- Home

- »

- Biotechnology

- »

-

Stem Cell Therapy Market Size, Share, Industry Report 2030GVR Report cover

![Stem Cell Therapy Market Size, Share & Trends Report]()

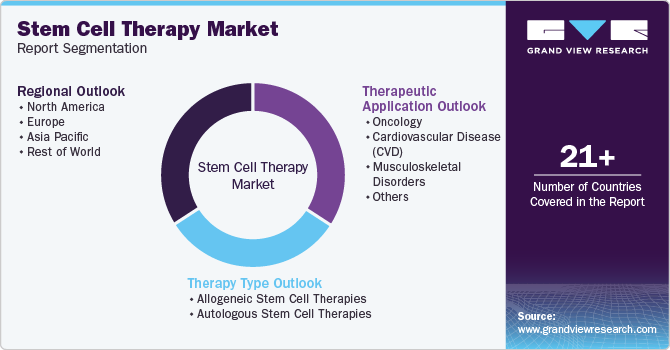

Stem Cell Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapy Type (Allogeneic Stem Cell Therapies, Autologous Stem Cell Therapies), By Therapeutic Application (Oncology), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-274-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stem Cell Therapy Market Summary

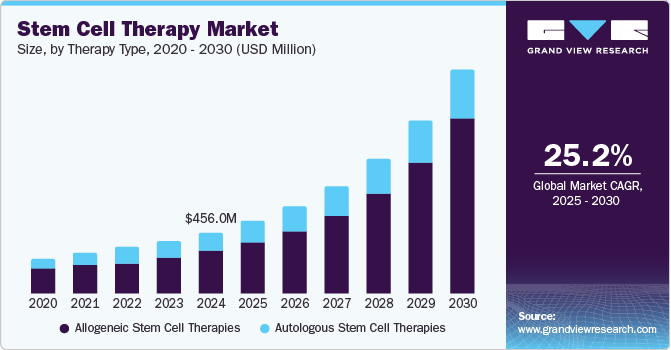

The global stem cell therapy market size was estimated at USD 456.0 million in 2024 and is projected to reach USD 1,670.1 million by 2030, growing at a CAGR of 25.23% from 2025 to 2030. One of the primary drivers of the market is the increasing incidence of chronic diseases and degenerative disorders, such as cancer and cardiovascular diseases, which has led to a search for new treatment options.

Key Market Trends & Insights

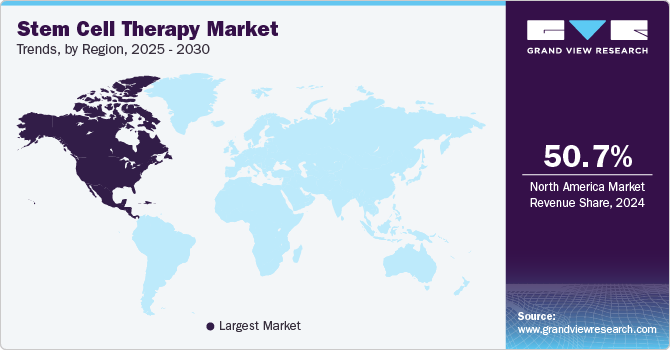

- North America accounted for the largest market share of 50.67% in 2024.

- The stem cell therapy market in Europe is witnessing robust growth.

- Based on therapy type, the allogeneic stem cell therapies segment dominated the market with a share of 69.22% in 2024.

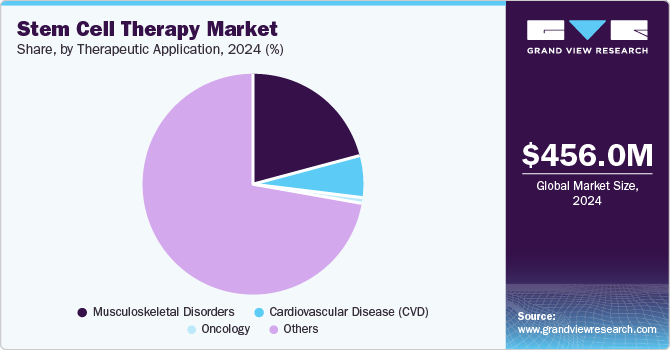

- Based on therapeutic application, the others segment accounted for 72.45% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 456.0 Million

- 2030 Projected Market Size: USD 1,670.1 Million

- CAGR (2025-2030): 25.23%

- North America: Largest market in 2024

Stem cell therapy offers the potential to regenerate damaged tissues and organs, providing hope for patients suffering from these debilitating conditions.

