- Home

- »

- Automotive & Transportation

- »

-

Space Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Space Tourism Market Size, Share & Trends Report]()

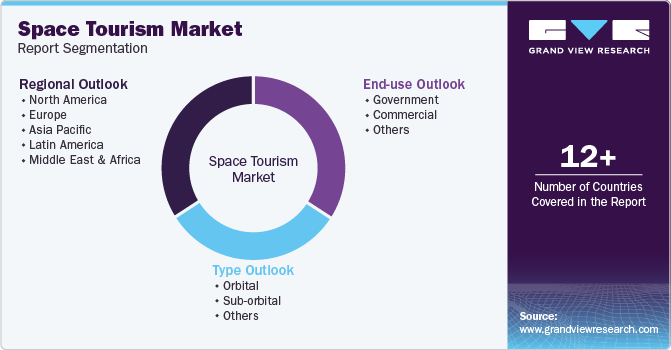

Space Tourism Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Orbital, Sub-orbital), By End Use (Government, Commercial), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-955-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Space Tourism Market Summary

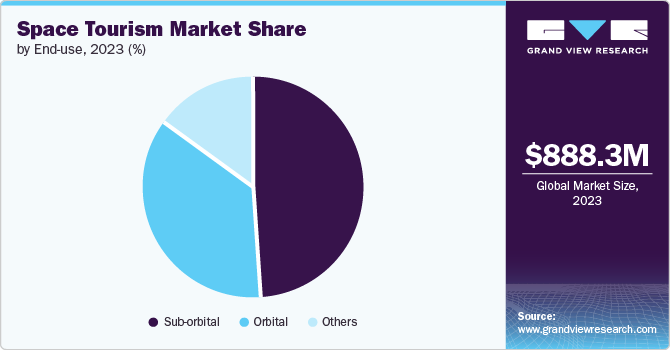

The global space tourism market size was estimated at USD 888.3 million in 2023 and is projected to reach USD 10.09 billion by 2030, growing at a CAGR of 44.8% from 2024 to 2030. The market is experiencing significant growth driven by advancements in technology, a growing interest in adventure travel, and the high net worth of individuals interested in orbiting flights.

Key Market Trends & Insights

- The North America space tourism market led globally in 2023, accounting for the largest revenue share of 38.9%.

- The U.S. space tourism market held the largest revenue share of 83.1% in the North American region in 2023

- By type, the sub-orbital segment dominated the overall market, gaining a market share of 48.5% in 2023.

- In terms of end use, the commercial segment is expected to dominate in 2023, gaining a market share of 55.8%.

Market Size & Forecast

- 2023 Market Size: USD 888.3 Million

- 2030 Projected Market Size: USD 10.09 Billion

- CAGR (2024-2030): 44.8%

- North America: Largest market in 2023

Technological innovations, such as reusable rockets and improved spacecraft designs, are making astronomical travel more viable and cost-effective. This, combined with the increasing demand from affluent individuals seeking unique experiences, is fueling the industry's expansion.

In addition, the market is benefiting from increased research and development efforts by both government space agencies and private organizations, which are crucial for overcoming the technical and logistical challenges associated with astronomical tourism.

Furthermore, supportive regulatory developments are facilitating safer and more accessible astronomical travel, ensuring the safety of passengers while promoting industry growth. The economic impact of the expanding astronomical tourism market is also notable, with potential job creation and advancements in related industries such as aerospace, hospitality, and tourism. In the coming years, astronomical tourism is expected to become more accessible to the general population, driven by technological and regulatory advancements and the sustained interest of high-net-worth individuals. This soaring industry is poised to transform travel experiences and open new frontiers for leisure and business purposes.

In 2023, there were 223 interplanetary launches, with 109 originating from the U.S., 67 from China, and 19 from Russia. The number of launches is expected to increase, which could harm the ozone layer and negatively impact the Earth's climate. In June 2022, researchers from the Massachusetts Institute of Technology (MIT), the University of Cambridge, and University College London (UCL) observed that soot emissions from rocket launches have a more significant heating effect on the atmosphere compared to other sources of emissions.

The emitted pollutants are responsible for the depletion of the ozone layer in the stratosphere. The spacecraft sent into orbit follows a multi-stage configuration and is plunged to pass through the Earth’s atmosphere. With every stage, the auxiliary parts are separated from the launch vehicle and are discarded or reused in further explorations.

