- Home

- »

- Medical Devices

- »

-

Intrathecal Pumps Market Size, Share & Trends Report, 2030GVR Report cover

![Intrathecal Pumps Market Size, Share & Trends Report]()

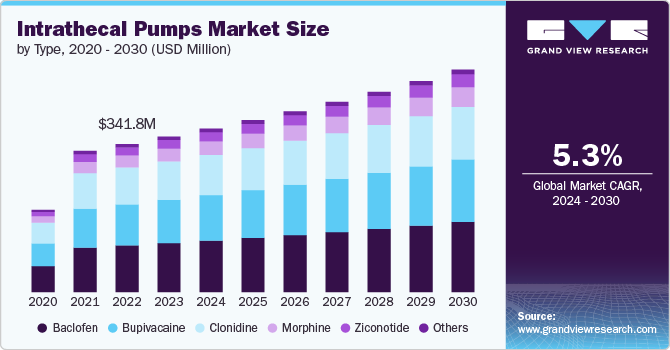

Intrathecal Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Baclofen, Bupivacaine, Clonidine, Morphine, Ziconotide), By Application (Pain, Spasticity), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-508-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intrathecal Pumps Market Size & Trends

The global intrathecal pumps market size was valued at USD 358.9 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The market is driven by the increasing prevalence of chronic pain conditions and spasticity, particularly in aging populations. According to the National Institute on Aging (NIA), the senior population is expected to reach 72 million by 2030. These devices offer targeted drug delivery, reducing systemic side effects and enhancing patient comfort. Technological advancements, such as improved pump designs and programmable features, further boost market growth by offering precise dosing and better patient outcomes. Rising awareness of pain management options and the growing demand for minimally invasive treatments also contribute to the market's expansion. Additionally, supportive healthcare policies and reimbursement frameworks encourage the adoption of intrathecal pumps for long-term pain management.

The market is primarily driven by the rising incidence of chronic pain and spasticity, particularly among the aging population and patients with conditions such as cancer, multiple sclerosis, and spinal cord injuries. These pumps offer a highly effective solution for managing severe pain by delivering medication directly into the cerebrospinal fluid, allowing for smaller doses and reducing systemic side effects compared to oral or intravenous therapies. According to a report published by the National Centre for Biotechnology Information in June 2022, Intrathecal Drug Delivery Systems (IDDS) are well-known as an effective treatment technique for people suffering from chronic benign pain. Furthermore, it is also treated as a tool for managing patients with severe muscle spasticity and providing therapies that address various spinal diseases. This targeted drug delivery is particularly beneficial for patients who do not respond adequately to conventional pain management methods.

Rising cases of pain disorders are projected to drive the intrathecal pumps market growth. With the rising survival rate for oncologic patients, the occurrence of cancer pain is also growing. Pain arises in 67% of patients with metastatic cancer and is among the most prevalent symptoms among the patients. The majority of chronic cancer pain can be managed with pharmacologic therapies, including analgesia. However, intrathecal drug delivery offers an alternative route of administration for analgesics that helps in reducing side effects with better bioavailability, thereby, accelerating the market progression.

The increasing number of product launches by several prominent market players is estimated to boost market growth. For instance, in June 2022, Amneal Pharmaceuticals announced the launch of LYVISPAH (baclofen) for the treatment of spasticity associated with multiple sclerosis and other spinal cord disorders. In addition, manufacturers of intrathecal pumps are also observed to advance devices having longer battery life, which may help minimize the number of future surgical procedures required to replace expiring pumps.

According to NCBI in October 2020, 94% (398/422) of patients experienced improved pain control after pump implantation, with 59% (249/422) rating their relief as good to excellent. However, 6% (24/422) reported worsened pain. This data is crucial for the intrathecal pumps market, highlighting the effectiveness of the therapy while also emphasizing the need to address potential complications. The high success rate boosts market confidence, encouraging adoption, while the small percentage of adverse outcomes underscores the importance of continuous innovation and patient monitoring to improve overall treatment efficacy and safety.

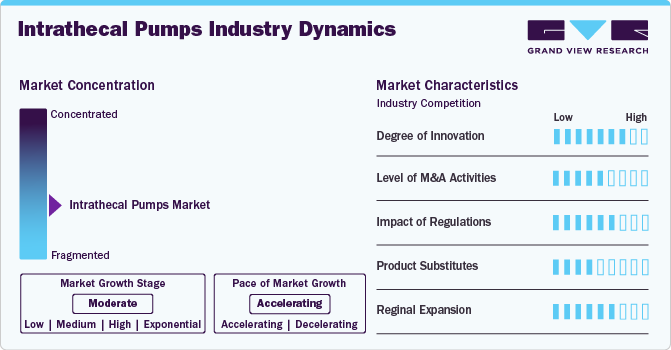

Market Concentration & Characteristics

The industry is moderately concentrated, with key players like Medtronic, Flowonix, and Boston Scientific dominating the space. These companies drive innovation through advanced technology and extensive research. The market is characterized by high barriers to entry due to stringent regulatory requirements, significant R&D investments, and the need for specialized expertise in drug delivery systems. Additionally, the industry is shaped by increasing demand for targeted pain management solutions, ongoing technological advancements, and a focus on improving patient safety and device reliability. Competitive pricing, partnerships, and expanding healthcare infrastructure further influence the industry dynamics.

