- Home

- »

- Plastics, Polymers & Resins

- »

-

Stand-up Pouches Market Size Report, 2030GVR Report cover

![Stand-up Pouches Market Size, Share & Trends Report]()

Stand-up Pouches Market Size, Share & Trends Analysis Report By Material (Plastic, Paper, Metal, Bioplastic), By Type (Aseptic, Standard, Retort), By Closure, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-949-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Report Overview

The global stand-up pouch market size was valued at USD 30.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. This growth is attributed to the large utilization of plastics in many industries worldwide. In addition, there is a rising demand for convenient and sustainable packaging solutions in the food, beverage, and pharmaceutical industries is fueling the market’s growth. Furthermore, increasing consumer preference for packaged goods and the focus on recyclable materials further propel market expansion.

Stand-up pouches are available in many varieties of materials. These pouches may include specialty film layers to protect internal items from punctures, moisture, contamination, sunlight exposure, and other hazards. Moreover, they are lightweight, easy to transport, look great on shelves, and are easy to re-seal and store; further pouch nozzles make them easy to use. Over the past few years, many manufacturers have incorporated stand-up pouches into their product packaging for their crucial benefits, propelling the demand for stand-up pouches and resulting in market expansion in upcoming years.

In addition, the quality to extend shelf life, product safety for quality, and implementation of the stand-up pouches by global industries of several sectors such as FMCG, retail, personal care, healthcare, and many other things, making it the best option for storing a variety of frozen food items, spices, pet foods, consumables, dry fruits, gel and powdered detergents etc. as they possess good qualities, functional features, easy to use and improved product quality. As a result, the global stand-up pouch market is poised to have a positive outlook throughout the forecast period. Furthermore, the consumption of frozen food has raised the demand for efficient packaging, owing to millennials' changing dietary habits.

Stand-up pouches also benefit packers and businesses in creating e-commerce strategies and strong qualities of preventing items from externalities. Furthermore, with its ease of use for the customer, many advantages, and effective marketing and storage benefits for manufacturers and retailers, the stand-up pouch has taken industries by a massive increment. Therefore, considering the above factors, stand-up pouches are set to witness high demand for their properties and advantages from different sectors.

Material Insights

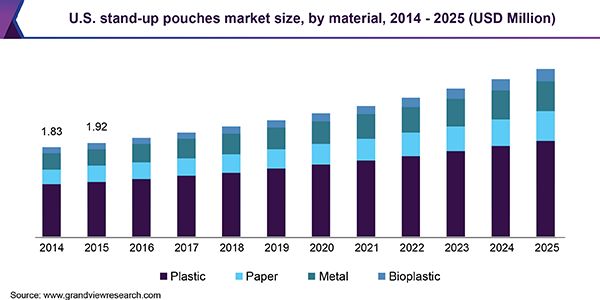

Plastic dominated the market and accounted for the largest revenue share of 55.0% in 2023. This growth is attributed to the expanding packaged foods and beverages industry, with increasing packaged solutions. Plastic is broadly used in various sectors, including manufacturing laminates and stand-up pouches, owing to its versatility that allows for the creation of pouches with tailored properties, such as enhanced barrier protection against moisture and oxygen, which is crucial for preserving the freshness and quality of packaged goods. Furthermore, the durability of plastic pouches, with their resistance to tearing and puncturing, ensures that products remain intact during transport and use. In addition, advancements in recycling technologies and the development of more sustainable plastic options have helped mitigate environmental concerns, supporting the market growth for plastic material.

Bioplastic is expected to grow at a CAGR of 10.7% over the forecast period driven by rising environmental concerns, increasing consumer awareness, and technological advancements, which are the significant factors driving the market. According to the International Union for Conservation of Nature, more than 460 million tons of plastic are being produced worldwide. Out of this data, an estimated 20 million metric tons lit up into the environment, and it is poised to grow significantly by the end of 2040. Bioplastics emit less carbon and have fewer greenhouse gases, attracting producers seeking to reduce their carbon footprint and follow rising stringent government regulations. Furthermore, increasing consumer awareness about bioplastics is important owing to their biodegradability and improved food safety, among other benefits.

Type Insights

Standard pouches led the market and accounted for the largest revenue share of 55.0% in 2023 attributed to consumers' increasing demand and popularity for single-serve and portable packaging due to standard pouches' ease, convenience, and versatility. These pouches accommodate different sizes, shapes, and materials, contributing to the growing adoption of standard pouches. In addition, advancements and developments in packaging technology have improved the durability and functioning of standard pouches, making them a suitable choice for various industries, including food and beverages, healthcare, and personal care. Furthermore, the increasing implementation and innovation of eco-friendly and sustainable standard pouches that reduce packaging waste and offer recyclable options are some driving factors for market growth.

