- Home

- »

- Advanced Interior Materials

- »

-

Steel Fiber Market Size And Share, Industry Report, 2030GVR Report cover

![Steel Fiber Market Size, Share & Trends Report]()

Steel Fiber Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hooked, Deformed, Straight), By Application (Slabs & Flooring, Pavements & Tunneling, Precast), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-946-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Steel Fiber Market Summary

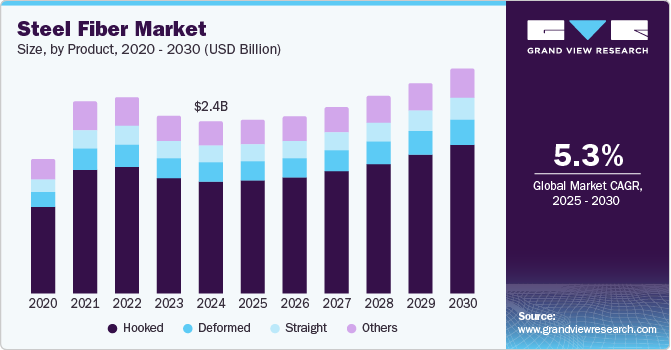

The global steel fiber market size was valued at USD 2.44 billion in 2024 and is projected to reach USD 3.19 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. This growth is attributed to the increasing demand for high-performance construction materials, infrastructure development, and sustainable building solutions.

Key Market Trends & Insights

- The Asia Pacific steel fiber market dominated the global market and accounted for the largest revenue share of 33.6% in 2024.

- Europe steel fiber market is expected to grow at a CAGR of 5.4% over the forecast period.

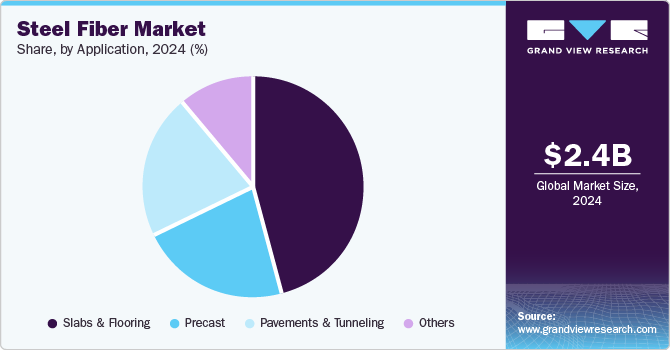

- Based on application, the slabs & flooring dominated the global steel fiber industry with the largest revenue share of 46.4% in 2024.

- In terms of product, the hooked steel fibers dominated the market and accounted for the largest revenue share of 65.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.44 Billion

- 2030 Projected Market Size: USD 3.19 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

In addition, the need for durable, crack-resistant materials in construction, rising infrastructure investments in emerging economies such as China and India, and the superior mechanical properties of steel fibers such as high tensile strength, drives the market growth. Furthermore, the construction sector's shift towards eco-friendly and resilient building techniques is further propelling market expansion.

Steel fibers are engineered metallic strands manufactured from pure metals or alloys, designed to enhance material performance across various industrial applications. These versatile fibers have emerged as transformative components in multiple sectors, offering unprecedented technological solutions. In the aerospace industry, metal fiber technologies are revolutionizing sound attenuation and filtration systems. Aircraft manufacturers are increasingly adopting sophisticated fiber composites to address growing noise pollution concerns near urban airports. These advanced materials effectively dampen cabin acoustic emissions, creating more comfortable flying experiences. Unlike traditional glass fiber media, metal fibers provide superior structural integrity through specialized sintering techniques, enabling more robust and reliable filtration mechanisms.

In addition, the textile sector has dramatically transformed by integrating metal fibers into functional materials. Conductive and antistatic textiles incorporating these innovative strands are gaining prominence across specialized domains such as pharmaceuticals, electronics, and medical technologies. These intelligent fabrics prevent electrostatic discharge, provide electromagnetic interference shielding, and enable sophisticated monitoring capabilities for complex physiological parameters. Furthermore, automotive industries are strategically leveraging metal fiber technologies to address increasingly stringent emission regulations. Crankcase airflow filters utilizing stainless steel non-woven media efficiently capture microscopic oil vapors from engine exhaust systems. Such advanced filtration solutions help manufacturers comply with rigorous environmental guidelines by reducing atmospheric contamination and improving overall engine performance.

