- Home

- »

- Consumer F&B

- »

-

Sports Supplements Market Size, Industry Report, 2033GVR Report cover

![Sports Supplements Market Size, Share & Trends Report]()

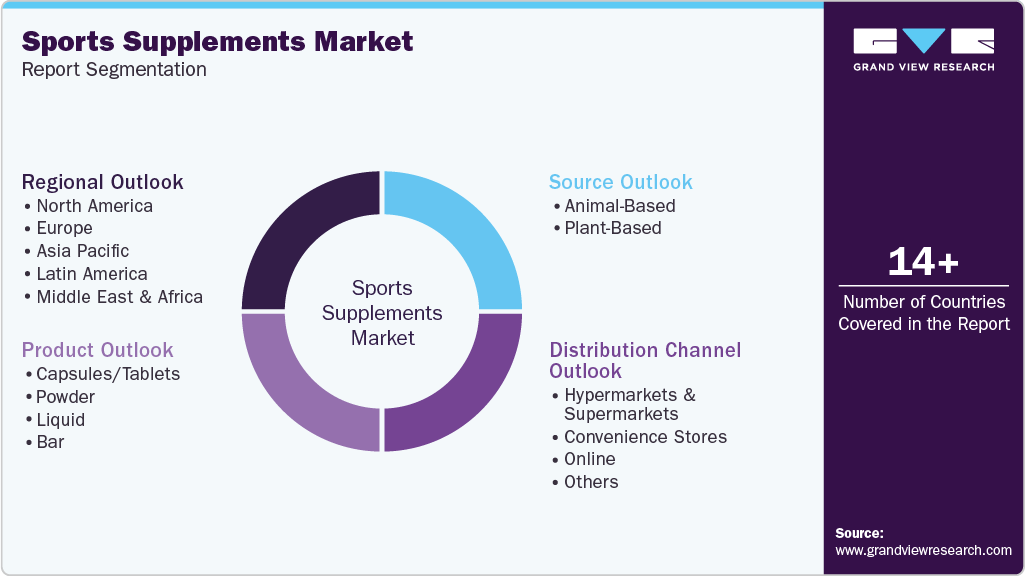

Sports Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Capsules/Tablets, Powder, Liquid, Bars), By Source (Animal-based, Plant-based), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-869-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sports Supplements Market Summary

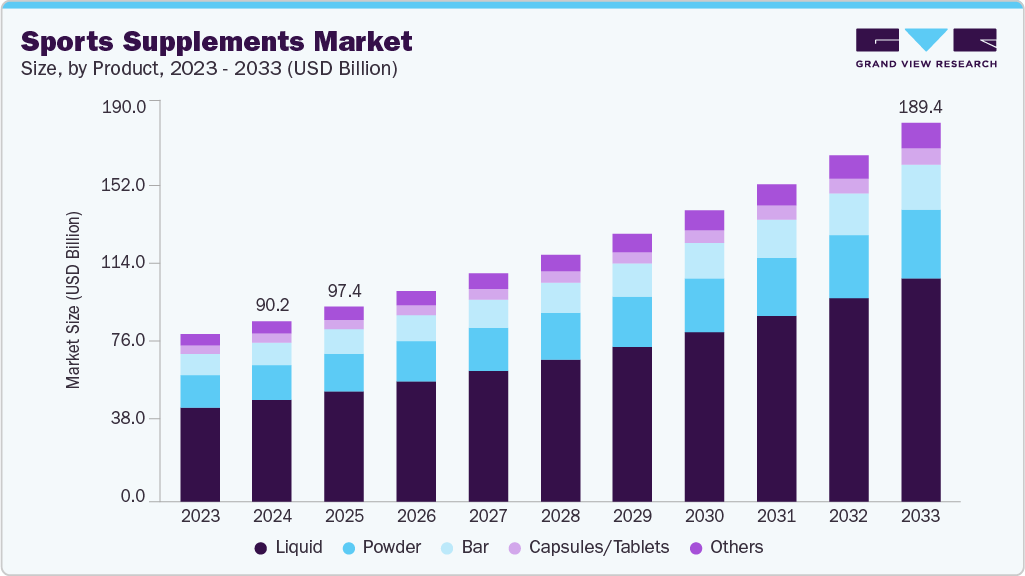

The global sports supplements market size was estimated at USD 90.24 billion in 2024 and is projected to reach USD 189.38 billion by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The global sports supplement industry has experienced significant growth over the past decade, driven by the rising adoption of fitness regimes and the increasing awareness of the importance of nutrition in maintaining an active lifestyle.