Aseptic pouches are expected to grow at a CAGR of 8.3% over the forecast period, owing to the increasing demand for convenient, long-lasting packaging solutions in the food, beverage, and pharmaceutical sectors. In addition, the rise in health awareness and consumer preference for packaged goods enhance this demand. Furthermore, innovations in sustainable materials and features such as zippers and spouts contribute to their appeal, offering functionality and reducing environmental impact. The market is projected to grow significantly, reflecting these trends.

Closure Insights

Zipper held the largest market share of 40.1% in 2023 as they are widely adopted for the packaging of food items, including pharmaceutical goods and personal care products. In addition, these pouches preserve food fresher by eliminating and controlling against the external elements. It offers several benefits, including protection against contamination and leakage, ease of re-sealing, and safeguarding products in transit. It also has many specialty films that prevent moisture, contaminants, harmful materials, UV rays, etc. The market for stand-up zipper pouches is boosted by customer demand backed by easy-to-use & store with assuring product freshness.

Spout is expected to grow at a CAGR of 8.3% over the forecast period. Spout pouches are an innovative and convenient alternative to rigid glass, metal, and plastic bottle packaging. Many FMCG brands and retailer sectors increasingly utilize such flexible packaging pouches, mainly for packing liquid, viscous, and powder items. In addition, spout pouches are inexpensive compared to conventional food packaging, and their high visibility and customized print make products attractive to customers. Furthermore, spout pouches have huge demand from consumer goods and healthcare industries for packaging many consumables and baby food, milk, yogurt, health and personal care products, household products, and institutional food packaging, resulting in positive market growth.

Application Insights

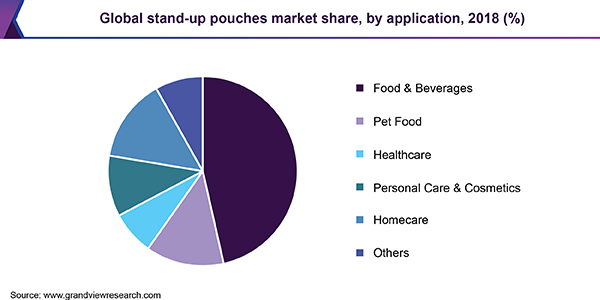

Food and beverages dominated the market and accounted for the largest revenue share of 54.7% in 2023 pertaining to the rising demand for stand-up pouches to improve the packaging technology of food and beverage products, including frozen food, fast food, and liquid consumables, such as dairy products, ready-to-eat soups, and sauces. Moreover, these pouches ascertain the quality of the product, freshness, and taste throughout its shelf life, further boosting the market demand for stand-up pouches.

Healthcare applications are expected to grow at a CAGR of 9.3% over the forecast period. These pouches provide practical, easy-to-carry, and long-lasting packaging options perfect for medical supplies, pharmaceuticals, and health supplements. Their outstanding barrier properties aid in preserving product effectiveness by shielding against moisture, oxygen, and impurities. Moreover, the shift towards eco-friendly packaging has boosted the demand for recyclable and compostable stand-up pouches. Stand-up pouches are economical and have lower production and transit costs than conventional rigid packaging, leading to market expansion.

Regional Insights & Trends

Asia Pacific stand-up pouches market dominated the global market and accounted for the largest revenue share of 33.9% in 2023 attributed to increasing demand for packaged food and beverages, particularly in developing countries such as China and India, driven by rising disposable incomes and changing lifestyles. In addition, advanced manufacturing capabilities allow for the production of high-quality pouches at competitive prices, leading to their increasing demand. Furthermore, expanding modern retail formats, such as supermarkets and hypermarkets, favors stand-up pouches for their aesthetic appeal and functionality, thereby contributing to the market's growth.

China Stand-up Pouches Market Trends

The stand-up pouches market in China led the Asia Pacific market and accounted for a significant revenue share in 2023. Increasing demand for convenient and sustainable packaging solutions in the food and beverage sector is paramount, as consumers seek products that are easy to use and environmentally friendly. Furthermore, rising disposable incomes and urbanization fuel the consumption of packaged goods. The versatility of stand-up pouches, which can accommodate various products and offer features such as spouts and zippers, enhances their appeal, further propelling market expansion in the country.

Middle East & Africa Stand-up Pouches Market Trends

The Middle East and Africa stand-up pouches market is expected to grow at a CAGR of 8.5% over the forecast period. This growth is attributed to the expansion of metropolitan areas and infrastructure improvements, which enhance distribution capabilities and increase demand for packaged food and beverages. In addition, consumers are favoring stand-up pouches for their convenience, lightweight nature, and aesthetic appeal. Furthermore, the rising focus on sustainability drives manufacturers to adopt recyclable materials, further boosting the market. As urbanization continues, the region's demand for innovative and functional packaging solutions is expected to rise significantly.

North America Stand-up Pouches Market Trends

The stand-up pouches market in North America is expected to grow substantially over the forecast period inupcoming years, owing to the growing demand from the packaged food industry and shifting customer behavior. Furthermore, the demand for stand-up pouches is fueled by customer preferences for environmentally friendly solutions and bio-based packaging materials, thereby driving the market’s growth.

