- Home

- »

- Homecare & Decor

- »

-

Stain Remover Products Market Size & Share Report, 2030GVR Report cover

![Stain Remover Products Market Size, Share & Trends Report]()

Stain Remover Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Household, Commercial), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-197-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stain Remover Products Market Summary

The global stain remover products market size was estimated at USD 22,272.7 million in 2023 and is projected to reach USD 31,318.1 million by 2030, growing at a CAGR of 5.1% from 2024 to 2030. The increasing awareness of personal hygiene and cleanliness has propelled demand for effective stain removal solutions. As consumers become more conscious of maintaining clean environments, both in their homes and on their clothing, the need for specialized products to address a variety of stains has grown.

Key Market Trends & Insights

- North America stain remover products market dominated the market and accounted for a market revenue share of 31.7% in 2023.

- Asia Pacific stain remover products market is anticipated to register the fastest CAGR over the forecast period.

- Based on product, the powder segment dominated the market and accounted for a market revenue share of 31.5% in 2023.

- Based on type, the household segment accounted for the largest market revenue share in 2023..

Market Size & Forecast

- 2023 Market Size: USD 22,272.7 Million

- 2030 Projected Market Size: USD 31,318.1 Million

- CAGR (2024-2030): 5.1%

- North America: Largest market in 2023

This heightened focus on hygiene and the desire for convenience has led to a surge in the popularity of stain removers across diverse segments. The growing penetration of washing machines across various demographics supports market growth for stain removers. With more households adopting automatic washing machines, there is an increased need for specialized laundry care products designed specifically for machine use, such as liquid detergents with built-in stain removers or pre-wash treatments that enhance cleaning efficiency during cycles.

The increasing number of working professionals and busy lifestyles have amplified the demand for quick and efficient stain removal solutions. With less time for traditional cleaning methods, consumers increasingly turn to products that offer rapid and effective results. This trend is particularly evident in urban areas where time constraints and the fast-paced nature of life drive the preference for convenient and high-performance stain removers. Consequently, the market has seen a rise in products designed for on-the-go use and those that provide immediate stain-fighting capabilities.

Furthermore, innovations such as enzyme-based cleaners, which target specific types of stains, and the development of eco-friendly formulations have significantly enhanced the efficacy and appeal of stain removers. These technological improvements have made stain removal more effective and catered to the increasing consumer demand for sustainable and environmentally friendly products.

Product Insights

The powder segment dominated the market and accounted for a market revenue share of 31.5% in 2023. The versatility of powder stain removers drives market expansion. Powders are formulated for a wide range of stains and fabrics, including those that require specialized treatment. This versatility makes them suitable for various household and commercial uses, from tackling stubborn grease stains in kitchens to removing dirt and grime from outdoor gear.

The spray segment is expected to register the fastest CAGR during the forecast period. Sprays offer a quick and efficient way to apply stain removers directly onto fabrics or surfaces, allowing consumers to tackle stains without needing additional tools or complicated application processes. This convenience aligns with modern lifestyles where time-saving solutions are highly valued, particularly among busy households and working professionals.

Application Insights

The household segment accounted for the largest market revenue share in 2023. With growing awareness of hygiene and cleanliness, consumers seek effective stain removal solutions to ensure their homes are spotless. The demand for stain removers that tackle a wide range of stains, from food spills to pet accidents, is driving growth in the household segment as people look for reliable products to keep their living spaces pristine.

The commercial segment is expected to register the fastest CAGR during the forecast period. Businesses such as restaurants, hotels, and healthcare facilities require effective stain removal solutions to ensure that their environments are visually appealing and free from contaminants. This heightened focus on cleanliness in commercial spaces drives demand for robust and reliable stain removers that can handle heavy-duty cleaning tasks.

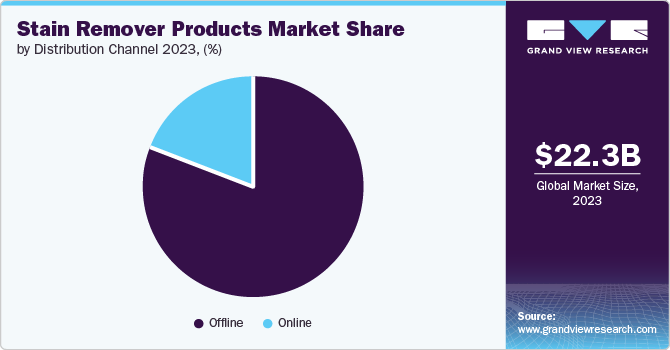

Distribution Channel Insights

The offline distribution channel accounted for the largest market revenue share in 2023. Shoppers often value seeing, touching, and comparing products in person, especially for cleaning products where efficacy and ingredient transparency are critical. Physical stores allow consumers to consult with knowledgeable staff, read product labels, and assess product claims directly, enhancing their confidence in purchasing stain removers from offline retailers.

