- Home

- »

- Advanced Interior Materials

- »

-

Steel Cord Market Size And Share, Industry Report, 2033GVR Report cover

![Steel Cord Market Size, Share & Trends Report]()

Steel Cord Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Tires, Conveyor Belts), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-803-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steel Cord Market Summary

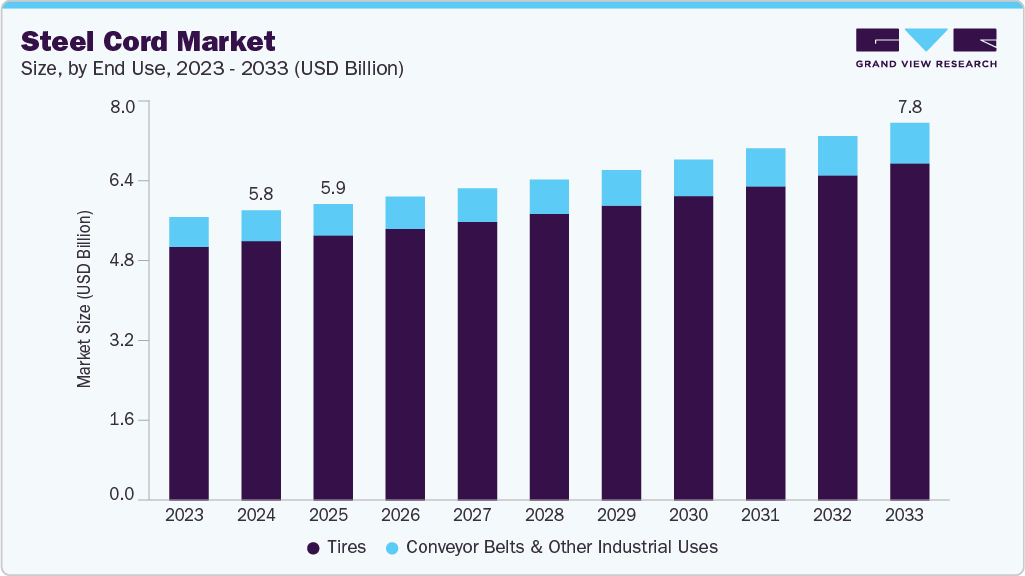

The global steel cord market size was estimated at USD 5.83 billion in 2024 and is projected to reach USD 7.83 billion by 2033, growing at a CAGR of 3.4% from 2025 to 2033. Rising vehicle production around the world is a primary engine for steel cord demand.

Key Market Trends & Insights

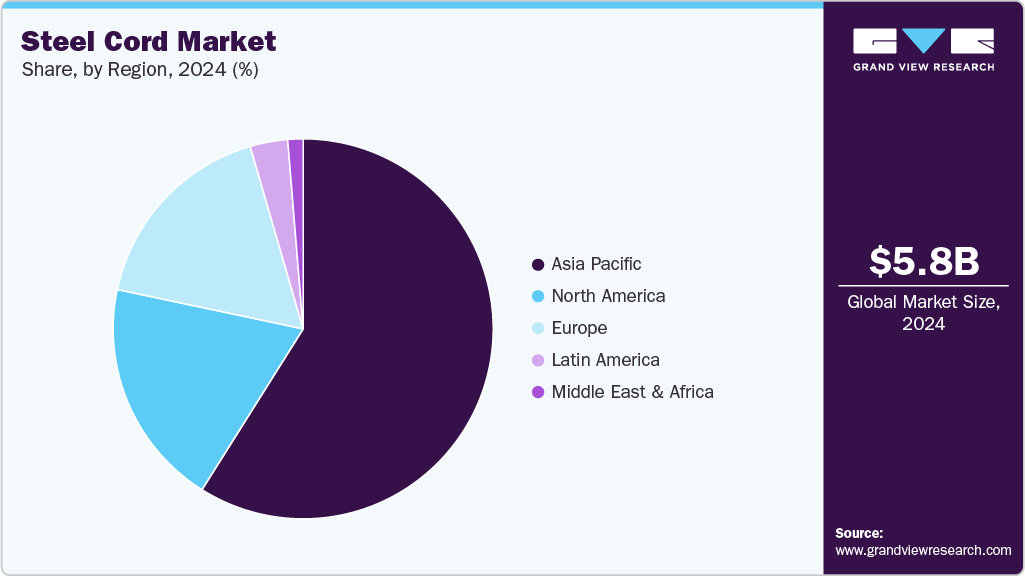

- Asia Pacific dominated the steel cord market with the largest market revenue share of 59.0%.

