- Home

- »

- Medical Devices

- »

-

Spinal Pumps Market Size, Share & Trends Report, 2030GVR Report cover

![Spinal Pumps Market Size, Share & Trends Report]()

Spinal Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Implantable Pump With Continuous Flow, Implantable Pump With Bolus-variable Flow), By Application (Spasticity Management), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-047-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spinal Pumps Market Summary

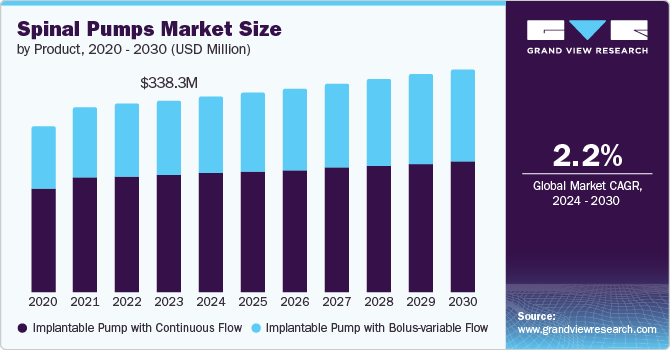

The global spinal pumps market size was valued at USD 338.3 million in 2023 and is projected to reach USD 392.9 million by 2030, growing at a CAGR of 2.2% from 2024 to 2030. The spinal pump market is expected to surge due to several factors: increasing cases of movement disorders and chronic pain, a growing elderly population at risk for these conditions, and advancements in spinal pump technology driven by rising R&D investment.

Key Market Trends & Insights

- The U.S. spinal pumps market dominated the North American market with a share of 89.3% in 2023.

- Asia Pacific spinal pumps market is anticipated to witness significant growth.

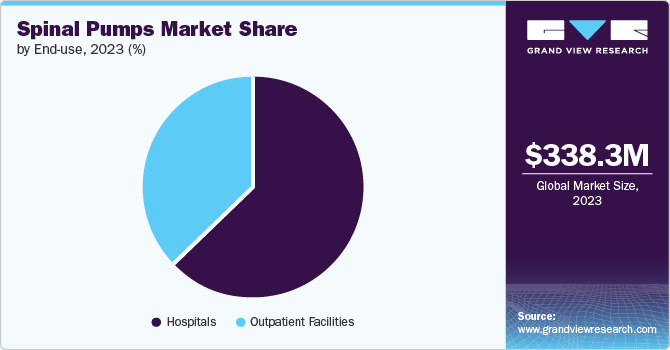

- Based on end-use, the hospitals segment dominated the market with 63.4% revenue share in 2023.

- In terms of application, the pain management segment accounted for the largest with 69.5% revenue share in 2023.

- Based on product, implantable pump with continuous flow dominated the market and accounted for a share of 61.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 338.3 Million

- 2030 Projected Market Size: USD 392.9 Million

- CAGR (2024-2030): 2.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

For instance, in April 2024, Bux Pain Management launched SynchroMed III, a U.S. Food and Drug Administration (FDA)-approved intrathecal drug delivery system for cancer pain, chronic pain, and severe spasticity. This innovative technology promises significant progress in pain management therapy. The rising prevalence of movement-related disorders such as multiple sclerosis and cerebral palsy increased the demand for spinal pumps across the globe. For instance, according to WHO, approximately 1.8 million people had Multiple Sclerosis (MS) in the year 2023.

The geriatric population is highly prone to suffering from movement-related disorders and different neurological conditions. Thus, increasing geriatric pollution worldwide is expected to drive the market. For instance, according to WHO, by 2050, one in six people is anticipated to be 60 years old or older. The global population of individuals aged 60 and over is projected to hit 2.1 billion, twice the current figure. Increasing research and development spending for developing novel therapies for chronic pain is expected to contribute to the market's growth in the forecast period. For instance, in 2022, the U.S. government selected NIAMS and multiple other NIH institutes to receive funding to improve opportunities for advancing pain science. This topic is crucial for NIAMS because many diseases and conditions in their portfolio are associated with acute and chronic pain, significantly affecting a person's quality of life.

Product Insights

Implantable pump with continuous flow dominated the market and accounted for a share of 61.4% in 2023. The market is expected to show high demand in the future due to the rising acceptance of implantable pumps with bolus-variable flow. These pumps provide a continuous supply of medication without disruption, which led to their higher acceptance. For instance, in January 2023, Alcyone Therapeutics partnered with Biogen Inc. to develop an implantable device designed for subcutaneous delivery of ASO therapies into the intrathecal space named ThecaFlex DRx System. This agreement aims to advance treatment options for neurological disorders.