The industry is characterized by significant innovation, driven by the demand for precise drug delivery and improved patient safety. Companies are creating advanced programmable pumps with real-time monitoring to minimize risks of overdosage and complications. For instance, the 3rd Generation Prometra Programmable Pump incorporates several technological advancements that enhance intrathecal therapy. Its design includes features that prevent common issues such as tissue ingrowth, weakened connections, suture complications, and refill problems. These innovations are essential for meeting patient needs and sustaining market leadership as the demand for advanced pain management solutions continues to rise.

Regulations significantly impact the intrathecal pump industry, ensuring device safety, efficacy, and patient protection. Stringent regulatory standards, such as FDA approvals, require thorough clinical trials and quality controls, slowing product development and enhancing reliability. For example, Medtronic's SynchroMed III received FDA approval after meeting rigorous safety and performance criteria, demonstrating compliance with regulatory requirements. These regulations drive companies to prioritize innovation while maintaining high safety standards. However, the complex approval processes can also increase costs and time to market, affecting smaller companies' ability to compete in this highly regulated industry.

The industry experiences moderate levels of mergers and acquisitions (M&A) as companies aim to expand their technological capabilities and market reach. Larger firms often acquire smaller, innovative companies to enhance their product portfolios and gain a competitive edge. These M&A activities help accelerate the development of advanced drug delivery systems and strengthen market positioning. However, the industry's consolidation through M&A can reduce competition and create higher entry barriers for new players. Overall, M&A activities are a strategic approach for companies to innovate and adapt to the growing demand for specialized pain management solutions.

In the intrathecal pumps industry, product substitutes include alternative pain management methods such as oral medications, transdermal patches, and external infusion pumps. Non-invasive treatments like spinal cord stimulators, nerve blocks, and physical therapy also serve as substitutes. While these alternatives may offer pain relief, they often lack the targeted drug delivery and reduced side effects provided by intrathecal pumps. However, their lower cost, ease of use, and fewer complications make them attractive options for some patients and healthcare providers. The availability of these substitutes can limit the adoption of intrathecal pumps, especially in cost-sensitive markets.

Regional expansion in the intrathecal pumps industry is driven by increasing demand for targeted pain management solutions in emerging and developing markets. Companies are focusing on regions such as Asia-Pacific, Latin America, and the Middle East, where healthcare systems are evolving and awareness of advanced treatment options is growing. Efforts include establishing local partnerships, expanding distribution networks, and adapting to regional regulatory requirements. The rising prevalence of chronic pain conditions and an aging population in these areas present significant growth opportunities. This strategic expansion helps companies enhance their market reach and capitalize on untapped potential in diverse geographic regions.

Type Insights

The morphine segment accounted for a significant revenue share of the global industry in 2023. Morphine is considered as the gold standard in intrathecal drug administration owing to its strong receptor affinity, stability, and extensive user experience of the drug. Additionally, morphine has received approval for long-term intrathecal pain treatment by the U.S. FDA. Furthermore, long-term intrathecal morphine has fewer side effects as compared to systemic opioids, expecting to spur the growth of this segment.

Bupivacaine is expected to grow at the fastest CAGR over the forecast period. Bupivacaine is considered an excellent adjunct medication in intrathecal therapy. Several studies have revealed that bupivacaine synergistically improves the effect of intrathecal opioids when used in combination, significantly contributing to its growing market share. Bupivacaine allows some patients to reduce their oral opioid usage, as well as minimizes dose escalations of intrathecal opioids. Thus, several advantages associated with bupivacaine are anticipated to secure the segment growth.

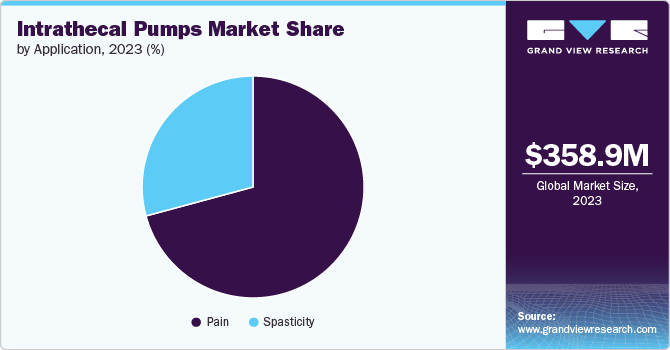

Application Insights

The pain segment accounted for the largest market share of 70.8% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The rising prevalence of chronic and acute disorders, such as chronic pain cancer, and other pain-causing ailments, such as failed back surgery syndrome, is one of the key factors enhancing segment growth. Hence, intrathecal pumps are best suited for individuals suffering from pain-associated disorders.