The space industry has seen significant evolution in the U.S. and Europe due to accessible launch facilities, commercial space launches, technological advancements, and the rise of astronomical tourism. The market is dominated by a few key players who hold a substantial share. These companies are heavily investing in research and development to create orbital and suborbital vehicles for future astronomical travel. Anticipating exponential growth in the industry, these companies have committed significant financial resources to seize emerging opportunities.

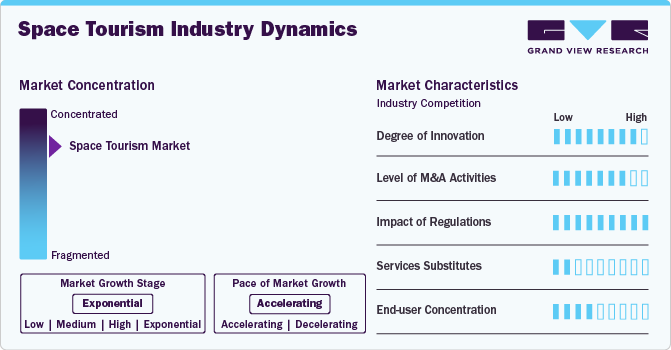

Industry Dynamics

The space tourism industry has a very high level of innovation since businesses are always trying to come up with new ideas and cutting-edge technologies to improve the entire astronomical travel experience. This innovation includes improvements in propulsion systems, safety procedures, and consumer engagement tactics in addition to spaceship architecture. The sector is ready to launch ground-breaking solutions that push the frontiers of space tourism, drawing a wide spectrum of clients and encouraging long-term growth, thanks to continuous investments in research and development.

In the space tourism industry, there are also numerous instances of mergers and acquisitions taking place. As the market develops, businesses look for strategic alliances, buyouts, and joint ventures to pool resources pool knowledge, and get past financial and technological obstacles. M&A transactions enable businesses to take advantage of synergies and improve processes by facilitating the transfer of knowledge and technologies. This ever-changing corporate transaction landscape highlights the industry's dedication to attaining economies of scale and promoting a cooperative atmosphere that encourages new developments.

Due to the strict rules to guarantee passenger safety and the integrity of interplanetary activities, regulations have a significant impact on the space tourism industry. Globally, governments are proactively establishing legal frameworks to tackle the distinct obstacles linked to commercial space exploration. For organizations in the space tourism industry, success largely depends on finding the correct balance between protecting the public interest and promoting innovation. It is always difficult for businesses to adjust to changing legislation, so they must continue to be flexible and proactive in their operations.

Given the unique nature of astronomical flight experiences, there are only a few alternatives to services in the space tourism business. Space tourism is a niche product with few direct competitors, despite the possibility of substitutes in the form of typical travel and leisure activities due to its inherent appeal and distinctiveness. With the business growing and becoming more accessible, there is a chance that demand will rise without much competition from other services, making space tourism a unique and sought-after experience for travelers looking for adventures that cannot be found anywhere else on Earth.

The space tourism industry has a relatively small end use concentration, with a varied client base that includes organizations investing in scientific initiatives and promotional operations as well as wealthy individuals seeking special experiences. The market is not unduly dependent on any one consumer category, but businesses nonetheless need to regularly review and modify their offerings to meet the changing needs and tastes of a wide range of clients. The significance of market segmentation techniques in efficiently targeting and engaging diverse demographic groups and guaranteeing long-term market growth is highlighted by this moderate degree of concentration.

Type Insights

In terms of type, the market is classified into orbital, suborbital, and others. The sub-orbital segment dominated the overall market, gaining a market share of 48.5% in 2023, and is anticipated to witness a CAGR of over 44.4% during the forecast period. Suborbital tourism allows individuals to experience weightlessness and view space without leaving Earth's orbit, reaching the edge of space without entering orbit. Orbital and suborbital flights are differentiated by the vehicle's speed; suborbital flights operate at lower speeds and do not achieve orbit. These flights ascend to a specific altitude and descend back to Earth once the engines shut down. Companies are increasingly focusing on suborbital flights due to the ability to reuse rockets, which reduces manufacturing costs.

The orbital segment is anticipated to witness the fastest CAGR of 45.5% from 2024 to 2030. Orbital flights can last from a few days to several weeks, depending on the destination, such as the International Space Station (ISS), the moon, or Mars. Companies like Virgin Galactic and Blue Origin primarily focus on suborbital flights, while SpaceX and Orion Span target orbital flights. For example, Orion Span, a U.S.-based astronomical travel company, plans to deploy a private commercial space station, the Aurora Space Station, in Low Earth Orbit (LEO) to serve as a space hotel, accommodating up to six tourists at a time.

