- Home

- »

- Next Generation Technologies

- »

-

Spend Management Platform Market Size Report, 2022-2030GVR Report cover

![Spend Management Platform Market Size, Share & Trends Report]()

Spend Management Platform Market (2022 - 2030) Size, Share & Trends Analysis Report By Deployment, By Enterprise, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-986-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spend Management Platform Market Summary

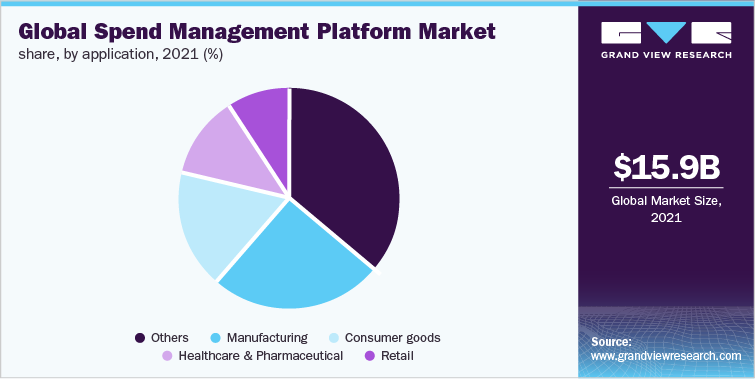

The global spend management platform market size was valued at USD 15.9 billion in 2021 and is projected to reach USD 38.1 billion by 2030, growing at a CAGR of 10.3% from 2022 to 2030. Factors such as rapid technological advancements, rising internet penetration, a competitive business environment, and a need to achieve efficiency in a competitive business environment are driving the demand for spend management platforms (SPM) across all industries engaged in various sectors.

Key Market Trends & Insights

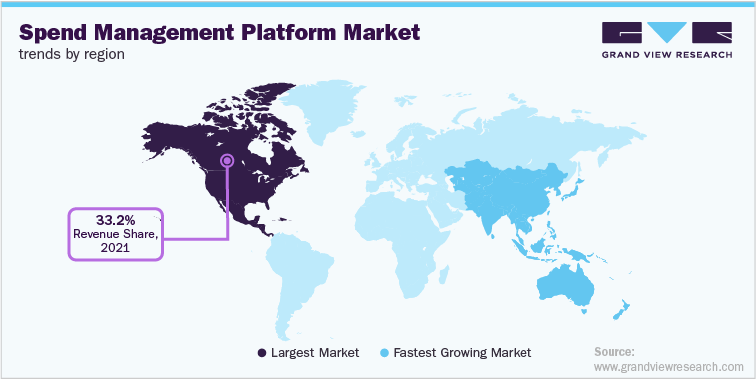

- North America dominated the market and accounted for a revenue share of 33.2% in 2021.

- Based on deployment, the on-premise segment dominated the market and accounted for a revenue share of 41.6% in 2021.

- Based on enterprise, the large enterprise segment dominated the market and accounted for 63.5% of the global revenue share in 2021.

- Based on application, the manufacturing segment accounted for the largest revenue share of 25.4% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 15.9 Billion

- 2030 Projected Market Size: USD 38.1 Billion

- CAGR (2022-2030): 10.3%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

The scope of the study includes procurement software, travel & expense software, and accounts payable platforms, among other related platforms as a sub-set of the spend management platform market. The COVID-19, pandemic negatively affected the spend management platform market. As a result of COVID-19, the economy had to deal with decreased activity and rising unemployment. The businesses have been operating despite the pandemic and the ones with efficient operations were able to survive this period. Enterprises had to quickly adopt remote working in the wake of the pandemic, which further led to investments in infrastructure based on the cloud. In May 2021, Sage Intacct announced the launch of its cloud business management in the Amazon Web Services (AWS) marketplace to support its objective of transforming the way people or organizations work and improving their efficiency. It was a move to provide streamlined and efficient financial management solutions through an easy-to-use platform and support to small-scale businesses.

