feeds and Fats Pvt. Ltd.

- AdamPolSoya

- Louis Dreyfus Company B.V.

- Perdue Farms

- Agrocorp International Pte Ltd

- Yihai Kerry Investments Co., Ltd.

- Nordic Soya Ltd.

- Irwing Soya

- Wilmar International

Recent Developments

-

In April 2023, CRC purchased soybeans from farmers in Central Kentucky to process in their soybean facility. The facility can process 330 tons of soybeans daily, producing high-protein soybean meal and valuable feed ingredient soybean hulls. This expansion enables CRC to process almost four million bushels of soybeans annually, producing vegetable oil, soybean meal, and hulls for livestock and poultry feed. CRC’s biodiesel refining division is expected to produce up to five million gallons per year.

-

In March 2022, Perdue AgriBusiness would invest USD 59.1 million to expand its soybean crushing facility in Chesapeake, Virginia. This expansion will increase the production of soybean oil, soybean meal, and hulls. The company currently purchases 80% of Virginia’s soybeans and exports 72 million tons of soybeans annually. The expansion will improve processing capabilities and support local farmers. Perdue AgriBusiness is a subsidiary of Perdue Farms Inc., a large grain company with operations worldwide.

-

In January 2021, The United Soybean Board partnered with DuPont Nutrition & Biosciences and Soylent for a pilot program to identify sustainably grown soy products. They will use a new label called the Sustainably Grown U.S. Soy mark, ensuring the soy comes from responsible farms. The goal is to improve sustainability in supply chains and offer the mark to other companies.

Soybean Meal Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 124.96 billion

Revenue forecast in 2030

USD 162.91 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Nature, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain, China; India; Japan; Indonesia; Vietnam; Brazil; South Africa

Key companies profiled

The Scoular Company; Kohinoor Feeds and Fats Pvt. Ltd.; AdamPolSoya; Louis Dreyfus Company B.V.; Perdue Farms; Agrocorp International Pte Ltd; Yihai Kerry Investments Co. Ltd.; Nordic Soya Ltd.; Irwing Soya; Wilmar International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soybean Meal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global soybean meal market report based on nature, end-use, and region:

-

Nature Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional

-

Organic

-

-

End-use Outlook (Revenue, USD Billion; 2017 - 2030)

-

Food & Beverages

-

Animal Feed

-

Poultry

-

Swine

-

Aquaculture

-

Other Animals (Dairy, Beef, Pets)

-

-

Industrial Use

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The increasing global demand for protein-rich animal feed, particularly in the growing livestock and poultry industries is driving the growth of the market. Soybean meal, a byproduct of soybean processing, is valued for its high protein content and nutritional qualities. The expanding population and rising incomes contribute to higher meat consumption, fueling the need for protein-rich animal feed. Additionally, the versatility of soybean meal in various feed formulations and its cost-effectiveness further propel its demand.

b. The global soybean meal market size was estimated at USD 120.34 billion in 2023 and is expected to reach USD 124.96 billion in 2024.

b. The global soybean meal market is expected to grow at a compounded growth rate of 4.5% from 2024 to 2030 to reach USD 162.91 billion by 2030.

b. Animal feed segment dominated the market in 2023. The growing awareness of the health benefits of soybean meal in animal diets is contributing to segment growth. Soybean meal is rich in amino acids, vitamins, and minerals, making it a nutritious choice for animal feed. Consumers are becoming more conscious of the quality of meat and dairy products they consume, and this has led to an increased demand for animal feed ingredients that enhance the nutritional value of livestock.

b. Some key players operating in soybean meal market include The Scoular Company, Kohinoor Feeds and Fats Ltd., AdamPolSoya, Louis Dreyfus Company B.V., Perdue Farms, Agrocorp International Pte Ltd, Yihai Kerry, Nordic Soya Ltd., Irwing Soya, Wilmar International Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.