- Home

- »

- Clothing, Footwear & Accessories

- »

-

Sports Equipment Market Size & Share Report, 2022-2030GVR Report cover

![Sports Equipment Market Size, Share & Trends Report]()

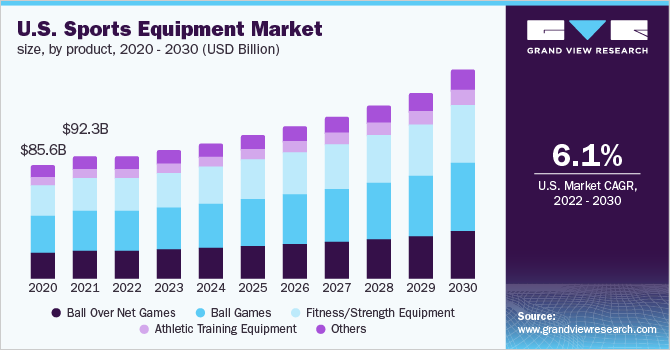

Sports Equipment Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Ball Over Net Games, Ball Games, Fitness/Strength Equipment, Athletic Training Equipment), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-407-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sports Equipment Market Summary

The global sports equipment market size was valued at USD 331.4 billion in 2021 and is expected to reach USD 578.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. Continuous innovations and rapid technological advancements to keep pace with dynamic consumer preferences are driving the growth of the market. The increasing awareness about the benefits of a healthy lifestyle and the importance of sports and fitness activities, is further stimulating the demand for such equipment.

Key Market Trends & Insights

- North America dominated the market for sports equipment and accounted for the largest revenue share of 31.7% in 2021.

- Asia Pacific, the market for sports equipment is projected to witness the highest CAGR of 7.3% over the forecast period.

- Based on product, the ball games segment dominated the market for sports equipment and accounted for the largest revenue share of 34.0% in 2021.

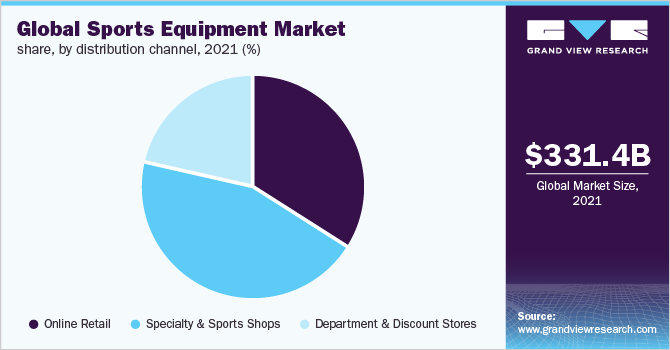

- In terms of distribution channel, the specialty and sports shops segment dominated the market for sports equipment and accounted for revenue share of 45.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 331.4 billion

- 2030 Projected Market Size: USD 578.9 billion

- CAGR (2022-2030): 6.4%

- North America: Largest market in 2021

The Covid-19 pandemic has adversely affected several industries including the athletic and fitness industry. Many tournaments and game events, including the Olympics, have either been postponed or their format has been altered. As a result, stakeholders in the market are trying to assess the downstream impact arising from disrupted cash flows, insecurities, and the potential declines in long-term attendance and engagement. The growing popularity of national and international events, such as the Soccer World Cup, Olympic Games, and Cricket World Cup, is also boosting the growth of this market for sports equipment. Rising cases of lifestyle-related health issues, such as stress and obesity, are pushing more people to engage in outdoor and fitness activities and this is fueling the demand for various sorts of fitness and sports equipment.

The growing availability of popular international athletic equipment brands is also contributing to product demand. Women’s participation in sports is a major factor that is likely to boost market growth. According to BBC, the difference between the number of men and women participating in sports in England has dropped to 1.55 million in 2018.

The gap is further expected to reduce over the coming years and this will have a positive impact on the demand for equipment. Spending on such equipment for kids has increased in gradually over the years thanks to the growing awareness pertaining to the benefits of such games in their physical development. India and China are lucrative markets for sports equipment. Rising disposable income and improved living standards of the consumers are key factors accelerating product demand in these countries. Moreover, low production costs and a thriving manufacturing industry are likely to propel the market growth in Asia Pacific.

Companies are trying to maximize market penetration by increasing brand awareness via TV commercials and print media, internet, social media platforms, team sponsorships, and partnerships with the athletes of various sports and fitness enthusiasts. Moreover, social media influencers and favorite sports personnel are endorsing various brands which is likely to supplement to the growth of the market for sports equipment.

