- Home

- »

- Alcohol & Tobacco

- »

-

Spiced Rum Market Size And Share, Industry Report, 2030GVR Report cover

![Spiced Rum Market Size, Share & Trends Report]()

Spiced Rum Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vanilla, Fruit, Mix, Others), By Distribution Channel (On-Trade, Off-Trade), By Region(North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-4-68038-443-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spiced Rum Market Summary

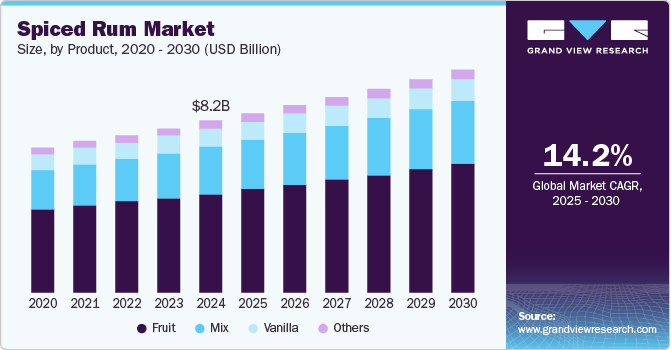

The global spiced rum market size was valued at USD 8.24 billion in 2024 and is projected to reach USD 10.69 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The market growth is majorly attributed to shifting consumer preference for premium alcoholic drinks.

Key Market Trends & Insights

- Asia Pacific dominated the global spiced rum industry with a revenue share of 46.3% in 2024.

- The U.S. spiced rum market held the largest revenue share of the regional industry in 2024.

- Based on products, fruit-based spiced rum products dominated the global spiced rum industry with a revenue share of 57.7% in 2024.

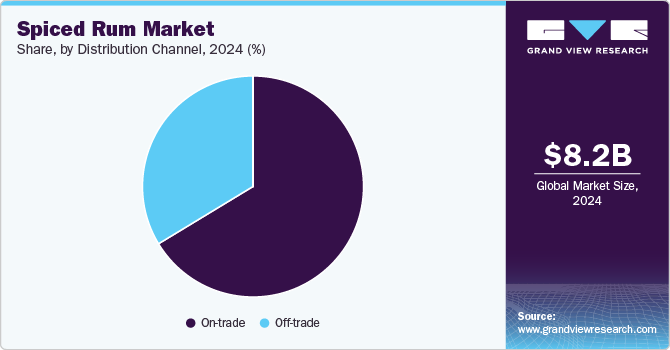

- In terms of distribution channel, the on-trade distribution segment held the largest revenue share of the global spiced rum industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.24 Billion

- 2030 Projected Market Size: USD 10.69 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

Factors such as increasing consumption by young urban consumers, growing utilization by commercial users for different formulations of cocktails, and the availability of diverse product portfolios offered by the major market participants are some other drivers propelling market growth.Spiced rum products are extensively used as a base for cocktails by multiple liquor-serving businesses such as bars, clubs, lounges, and others. Product innovation and novel product launches by the key rum producers in the industry have added growth opportunities for this market. For instance, Captain Morgan Original Spiced Gold and Pepsi Max Premix, a product launched with collective efforts of Diego and PepsiCo, contains vanilla and selected spices infused with rum and sugar-free, low-calorie versions of soft drink products. Growing demand and customer attention from household users and commercial buyers are expected to drive growth in the next few years.

Well-liked spiced rums are often infused with vanilla and cinnamon flavors and delicate hints of other ingredients such as dried fruits, almonds, and more. Molasses from sugarcane, water, and yeast are basic ingredients used in the making of rum. Automation adopted in manufacturing, effective branding strategies, and vast distribution networks are expected to generate a surge in growth for this industry. According to Distilled Spirits Council of the United States, the spiced and flavored rums account for nearly 55.0% of overall sale of rum.

Changing consumer demand for a variety of cocktails, the presence of flavor intricacies facilitated by cinnamon, clove, nutmeg, vanilla, and other ingredients, and the aromatic taste offered by the product are primarily driving the demand for this product. Mixologists and rum enthusiasts frequently use spiced rums to provide interesting cocktails and mixes. Resonance with local palates and the inclusion of numerous spices that belong to different regions also influence the demand experienced by this market.

Product Insights

Based on products, fruit-based spiced rum products dominated the global spiced rum industry with a revenue share of 57.7% in 2024. This segment is primarily driven by aspects such as the increasing acceptance of cocktails culture, the large number of companies seeking novel flavors and tastes, the premiumization trend, and significant demand from the millennial customer base. Often, fruit-based spiced rums are launched with the inclusion of locally grown fruits, which stimulates continuous growth in demand.

The mix products segment is expected to experience the fastest CAGR during the forecast period. This is attributed to factors such as the growing number of established brands entering the product market and a large number of young consumers who prefer buying pre-mixes over other alcoholic beverages. For instance, in September 2024, Bacardi Limited, one of the market participants, joined forces with the Coca-Cola Company to declare plans to introduce a ready-to-drink (RTD) pre-mixed cocktail product. The planned product, a mix of Coca-Cola and BACARDÍ rum, is expected to reach shelves in European markets and Mexico in 2025.