One of the most important drivers of the stem cell therapy market is the increasing investment in research and development. Governments, private investors, and pharmaceutical companies are allocating significant funds to stem cell research in recognition of its potential to transform health care. For instance, the Department of Biotechnology (DBT) in India is actively supporting initiatives in many areas of stem cell research from 2019 to 2022. These initiatives include fundamental biological insights, translational research projects, and genetics conversion technologies for power and clinical applications. During this period, DBT committed USD 8.80 million to these projects.

In addition, the increasing prevalence of chronic diseases represents a significant driver of market growth. As the global population ages and lifestyles become more sedentary, conditions such as cardiovascular diseases, neurodegenerative disorders, and autoimmune diseases are on the rise. As per the February 2024 report released by the CDC, roughly 129 million individuals in the U.S. are impacted by at least one significant chronic illness. Cell therapies offer a promising avenue for addressing these challenges by providing regenerative solutions that can repair damaged tissues and organs, potentially transforming the treatment landscape for patients with debilitating conditions.

Moreover, the biotechnology industry's research and development (R&D) boom has greatly contributed to stem cell therapy's market expansion. The development of cutting-edge tools and methods brought about by this surge in investment and creativity has completely changed how bioprocesses are observed and managed. The market for stem cell therapy is growing quickly because of the sophisticated instruments and techniques that make it possible to measure several parameters precisely and efficiently while biological products are being produced.

Furthermore, the marketplace has expanded due to enormous technological advancements in stem cell therapy. Biotechnology and regenerative medicine advances such as CRISPR-Cas9 gene modifying and induced pluripotent stem cells (iPSCs) have extended the healing ability of stem cell therapy. As scientists explore new therapeutic avenues and applications for stem cell-based therapies, these developments have created increasingly specialized and focused medications, drawing funding and propelling market growth.

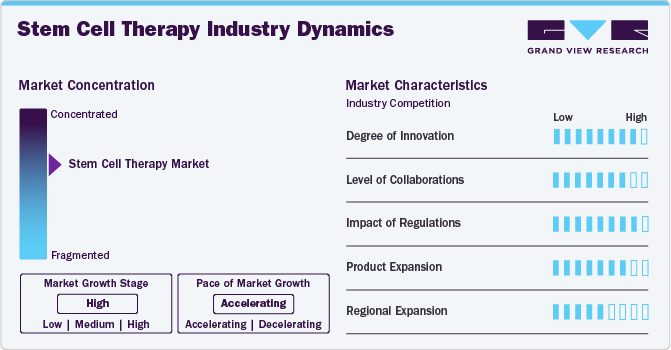

Market Concentration & Characteristics

The innovation in the stem cell therapy industry is high, driven by continuous advancements in biotechnology, regenerative medicine, and cellular biology. Stem cell therapies represent a cutting-edge approach to treating various medical conditions, potentially regenerating damaged tissues and organs, replacing diseased cells, and restoring normal physiological function.

Due to the multidisciplinary character of regenerative medicine, there is a great deal of collaboration and partnership activity in the stem cell therapy industry. Academic institutions, research groups, and biopharmaceutical companies frequently collaborate to leverage complementary infrastructure, resources, and expertise. For instance, in September 2022, Bristol Myers Squibb and Century Therapeutics formed a strategic alliance to advance the development of therapies utilizing allogeneic cells produced from induced pluripotent stem cells. Century's cutting-edge iPSC-derived allogeneic cell therapy technology and Bristol Myers Squibb's extensive understanding of oncology drug development and cell therapy are united through this partnership.

The FDA and other international organizations have built stringent regulatory frameworks that govern the development, production, and marketing of stem cell therapies. Respecting regulatory rules is essential to getting market approval, gaining the trust of patients and medical professionals, and lowering the dangers involved with using experimental or dangerous medicines. Because regulations guarantee the safety, effectiveness, and moral standards of therapies, they have a significant influence on the stem cell therapy business.

