- Home

- »

- Advanced Interior Materials

- »

-

Stainless Steel 400 Series Market Size & Share Report, 2030GVR Report cover

![Stainless Steel 400 Series Market Size, Share & Trends Report]()

Stainless Steel 400 Series Market Size, Share & Trends Analysis Report By Application (Building & Construction, Automotive & Transportation), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-024-5

- Number of Report Pages: 97

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

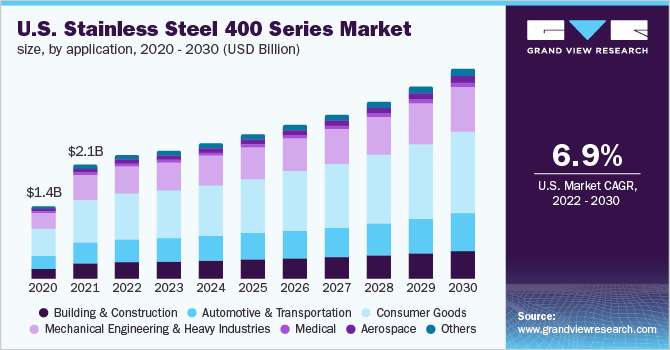

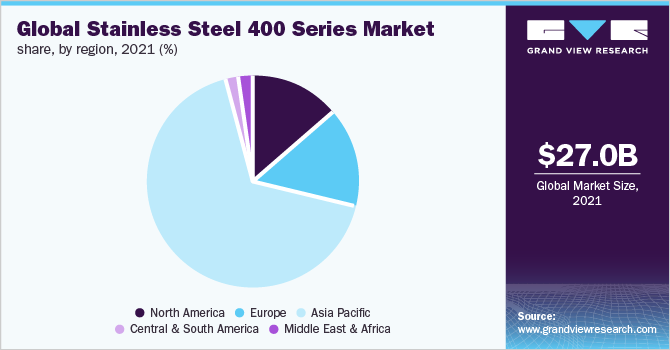

The global stainless steel 400 series market size was valued at USD 27.04 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2022 to 2030. The market growth is projected to be driven by the increasing demand for the stainless steel 400 series products from the building & construction, consumer goods, and mechanical engineering & heavy industries. Properties such as formability, weldability, corrosion resistance, and aesthetic appearance make the series an important constituent in the construction industry. These products are primarily used for architectural cladding, handrails, drainage & water systems, wall support products, roofing, and structures & fixing.

The growth of the construction industry in the U.S. is a key factor contributing to the demand for the stainless steel 400 series in the country. According to the U.S. Census Bureau, the total construction spending (residential and non-residential) in the country was USD 1.811 trillion as of September 2022, witnessing an increase of 10.9% as compared with the construction spending of September 2021 in the U.S.

Also, the rising production of vehicles in the country is further aiding product demand. For instance, according to the Federal Reserve Board, the production of motor vehicles and their parts in the U.S. rose to 7.8% in March 2022 from 4.6% in February 2022. In March 2022, the total assemblies of light trucks and cars reached approximately 9.5 million vehicles from 8.3 million in February 2022.

Furthermore, increasing production and consumption of appliances and electronic gadgets such as refrigerators, television sets, and mobile phones across the world are anticipated to fuel market growth. For instance, in February 2022, the Government of India announced an investment of around USD 4.17 billion for the large-scale production of electronic devices such as mobile phones in the country under its Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS).

The Russia-Ukraine conflict, however, impacted the market as the cost of production rose. The stainless steel production decline in Ukraine and the import restrictions imposed on Russia by other countries increased the price of pig iron in various countries. According to Metal Bulletin, the price of pig iron in the U.S. surged to USD 1,000-1,030 per ton on March 18, 2022, compared to its price of USD 860-890 per ton and USD 640-650 per ton on March 11 and March 7, 2022, respectively.

Application Insights

Based on application, consumer goods held the largest revenue share of more than 37.0% in 2021 and the trend is projected to continue over the forecast period. The stainless steel 400 series is used in a wide range of consumer goods such as home and kitchen appliances, including fridges, air conditioners, washing machines, pots, kettles, and knives. Surging investments worldwide for enhancing the production output of consumer goods are expected to augment the segment growth from 2022 to 2030.

Mechanical engineering & heavy industries are anticipated to register a CAGR of 7.0%, in terms of revenue during the forecast period. The segment growth can be attributed to rising investments in the oil & gas industry, where the stainless steel 400 series find applications in gas turbine exhaust silencers and other hardware. For instance, in April 2022, Cairn Oil & Gas announced an investment worth USD 687.0 million in oil & gas exploration projects in India.

