- Home

- »

- Consumer F&B

- »

-

Specialty Coffee Market Size, Share & Growth Report, 2030GVR Report cover

![Specialty Coffee Market Size, Share & Trends Report]()

Specialty Coffee Market (2025 - 2030) Size, Share & Trends Analysis Report By Age Group (18-24 Years, 25-39 Years, 40-59 Years, Above 60), By Distribution Channel (Retail, Away From Home), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-060-1

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Coffee Market Summary

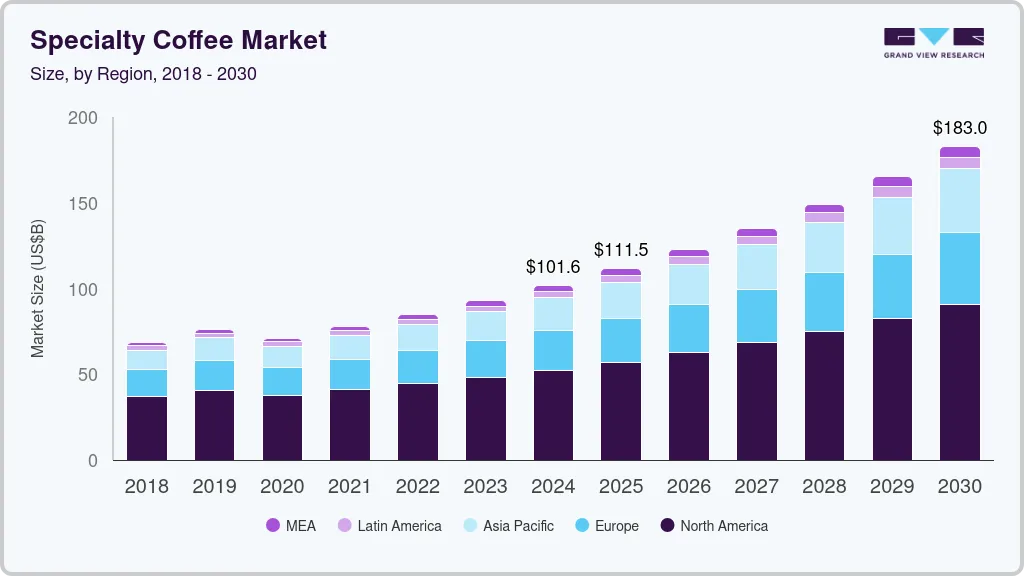

The global specialty coffee market size was estimated at USD 101.6 billion in 2024 and is projected to reach USD 183.0 billion by 2030, growing at a CAGR of 10.4% from 2025 to 2030. The market growth can be attributed to evolving consumer preferences and a heightened awareness of high-quality coffee products.

Key Market Trends & Insights

- The North America specialty coffee market captured a revenue share of over 51.1% in 2024 of the market.

- The U.S. specialty coffee market is expected to grow at a CAGR of 9.5% from 2025 to 2030.

- By age group, the 18-24 years age group segement accounted for a global revenue share of 32.4% in 2024.

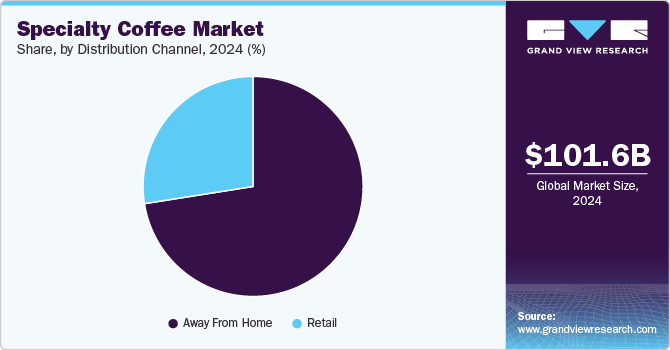

- By distribution channel, the sales of specialty coffee segment through away-from-home channels accounted for a share of 72.5% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 101.6 Billion