Key Market Trends & Insights

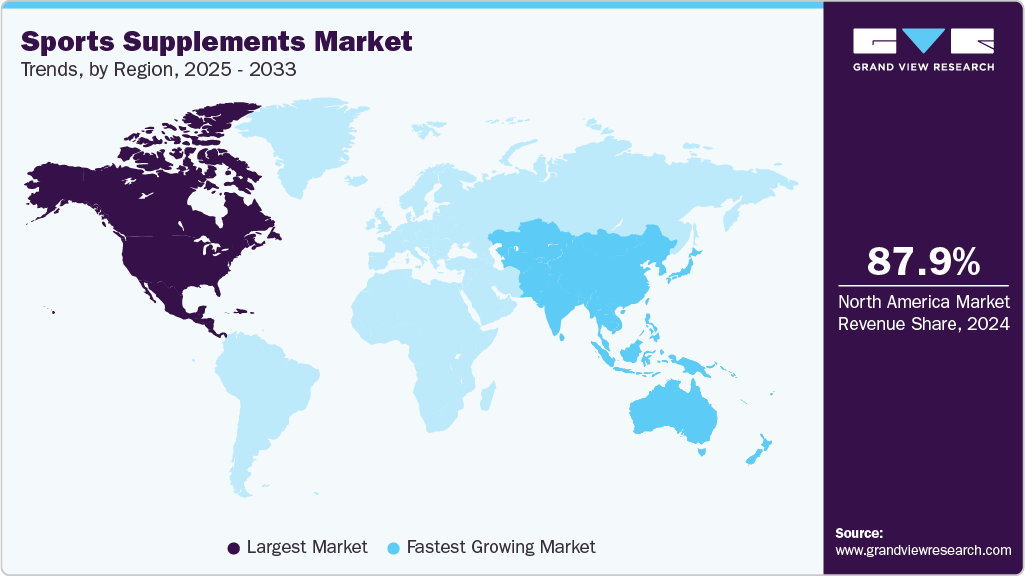

- North America dominated the sports supplements market with the largest revenue share of 54.40% in 2024.

- The sports supplements market in the U.S. accounted for the largest market revenue share of 87.92% in North America in 2024.

- By product segment, the liquid segment led the market with the largest revenue share of 56.42% in 2024.

- By source segment, the animal-based segment accounted for the largest market revenue share in 2024.

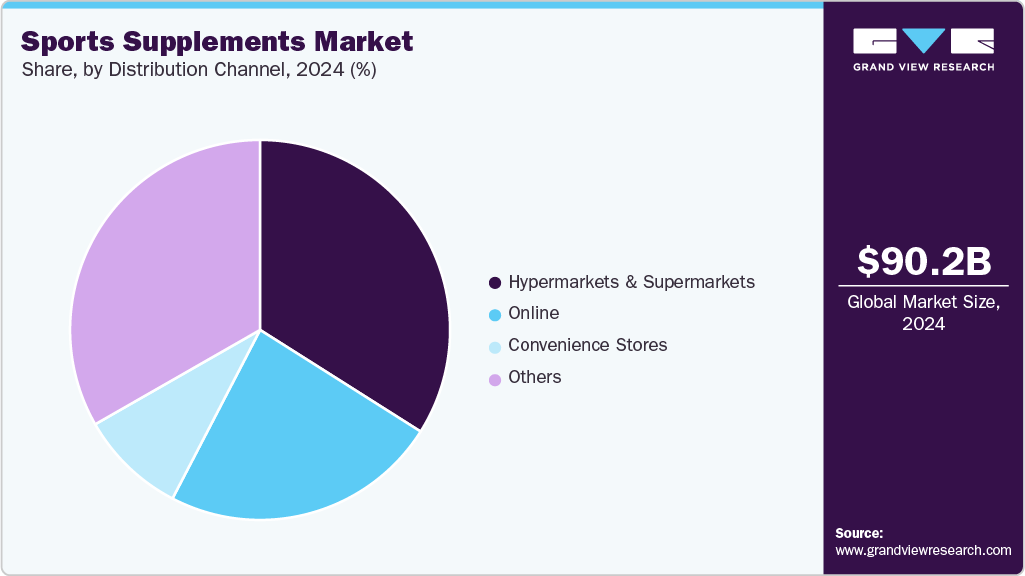

- Based on the distribution channel, the hypermarkets & supermarkets segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 90.24 Billion