- By end use, tires segment accounted for the largest market revenue share of over 89% in 2024.

- By end use, the conveyor belts segment is anticipated to grow at the fastest CAGR during the forecast period

Market Size & Forecast

- 2024 Market Size: USD 5.83 Billion

- 2033 Projected Market Size: USD 7.83 Billion

- CAGR (2025-2033): 3.4%

- Asia Pacific: Largest market in 2024

As passenger car and light commercial vehicle sales increase, so does the need for stronger, yet lighter, tire reinforcements that enhance durability and fuel efficiency. Growth in regional vehicle manufacturing hubs and the expansion of automotive assembly lines directly feed into higher volumes of tire production, which in turn drives the purchase of steel cord at scale.The shift toward performance and specialty tires increases demand for higher-grade steel cord products. Tire makers are investing in reinforced constructions to achieve better wet grip, handling, and lower rolling resistance. Electric vehicles create additional requirements for load-bearing and heat resistance due to heavier battery packs and different torque profiles, prompting tire designers to specify steel cords with improved tensile properties.

The replacement and retread markets sustain steady consumption, providing a reliable baseline for steel cord sales. As vehicle fleets age and traffic volumes rise, demand for tire retreading and replacement grows, particularly in commercial transport and mining sectors. This aftermarket activity helps smooth cyclical swings in new vehicle production and encourages manufacturers to produce a wider range of steel cord types to meet varying retread and replacement specifications.

Investment in production technology and process optimization at steel cord plants enhances capacity and reduces unit costs, thereby supporting market expansion. Advances in wire drawing, coating, and strand twisting deliver cords with more consistent quality and longer life, which attracts tire makers looking for performance gains. Automation and scale efficiencies also enable suppliers to meet stricter tolerance and delivery expectations from global tire manufacturers.

The availability and pricing of raw materials, as well as regulatory and sustainability pressures, significantly influence market dynamics. Fluctuations in steel scrap and wire rod supply affect input costs, which can alter purchase patterns across regions. Meanwhile, an increasing focus on recyclability and lower carbon footprints is prompting both tire and steel cord producers to adopt greener practices, creating demand for cords manufactured using more efficient processes and traceable supply chains.

Drivers, Opportunities & Restraints

The steel cord industry is experiencing robust growth due to the expansion of the global automotive sector and the rising demand for high-performance tires. Rapid urbanization, industrialization, and increasing transportation needs are driving higher vehicle production, particularly in the Asia Pacific and emerging economies. Steel cords offer superior strength, fatigue resistance, and dimensional stability, which make them essential in tire reinforcement for both passenger and commercial vehicles. Moreover, the growing preference for radial tires, which use steel cord as a core component, is a strong catalyst for market expansion.

Technological advancements in steel cord production are creating new growth avenues for manufacturers. Innovations such as ultra-high tensile strength cords, improved coating technologies, and eco-friendly manufacturing processes are enabling companies to meet the evolving needs of tire makers, who are focused on durability, performance, and sustainability. The rise of electric vehicles presents another promising opportunity, as these vehicles require tires with greater load-bearing capacity and lower rolling resistance. In addition, expanding into emerging markets with growing automotive manufacturing bases presents significant potential for long-term growth.

Despite favorable trends, the market faces several challenges, including fluctuating raw material prices and high production costs associated with the manufacture of precision steel wire. The volatility in steel prices can impact profitability and supply stability for tire producers. Environmental regulations surrounding steel production and waste management are also creating compliance pressures for manufacturers. Furthermore, the growing adoption of alternative reinforcement materials, such as aramid or polyester cords, in certain tire segments may limit the growth of steel cord usage in specific applications.