End Use Insights

In terms of End Use, the market is classified into government, commercial, and others. Among these, the commercial segment is expected to dominate in 2023, gaining a market share of 55.8%. It is expected to grow at the fastest CAGR of 45.3% during the forecast period. In 2021, thirteen commercial spaceflight missions were conducted by various private and government organizations, with seven missions successfully completed. The industry's potential is increasingly evident as technical advancements pave the way for commercial space tourism. However, significant challenges remain, particularly the high cost of space tourism. Industry participants are working to make these experiences more affordable for a broader audience.

Billionaires have invested substantial amounts to travel to space and view Earth from above. Companies like Virgin Galactic, Blue Origin, SpaceX, and NASA have carried out missions to transport non-astronaut individuals to space and return them to Earth after a certain period. These missions have achieved notable milestones, including the first feature film shot in space and sending the oldest person to space.

The government segment is anticipated to grow at a considerable CAGR of 44.6% throughout the forecast period. The government segment is expected to register the fastest CAGR over the forecast period due to substantial investments in space exploration and technological advancements. Governments are increasingly partnering with private companies to commercialize space travel, leveraging public resources and regulatory support to facilitate growth. In addition, government initiatives aimed at scientific research, national security, and international collaboration drive demand for advanced space missions, further boosting the market's expansion.

Regional Insight

The North America space tourism market led globally in 2023, accounting for the largest revenue share of 38.9%. The region's highly developed infrastructure and extensive research and development base make it the leading revenue contributor in the global market during the projected period. This advanced infrastructure facilitates the rapid adoption of modern technologies. In addition, the significant presence of small and medium-sized enterprises in North America, which supply components and services to major companies like SpaceX, Blue Origin, and Virgin Galactic, has further driven market growth.

U.S. Space Tourism Market Trends

The U.S. space tourism market held the largest revenue share of 83.1% in the North American region in 2023 and is expected to retain its dominance over the forecast period owing to the inclination of high-net-worth individuals towards space tourism and growing technological investments in the region. Furthermore, breakthroughs in space travel technology, including reusable rockets and spacecraft, have lowered costs and increased accessibility to space tourism experiences, which is anticipated to further bolster the growth of the market in the U.S.

Europe Space Tourism Market Trends

The space tourism market in Europe is anticipated to grow at a considerate CAGR during the forecast period from 2024 to 2030, owing to advances in aerospace technology, an increase in private sector participation, and government support. For instance, European governments, along with agencies like the European Space Agency (ESA), are increasingly supporting space tourism initiatives. On the other hand, the involvement of private companies like SpaceX, Blue Origin, and Virgin Galactic has injected momentum into the space tourism market. These companies are investing in developing space tourism infrastructure and vehicles, making space travel more feasible and appealing to a broader audience.

Russia space tourism market held the largest revenue share in the European region in 2023 and is mainly driven by factors such as rich space heritage, affordable space tourism options compared to other countries, and extensive space infrastructure and launch capabilities. For instance, Russian space agencies like Roscosmos have the expertise and experience to support space tourism initiatives, including orbital flights to the ISS, which can further fuel the growth of the market in Russia.

The UK space tourism market is estimated to grow at a significant CAGR from 2024 to 2030. The UK government has been actively supporting the space industry through investments, regulatory reforms, and partnerships with private companies, which is fueling the growth of the market. Furthermore, the UK’s robust tourism and hospitality industry can complement the space tourism industry in the UK by offering pre- and post-flight experiences for space tourists.

The space tourism market in Germany is expected to grow significantly from 2024 to 2030, owing to huge research and development initiatives in space exploration and tourism. Germany fosters collaboration between government agencies, research institutions, and private companies to drive innovation and investment in the space tourism sector.

Asia Pacific Space Tourism Market Trends

The space tourism market in Asia Pacific is expected to increase substantially by the forecast period and grow at a CAGR of 45.1% from 2024 to 2030. Governments in the Asia Pacific region, such as China, India, and Japan, have been actively investing in space exploration and tourism initiatives. Significant contributors to the growth of the Asia-Pacific market include the China National Space Administration (CNSA), the Indian Space Research Organization (ISRO), and the Japan Aerospace Exploration Agency (JAXA). Furthermore, there is a rising interest in space exploration and tourism across the Asia Pacific region. As economies grow and disposable incomes increase, more individuals are seeking novel and adventurous experiences, including space travel. This growing demand for space tourism presents opportunities for businesses and entrepreneurs to enter the market and innovate.