Distribution Channel Insights

The on-trade distribution segment held the largest revenue share of the global spiced rum industry in 2024. Increasing demand from urban consumers, rising focus of multiple service providers on including spiced rum-based cocktails in the list of offerings, and a large number of bars, lounges, clubs, pubs, and similar settings opened in recent years. Increasing inclination among young consumers to prefer immediate serving experiences over other means is expected to drive the growth of this segment in the coming years.

The off-trade distribution segment is anticipated to experience the fastest CAGR from 2025 to 2030. This is attributed to significant growth in demand from commercial buyers who often buy stocks in larger quantities and store inventory for mixing and serving purposes. These buyers include lounges, suppliers, and local vendors. Increasing product innovation in on-trade distribution is projected to add growth opportunities for this segment.

Regional Insights

Asia Pacific dominated the global spiced rum industry with a revenue share of 46.3% in 2024. This market is primarily driven by factors such as the increasing demand for ready-to-drink offerings, pre-mixes, and cocktails by young urban consumers in the region. Demand from countries such as China and India also stimulates its growth. Increasing availability, a large number of commercial buyers, and a significant rise in new product launches are projected to generate greater growth in the coming years.

China held the largest regional spiced rum industry revenue share in 2024. This is attributed to the country's availability of multiple global brand products, increasing demand for cocktails and premixes containing spiced rum, and enhanced consumption in urbanized areas and large cities. The popularity of cocktail culture, especially in cities and provinces where international visitors frequently travel, is expected to add growth opportunities for this market.

North America Spiced Rum Market Trends

North America spiced rum market was identified as one of the key regions for the global spiced rum industry in 2024. The North American market, especially the U.S., has been experiencing growth in the consumption of cocktails, ready-to-drink premixes, and similar products. The large number of international travelers visiting the regional countries also contributes significantly to the growing consumption of alcohol-based products.

U.S. Spiced Rum Market Trends

The U.S. spiced rum market held the largest revenue share of the regional industry in 2024. This market is primarily driven by multiple manufacturers in the country, increased accessibility and availability of various product portfolios characterized by innovation, and growing demand from commercial buyers. The growth experienced by the hospitality and tourism industry also contributes to the increasing utilization of spices in the formulation of cocktails and pre-mixes.

Europe Spiced Rum Market Trends

Europe spiced rum market is anticipated to experience the fastest CAGR during the forecast period. This market is significantly influenced by aspects such as the large number of distilleries and facilities located in the region, the presence of multiple global brands originating in the region, and the growing acceptance of cocktail culture. Brands such as Bacardi, Captain Morgan, and others primarily add growth opportunities for this market.

The U.K. spiced rum market held the largest revenue share of the regional industry in 2024. This is attributed to increasing on-trade distribution driven by the large number of local pubs, clubs, modern restaurants with liquor servings, bars, and others. Growing demand from commercial users, the increasing popularity of cocktail culture, and ease of availability add to the growth of this market.

Key Spiced Rum Company Insights

Some of the key companies in the global spiced rum market are Diageo, Bacardi Limited, Havana Club (Pernod Ricard), SUNTORY HOLDINGS LIMITED, and others. To address changing consumer preferences, increasing demand from commercial buyers, and growing consumption through off-trade distribution, the companies are embracing strategies such as enhanced portfolios, geographical expansions, automation, and more.

-

Diageo, one of the participants in the alcoholic beverages industry, offers Captain Morgan Spiced Rum. It also provides a portfolio comprising various alcoholic beverage brands such as Johnnie Walker, Guinness, Tanqueray, Baileys, and others. It operates nearly 200 brands in 180 countries worldwide.

-

Bacardi Limited, a company specializing in a range of alcoholic products, provides a diverse portfolio of whiskies, rums, tequila, gin, and more. BACARDÍ Spiced is a gluten-free spiced rum made from charred American oak barrels. It also provides other products such as superior white rum, superior black rum, superior gold rum, and more.

Key Spiced Rum Companies:

The following are the leading companies in the spiced rum market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- Bacardi Limited

- Tanduay Distillers

- Havana Club (Pernod Ricard)

- Maine Craft Distilling

- Altitude Spirits

- HEAVEN HILL BRANDS

- SUNTORY HOLDINGS LIMITED

- Don Q Rum (estilería Serrallés, Inc.)

- SAZERAC CO, INC.

- The Kraken (Proximo Spirits)

Recent Developments

-

In October 2024, Diego and a contract logistics company in North America, DHL Supply Chain, announced the incorporation of two fuel cell-powered electric trucks in the U.S. supply chain fleet.

-

In March 2024, Bacardi Limited, one of the global companies operating in the alcoholic beverage market, launched its first premium-category spice product, BACARDÍ Caribbean Spiced, aged rum with pineapple, coconut, and spices.

Spiced Rum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.61 billion

Revenue forecast in 2030

USD 10.69 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, South Korea, Japan, Australia Brazil, South Africa

Key companies profiled

Diageo; Bacardi Limited; Tanduay Distillers; Havana Club (Pernod Ricard); Maine Craft Distilling; Altitude Spirits; HEAVEN HILL BRANDS; SUNTORY HOLDINGS LIMITED; Don Q Rum (estilería Serrallés, Inc.); SAZERAC CO, INC.; The Kraken (Proximo Spirits)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spiced Rum Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global spiced rum industry report based on product, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vanilla

-

Fruit

-

Mix

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.