The market for stem cell therapy is experiencing rapid product expansion due to continued R&D activities, technology breakthroughs, and rising patient demand for advanced treatments. Companies are constantly launching new treatments, enhancing current products, and investigating novel uses, all of which support the market's explosive expansion and development. For instance, Gamida Cell Ltd. announced in April 2024 that the FDA in the U.S. approved Gamida Cell's allogeneic cell therapy, Omisirge, for use in adult and pediatric patients 12 years of age and older who have hematologic malignancies and are scheduled to receive umbilical cord blood transplantation following myeloablative conditioning. The purpose of this permission is to shorten the time it takes for neutrophils to recover and to become infected.

In the stem cell therapy industry, regional expansion refers to the growth of treatment facilities, research facilities, and market presence in various geographical areas. In the regional expansion scenario of stem cell therapy, high growth can be observed in North America and Europe due to advanced research and investment. Moderate growth is seen in Asia, while some regions may experience low growth due to regulatory challenges and limited resources.

Therapy Type Insights

Based on the therapy type, the market is segmented into allogeneic stem cell therapy and autologous stem cell therapy. The allogeneic stem cell therapies segment dominated the market with a share of 69.22% in 2024. The large share is propelled by several factors contributing to its expansion. Foremost among these is the increasing landscape of research and clinical trials. As scientific understanding deepens and technological advancements accelerate, there's a notable surge in investigations into allogeneic stem cell therapies. This increased focus on research and development leads to new treatments and therapies and market growth.

In addition to increased collaboration between academic institutions, biotech companies and pharmaceutical companies promote innovation. In August 2021, for instance, Gilead Sciences subsidiary Kite announced the acquisition of Appia Bio Inc., a biotechnology company. The partnership aims to jointly explore and develop new hematopoietic stem cell (HSC)-derived therapies specifically targeting hematopoietic cancers (haematological malignancies). This collaboration combines the expertise of both companies for cell delivery in improving the treatment of cancer patients. As a result, the market for allogeneic stem cell therapies is poised for further expansion, providing new hope for patients and physicians searching for advanced regenerative medicine solutions.

The autologous stem cell therapy market is witnessing a significant expansion, driven by significant progress in clinical trials and research within the field. As scientists explore the potential of autologous stem cells and their applications across various medical conditions, a strong sense of anticipation fuels innovation. For instance, in August 2022, at the National Institutes of Health, a medical team successfully implanted a tissue patch made from a patient's cells as a step toward treating advanced dry age-related macular degeneration (AMD). This innovative therapy, derived from induced Pluripotent Stem (iPS) cells, was developed in collaboration between the Ocular and Stem Cell Translational Research Sections. The growing number of clinical trials focused on leveraging a patient's stem cells for regenerative purposes signifies the increasing interest and investment in this area of medicine. With each advancement and successful trial, the potential for autologous stem cell treatments continues growing, offering patients newfound hope and life-changing opportunities worldwide.

Therapeutic Application Insights

Based on therapeutic application, the market is segmented into oncology, cardiovascular disease (CVD), musculoskeletal disorders, and others. The others segment accounted for 72.45% in 2024, fueled by ongoing research and clinical advancements. For blood disorders like ß-thalassemia and sickle cell disease, stem cell therapy offers promising avenues for treatment by addressing underlying genetic defects and replenishing healthy blood cells. A recent study between 2000 and 2021 revealed that although national incidence rates of sickle cell disease remained relatively steady, there has been a notable 13.7% increase in the global births of infants affected by this debilitating condition. Through techniques such as hematopoietic stem cell transplantation, patients have the potential to achieve improved outcomes and enhanced quality of life.

Similarly, in the field of neurological disorders, including conditions such as Cerebral adrenoleukodystrophy, Parkinson's disease, Alzheimer's disease, and spinal cord injuries, stem cell therapy holds immense potential for regenerative medicine approaches. A study published in The Lancet Neurology has anticipated a significant increase in the number of individuals affected by Parkinson's disease by 2040. The projected figure is alarming, as it suggests that the number of people living with this neurodegenerative disorder may double, reaching at least 12.9 million worldwide. Stem cells can be harnessed to replace damaged neurons, promote tissue repair, and modulate inflammatory responses, offering hope for disease modification and functional recovery. As research progresses and clinical trials yield promising results, the market for stem cell therapies in these segments is poised for continued expansion, with the potential to revolutionize the treatment landscape for patients worldwide.