The China space tourism market held the largest share in the Asia Pacific region in 2023 and is also anticipated to grow at a significant CAGR from 2024 to 2030. China has significantly advanced its space program through the Chang'e lunar missions and the establishment of the Tiangong space station. These developments showcase China's technological capabilities and could potentially facilitate future space tourism initiatives. CAS Space, a commercial entity affiliated with the Chinese Academy of Sciences, is developing rockets for satellite launches. The company aims to conduct a demonstration flight in 2022, followed by a suborbital flight in 2023, and plans to offer space tourism services by 2024.

A market research study by the Chinese University of Hong Kong indicates that young Chinese consumers exhibit a higher interest in space tourism and space-based accommodations compared to their American counterparts. The study found that Chinese respondents are prepared to invest approximately USD 1.6 million for a round-trip to Earth. In contrast, American respondents are willing to spend around USD 0.9 million for the same journey.

The space tourism market in India is expected to grow significantly owing to rising government initiatives, investments, and support in space-related activities. Furthermore, there is a growing interest in space exploration and tourism among the Indian population. With the expanding economy and rising disposable incomes, an increasing number of individuals are seeking distinctive and adventurous experiences, including space travel, thereby fueling the growth of the space tourism industry in India.

The Japan space tourism market is expected to grow at the fastest CAGR from 2024 to 2030. Japan's JAXA (Japan Aerospace Exploration Agency) has been involved in international space projects and collaborations. Japan's advancements in robotics and space technology position it as a key player in the space tourism industry in the Asia Pacific.

Middle East & Africa Space Tourism Market Trends

The space tourism market in the Middle East and Africa region is witnessing gradual growth, driven by several key factors, including ambitious space programs and infrastructural enhancements by the development of spaceports. In addition, countries in the Middle East & Africa are forging strategic partnerships and collaborations with leading space agencies and private companies to accelerate their space programs and develop space tourism capabilities. In the Middle East, countries such as UAE and Saudi Arabia have emerged as significant countries in the space tourism sector. Furthermore, in Africa, countries such as South Africa are demonstrating increasing interest and involvement in space-related activities. The countries within the African region recognize the economic potential of space tourism and are taking steps to develop their space industries accordingly.

Key Space Tourism Company Insights

Some of the key companies operating in the space tourism industry include Virgin Galactic and SpaceX among others.

-

Virgin Galactic is a pioneering spaceflight company that aims to make commercial space travel a reality. Operating as a part of the broader Virgin Group, the company is looking forward to opening space travel to everyone. The company's primary focus is on facilitating space tourism by conducting suborbital flights. VSS Unity, the company's flagship vehicle, is a spaceplane designed to provide a unique and transformative experience to passengers by carrying them to the edge of space. In terms of technology, Virgin Galactic has developed a unique air-launched system whereby VSS Unity is carried aloft by a carrier aircraft called WhiteKnightTwo and released at high altitudes.

-

SpaceX is rapidly expanding its market share within the thriving space tourism industry through innovative strategies and technological advancements. Through its innovative spacecraft, including the Crew Dragon, SpaceX has successfully demonstrated the capability to transport astronauts to and from the International Space Station, setting a strong foundation for its foray into the market. SpaceX's reusable rocket technology, exemplified by the Falcon 9 and Falcon Heavy launch vehicles, provides a cost-effective and sustainable approach to space travel, opening new possibilities for commercial space tourism ventures. The company's commitment to safety, reliability, and cutting-edge engineering positions it as a trusted partner for space tourism operators and adventurous individuals seeking extraordinary experiences beyond Earth's boundaries.

Blue Origin and Axiom Space, Inc. are some of the emerging companies in the space tourism industry.

-

Blue Origin is making significant strides to expand its market share in the burgeoning space tourism industry through a strategic and customer-centric approach. Through its New Shepard spacecraft, Blue Origin offers an extraordinary journey into space, providing individuals with a remarkable and unforgettable experience. Blue Origin has established itself as a trusted and sought-after provider of space tourism services as it prioritizes safety, reliability, and exceptional passenger comfort. The company's focus on reusable rocket technology, exemplified by the New Shepard's vertical landing capabilities, ensures a sustainable and cost-effective approach to space travel. Through strategic partnerships and collaborations, Blue Origin is expanding its network and gaining wider access to potential customers.