- 2033 Projected Market Size: USD 189.38 Billion

- CAGR (2025-2033): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This market encompasses a broad range of products, including protein powders, energy bars, dietary supplements, and ready-to-drink (RTD) beverages, designed to enhance athletic performance, support recovery, and improve overall health, driving the overall market during the forecast period.The growing awareness of the importance of maintaining a healthy lifestyle is one of the primary drivers of the global sports supplement industry. Increasing numbers of people are adopting active lifestyles, driven by a desire to enhance their physical fitness and overall well-being. This trend is particularly prominent among millennials and Gen Z, who place a high value on fitness and wellness. The increase in gym memberships, participation in sports and fitness activities, and the rise of fitness influencers on social media platforms have contributed to the growing demand for sports supplement products.

An Ipsos poll conducted for the Council for Responsible Nutrition (CRN) in 2023 shows that 74% of Americans use dietary or nutritional supplements, with 55% of them being regular users. Trust in the dietary supplement industry remains strong, with 74% of Americans and 83% of supplement users expressing confidence in the sector. Additionally, 92% of supplement users consider dietary supplements essential for maintaining their health. Confidence in the safety and quality of sports supplements and weight management supplements has improved, with 66% of users expressing confidence in 2023, a five-percentage-point increase from 2022. These findings reflect consistent usage trends and growing trust in supplementing safety and quality.

Moreover, athletes and fitness enthusiasts continually seek products to enhance their performance, improve endurance, and support recovery. This has driven the demand for a wide range of sports supplement products, including protein powders, energy bars, and recovery drinks. The increasing focus on performance optimization has led to the development of products tailored to specific needs, such as pre-workout supplements for energy, intra-workout products for endurance, and post-workout supplements for recovery.

Companies like Optimum Nutrition have developed products, such as Gold Standard Whey, designed to support muscle recovery and growth. The product’s success can be attributed to its high-quality formulation, which includes a blend of whey protein isolates and concentrates, making it a popular choice among athletes and bodybuilders.

In addition, technological advancements and innovations in food science have led to the development of new and improved sports supplement products. Companies are investing heavily in research and development (R&D) to create effective and appealing products. For instance, the introduction of plant-based protein powders and bars has opened up new market segments, catering to the growing number of consumers adopting vegetarian and vegan diets, which is further expected to augment market growth during the forecast period.

The rise of e-commerce has significantly impacted the global sports supplement industry by making these products more accessible to a broader audience. Online platforms offer consumers the convenience of purchasing products from the comfort of their homes, often with detailed product descriptions, reviews, and recommendations.