Product Insights

The ball games segment dominated the market for sports equipment and accounted for the largest revenue share of 34.0% in 2021. Since ball games are popularly watched all over the world, the revenue generated from this segment is notably higher than rest of the segments. The segment is expected to witness a CAGR of over 6.3% over the forecast period. Burgeoning global popularity of events such as cricket, basketball, and football is projected to be one of the key factors contributing to the growth of the segment.

On the other hand, fitness/strength equipment segment is projected to witness highest CAGR over the forecast period. In recent times, a drastic change has been witnessed in lifestyles of urban population, owing to rigorous, complex, and chiefly sedentary work cultures. Growing health concerns coupled with rising disposable incomes of consumers are further boosting their inclination towards sports and fitness.

Distribution Channel Insights

The specialty and sports shops segment dominated the market for sports equipment and accounted for revenue share of 45.0% in 2021. These stores have a broad portfolio of branded products and provide required support and information to consumers through expert customer service personnel. Moreover, convenience provided by this distribution channel and its ability to stock popular brands has been supplementing the growth of this segment.

The online retail segment is projected to register a CAGR of 7.4% in the sports equipment market from 2022 to 2030. Rising internet penetration amongst consumers and target marketing done by companies to reach all customer touchpoints are likely to fuel the growth of this segment. In addition, increasing use of smartphones, increasing consumer spending, growing penetration of internet and online shopping from e-commerce platforms are factors likely to drive segment growth over the forecast period.

Regional Insights

North America dominated the market for sports equipment and accounted for the largest revenue share of 31.7% in 2021.The growing popularity of games such as football, basketball, etc., are prompting government in the region to established arenas and offer an enhanced sporting experience to citizens. This is expected to create positive outlook for the market growth market over the forecast period. In Asia Pacific, the market for sports equipment is projected to witness the highest CAGR of 7.3% over the forecast period. In 2021, Asia Pacific countries registered a swift increase in sales of fitness equipment on account of COVID-19. India has also made significant strides in outdoor equipment over the past couple of years owing to the growing popularity of games and subsequently the rising number of associated leagues.

Furthermore, high demand in Australia can be attributed to rising focus on sports. Additionally, increasing disposable income and consumer spending across emerging markets such as India, China, and the Middle Eastern countries are expected to bolster the demand for sporting goods. These countries have also been hosting a variety of athletic events and have developed infrastructure to attract more people to participate in several gaming events, subsequently triggering the growth of the market in APAC.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retails, expanding distribution channel, entering in department and discount stores, and collaborating with the celebrities in order to gain maximum customer penetration.

-

In March 2021, DICK'S Sporting Goods, the largest U.S.-based, omni-channel sporting goods retailer, announced the introduction of VRST, a men's athletic apparel brand built for the modern active man who lives life on-the-go.

-

In June 2021, JD Sports Group recently acquired Deporvillage, an online-only retailer of outdoor sporting equipment. Under this acquisition, the company will acquire 80% of stake, while 0% will be retained by Deporvillage founders Xavier Pladellorens and Ángel Corcuera.

Some of the prominent players in the sports equipment market include:

-

Adidas AG

-

Amer Sports

-

Callaway Golf Co.

-

Sumitomo Rubber Industries Limited

-

Nike, Inc.

-

Puma SE

-

Mizuno Corporation

-

Sports Direct International PLC

-

Under Armour

-

Yonex Co., Ltd

Sports Equipment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 347.4 billion

Revenue forecast in 2030

USD 578.9 billion

Growth Rate

CAGR of 6.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan; Australia; New Zealand; Mexico; Brazil

Key companies profiled

Adidas AG; Amer Sports; Callaway Golf Co.; Sumitomo Rubber Industries Limited; Nike, Inc.; Puma SE; Mizuno Corporation; Sports Direct International PLC; Under Armour; Yonex Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the sports equipment market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Ball over net games

-

Ball games

-

Fitness/Strength equipment

-

Athletic training equipment

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online retail

-

Specialty & sports shops

-

Department & discount stores

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global sports equipment market size was estimated at USD 331.4 billion in 2021 and is expected to reach USD 347.4 billion in 2022.

b. North America dominated the sports equipment market with a share of 31.6% in 2021. This is attributable to rising consumer participation in sports activities.

b. Some of the prominent companies operating in the sports equipment market are Callaway Golf Co.; Amer Sports; Puma SE; Adidas AG; Nike, Inc.; Mizuno Corporation; and YONEX Co. Ltd.

b. Key factors that are driving the sports equipment market growth include the rising awareness regarding general health & fitness and the rising popularity of casual and athletic designs in sports equipment.

b. The global sports equipment market is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 578.9 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.