Moreover, the convergence of metal fiber technologies represents a remarkable intersection of engineering innovation, environmental consciousness, and functional performance. Their extraordinary ability to enhance material properties across diverse applications positions them as critical components in modern industrial design. By offering sophisticated solutions that balance technological advancement with sustainability objectives, metal fibers are reshaping manufacturing paradigms and driving transformative changes across multiple industrial sectors.

Product Insights

The hooked steel fibers dominated the market and accounted for the largest revenue share of 65.1% in 2024. This growth is attributed to their exceptional ability to provide superior anchorage within concrete matrices, offering excellent crack control and enhanced tensile strength. In addition, their widespread adoption in industrial flooring, tunnel linings, and shotcrete applications stems from their proven performance in improving structural integrity, durability, and mechanical properties of construction materials.

The deformed steel fiber segment is expected to grow at a CAGR of 5.3% over the forecast period, owing to its remarkable performance in concrete applications, particularly in preventing cracking and water damage. Furthermore, these fibers are distinguished by superior abrasion and impact resistance, delivering better post-crack strength and meeting the increasing demand for high-performance construction materials that require enhanced structural resilience.

Application Insights

The slabs & flooring dominated the global steel fiber industry with the largest revenue share of 46.4% in 2024, primarily driven by increasing demand for non-structural and architectural building components, with concrete reinforcement playing a pivotal role. In addition, steel fibers help reduce slab thickness, improve placement efficiency, and save on concrete costs. Furthermore, their ability to minimize errors during fabric positioning and accelerate construction speed makes them attractive for modern building techniques, driving significant market expansion.

The pavements & tunneling is expected to grow at a CAGR of 5.5% from 2025 to 2030 segment's growth is driven by infrastructure development projects and the need for durable transportation infrastructure. In addition, steel fibers enhance concrete pavements' performance, potentially decreasing fuel consumption and reducing greenhouse gas emissions. Furthermore, their superior mechanical properties, including improved tensile strength and crack resistance, make them ideal for constructing robust highways, tunnels, and transportation infrastructure.

Regional Insights

The Asia Pacific steel fiber market dominated the global market and accounted for the largest revenue share of 33.6% in 2024. This growth is attributed to rapid urbanization, extensive infrastructure development, and significant construction projects. In addition, growing investments in green buildings, sustainable construction techniques, and technological advancements in manufacturing sectors are propelling market growth. Furthermore, emerging economies such as India and China are key contributors, with increasing demand for high-performance construction materials that offer superior durability, crack resistance, and enhanced mechanical properties.

China Steel Fiber Market Trends

The steel fiber market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by massive infrastructure expansion, urban development initiatives, and government-backed construction projects. In addition, the country's focus on sustainable infrastructure, transportation networks, and industrial facilities is creating substantial demand for steel fibers. Furthermore, technological innovations, increasing investments in infrastructure modernization, and the need for advanced construction materials with superior mechanical properties are driving market expansion.

Europe Steel Fiber Market Trends

Europe steel fiber market is expected to grow at a CAGR of 5.4% over the forecast period, owing to advanced manufacturing technologies, stringent sustainability regulations, and a strong focus on eco-friendly construction practices. Furthermore, increasing demand in industrial flooring, infrastructure rehabilitation, and specialized construction applications drives market growth. Moreover, the region's emphasis on energy-efficient buildings, infrastructure resilience, and innovative construction techniques contributes to the expanding steel fiber market.

The steel fiber market in Germany led the European market and accounted for the largest revenue share in 2024, primarily driven by technological innovation, precision engineering, and advanced manufacturing capabilities. The country's automotive, construction, and industrial sectors demand high-performance materials with superior mechanical properties. In addition, emphasis on sustainable infrastructure, energy-efficient buildings, and stringent quality standards contribute to the market's expansion. Furthermore, continuous research and development in material sciences further accelerate market growth.