- 2030 Projected Market Size: USD 183.0 Billion

- CAGR (2025-2030): 10.4%

- North America: Largest market in 2024

One of the most compelling trends is the increasing interest among consumers in ethically sourced and sustainably produced coffee. Moreover, certifications such as Fair Trade, Rainforest Alliance, and organic labeling are becoming key benchmarks for consumers when selecting coffee. As more coffee brands embrace transparent sourcing practices and invest in sustainability initiatives, they cater to a market segment that prioritizes ethical consumption and environmental stewardship, thereby further fueling demand for specialty coffee.

The growing coffee culture, particularly among millennials and Generation Z consumers, is anticipated to boost product demand. The emergence of third-wave coffee shops, which prioritize artisanal brewing techniques and unique coffee origins, has cultivated a culture of exploration and appreciation for the sensory experience of coffee. Moreover, customers are increasingly seeking knowledge about the origins of their coffee beans, preparation methods, and flavor profiles, prompting coffee brands to adapt their marketing strategies to educate consumers about the demand for specialty coffee.

The rise of the 'at-home coffee experience' during and following the COVID-19 pandemic has also significantly spiked interest in specialty coffee. As many consumers shifted to remote work and sought out ways to recreate café experiences at home, there was a notable increase in the purchasing of high-quality coffee beans and brewing equipment. Home barista culture gained momentum, with consumers investing in espresso machines, pour-over kits, and grinder technologies to achieve café-quality coffee at home. This trend reflects the increasing desire for controlled and curated coffee experiences, further driving the overall market growth as consumers seek to replicate their favorite coffee shop beverages.

Online sales are surging as consumers increasingly prefer the convenience and variety offered by e-commerce platforms. Many coffee brands are harnessing the power of social media and digital marketing strategies to build a loyal customer base and showcase their unique blends. Meanwhile, brick-and-mortar cafes continue to serve as vital touchpoints for consumers, allowing them to engage with the product and brand at a personal level. Additionally, partnerships with gourmet food retailers and premium grocery chains are proving effective in reaching a wider audience.

Technological advancements also play a significant role in the specialty coffee market. Improvements in coffee processing techniques, brewing technology, and data analytics have enhanced the quality and consistency of coffee products. Roasters and brewers now utilize sophisticated software and equipment to refine their techniques, resulting in innovative products that cater to discerning tastes. Additionally, innovations in cold brew and nitro coffee formats have expanded the product offerings available to consumers, further enticing them to explore specialty options. As personal preferences shift towards convenience and quality, coffee brands that invest in modern brewing technology and inventive product formulations are likely to gain a competitive edge.

Age Group Insights

The 18-24 years age group accounted for a global revenue share of 32.4% in 2024, driven by a distinctive blend of lifestyle choices and social media influence. This demographic, often labeled as millennials and Generation Z, emphasizes unique experiences and high-quality products. They are increasingly drawn to artisanal brands that promote sustainability and ethical sourcing, reflecting their broader values of social responsibility and environmental consciousness. Moreover, digital engagement is another key trend among the 18-24 age group, as they are avid users of social media platforms like Instagram and TikTok, where visually appealing coffee presentations can go viral. This accessibility to information and experiences drives their preference for trendy coffee beverages, such as cold brews and nitro coffee, which appeal to their desire for novelty and excitement.

The 25-39 years segment is expected to grow at a CAGR of 11.2% from 2025 to 2030. This demographic tends to prioritize quality over quantity, often seeking out premium coffee experiences that align with their evolving tastes and schedules. As professionals with disposable income, they are increasingly willing to invest in high-quality coffee products that enhance their daily routines, whether at home or in artisanal cafés. Moreover, this age group is heavily influenced by health and wellness trends, leading to a rise in requests for organic, fair-trade, and health-conscious coffee options. They are also more likely to explore alternative coffee beverages, such as plant-based or low-calorie options, reflecting their interest in personal health management.