The online distribution channel is expected to register the fastest CAGR during the forecast period. Consumers value the ability to browse, compare, and purchase stain removers from the comfort of their homes without the need to visit physical stores. The convenience of online shopping and features such as home delivery have made it an increasingly engaging alternative for busy consumers who value time-saving solutions.

Regional Insights

North America stain remover products market dominated the market and accounted for a market revenue share of 31.7% in 2023. North American consumers are increasingly seeking products that are not only effective but also safe for their families and the environment. This trend has led to a surge in demand for stain removers that feature natural ingredients and eco-friendly formulations. Brands such as Seventh Generation Inc. offer biodegradable and non-toxic stain removers, meeting the growing consumer preference for environmentally responsible products.

U.S. Stain Remover Products Market Trends

The U.S. stain remover products market is anticipated to grow significantly over the forecast period. Increased consumer awareness and preference for maintaining high standards of cleanliness and hygiene have significantly contributed to the market's expansion in the country. Consumers increasingly invest in advanced stain removal solutions to ensure their clothing and household textiles remain spotless, with the rising emphasis on personal grooming and home cleanliness. This heightened awareness has increased demand for innovative stain removal products that promise effective and efficient cleaning, fueling market growth.

Europe Stain Remover Products Market Trends

Europe stain remover products market was identified as a lucrative region in 2023. There is a growing emphasis on proper garment care, including specialized stain removers to prolong the life of clothing and textiles. This increased awareness is partly due to educational campaigns and the availability of information through various media channels. As consumers become more knowledgeable about the benefits of using high-quality stain removers, they are more likely to invest in these products, contributing to market growth.

The UK stain remover products market is anticipated to grow rapidly over the forecast period. As fashion trends evolve rapidly in the country, consumers increasingly invest in clothing that requires special care due to delicate fabrics or vibrant colors prone to staining. This growing fashion consciousness drives demand for effective stain removers that can help maintain the appearance of garments over time.

Asia Pacific Stain Remover Products Market Trends

Asia Pacific stain remover products market is anticipated to register the fastest CAGR over the forecast period. With rising awareness about health-related issues, consumers are becoming more conscious of their surroundings' cleanliness, clothing, and home textiles. This heightened awareness has translated into greater demand for stain removers that address stains effectively and adhere to safety standards, ensuring that harmful chemicals are minimized.

India stain remover products market held a substantial market share in 2023. The growth of the e-commerce sector in India has played a pivotal role in expanding the market. The rise of online shopping platforms provides consumers easy access to a wide range of stain removal products, often accompanied by detailed product descriptions, reviews, and comparisons. This increased accessibility allows consumers to explore and purchase products that may not be readily available in local stores.

Key Stain Remover Products Company Insights

Some of the key companies in the stain remover products market include Church & Dwight, Reckitt Benckiser Group plc, S. C. Johnson & Son, Inc., Henkel AG & Co. KGaA, and others.

-

Church & Dwight offers a variety of stain removal products within the Oxi Clean line. These products provide strong oxygen-based cleaning power, effectively addressing stubborn stains on clothing, rugs, and other surfaces. Oxi Clean offers various forms, such as powders, liquids, and pre-treat sprays, to cater to various stain removal requirements and customer preferences.

-

Reckitt Benckiser Group plc offers a variety of stain removal products designed to tackle tough stains on various surfaces, including fabrics, carpets, and hard surfaces. Their brands, such as Vanish and OxiClean, are specifically formulated to provide effective stain removal while being gentle on materials.

Key Stain Remover Products Companies:

The following are the leading companies in the stain remover products market. These companies collectively hold the largest market share and dictate industry trends.

- Church & Dwight

- Reckitt Benckiser Group plc

- S. C. Johnson & Son, Inc.

- Henkel AG & Co. KGaA

- Procter & Gamble

- Unilever

- The Clorox Company

- LG Household & Health Care Ltd.

- Tetraclean

Recent Developments

-

In March 2024, Procter & Gamble's brand Tide launched Tide evo to simplify the laundry process while maintaining the brand's commitment to effective cleaning. This launch reflects Tide's ongoing dedication to innovation in household products, aiming to meet the evolving needs of consumers who seek convenience without compromising quality.

-

In August 2022, arbOUR launched a range of professional-grade, plant-based stain remover laundry products. This innovative line is designed to cater to household consumers and professional markets, emphasizing sustainability without compromising performance. The products are formulated with natural ingredients that effectively clean and minimize environmental impact, aligning with the growing consumer demand for eco-friendly alternatives.

Stain Remover Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.28 billion

Revenue forecast in 2030

USD 31.32 billion

Growth Rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Korea; South Africa

Key companies profiled

Church & Dwight; Reckitt Benckiser Group plc; S. C. Johnson & Son, Inc.; Henkel AG & Co. KGaA; The Procter & Gamble Company; Unilever; The Clorox Company; LG Household & Health Care Ltd.; Tetraclean; Biokleen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stain Remover Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stain remover products market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Bar

-

Spray

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.