The musculoskeletal disorders segment is expected to register a significant CAGR during the forecast period. The musculoskeletal disorders market, driven by the increasing prevalence of conditions such as osteoarthritis, rheumatoid arthritis, and spinal disorders, is witnessing a significant surge in interest in stem cell therapy. For instance, a report released by the World Health Organization (WHO) in July 2022 revealed that a staggering 1.71 billion individuals globally suffer from musculoskeletal conditions. These health issues, which predominantly involve the bones, joints, and related tissues, hold the unfortunate distinction of being the primary driver of disability across the world. As a promising alternative to traditional treatments stem cell-based therapies offer the potential for long-lasting relief and improved quality of life for patients suffering from these debilitating conditions. As a result, patients and healthcare providers are becoming more hopeful about the transformative impact of stem cell therapies on the management and treatment of musculoskeletal disorders.

Regional Insights

North America accounted for the largest market share of 50.67% in 2024 and the highest CAGR during the forecast period. Favorable regulatory frameworks, rising rates of chronic diseases, and technological improvements facilitate the growth of the market. Furthermore, research and development activities are fueled by substantial funding from institutions and private organizations, which promotes innovation in stem cell therapy. For instance, the California Institute for Regenerative Medicine (CIRM) Board authorized funding for initiatives related to its Clinical and Translation programs totaling about USD 89 million in April 2023. Further driving market expansion are expanding investments in healthcare infrastructure and the growing need for regenerative medicine solutions. Together, these factors place North America at the forefront of the worldwide stem cell therapy industry, with prospects for growth in the future.

U.S. Stem Cell Therapy Market Trends

The U.S. stem cell therapy market is anticipated to expand due to increased clinical studies and significant funding initiatives. Regenerative medicine is a field that promises revolutionary solutions for a range of medical diseases, and it is primed for significant expansion due to continuous research advances and growing investments. For instance, UC San Diego achieved a major milestone in increasing research opportunities in the field. It secured a USD 8 million grant in November 2022 to progress its stem cell treatment clinical trials.

Europe Stem Cell Therapy Market Trends

The stem cell therapy market in Europe is witnessing robust growth, driven by increasing research activities and a rising demand for regenerative medicine. Key players like Novartis, Mesoblast, and TiGenix are investing in technology and infrastructure to capitalize on this growth. For instance, in January 2024, CellVoyant secured USD 8.11 million in seed funding to accelerate the advancement of innovative stem cell therapies. Supportive government initiatives and collaborations between academic institutions and industry fuel market expansion. With an estimated market value of billions, Europe's stem cell therapy sector continues to attract significant investments and innovation.

The stem cell therapy market in the UK held a significant share in 2024, propelled by initiatives from research centers. For instance, the University of Liverpool's February 2024 spin-out company TrophiCell shows creative approaches to using adult mesenchymal stem cells (MSCs) for medicinal applications. By introducing novel techniques and products, these initiatives greatly aid in the market's growth. The stem cell therapy industry in the UK is expected to grow and witness significant advances in the treatment of a range of medical problems due to continuous developments and collaborations between academics and industry.

Germany stem cell therapy market is witnessing growth due to strategic acquisitions and the development of local market players. These efforts foster innovation and collaboration, ultimately driving the expansion of this dynamic industry. For instance, In July 2020, Boehringer Ingelheim formed a partnership with the Belgian biotech company GST, which specializes in developing and producing cutting-edge stem cell products. This collaboration aims to leverage their combined expertise and resources to advance stem cell research and applications.

Asia Pacific Stem Cell Therapy Market Trends

The Asia Pacific stem cell therapy market is witnessing remarkable growth, driven by extensive research and development efforts in stem cell technology. For instance, in March 2024, researchers from the Indian Institute of Science (IISc) made notable discoveries regarding the process of gene expression as adult cells are reprogrammed into induced pluripotent stem cells (iPSCs). These findings contribute to a deeper understanding of stem cell reprogramming and may pave the way for improved regenerative medicine applications. As countries in this region invest in innovation and collaborate to advance medical science, the market is poised to expand and bring forth transformative healthcare solutions.