Consumer Insights

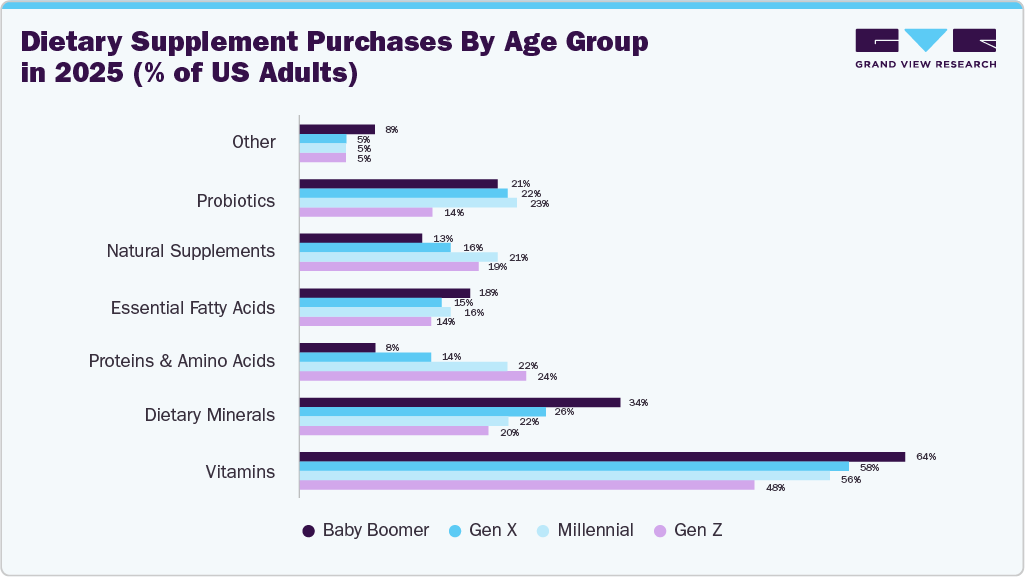

According to the 2025 YouGov dietary supplement consumer survey in the U.S., vitamins are the most commonly purchased supplements across all generations, with the likelihood of purchasing them increasing with age. Nearly half of Gen Z consumers (48%) report buying vitamins such as Vitamin C, compared to 64% of Baby Boomers. Millennials (56%) and Gen X (58%) fall in between, reflecting a steady increase in vitamin consumption with age. Dietary minerals, including calcium and potassium, show a similar trend. Only 20% of Gen Z purchase these minerals, while 34% of Baby Boomers include them in their supplement routines.

In contrast, interest in proteins and amino acids, such as whey protein, commonly used for fitness and bodybuilding, peaks among younger generations. About 24% of Gen Z and 22% of Millennials purchase these products, with interest declining significantly among older cohorts. Essential fatty acids, such as those found in fish oil, exhibit more consistent purchase rates across age groups, ranging from 14% among Gen Z to 18% among Baby Boomers. Natural supplements, often derived from plant or fungal sources, are most popular with Millennials (21%) but less so among Baby Boomers (13%). Probiotic supplements, containing live bacteria to support gut health, are more commonly purchased by Millennials (23%) and Gen X (22%) than by Gen Z (14%) or Baby Boomers (21%).

Despite the growing market, a notable portion of consumers across all age groups report not purchasing any dietary supplements in the past six months. This is most pronounced among Gen Z, where 31% have abstained from supplement purchases, compared to 24% of Baby Boomers.

Most consumers tend to approach supplement purchases with more flexibility, buying products on an as-needed basis. Nearly half of Gen Z (49%) and more than half of Millennials (53%) buy supplements when needed, as do 58% of Gen X and 57% of Baby Boomers.

Maintaining a small supply of supplements at home is equally common among Gen Z and Millennials (29% each), while slightly less prevalent among Gen X (23%) and Baby Boomers (22%). A smaller segment across all age groups prefers to keep a well-stocked supplement cabinet, with the highest rate among Baby Boomers at 15%.

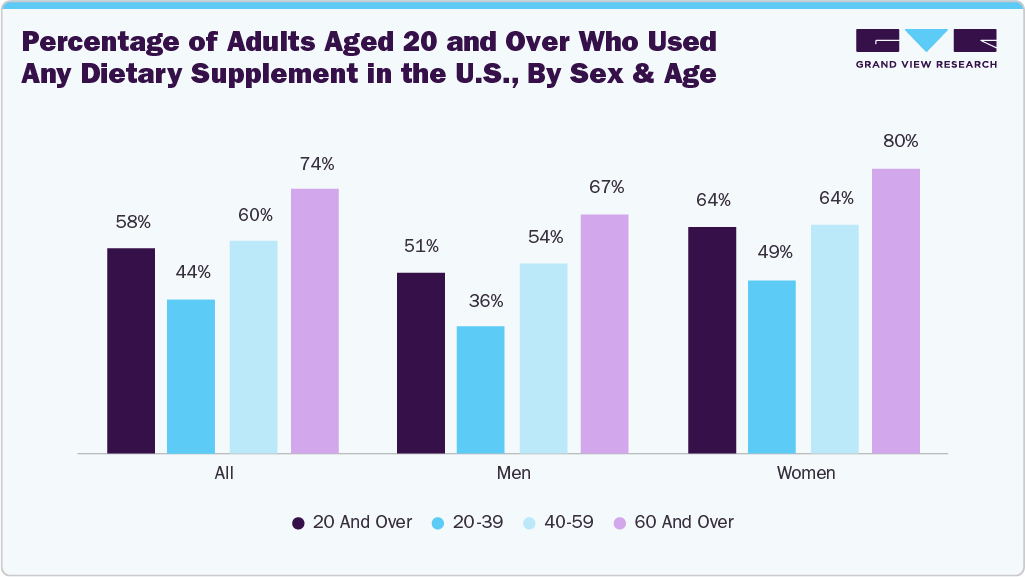

Furthermore, according to the National Health and Nutrition Examination Survey, in the U.S., supplement use is widespread among women, with 57.6% of women aged 20 and over reporting the use of dietary supplements. Supplement usage tends to increase with age, peaking at 80.2% among women aged 60 and over. This trend highlights the importance of understanding the distinct nutritional needs of female athletes across various age groups and tailoring supplements to meet these needs effectively.