U.S. Stand-up Pouches Market Trends

The U.S. stand-up pouches market is significant, led by technological developments, increased customer demand, and regulatory obligations. Furthermore, changes in lifestyle and dietary patterns and easy access to information on health and nutrition are growing the market for healthy foods and beverages, convenience packaged foods, and ready-to-eat options. These changes in the food and beverage landscape provide demand for convenient packaging alternatives such as stand-up pouches.

Europe Stand-up Pouches Market Trends

The stand-up pouches market in Europe is expected to grow substantially over the forecast period. This is attributed to the region's large and diverse consumer base, which strongly prefers flexible and convenient packaging solutions. In addition, Europe's well-established food and beverage industry, coupled with its stringent regulations and standards for packaging safety and sustainability, has driven the adoption of stand-up pouches as a preferred packaging format.

UK Stand-up Pouches Market Trends

The UK stand-up pouches market is expected to witness significant growth owing to the region's high level of urbanization and busy lifestyles. This has fueled the demand for portable, resalable, and easy-to-use packaging solutions, further solidifying its position in terms of the stand-up pouch market. Furthermore, the presence of key players in the packaging industry, such as their investments in research and development, innovation, and manufacturing capabilities to meet the region's growing demand, results in the growth of the stand-up pouch market.

Key Companies & Market Share Insights

Some key companies in the stand-up pouches market include Mondi, Constantia Flexibles, Amcor plc, Berry Global Inc., Coveris, Cascades Inc., Sealed Air, and Smurfit Westrock. These companies focus on product innovation, developing sustainable and recyclable stand-up pouches, investing in advanced manufacturing technologies, and pursuing strategic partnerships to leverage each other's strengths and expand product offerings.

-

Constantia Flexibles specializes in manufacturing flexible packaging products, including K-Seal stand-up pouches, suitable for a variety of applications, such as food, beverages, and non-food items. Constantia Flexibles focuses on delivering high-quality, customizable pouches that enhance shelf appeal and functionality while addressing the growing demand for environmentally friendly packaging options.

-

Amcor manufactures and distributes packaging for the company and offers a wide range of flexible and rigid packaging, specialty cartons, closures, and services used with snacks and confectionery, cheese and yogurt, fresh produce, beverage and pet food products, and rigid-plastic containers for several companies the food & beverage, pharmaceutical, and personal and home-care companies.

Key Stand-Up Pouches Companies:

The following are the leading companies in the stand-up pouches market. These companies collectively hold the largest market share and dictate industry trends.

- Mondi

- Amcor plc

- Berry Global Inc.

- Coveris.

- Cascades Inc.

- Sealed Air

- Smurfit Westrock.

- ProAmpac.

- Constantia Flexibles

- Sonoco Products Company

Recent Developments

-

In February 2024, Amcor and Stonyfield Organic introduced a new spouted pouch designed for yogurt, showcased at the 2024 CPNA (Cannabis Packaging Summit). This innovative packaging, featuring recyclable materials, aims to enhance convenience and sustainability. The collaboration emphasizes Amcor's commitment to eco-friendly solutions while meeting consumer demand for portable, easy-to-use products. The pouch is part of a broader trend towards sustainable packaging in the food industry, aligning with Stonyfield's mission to promote organic and environmentally responsible practices.

-

In September 2023, Berry Global announced the launching of food-grade low-density polyethylene films containing at least 30% post-consumer recycled (PCR) plastic. This initiative supports brand owners in achieving their sustainability goals by providing a solution that meets food safety standards, as confirmed by the FDA. The new PCR-LLDPE films are designed for various food applications, particularly in the bakery and frozen food sectors, and are compatible with multiple packaging formats. Berry aims to enhance the environmental impact of everyday products through this innovative approach.

-

In August 2023, Mondi, a provider of packaging and paper, collaborated with Fressnapf, Europe's largest pet supplies retailer, to introduce a new recyclable packaging solution for their dry pet food range. The innovative packaging features a mono-material polypropylene (PP) structure, enabling easy recycling. The packaging also incorporates process color printing technology, providing high-quality graphics and branding. This collaboration demonstrates Mondi's commitment to developing sustainable packaging solutions that meet the needs of both retailers and consumers while reducing environmental impact.

Stand-Up Pouches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.3 billion

Revenue forecast in 2030

USD 48.4 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, closure, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia, Southeast Asia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Mondi; Amcor plc; Berry Global Inc.; Coveris.; Cascades Inc.; Sealed Air; Smurfit Westrock.; ProAmpac.; Constantia Flexibles; Sonoco Products Company

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stand-up Pouches Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stand-up pouches market report based on material, type, closure, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Paper

-

Metal

-

Bioplastic

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Aseptic Pouches

-

Standard Pouches

-

Retort Pouches

-

Others

-

-

Closure Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Tear Notch

-

Zipper

-

Spout

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Cosmetics & Toiletries

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."