Distribution Channel Insights

The sales of specialty coffee through away-from-home channels accounted for a share of 72.5% of the global revenue in 2024. As consumer preferences evolve, an increasing number of coffee enthusiasts are seeking high-quality, artisanal coffee experiences outside their homes. This trend is fueled by a growing café culture, especially among younger demographics who prioritize social interaction and unique tasting experiences. Establishments such as specialty coffee shops, cafes, and restaurants are adapting their offerings to include single-origin brews, artisan blends, and hands-on barista techniques, effectively catering to the discerning tastes of their clientele. Additionally, the rise of remote work has transformed traditional workspaces into informal social hubs where people congregate to enjoy specialty coffee, further driving its demand in the away-from-home segment.

The sales of specialty coffee through retail channels are expected to grow at a CAGR of 10.8% from 2025 to 2030, propelled by the increasing availability and accessibility of premium products in supermarkets and convenience stores. As consumers become more educated about coffee quality and origins, they are demanding better choices even in their everyday shopping experiences. Moreover, e-commerce platforms provide consumers with unparalleled access to a vast array of specialty coffees, often accompanied by detailed ratings, reviews, and origin stories, empowering informed purchasing decisions. Additionally, attractive packaging and marketing campaigns are enhancing consumer awareness and interest, thereby driving sales in this distribution channel.

Regional Insights

North America Specialty Coffee Market Trends

The North America specialty coffee market captured a revenue share of over 51.1% in 2024 of the market, driven primarily by an increasing consumer preference for high-quality, ethically sourced coffee. Specialty coffee shops have proliferated in urban areas, emphasizing craftsmanship and unique flavor profiles. Consumers are becoming more aware of the coffee supply chain, fostering a demand for transparency and sustainability, which specialty coffee brands are keen to fulfill. Additionally, trends such as the rise of cold-brew and nitro coffee options have attracted new demographics, particularly younger consumers, to specialty coffee drinks.

U.S. Specialty Coffee Market Trends

The U.S. specialty coffee market is expected to grow at a CAGR of 9.5% from 2025 to 2030, driven largely by the increasing consumer preference for high-quality, ethically sourced coffee. Americans are becoming more discerning coffee drinkers, with a growing appreciation for artisanal brewing methods and unique flavor profiles. Moreover, the rise of third-wave coffee shops and roasters has played a significant role in educating consumers about the intricacies of coffee production and brewing, further fueling demand.

Europe Specialty Coffee Market Trends

The Europe specialty coffee market is expected to grow at a CAGR of 10.3% from 2025 to 2030. European coffee drinkers are increasingly valuing quality over quantity, reflected in the thriving third-wave coffee movement that emphasizes artisanal coffee preparation and unique flavor profiles sourced from quality beans. This region's market is notably influenced by the popularity of specialty coffee shops that offer highly curated coffee experiences, providing consumers with an opportunity to explore various brewing methods, such as pour-over and Aeropress. Moreover, the demand for sustainable practices is also prominent, as consumers in Europe show a keen interest in ethically sourced coffee, with certifications like Fair Trade and Rainforest Alliance gaining traction.

The Germanyspecialty coffee market is profoundly influenced by a growing cultural appreciation for coffee as a gourmet experience. German consumers are increasingly seeking out specialty coffee shops that prioritize quality and transparency in their sourcing practices. This shift in consumer behavior has led to a flourishing marketplace that features everything from small, independent roasters to established specialty cafes offering beans from around the world. There's also a marked interest in the craft of coffee brewing, with gourmet equipment such as pour-overs and espresso machines selling well, indicating a trend towards home brewing among German coffee.

The UK specialty coffee market has witnessed a substantial rise, driven by a cultural shift that values quality and unique flavor experiences. London and other urban centers are at the forefront of this trend, with a proliferation of coffee shops and roasters offering meticulously sourced beans from renowned coffee-growing regions. Moreover, consumers in the UK are increasingly interested in the origin and story behind their coffee, leading to heightened demand for single-origin and artisanal blends. Besides, the appreciation for coffee craft has given rise to a thriving café culture, characterized by innovative brewing techniques and coffee-centric events such as cupping sessions and barista competitions.