The implantable pump with a bolus-variable flow segment is expected to grow at the fastest CAGR of 3.2% over the forecast period. The market is projected to be the fastest-growing segment due to the high demand for implantable pumps with bolus-variable flow over implantable pumps with continuous flow.

Application Insights

The pain management segment accounted for the largest with 69.5% revenue share in 2023, primarily due to the many patients experiencing chronic pain and unsuccessful treatment outcomes with other methods. For instance, according to a Centre for Disease Control (CDC) report, in 2021, 20.9% of American adults (51.6 million) experienced chronic pain, and 6.9% (17.1 million) suffered high-impact chronic pain, with non-Hispanic American Indian or Alaska Native adults being disproportionately affected.

Spasticity management is expected to grow at the fastest CAGR of 2.5% over the forecast period. The increasing cases of movement and neurological disorders, along with limited treatment options for spasticity, are responsible for the exponential growth. For instance, according to the University of Washington Rehabilitation Medicine, spasticity is a common problem affecting both spinal cord injury (78%) and cerebral palsy (80%) patients.

End-use Insights

The hospitals segment dominated the market with 63.4% revenue share in 2023. Patients often prefer hospitals for treatment because they are easily accessible and trusted. Patients have the option to go to the hospital for spinal pump implantation, which involves implantation of spinal pumps directly into the patient's spinal cord. As a result, the demand for spinal pumps in hospitals is increasing.

The outpatient facilities segment is expected to grow at the fastest CAGR of 2.6% over the forecast period. The growth can be attributed to technological advancements, accessible training, and improved patient satisfaction. Outpatient facilities are crucial because, at times, a pump malfunction or a delayed pump refill can lead to severe withdrawal syndrome. Patients with intrathecal pumps are usually supervised in outpatient facilities or specialized centers with consistent patient monitoring and follow-up to mitigate the risks.

Regional Insights

North America spinal pumps market dominated the market in 2023. It is attributable to increasing spending on research and development in the region for chronic pain management. For instance, a May 2023 Dovepress report revealed the NIH-funded research on chronic pain in 2023, allocating USD 200 million for peripheral neuropathy, USD 69 million for back pain, USD 13 million for fibromyalgia, and USD 8 million for neck pain.

U.S. Spinal Pumps Market Trends

The U.S. spinal pumps market dominated the North American market with a share of 89.3% in 2023 due to the country's high demand for spinal pumps. Moreover, the rising prevalence of chronic pain conditions among U.S. adults is expected to boost the market. For instance, a 2023 study in the Journal of the American Medical Association reported chronic pain rates in the U.S. in 2020 as high-impact chronic pain as 12.0 cases per 1000 PY and 52.4 cases per 1000 person-years (PY), based on 10,415 adult participants from the National Health Interview Survey 2019-2020 Longitudinal Cohort. The rate of persistent chronic pain among those with baseline chronic pain was 462.0 cases per 1000 PY.

Europe Spinal Pumps Market Trends

Europe's spinal pumps market was identified as a lucrative region in 2023 due to increasing neuropathic pain patient cases. For instance, according to a report published in PAIN Reports in March 2023, a total of 76,095 participants (51.1%) reported experiencing chronic pain. Neuropathic pain was found to have a prevalence of 9.2% and was associated with deteriorating quality of life. As expected, neuropathic pain was connected to diabetes and neuropathy, as well as pelvic, postsurgical, and migraine pains, rheumatoid arthritis, osteoarthritis, and fibromyalgia musculoskeletal disorders.

The UK spinal pumps market is expected to grow rapidly in the coming years due to rapid population aging.For instance, UK Census 2021 data revealed England and Wales' population was aging. From 2011 to 2021, the number of people aged 65+ grew from 9.2 million to over 11 million, increasing from 16.4% to 18.6%.

Spinal pumps market in Germany held a substantial market share in 2023 due to the country's increasing prevalence of back and neck pain. For instance, a study published in the Journal of Health Monitoring in March 2021 indicated that 61.3% of participants experienced back pain last year. 15.5% of respondents reported chronic back pain, neck pain was reported by 45.7% of respondents, while 15.6% indicated they had both lower and upper back pain along with neck pain in the previous year.

Asia Pacific Spinal Pumps Market Trends

Asia Pacific spinal pumps market is anticipated to witness significant growth. This growth owes to the region's high prevalence of chronic pain patients. For instance, a report published by NOVOTECH in June 2022 stated that in the Asia Pacific region, over 50% of the population is impacted by Chronic Pain, and together, China and India account for 700 million cases.

The Japan spinal pumps market is expected to grow rapidly in the coming years due to the increasing demand for intrathecal pumps in the forecasted period. The market is driven by the recent advancement in intrathecal drug delivery of opioids or other analgesics for the treatment of multiple sclerosis-associated pain and other neurological pain.