The stainless steel 400 series is widely used in medical applications as well. This series is used for the production of surgical and medical tools owing to its good wear resistance, high strength, and good machinability. The surge in the global demand for surgical tools owing to effective healthcare facilities and services worldwide is expected to fuel the segment growth from 2022 to 2030.

Regional Insights

Based on region, Asia Pacific held the largest revenue share of over 67.0% in 2021. The increasing manufacturing activities and surging foreign investments in industries like automotive, construction, and medical are the key drivers fueling the product demand in the region. For instance, passenger car production rose by 7% in the region, from 2020 to 2021.

North America held the second-largest share of the market in 2021. The product demand is attributable to rising investments in the building and construction industry. For instance, according to Statistics Canada, investments in single-home construction activities rose by 4.9% to reach USD 8 billion in Canada in February 2022. Moreover, investments for construction in Ontario and Quebec provinces increased by 5.3% and 8.2%, respectively.

Furthermore, growing investments in the automotive industry in the region are anticipated to aid market growth. For instance, in May 2021, Bosch announced an investment worth USD 100 million to enhance the operations of its production facilities in Mexicali, Toluca, and Hermosillo in Mexico. In 2020, the company invested USD 87 million in its production plants in the country.

Europe is anticipated to register a CAGR of 6.1%, in terms of revenue during the forecast period. The large-scale production of components in European countries that are used in various industries such as automotive, building & construction, and aerospace are anticipated to fuel market growth. Europe is characterized by the presence of a large number of manufacturers of automobiles and automotive components in Germany and a massive aircraft manufacturing industry in France.

Key Companies & Market Share Insights

The market is competitive in nature with the presence of numerous players worldwide. Stainless steel 400 series manufacturing companies face stiff competition not only from other stainless steel producing companies but also from companies engaged in manufacturing substitute products such as aluminum, carbon fiber, and plastic. The market players are engaged in product innovations to stay ahead of the competition.

For instance, in September 2022, Yieh Corp. generated a new nickel-free high-value stainless steel 400 series with high corrosion resistance and a stable price. Fluctuations in nickel prices affected stainless steel grades, such as 304 and 316, as nickel is used in their production. The new 400 series stainless steel products from Yieh Corp. can be used for various applications such as sinks & water towers, curtain walls, solar brackets, solar panels, industrial plant wire racks, outdoor distribution boxes, and others. Some of the prominent players in the global stainless steel 400 series market include:

-

Acerinox S.A.

-

Aperam

-

Baosteel Group

-

Fushun Special Steel Co., Ltd.

-

Jindal Stainless

-

Outokumpu

-

POSCO

-

thyssenkrupp AG

-

Yieh United Steel Corp

Stainless Steel 400 Series Market Report Scope

Report Attribute

Details

Market value in 2022

USD 29.32 billion

Revenue forecast in 2030

USD 51.16 billion

Growth Rate

CAGR of 7.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2021

Forecast period

2022 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; China; India; Japan; South Korea; Brazil; GCC

Key companies profiled

Acerinox S.A.; Aperam; Baosteel Group; Fushun Special Steel Co., Ltd.; Jindal Stainless; Outokumpu; POSCO; thyssenkrupp AG; Yieh United Steel Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stainless Steel 400 Series Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global stainless steel 400 series market report based on application and region:

-

Application Outlook (Volume, Kilotons Revenue, USD Million, 2017 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Consumer goods

-

Mechanical Engineering & Heavy Industries

-

Medical

-

Aerospace

-

Others

-

-

Regional Outlook (Volume, Kilotons Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global stainless steel 400 series market size was estimated at USD 27.04 billion in 2021 and is expected to reach USD 29.32 billion in 2022.

b. The global stainless steel 400 series market is expected to grow at a compound annual growth rate of 7.3% from 2022 to 2030 to reach USD 51.16 billion by 2030.

b. Based on application, consumer goods accounted for the largest revenue share of more than 35.0% in 2021 of the overall market. Rising investments in consumer appliances and the emerging middle-class population are expected to boost the market growth over the forecast period.

b. The key players operating in the stainless steel 400 series market include Acerinox S.A., Aperam, Baosteel Group, Fushun Special Steel Co., Ltd., Jindal Stainless, Outokumpu, POSCO, thyssenkrupp AG, and Yieh United Steel Corp.

b. The growth of the construction sector and the rising need for parts used in mechanical engineering & heavy industries is expected to fuel the stainless steel 400 series market growth across the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."