Asia Pacific Specialty Coffee Market Trends

The specialty coffee market in Asia Pacific is expected to witness a CAGR of 12.2% from 2025 to 2030, spurred by a burgeoning middle class with increasing disposable incomes and an evolving coffee culture. Countries like China, India, Japan, South Korea, and Australia are leading this trend, where consumers are becoming more sensitive about their coffee choices. Moreover, specialty coffee shops are spreading rapidly, often incorporating local flavors and unique brewing techniques, thus creating a fusion between traditional coffee practices and modern preferences. Besides, the younger generation is influenced by global trends and the rise of café culture, which promotes coffee as a lifestyle choice rather than just a daily beverage.

The specialty coffee market in China is expected to witness a CAGR of 12.4% from 2025 to 2030, spurred on by an emerging coffee culture that increasingly values quality over quantity. As the younger generation seeks new experiences, specialty coffee has become a symbol of sophistication and modernity. Coffee consumption is increasingly viewed as a social activity, with cafés becoming popular meeting spots. Moreover, urban centers including Shanghai and Beijing have witnessed a surge in specialty coffee shops, featuring artisanal brews and innovative brewing methods that cater to the tastes of a more discerning consumer base. This shift is attracting both local and international coffee brands, leading to a more diverse coffee landscape.

The Japan specialty coffee market is expected to grow during the forecast period. Japan has long had a deep-rooted coffee culture, recognized for its meticulous preparation methods and aesthetic appreciation of the beverage. The Japan market is characterized by a unique blend of tradition and innovation, with a growing interest in artisanal roasting and brewing techniques. Japanese consumers have a discerning palate, leading to increased demand for high-quality beans and sophisticated brewing equipment. The prominence of siphon coffee brewing, along with an emphasis on pour-over techniques, illustrates Japan's dual embrace of both traditional and modern coffee practices, creating a rich tapestry of coffee experiences available to consumers.

Latin America Specialty Coffee Market Trends

The specialty coffee market in Latin America is expected to witness a CAGR of 10.6% from 2025 to 2030. The market is experiencing a recovery in particular countries like Colombia, Brazil, and Costa Rica, where an emphasis on high-quality beans and distinct flavor profiles has led to an influx of specialty coffee brands. Consumers are increasingly recognizing the value of local production and are showing a preference for coffees that highlight regional characteristics and sustainable farming practices. This shift towards quality is complemented by educational initiatives, where coffee producers are enhancing their knowledge about processing methods, thereby improving the overall quality of their offerings.

Middle East & Africa Specialty Coffee Market Trends

The specialty coffee market in the Middle East and Africa is on the rise, fueled by increasing coffee culture, particularly in countries such as South Africa, Saudi Arabia, UAE, Nigeria, and Ethiopia. Ethiopia, known as the birthplace of coffee, is witnessing a revival of interest in locally sourced, high-quality coffee beans. There is a growing appreciation for traditional brewing methods, such as the Ethiopian coffee ceremony, which fosters a rich cultural connection to coffee. Moreover, the urbanization of cities and the emergence of specialty coffee shops across the region are further driving the demand for unique coffee experiences, with consumers seeking out blends that reflect local flavors and origins.

Key Specialty Coffee Company Insights

The global specialty coffee market is characterized by intense competition among key players seeking to capitalize on the increasing consumer demand for high-quality coffee experiences. Major companies in this sector, such as Starbucks Coffee Company, F. Gaviña & Sons, Inc., Barista Coffee Company Limited, Kurasu, etc. have adopted a multi-faceted approach to strengthen their market positions. Key players have increased their efforts towards innovative product launches tailored to evolving consumer preferences for sustainable and ethically sourced coffee. For instance, Starbucks has expanded its menu to include diverse specialty offerings such as non-dairy milk and cold brews infused with unique flavors. Moreover, partnerships with local coffee growers have enabled these companies to enhance their supply chain sustainability while providing transparency to conscientious consumers.