Men constitute the largest segment of sports supplement consumers, particularly in the 18-34 age group. Their consumption patterns are often influenced by goals related to muscle building, performance enhancement, and endurance. Male consumers typically prefer products like protein powders, creatine, BCAAs (branched-chain amino acids), and pre-workout supplements. They are more likely to invest in products that promise significant physical gains and improved athletic performance. The male demographic drives the majority of sales in the sports supplement market, particularly in segments such as protein supplements and performance enhancers.

Women are an important demographic in the sports supplement industry, particularly in the 25-44 age group. Their purchasing decisions are often driven by a desire to improve overall health, manage weight, and maintain energy levels. Female consumers tend to prefer products that offer weight management benefits, such as meal replacement shakes, low-calorie protein powders, and supplements that support metabolism and energy. There is also a strong preference for products with clean labels, natural ingredients, and added vitamins and minerals.

Product Insights

The liquid segment led the market with the largest revenue share of 56.42% in 2024. The popularity of Ready-to-Drink (RTD) sports supplements is growing as urban consumers and busy professionals seek convenient, on-the-go nutrition solutions. These beverages enable users to quickly consume pre- or post-workout protein, electrolytes, or recovery nutrients without the need to mix powders or prepare shakes. For example, Muscle Milk RTD offers a protein-rich, ready-to-consume option that supports muscle recovery and energy replenishment. It is ideal for individuals with active lifestyles who value convenience and performance benefits.

The sports segment is projected to grow at the fastest CAGR of 8.6% over the forecast period. To appeal to health-conscious consumers, energy and protein bars increasingly incorporate functional additives such as superfoods, vitamins, minerals, and reduced sugar. These innovations not only enhance the nutritional profile of the bars but also cater to growing demand for convenient, guilt-free snacking options that support overall wellness. By combining taste with added health benefits, brands are positioning these bars as enjoyable and functional alternatives to traditional nutrition.

Source Insights

The animal-based segment led the market with the largest revenue share of 76.17% in 2024. Animal-based proteins have been extensively researched and have demonstrated clear advantages in supporting muscle protein synthesis, promoting strength gains, and facilitating post-workout recovery. Studies consistently show that proteins like egg protein and casein help athletes and fitness enthusiasts recover faster, build lean muscle mass more effectively, and improve overall exercise performance compared to some plant-based alternatives that may lack one or more essential amino acids. One of the key reasons animal-based proteins are preferred is their rapid absorption and high bioavailability. For example, egg white protein is quickly digested and delivers amino acids to muscles efficiently after exercise, which is crucial for initiating muscle repair and recovery. This fast action makes it an ideal choice for post-workout nutrition, ensuring the body gets the nutrients it needs when it is most receptive.

The plant-based segment is projected to grow at the fastest CAGR of 10.1% over the forecast period. Plant-based protein supplements, such as those derived from peas, rice, and hemp, are often easier to digest and gentler on the stomach compared to some animal-derived proteins, making them a preferred choice for individuals with digestive sensitivities or lactose intolerance. While they are perceived as healthier, it’s important to note that plant-based proteins may have one or more amino acids in lower amounts than animal proteins. For example, brown rice contains about 78% protein by weight, with 36% essential amino acids and 18% branched-chain amino acids, values similar to those of soy protein isolate, which is considered a relatively complete plant protein. Pea protein, although slightly lower in methionine, is also relatively complete. This shows that plant-based proteins can offer digestive and allergen-friendly benefits while providing a balanced amino acid profile suitable for muscle recovery and athletic performance.

Distribution Channel Insights

The hypermarkets & supermarkets segment led the market with the largest revenue share of 33.98% in 2024. Supermarkets and hypermarkets have become major players in the distribution of sports supplements, highlighting their significant role in making sports nutrition and wellness products widely accessible to the general public. Their extensive reach, large shelf space, and ability to stock various brands allow consumers to find both mainstream and niche supplements in one location, enhancing visibility and boosting impulse purchases. In addition to accessibility, consumer behavior strongly favors the convenience of purchasing supplements alongside everyday groceries. Shoppers appreciate the convenience of picking up their protein powders, vitamins, or pre-workout drinks while doing their regular food shopping, rather than visiting specialized stores. This one-stop shopping experience saves time and encourages the trial of new products, as the diverse assortment in hypermarkets and supermarkets allows consumers to explore different brands and formulations in a familiar environment.