Spinal pumps market in China held a substantial market share in 2023 due to increased intrathecal pump usage in treating cancer-associated pain. For instance, a study published in the ANNALS OF PALLIATIVE MEDICINE Journal described that an intrathecal morphine pump relieved cancer-associated pain in patients. In total, 33 patients were included and split into traditional care and Family Integrated Care (FIC) groups. The findings indicated that the insertion of IMP (Intrathecal Morphine Pump) relieved the pain in both participants. Additionally, individuals in the FIC cohort experienced a noticeably greater reduction in pain compared to participants in the standard group.

Latin America Spinal Pumps Market Trends

The Latin American spinal pumps market is anticipated to grow significantly over the forecast period. Collaborations and investments from major industry leaders drive the market, as does the regulatory approval of intrathecal pumps for the treatment of chronic to moderate pain in the region.

Brazil's spinal pump market held a substantial market share in 2023 and is expected to grow significantly because chronic pain is highly prevalent in Brazil. For instance, a study published in the Clinics Journal in May 2023 concluded that the prevalence of chronic pain in the adult population was 35.70%, and in older adults, it was 47.32%.

Middle East & Africa Spinal Pumps Market Trends

The Middle East and Africa spinal pumps market is anticipated to witness significant growth over the forecast period owing to the increasing prevalence of chronic conditions in the region, as these devices offer effective pain management solutions for conditions such as chronic back pain, cancer pain, and spasticity. According to the DUPHAT, chronic diseases are a major health threat in the Middle East and North Africa (MENA). Leading the way were cardiovascular diseases, responsible for over 810,000 deaths from ischemic heart disease and over 370,000 deaths from stroke in 2019 alone. Cancer was another growing concern, with nearly half a million new cases and over a quarter million deaths predicted for 2020.

The South Africa spinal pump market had a substantial market share in 2023 and the projected high demand for spinal pumps in the treatment of neuropathic pain will rapidly drive the growth of the South Africa Spinal Pumps over the forecast period. The African population experiences neuropathic pain because of the unavailability of essential nutrients.

Key Spinal Pumps Company Insights

Some of the key companies in the Spinal Pumps market include Medtronic, DePuy Synthes (Medical Device Business Services, Inc.), Teleflex Incorporated, Smiths Group plc, FLOWONIX MEDICAL INC, Tricumed Medical Technology GmbH, Baxter, Globus Medical, DAIICHI SANKYO COMPANY, LIMITED., and Stryker. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Medtronic is a medical technology company that creates, produces, and sells medical devices and solutions. It provides products to treat a wide range of health conditions including coronary artery diseases, heart failure, peripheral vascular diseases, heart valve disorders, venous renal and neurological conditions, aortic conditions, spine and musculoskeletal disorders, and ear, nose, and throat ailments. It additionally offers biological remedies for the orthopedic and dental sectors.

-

Smiths Group plc is a technology company with diversified operations. It offers vital solutions for energy and processing, medical devices and supplies, and devices for detecting and identifying security threats and contraband. It also offers answers for fast connection and parts for heating and transferring fluids and gases.

Key Spinal Pumps Companies:

The following are the leading companies in the spinal pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- DePuy Synthes (Medical Device Business Services, Inc.)

- Teleflex Incorporated

- Smiths Group plc

- FLOWONIX MEDICAL INC

- Tricumed Medical Technology GmbH

- Baxter

- Globus Medical

- DAIICHI SANKYO COMPANY, LIMITED.

- Stryker

Recent Developments

-

In October 2023, Medtronic announced that the U.S. FDA approved its new SynchroMed III intrathecal drug delivery system for patients suffering from cancer pain, severe spasticity, and chronic pain. SynchroMed III is a system for delivering drugs directly to the fluid surrounding the spinal cord, targeting symptoms for relief.

-

In December 2021, DePuy Synthes (Medical Device Business Services, Inc.) announced the completion of acquisition of OrthoSpin, Ltd. An external ring fixation system named DePuy Synthes MAXFRAME Multi-Axial Correction System works together with OrthoSpin innovative automated strut system.

Spinal Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 344.9 million

Revenue forecast in 2030

USD 392.9 million

Growth rate

CAGR of 2.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Medtronic; DePuy Synthes (Medical Device Business Services, Inc.); Teleflex Incorporated;

Smiths Group plc; FLOWONIX MEDICAL INC; Tricumed Medical Technology GmbH; Baxter; Globus Medical; DAIICHI SANKYO COMPANY, LIMITED.; Stryker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spinal Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spinal pumps market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable Pump with Continuous Flow

-

Implantable Pump with Bolus-variable Flow

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Spasticity Management

-

Pain Management Machine Learning

-

Non-malignant Pain

-

Malignant Pain

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.