In recent years, there has been a significant demand for the spend management platform, as it, eliminates inaccuracy, and provides advanced analytics for a greater understanding of the financial condition of the firm. The market for spend management platform services has great potential in emerging economies such as India, China, Brazil, and Australia and also in developed countries like the U.S. where technology is way more advanced compared to developing economies. For instance, in October 2019, SutiSoft Inc., a U.S.-based mobile business management solutions provider announced advanced features and enhancements in its online customer management software solution SutiCRM version 7.7.

The cloud-based spend management platform helps industries to achieve efficiency in their operations. Small and medium enterprises prefer cloud-based SPM as it is cost-efficient compared to the on-premise segment. The cloud-based segment can be applied in consumer goods, retail, healthcare, manufacturing, etc.

Cloud-based spend management solutions give users and enterprises transparency into regions that can be improved, including cost management and operational efficiency. Companies are relying on innovations and technologies in the market, such as cloud-based deployment and AI in software services to meet the requirements of the market along with better productivity and profitability expectations.

However, the spend management platform market's growth is constrained by issues associated with data security, protection, and high investment & maintenance costs for on-premise deployment. Data loss routinely puts cloud storage security at risk. Information can be impacted by a computer virus, hacking, or a broken system, as opposed to being stolen and shared.

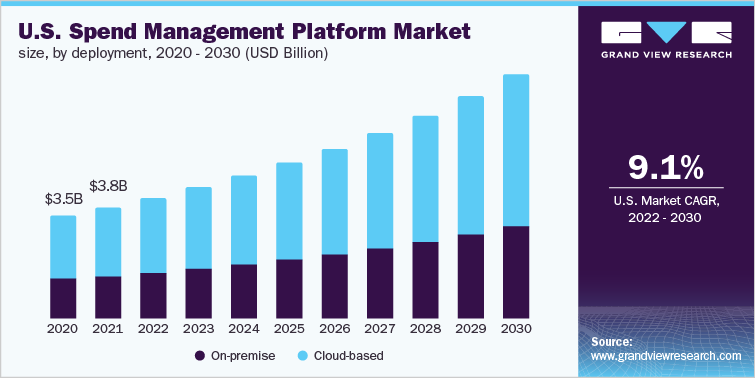

Deployment Insights

The on-premise segment dominated the market and accounted for a revenue share of 41.6% in 2021. The on-premise leads to heavy expenditure by the enterprise and is usually opted by large-scale enterprises for cutting down wasteful expenditures and increasing operational efficiency. Businesses have the freedom to choose which deployment to use depending on their requirements and the resources available to them.

The cloud-based segment is expected to witness the highest CAGR of 10.7% during the forecast period 2022 - 2030. The on-premise deployment requires the software to be installed in systems at company locations for managing expense management. Using the cloud-based deployment makes it possible for small and medium enterprises to avail many benefits of spend management software without initially investing a lot of capital in installing software. Advantages of cloud-based software include the freedom to use it from any device with internet access, also it is low on maintenance and investment. The customers are eligible to access every update in the software compared to the on-premise deployment.

Enterprise Insights

The large enterprise segment dominated the market and accounted for 63.5% of the global revenue share in 2021. The growth of this segment can be attributed to the growing demand for digitalization, better procurement, supply chain, and enhanced efficiency in expense management of the company operations. The small and medium enterprise segment is likely to grow at the highest CAGR of 10.9%. The growth of this segment can be attributed to the factors such as increased efficiency in productivity, profitability, and company operations.

Application Insights

The manufacturing segment accounted for the largest revenue share of 25.4% in 2021 and is projected to witness a CAGR of 9.5% over the forecast period. The factors such as increasing demand for cloud-based technology and AI software have attracted a lot of large and small-scale industries to use the spend management platform which is driving the market growth of this segment.

The retail segment is expected to register the highest CAGR of 11.5%. Enterprises can obtain a variety of benefits by using a cloud-based spend management software solution, including efficient operations, real-time spend visibility, more accurate bill invoicing, and contract management.