The online segment is projected to grow at the fastest CAGR of 10.2% over the forecast period. Consumers today are increasingly turning to online stores for sports supplements due to their convenience and ease of use. Shopping from home eliminates the need to visit physical stores, allowing buyers to browse a wide range of products at any time, fitting easily into their busy lifestyles. Another reason is the access to a wider variety of products and detailed information. Online platforms often stock both mainstream and niche brands that may not be available locally, while providing comprehensive product descriptions, nutritional facts, and customer reviews. This helps consumers make informed choices and select supplements that meet their fitness goals.

Regional Insights

North America dominated the sports supplements market with the largest revenue share of 54.40% in 2024. The growth is driven by increasing health and fitness awareness, rising gym memberships, and a growing focus on preventive health and performance nutrition. Consumers seek convenient, high-quality products to support muscle growth, recovery, and overall wellness. Innovation in formulations, flavors, and delivery formats, along with the influence of social media and fitness culture, further boosts demand.

U.S. Sports Supplements Market Trends

The sports supplements market in the U.S. accounted for the largest market revenue share of 87.92% in North America in 2024. In the U.S., a significant driver of sports supplement consumption is the focus on fitness and performance. Many consumers aim to build strength, improve endurance, or manage weight, and supplements like protein powders, BCAAs, and pre-workout formulas provide targeted support for these goals. These products help enhance muscle growth, speed up post-workout recovery, and improve overall athletic performance, making them an essential part of the fitness routines for athletes, gym-goers, and active individuals.

A 2024 study published in the Journal of the International Society of Sports Nutrition found that 68.3% of participants used supplements primarily to enhance sports performance, while 34.1% consumed them for general health reasons. Similarly, a 2021 National Institutes of Health survey of U.S. college athletes reported that 41.7% used protein products, 28.6% consumed energy drinks or shots, and 14% took creatine, highlighting the role of supplements in supporting muscle growth, recovery, and overall athletic performance.

Europe Sports Supplements Market Trends

The sports supplements market in Europe is closely linked to growing participation in gyms, fitness clubs, and recreational sports. Younger demographics, particularly Gen Z, drive this trend by actively engaging in strength training, group classes, and endurance activities such as running and cycling. For these consumers, supplements serve as practical tools to enhance performance, accelerate recovery, and provide nutritional convenience in fast-paced lifestyles. Fitness culture and recreational sports are central to supplement demand, as they create a strong consumer base seeking functional, easy-to-use nutrition products.

Asia Pacific Sports Supplements Market Trends

The sports supplements market in Asia Pacific is projected to grow at the fastest CAGR of 10.7% from 2025 to 2033. Consumers are increasingly seeking products that are high in protein and align with ethical and environmental values. For example, brands like Vega and Orgain are expanding their plant-based protein offerings in Australia & New Zealand, and India, catering to health-conscious and vegan consumers. For instance, India faces a widespread protein deficiency, with nearly 73% of the population failing to meet the recommended daily protein intake. This has fueled demand for protein supplements, as consumers seek convenient ways to boost their intake. Sports nutrition products such as whey protein powders, mass gainers, and pre-workout supplements are becoming increasingly popular to address this nutritional gap. For instance, brands such as MuscleBlaze and Optimum Nutrition have experienced strong growth in India, reflecting a rising consumer interest in performance-focused nutrition.

Key Sport Supplements Company Insights

The global sports supplements industry is characterized by a diverse mix of established nutrition companies and rapidly scaling challenger brands that continue to compete on formulation quality, functional benefits, and performance outcomes. Leading players emphasise clean-label ingredients, clinically supported actives, and safer formulations suited for both professional athletes and lifestyle fitness users. Strategic expansion through sports retailers, specialty nutrition chains, gyms, and digital-first direct-to-consumer (D2C) storefronts has helped these companies enhance their reach and strengthen brand visibility across various consumer demographics.

In addition, partnerships with sports leagues, athlete endorsements, and sponsorship-driven brand building enable faster trust adoption and recall. The market is also seeing differentiated offerings, ranging from plant-based proteins and hydration mixes to pre-workout complexes and on-the-go recovery formats, allowing manufacturers to target niche performance needs and wellness-oriented segments within the broader active lifestyle economy.