North America Steel Fiber Market Trends

The North America steel fiber market is expected to grow significantly over the forecast period, owing to technological advancements, significant infrastructure reconstruction activities, and growing demand in mining and construction industries. In addition, increasing focus on sustainable infrastructure, infrastructure rehabilitation projects, and innovative construction techniques drive market expansion. Furthermore, the region's emphasis on high-performance materials, energy efficiency, and advanced engineering solutions contributes to the steel fiber market's robust growth.

The growth of steel fiber market in the U.S. is expected to be driven by extensive infrastructure development, reconstruction activities, and technological innovations. In addition, growing demand in construction, transportation, and industrial sectors, coupled with a focus on sustainable and resilient infrastructure, drives market expansion. Furthermore, increasing investments in smart city projects, advanced manufacturing techniques, and high-performance construction materials further accelerate the market's growth trajectory.

Key Steel Fiber Company Insights

Key companies in the global steel fiber industry include Bekaert, Fibrometals, Green Steel Group, and others. These companies are strategically focusing on product innovation, technological advancements, and strategic collaborations. In addition, they are actively pursuing mergers and acquisitions, developing specialized fiber products, expanding geographical presence, and investing in research and development to enhance their competitive positioning in the rapidly evolving construction materials sector.

-

ArcelorMittal offers a comprehensive range of steel fiber products including TABIX (undulated), HE (hooked-end), FE (flat-end), and HFE (hooked flat-end) variants. The company operates in concrete reinforcement segments such as infrastructure, industrial flooring, precast, and structural applications, providing innovative steel fiber solutions with enhanced mechanical properties.

-

Nippon Seisen Co., Ltd produces metal fibers with superior heat resistance, corrosion resistance, and versatile applications across multiple industries. The company operates in filtration, concrete reinforcement, heat-resistant materials, and advanced manufacturing sectors, offering innovative steel fiber solutions for diverse technical applications.

Key Steel Fiber Companies:

The following are the leading companies in the steel fiber market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Bekaert

- Fibrometals

- Green Steel Group

- Kerakoll SpA

- KOSTEEL CO, LTD.

- Nippon Seisen Co., Ltd.

- Severstal

- SIKA AG

- SPAJIC DOO

- Zhejiang Boen Metal Products Co. Ltd

Recent Developments

-

In January 2024, Bekaert’s innovative steel fiber solution, Dramix, was awarded the prestigious Pioneer Award by the Solar Impulse Foundation, recognizing its role in promoting ecological sustainability in construction. Collaborating with Société du Grand Paris and Eiffage, the use of Dramix steel fibers in the Grand Paris Express project has significantly reduced 10,000 tons of CO2 emissions per 10 kilometers of tunnels compared to traditional rebar methods. This award highlights the environmental benefits of steel fiber-reinforced concrete in large-scale infrastructure projects.

-

In September 2023, SIKA AG announced a significant investment in the production of macro fibers in the U.S., aiming to enhance its portfolio of concrete reinforcement solutions. This investment focuses on manufacturing synthetic macro fibers designed to improve the performance and durability of concrete, similar to steel fibers. The initiative underscores SIKA's commitment to delivering innovative construction materials that meet the growing demand for sustainable and high-performance solutions in the construction industry, particularly in infrastructure and commercial projects.

Steel Fibers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.47 billion

Revenue forecast in 2030

USD 3.19 billion

Growth Rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Malaysia, Germany, UK, Russia, Brazil, and Saudi Arabia

Key companies profiled

ArcelorMittal; Bekaert; Fibrometals; Green Steel Group; Kerakoll SpA; KOSTEEL CO, LTD.; Nippon Seisen Co., Ltd.; Severstal; SIKA AG; SPAJIC DOO; Zhejiang Boen Metal Products Co. Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steel Fibers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global steel fibers market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hooked

-

Straight

-

Deformed

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Slabs & Flooring

-

Precast

-

Pavements & Tunneling

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.