-

Axiom Space, Inc. is a private aerospace company specializing in commercial spaceflight and space station development. The company offers various programs for both individuals and organizations to experience space travel. Through a partnership with SpaceX, the company plans to launch individuals to the ISS on short-duration missions and provide them with an opportunity to live and work in microgravity.

Key Space Tourism Companies:

The following are the leading companies in the space tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Origin

- Virgin Galactic

- SpaceX

- Airbus Group SE

- Boeing

- Zero Gravity Corporation

- Axiom Space, Inc.

- Rocket Lab USA

- Space Adventures

- Space Perspective

- World View Enterprises, Inc.

- Zero 2 Infinity S.L.

Recent Developments

-

In March 2024, Blue Origin demonstrated its Blue Ring spacecraft's operational capabilities on the Defense Innovation Unit's DarkSky-1 mission, validating flight systems and in-space processing. This public-private collaboration aims to enhance Blue Ring's multi-orbit access, supporting the vision of increased human activity in space. The mission launched on an unnamed National Security Space Launch provider's upper stage, with the exact timing undisclosed.

-

In October 2023, Blue Origin launched Blue Ring, a spacecraft platform offering comprehensive in-space logistics and delivery services to commercial and government clients. Operating from medium Earth orbit to the Cislunar region, Blue Ring provides payload hosting, transport, refueling, data transmission, logistics, and cloud computing services within space. With a payload capacity of over 3,000 kg, Blue Ring enhances mission flexibility, potentially reducing costs and simplifying mission planning for a diverse clientele.

-

In June 2023, Virgin Galactic announced the commencement of the company’s commercial space line operations. The inaugural commercial spaceflight, 'Galactic 01', was scheduled between June 27, 2023, and June 30, 2023, with the second commercial spaceflight, 'Galactic 02', scheduled for early August 2023. Plans envisaged the company conducting monthly spaceflights as part of its commercial operations.

-

In May 2023, Blue Origin announced a Sustaining Lunar Development contract under NextSTEP-2 Appendix P from NASA. As part of the contract, Blue Origin would be responsible for developing and flying a lunar lander capable of executing precise landings on any location on the lunar surface and developing a cislunar transporter.

-

In April 2023, Axiom Space, Inc. introduced the Axiom Space, Inc. Access Program, an initiative that allows countries to realize the long-term economic and scientific value microgravity can potentially offer. The program revolutionizes the conventional approach by eliminating the need for nations to invest in building or expanding the infrastructure, including launch vehicles, on-orbit facilities, training or medical programs, and support capabilities.

-

In November 2022, World View Enterprises, Inc. and Sierra Nevada Corporation (SNC) entered into a strategic agreement to establish and operate uncrewed platforms for Intelligence, Surveillance, and Reconnaissance (ISR) missions and stratospheric communications.

-

In November 2022, Axiom Space, Inc. partnered with Virgin Galactic to facilitate a mission dedicated to microgravity research and training. As part of the partnership, Axiom Space, Inc. and Virgin Galactic would leverage their respective expertise and resources to execute the mission, foster advancements in scientific knowledge, and offer valuable training experiences in the realm of microgravity.

Space Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,094.0 million

Revenue forecast in 2030

USD 10.09 billion

Growth Rate

CAGR of 44.8% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; UK; Germany; Russia; Japan; China; India; Brazil

Key companies profiled

Blue Origin, Virgin Galactic, SpaceX, Airbus Group SE, Boeing, Axiom Space, Inc., Rocket Lab USA, Space Adventures, Space Perspective, World View Enterprises, Inc., and Zero 2 Infinity S.L.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Space Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global space tourism market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Orbital

-

Sub-orbital

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Government

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global space tourism market size was estimated at USD 888.3 million in 2023 and is expected to reach USD 1,094.0 million in 2024.

b. The global space tourism market is expected to grow at a compound annual growth rate of 44.8% from 2024 to 2030 to reach USD 10.09 billion by 2030.

b. North America dominated the space tourism market with a share of over 38.9% in 2023. This is attributable to the presence of a highly developed infrastructure and presence of an extensive research and development base.

b. Some key players operating in the space tourism market include Blue Origin, Virgin Galactic, SpaceX, Airbus Group SE, Boeing, Axiom Space, Inc., Rocket Lab USA, Space Adventures, Space Perspective, World View Enterprises, Inc., and Zero 2 Infinity S.L.

b. Key factors that are driving the Space Tourism market growth include rising advancements in technology, growing inclination of adventure travelers & high net worth income (HNWI) individuals toward spaceflight.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.