End Use Insights

The tires segment led the market with the largest revenue share of 89.4% in 2024. The tires segment forms the backbone of the steel cord industry as global demand for passenger and commercial vehicles continues to rise. The expansion of automobile production in the Asia Pacific, Europe, and North America has significantly increased the consumption of steel cord, which is primarily used to reinforce radial tires. Steel cord enhances tire performance by providing high tensile strength, flexibility, and resistance to deformation, thereby improving fuel efficiency, handling, and safety. The growing adoption of radial tires, coupled with the increasing demand for durable and long-lasting tires, continues to drive the use of steel cords across original equipment manufacturers and the replacement tire market.

The conveyor belts segment is anticipated to grow at the fastest CAGR during the forecast period. The conveyor belts and other industrial uses segment represents a vital growth area for the steel cord industry, driven by rapid industrialization and expansion in mining, construction, and manufacturing sectors. Steel cords are widely used in heavy-duty conveyor belts due to their exceptional tensile strength, flexibility, and resistance to abrasion and fatigue. These properties enable conveyor systems to operate efficiently under high-stress and load conditions, which is essential for transporting bulk materials such as coal, cement, and minerals. The ongoing development of large-scale industrial projects, automation in production facilities, and increased focus on operational efficiency have strengthened the demand for steel cord-reinforced conveyor belts across global industries.

Regional Insights

The steel cord market in North America is witnessing notable growth driven by rising demand for high-performance tires across both passenger and commercial vehicle segments. The region’s strong automotive production base, led by the U.S., Mexico, and Canada, drives consistent demand for steel cords in tire reinforcement. Increasing consumer preference for durable, fuel-efficient, and long-lasting tires is encouraging tire manufacturers to integrate advanced steel cords that enhance strength, flexibility, and safety. Moreover, growth in replacement tire demand, supported by the large vehicle fleet and expanding logistics sector, is further strengthening market momentum across the region.

U.S. Steel Cord Market Trends

The steel cord market in the U.S. is expanding steadily, supported by a strong automotive manufacturing base and growing demand for durable, high-performance tires. In 2024, the country produced approximately 10.6 million vehicles, reflecting consistent output across passenger cars, SUVs, and commercial vehicles. This steady vehicle production sustains large-scale tire demand, directly driving the consumption of steel cords for reinforcement. Tire manufacturers are increasingly adopting advanced steel cord technologies to enhance strength, durability, and fuel efficiency, aligning with the market shift toward electric and hybrid vehicles that require stronger tires to support heavier battery systems.

Asia Pacific Steel Cord Market Trends

Asia Pacific dominated the steel cord market with the largest revenue share of 59.0% in 2024, driven by several key factors. Rapid urbanization and industrialization across countries like China, India, and Indonesia are increasing the demand for essential minerals and metals, escalating the need for efficient steel cord practices. This demand is further amplified by the surge in electric vehicle production and investments in renewable energy, which require critical raw end use such as lithium, cobalt, and rare earth elements. To meet these needs, advancements in recycling technologies and adopting sustainable mining solutions are being prioritized, facilitating the recovery of valuable end use from electronic waste, construction debris, and other urban sources.

Europe Steel Cord Market Trends

The steel cord market in Europe is experiencing steady growth driven by the rebound of the automotive industry and the increasing production of high-performance tires. In 2024, around 14.4 million vehicles were produced across Europe, strengthening demand for steel cords used in radial tire reinforcement. Tire manufacturers are focusing on enhancing safety, durability, and energy efficiency to comply with the EU’s stringent regulations on vehicle performance and emissions.

Latin America Steel Cord Market Trends

The steel cord market in Latin America is gaining traction as the automotive and tire manufacturing industries continue to recover from recent slowdowns. Countries such as Brazil, Mexico, and Argentina are leading regional vehicle production, with growing demand for passenger and commercial vehicles driving tire consumption. The shift from bias to radial tires is a significant factor driving the increase in steel cord usage, as radial designs offer greater strength, flexibility, and durability.