Several companies are concentrating on developing treatments for spasticity. Medtronic's Intrathecal Baclofen Therapy (ITB) involves administering Lioresal Intrathecal (baclofen) into the spinal fluid to manage severe spasticity. Additionally, the increasing global incidence of stroke is a significant driver of growth in this segment. A report from the American Heart Association, Inc. in February 2022 noted a sharp rise in stroke cases among Americans aged 49 and under over the past 30 years.

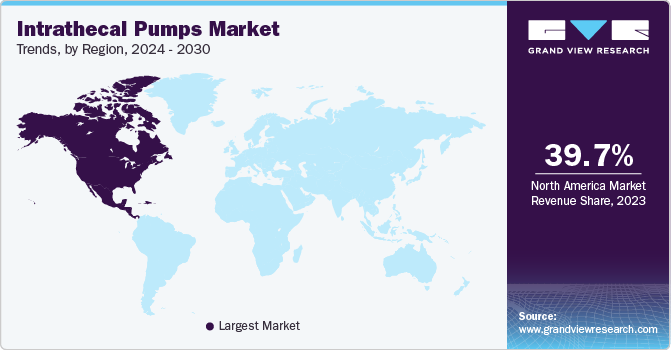

Regional Insights

North America intrathecal pumps market dominated the global market and accounted for the 39.7% revenue share in 2023. The growth of the market in North America is supported by the presence of well-established primary, secondary, and tertiary care hospitals. Additionally, a robust reimbursement system and favorable government funding are key factors expected to drive market expansion. Increased efforts by leading companies to enhance their product offerings and maintain high-quality standards are anticipated to boost demand for intrathecal pumps in the region.

U.S. Intrathecal Pumps Market Trends

The intrathecal pumps market in the U.S. held a significant share of North America's intrathecal pumps market in 2023. The prevalence of cancer in the U.S. continues to rise rapidly, creating an increased demand for effective and advanced intrathecal pumps. As reported by NCBI in March 2024, the United States is expected to see 2,001,140 new cancer cases and 611,720 cancer-related deaths in 2024. Furthermore, the rising incidence of back pain is expected to drive growth for intrathecal pumps. The American Chiropractic Association reports that approximately 80% of people will experience back pain at some point in their lives.

Europe Intrathecal Pumps Market Trends

The intrathecal pumps market in Europe is supported by the increasing senior population, which represents a significant segment of the market. Eurostat data from February 2024 reveals that over 21% of Europe’s 448.8 million people were aged 65 and older as of January 2023.This aging demographic is more prone to chronic pain and conditions requiring advanced pain management solutions, such as intrathecal pumps. The growing need for effective treatment options among the elderly drives demand for these devices, highlighting the potential for market growth as the senior population continues to rise.

UK intrathecal pumps market is seeing growth due to increasing demand for advanced pain management solutions driven by a rising prevalence of chronic pain and neurological disorders. Technological advancements in pump designs and supportive healthcare policies further boost market expansion. Additionally, ongoing research and development efforts enhance the effectiveness and safety of intrathecal pumps.

The intrathecal pumps market in France is driven by the anticipated increase in new cancer cases, which are expected to rise from 216,130 in 1990 to 433,136 in 2023. This surge in cancer incidence, due to factors like an aging population and lifestyle risks, creates a heightened demand for advanced pain management solutions. Intrathecal pumps are essential for improving cancer patients' quality of life by providing effective pain relief. Given cancer's status as a leading cause of death, the growing need for targeted therapies to manage severe pain and related symptoms is expected to significantly boost the market for intrathecal pumps in France.

Germany intrathecal pumps market is significantly growing, attributed to German manufacturers' strong reputation for high-quality medical devices. The country’s stringent quality control and strict adherence to safety regulations bolster this reputation, earning the trust of healthcare providers and driving sales and market dominance. The rising number of pain management centers and a focus on improving patient outcomes contribute to the positive market trends in Germany.

Asia Pacific Intrathecal Pumps Market Trends

The intrathecal pumps market in the Asia Pacific region is projected to experience the highest growth rate during the forecast period. The large patient population in this region is expected to drive demand for intrathecal pumps. The rise in pain care centers in countries like China, Singapore, Japan, and India is anticipated to further boost adoption. For example, the Singapore Pain Care Center (SPCC) offers alternative treatments to open surgery. Additionally, the high incidence of pain-related disorders, increased R&D investment, and expanding number of pain care facilities in the U.S. and Canada have significantly contributed to the region's growth.