-

The Simply Good Foods Company is a leading player in the active nutrition and better-for-you snacking market, specializing in high-protein, low-sugar products designed for health-conscious and performance-driven consumers. The company’s portfolio spans bars, ready-to-drink shakes, confectionery, and plant-based beverages under well-recognized brands such as Quest, Atkins, and OWYN. Quest serves the fitness and performance segment with protein bars, cookies, chips, and shakes, while Atkins focuses on low-carb, weight management products, including bars, shakes, and snack foods.

-

GlaxoSmithKline PLC (GSK) has a strong foothold in the sports supplement industry, leveraging its expertise in health science to deliver performance-focused nutrition solutions. The company’s portfolio includes well-known brands such as Maxinutrition, catering to a wide range of consumers from casual fitness enthusiasts to professional athletes. Its products are formulated to support muscle recovery, strength development, and sustained energy, with blends of high-quality proteins, essential amino acids, and key vitamins and minerals. GSK emphasizes scientifically backed formulations, aligning its sports nutrition offerings with broader health and wellness goals. By combining trusted heritage brands with specialized sports supplements, GSK positions itself as a reliable provider of clinically informed, performance-driven products that integrate seamlessly into active lifestyles.

Key Sports Supplements Companies:

The following are the leading companies in the sports supplements market. These companies collectively hold the largest market share and dictate industry trends.

- The Simply Good Foods Company

- Maxinutrition

- Universal Nutrition

- GNC Holdings, LLC

- Glanbia PLC

- NOW Foods

- SciTec, Inc.

- THG PLC

- PepsiCo

- Abbott

- Herbalife

Recent Developments

-

In July 2025,Herbalife announced the launch of MultiBurn, a new dietary supplement formulated with clinically studied botanical ingredients to support metabolic health, energy expenditure, and weight management. The product is vegan, gluten-free, and free of synthetic colors and dyes, underscoring the company’s emphasis on clean labeling. Key active components include Morosil (for body fat reduction and support of waist/hip measurements), Metabolaid (to aid satiety and healthy fat reduction), and Capsifen (to promote energy expenditure), along with caffeine and chromium for metabolic and blood sugar support. MultiBurn is designed for daily use (three capsules with breakfast or lunch) and is intended to complement a healthy diet, regular exercise, and other Herbalife nutritional products.

-

In February 2024, Herbalife introduced a new offer named GLP-1 Nutrition Companion, which features tailored combinations of food and supplement products to support individuals using GLP-1 and other weight-loss medications. The launch includes both Classic and Vegan versions, combining their signature protein shakes, fiber, vitamins, and plant-based blends to help preserve muscle mass, deliver essential nutrients, and maintain digestive health. It targets a U.S. and Puerto Rico rollout, addressing nutrition gaps linked to weight-loss therapies, and aims to foster lasting healthy habits through the support of its distributor community.

Sports Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 97.44 billion

Revenue forecast in 2033

USD 189.38 billion

Growth rate

CAGR of 8.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

The Simply Good Foods Company; Maxinutrition; Universal Nutrition; GNC Holdings, LLC; Glanbia PLC; NOW Foods; SciTec, Inc.; THG PLC; PepsiCo; Abott; Herbalife

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sports supplements market report based on the product, source, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules/Tablets

-

Powder

-

Liquid

-

Bar

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Animal-Based

-

Plant-Based

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sports supplements market size was estimated at USD 90.24 billion in 2024 and is expected to reach USD 97.44 billion in 2025.

b. The global sports supplements market is expected to grow at a compound annual growth rate of 8.7% from 2025 2033 to reach USD 189.38 billion by 2033.

b. North America dominated the sports supplement market with a share of 54.40% in 2024. This is attributed to changing consumer preferences for nutritional goods, increasing number of fitness and health centers, and growing health awareness.

b. Some key players operating in the sports supplement market include The Simply Good Foods Company; Maxinutrition; Universal Nutrition; GNC Holdings, LLC; Glanbia PLC; NOW Foods; SciTec, Inc.; THG PLC; PepsiCo; Abott; Herbalife

b. Key factors that are driving the market growth include high demand for protein bars and dietary sources among athletes and bodybuilders and rigorous marketing campaigns by manufacturers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.