Regional Insights

North America dominated the market and accounted for a revenue share of 33.2% in 2021. The market is projected to witness a CAGR of 9.4% over the forecast period. Isolated infrastructure has been migrated to cloud technology in North America due to the region's strong economy and increased internet penetration rates. Additionally, the key drivers of the expansion of the North American spend management platform industry is the requirement for efficient data, time, and resource management due to cutthroat market competition.

Asia Pacific is expected to be the fastest-growing region and is expected to expand at a CAGR of over 11.4% over the forecast period. Factors such as the increase in cloud-based application deployment for the rising demand for expense management, growing internet penetration, and increased technological advancements in the region are attributing to the growth of the market.

Key Companies & Market Share Insights

The competitive landscape of the spend management platform market is fragmented in nature, featuring several global as well as regional players. The key participants are entering into strategic collaborations, partnerships, and mergers & acquisitions to expand their business footprint and survive the highly competitive environment. Moreover, platform providers are investing considerably in research & development activities to incorporate new technologies in their offerings and develop advanced products to gain a competitive advantage over other market players.

For instance, in September 2021, Amazon Business and SAP SE entered into a partnership that would assist employees to get access to millions of objects on Amazon Business directly from within SAP Ariba solutions, while assisting with corporate purchasing policies compliance. Some of the prominent players in the spend management platform market include:

-

Coupa Software, Inc.

-

Touchstone Group

-

SAP SE

-

Sievo

-

Expensify Inc.

-

The Sage Group PLC

-

TRADOGRAM

-

SutiSoft Inc.

-

GEP

-

Happay

-

Procurify Technologies Inc.

-

Advanced

Spend Management Platform Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 17.4 billion

Revenue forecast in 2030

USD 38.1 billion

Growth Rate

CAGR of 10.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, enterprise, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Australia; Brazil; Mexico; Turkey; Saudi Arabia; UAE

Key companies profiled

Coupa Software Inc.; Touchstone Group; SAP SE; Sievo; Expensify Inc.; The Sage Group PLC; TRADOGRAM; SutiSoft Inc.; GEP; Happay; Procurify Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spend Management Platform Market Segmentation

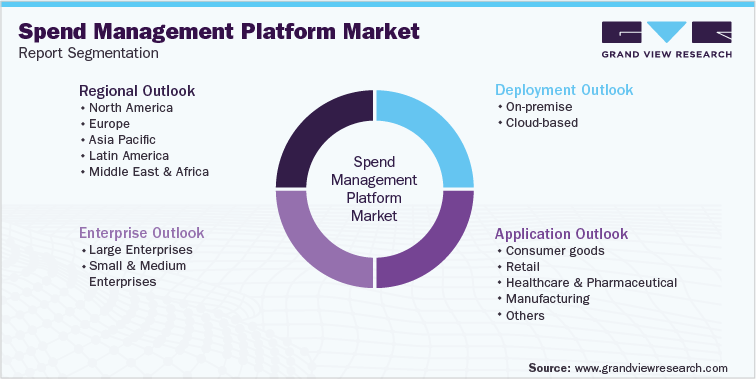

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global spend management platform market report based on deployment, enterprise, application, and region:

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud-based

-

-

Enterprise Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer goods

-

Retail

-

Healthcare & Pharmaceutical

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Turkey

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global spend management platform market size was estimated at USD 15.9 billion in 2021 and is expected to reach USD 17.4 billion in 2022.

b. The global spend management platform market is expected to grow at a compound annual growth rate of 10.3% from 2022 to 2030 to reach USD 38.1 billion by 2030.

b. North America dominated the spend management platform market with a share of 33.2% in 2021. This is attributed to the presence and concentration of prominent players such as Coupa Software, Inc., SutiSoft Inc., Procurify Technologies Inc., GEP, Expensify Inc., and others.

b. Some key players operating in the spend management platform market include Coupa Software Inc., Sage Group plc, SAP SE, Expensify Inc., Advanced, and others.

b. Key factors that are driving the market growth include rapid adoption of smartphones and cloud-based deployment in small & medium enterprises across the globe and increase in need for profitability & operational efficiency in business process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.