Japan intrathecal pumps market is experiencing growth due to an increasing prevalence of chronic pain and neurological disorders. Japan’s advanced healthcare system and focus on innovative medical technologies support the adoption of intrathecal pumps. The aging population further drives the market, which often requires advanced pain management solutions.

The intrathecal pump market in China is expanding due to rising chronic pain prevalence and healthcare advancements. For instance, Research from Tsinghua University, reported by the South China Morning Post in November 2022, estimates that around 300 million people in China suffer from chronic pain, with the number steadily increasing. Increased healthcare spending and technological innovations drive demand for targeted pain management solutions.

India intrathecal pumps market is growing due to rising chronic pain cases and advancements in pain management technology. Increased healthcare investments and awareness are driving adoption. Innovations in pump design and supportive policies further boost market expansion, addressing the needs of an expanding patient population.

Latin America Intrathecal Pumps Trends

The intrathecal pumps market in Latin America is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for intrathecal pumps as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Middle East & Africa Intrathecal Pumps Market Trends

The intrathecal pumps market in the Middle East & Africa is expected to experience growth due to the increasing geriatric population, which is more susceptible to chronic pain and conditions requiring advanced pain management. For instance, according to the Saudi Arabian Monetary Agency (SAMA), the proportion of Saudis aged 60 and older is projected to reach 25% by 2050. This aging demographic will drive higher demand for effective pain management solutions, such as intrathecal pumps, to address age-related health issues. As the elderly population grows, the need for sophisticated pain relief options will further stimulate market expansion.

Key Intrathecal Pumps Company Insights

The key players that dominated the global market in 2021 include Medtronic; Flowonix, Codman & Shurtleff (J&J), Tricumed GmbH. These companies are focusing on developing strategic growth initiatives such as mergers, product launches, and partnerships to gain a competitive edge. In October 2019, Flowonix Medical received approval from the FDA for Prometra II 40 ml programmable pump for use with intrathecal baclofen. This product launch allowed the company to provide Prometra system to serve 40 ml pumps to cancer patients.

The market players are adopting various strategies such as mergers & acquisitions, new product development, joint ventures, and partnerships to maintain a strong foothold in the intrathecal pumps market. For instance, in January 2018, Medtronic received FDA approval of a novel clinician programmer for use with SynchroMed (TM)II intrathecal drug delivery system.

Key Intrathecal Pumps Companies:

The following are the leading companies in the intrathecal pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- Codman & Shurtleff

- Medallion Therapeutics

- Arrow International Inc.

- Tricumed GmbH;

- Codman & Shurtleff;

- Smith’s Medical;

- Teleflex Incorporated

Recent Developments

-

In April 2024, Baxter received U.S. FDA clearance for its Novum IQ large-volume infusion pump and Dose IQ Safety Software. These innovations enhance infusion accuracy and patient safety in hospitals. The Novum IQ pump integrates with Dose IQ software, offering advanced drug library management and error reduction features to improve overall infusion therapy.

-

In October 2023, Medtronic received FDA approval for its SynchroMed III intrathecal drug delivery system, designed to treat chronic pain, cancer pain, and severe spasticity. This system delivers medication directly to the spinal fluid, providing targeted pain relief while minimizing systemic side effects. It offers an advanced solution for patients with severe pain conditions.

Intrathecal Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 377.1 million

Revenue forecast in 2030

USD 513.3 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic plc; Flowonix; Medallion Therapeutics; Arrow International, Inc.; Tricumed GmbH; Codman & Shurtleff; Smith’s Medical; Teleflex Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intrathecal Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intrathecal pumps market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Baclofen

-

Bupivacaine

-

Clonidine

-

Morphine

-

Ziconotide

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Spasticity

-

Pain

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intrathecal pumps market size was estimated at USD 358.9 million in 2023 and is expected to reach USD 377.1 million in 2024.

b. The global intrathecal pumps market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 513.3 million by 2030.

b. North America dominated the intrathecal pumps market with a share of 40.1% in 2023. This is attributable to the high prevalence of chronic diseases, improved healthcare infrastructure, and the adoption of advanced devices for providing enhanced medical care.

b. Some key players operating in the intrathecal pumps market include Medtronic plc; Flowonix; Medallion Therapeutics; Arrow International, Inc.; Tricumed GmbH; Codman & Shurtleff; Smith’s Medical; Teleflex Incorporated

b. Key factors that are driving the intrathecal pumps market growth include the increasing prevalence of chronic back pain and muscle spasticity, increasing demand for targeted drug delivery systems, and technological advancements in intrathecal pumps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.