Moreover, mergers and acquisitions have also played a crucial role in shaping the competitive landscape of the specialty coffee market. Notably, Nestlé's acquisition of Blue Bottle Coffee exemplifies how strategic buyouts can enhance product portfolios and market reach. R&D investments are also vital for developing unique blends and brewing technologies, which can set companies apart in a crowded market. Furthermore, expanding distribution channels, both online and offline, has become a focal point; companies are increasingly leveraging e-commerce platforms to reach a broader audience. Through these strategies, key players are not only securing substantial market shares but also driving the overall growth and diversity of the global specialty coffee sector.

Key Specialty Coffee Companies:

The following are the leading companies in the specialty coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Starbucks Coffee Company

- F. Gaviña & Sons, Inc.

- Barista Coffee Company Limited

- Coffee Day Enterprises Ltd.

- Kurasu

- Eight O’Clock Coffee Company

- Keurig Green Mountain Inc.

- Costa Coffee

- The J.M. Smucker Company

- Inspire Brands

Recent Developments

-

In August 2024, specialty coffee brand AbCoffee partnered with Shoppers Stop to establish coffee outlets within their stores nationwide. They have launched three new coffee decks in key cities: Delhi, Bengaluru, and Mumbai. This strategic collaboration enhances AbCoffee's brand visibility and customer reach, leveraging Shoppers Stop's strong footfall. It also enriches the retail experience for Shoppers Stop's customers, adding value through in-store dining options.

-

In December 2023, Bellwether Coffee expanded into the European market by installing its first roaster in partnership with Hagen, a premium specialty coffee company in London. This strategic move allows Bellwether to tap into the growing European specialty coffee market, enhance brand visibility, and strengthen its global presence. Partnering with Hagen positions Bellwether to cater to sustainability-focused consumers and capitalize on the demand for eco-friendly coffee roasting solutions.

Specialty Coffee Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 111.5 billion

Revenue forecast in 2030

USD 183.0 billion

Growth rate

CAGR of 10.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Starbucks Coffee Company; F. Gaviña & Sons, Inc.; Barista Coffee Company Limited; Coffee Day Enterprises Ltd.; Kurasu; Eight O’Clock Coffee Company; Keurig Green Mountain Inc.; Costa Coffee; The J.M. Smucker Company, Inspire Brands

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Specialty Coffee Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global specialty coffee market report based on age group, distribution channel, and region:

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-24 Years

-

25-39 Years

-

40-59 Years

-

Above 60

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Coffee Shops And Cafes

-

Hotels And Restaurants

-

Others

-

-

Away From Home

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global specialty coffee market size was estimated at USD 101.6 billion in 2024 and is expected to reach USD 111.5 billion in 2025

b. The global specialty coffee market is expected to grow at a compound annual growth rate of 10.4% from 2025 to 2030 to reach USD 183.0 billion by 2030

b. North America dominated the specialty coffee market with a market share of 51.1% in 2024. This is attributed to factors such as increased consumer awareness, a thriving coffee culture, higher disposable incomes, and a desire for high-quality, ethically sourced coffee products.

b. Some key players operating in the specialty coffee market include Starbucks Coffee Company, F. Gaviña & Sons, Inc. (Don Francisco’s Coffee), Barista Coffee Company limited, Coffee Day Enterprises Ltd., Blue Bottle Coffee, Inc., Eight O’Clock Coffee Company, Keurig Green Mountain, Inc., Costa Coffee, The J.M. Smucker Company, Inspire Brands (DD IP Holder LLC)

b. Key factors driving the market growth include rising preference for ready-to-drink coffee and premium coffees and increasing number of coffee shops

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.