Middle East & Africa Steel Cord Market Trends

The steel cord market in Middle East & Africa is expanding steadily, driven by rapid infrastructure development, industrial growth, and the increasing adoption of radial tires. Nations such as Saudi Arabia, the UAE, and South Africa are witnessing strong demand for heavy-duty vehicles and equipment used in construction, mining, and logistics, all of which rely on steel cords for tire reinforcement and conveyor applications.

Key Steel Cord Company Insights

Some of the key players operating in the market include Kiswire Ltd., Jiangsu Xingda Steel Tyre Cord Co., Ltd., and others.

-

Jiangsu Xingda Steel Tyre Cord Co., Ltd. is a global supplier of tire-reinforcement materials. The company operates several production facilities in China and maintains a strong global presence with subsidiaries and offices across Asia, Europe, and the Americas. The company’s steel cord portfolio caters to various tire segments, including passenger cars, trucks, buses, and off-the-road vehicles. Its products are engineered to provide superior adhesion, fatigue resistance, and tensile strength, which are essential for tire performance and safety.

-

Kiswire Ltd. is a global manufacturer of specialty steel wire and reinforcement materials. The company operates numerous plants across Asia, Europe, and North America, supplying products to automotive, construction, energy, and industrial sectors. Kiswire’s steel cord division produces high-performance reinforcement materials designed for use in radial tires for passenger vehicles, trucks, and heavy-duty applications. The company’s steel cords are valued for their superior strength, flexibility, and resistance to corrosion and fatigue, which help enhance tire safety, stability, and service life.

Key Steel Cord Companies:

The following are the leading companies in the steel cord market. These companies collectively hold the largest market share and dictate industry trends.

- Bridgestone (Shenyang) Steelcord Co. Ltd

- Henan Hengxing Science & Technology Co. Ltd

- HYOSUNG Advanced Materials

- Jiangsu Xingda Steel Tyre Cord Co. Ltd

- Kiswire Ltd

- NV Bekaert SA

- Qingdao HL Group Ltd

- Shandong Xinhao Tire Materials Co. Ltd

- Sumitomo Electric Industries Ltd

- TOKUSEN KOGYO Co. Ltd

Recent Development

-

In November 2024, Shandong Daye announced a major investment of approximately USD 200.5 million to establish a new manufacturing center in Morocco focused on bead wire and steel cord production. The project will be implemented in two phases, with the first phase involving an investment of approximately USD 114.8 million to establish a production line capable of manufacturing 40,000 tons of bead wire and 40,000 tons of steel cord annually.

Steel Cord Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.98 billion

Revenue forecast in 2033

USD 7.83 billion

Growth rate

CAGR of 3.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Market definition

The steel cord market size represents the total annual value of steel cord supplied for tire and other industries.

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia; UAE

Key companies profiled

NV Bekaert SA; Sumitomo Electric Industries Ltd; HYOSUNG Advanced Materials; Henan Hengxing Science & Technology Co. Ltd; TOKUSEN KOGYO Co. Ltd; Jiangsu Xingda Steel Tyre Cord Co. Ltd; Bridgestone (Shenyang) Steelcord Co. Ltd; Kiswire Ltd; Qingdao HL Group Ltd; Shandong Xinhao Tire Materials Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Cord Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global steel cord market report based on the end use, and region:

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Tires

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Conveyor Belts & Other Industrial Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global steel cord market size was estimated at USD 5.83 billion in 2024 and is expected to reach USD 5.98 billion in 2025.

b. The global steel cord market is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2033 to reach USD 7.83 billion by 2033.

b. The tires segment dominated the market with a revenue share of 89.4% in 2024.

b. Some of the key players of the global steel cord market are NV Bekaert SA, Sumitomo Electric Industries Ltd, HYOSUNG Advanced Materials, Henan Hengxing Science & Technology Co. Ltd, TOKUSEN KOGYO Co. Ltd, Jiangsu Xingda Steel Tyre Cord Co. Ltd, Bridgestone (Shenyang) Steelcord Co. Ltd, Kiswire Ltd, Qingdao HL Group Ltd, Shandong Xinhao Tire Materials Co. Ltd, and others.

b. The key factor driving the growth of the global steel cord market is the rising demand for high-performance and durable radial tires across the automotive and transportation sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.