The stem cell therapy market in China is witnessing remarkable growth due to rapid advancements in stem cell technology and the streamlining of approval processes from the regulatory framework. For instance, in September 2023, a groundbreaking stem cell-based bio-artificial liver device received approval for clinical trials. This innovative technology aims to assist liver patients in detoxifying their blood, offering a promising solution to improve their quality of life and potentially revolutionize liver disease treatment. As China invests in research and development, it fosters an environment for innovative medical breakthroughs, further propelling the expansion of the stem cell therapy market in the region.

Japan stem cell therapy market experiences growth due to significant factors such as robust research and development efforts, increased government support, and a strong focus on innovation in the healthcare sector. For instance, in October 2023, a Japanese medical institution plans to pursue governmental approval for embryonic stem cells as a regenerative treatment option for infants suffering from severe liver ailments. This innovative approach aims to revolutionize the medical landscape by leveraging stem cell technology to address critical health issues in young patients. This fosters a conducive environment for advancements in stem cell technology, contributing to the market's expansion in the region.

Rest of World Stem Cell Therapy Market Trends

The rest of the world stem cell therapy market is driven by technological advancements and increasing awareness about the potential benefits of these innovative treatments. As scientific breakthroughs continue to emerge, the region is poised to witness further expansion in this transformative sector.

Key Stem Cell Therapy Company Insights

The market players operating in the stem cell therapy market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Stem Cell Therapy Companies:

The following are the leading companies in the stem cell therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Bluebird bio, Inc.

- NIPRO

- Kyowa Kirin

- Pharmicell Co., Ltd.

- CorestemChemon Inc.

- ANTEROGEN.CO., LTD.

- Holostem S.r.l.

- Vertex Pharmaceuticals, Inc.

- Cleveland Cord Blood Center

- Highbridge Capital Management

Recent Development

-

In March 2024, Gamida Cell Ltd. secured a Restructuring Support Agreement with its main lender, Highbridge Capital Management, to ensure long-term financial stability and support the ongoing commercialization of Omisirge. The restructuring will take place through a voluntary process in Israel.

-

In January 2024, Cellcolabs AB, a Karolinska Institute spin-off focused on manufacturing research-grade and Good Manufacturing Practice (GMP) mesenchymal stem cells (MSCs), has formed a partnership with REPROCELL Inc., Japan's pioneering induced pluripotent stem cell (iPSC) company. This collaboration aims to globally distribute high-quality MSCs and MSC-derived products, manufactured by Cellcolabs, for research and clinical purposes. Additionally, Cellcolabs has secured exclusive distribution rights in Japan.

-

In February 2023, Garuda Therapeutics revealed securing an additional USD 62 million in funding, fifteen months after its initial launch with USD 72 million. The company focused on developing stem cell-based treatments for various diseases, has now expanded its target list from 70 to 120 potential diseases.

-

In May 2023, EPROCELL is set to introduce Contract Development and Manufacturing Organization (CDMO) services for producing Advanced Therapies Medicinal Products (ATMPs) derived from mesenchymal stem cells (MSC). A partnership with Histocell facilitates this expansion.

-

In April 2023, Gamida Cell Ltd. announced that the FDA in the U.S. approved Gamida Cell's allogeneic cell therapy, Omisirge, for use in adult and pediatric patients 12 years of age and older who have hematologic malignancies and are scheduled to receive umbilical cord blood transplantation following myeloablative conditioning.

Stem Cell Therapy Market Report Scope

Report Attribute

Details

Market size in 2025

USD 542.2 million

Revenue Forecast in 2030

USD 1,670.1 million

Growth rate

CAGR of 25.23% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, therapeutic application, region

Regional scope

North America; Europe; Asia Pacific; Rest of World

Country scope

U.S.; Canada; UK; Germany; Switzerland; Rest of Europe; Japan; China; India; Rest of APAC;South Korea

Key companies profiled

Bluebird bio, Inc.; NIPRO; Kyowa Kirin; Pharmicell Co., Ltd.; CorestemChemon Inc.; ANTEROGEN.CO.,LTD.; Holostem S.r.l.; Vertex Pharmaceuticals, Inc.; Cleveland Cord Blood Center;

Highbridge Capital Management

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Stem Cell Therapy Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global stem cell therapy market based on therapy type, therapeutic application, and region.

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allogeneic Stem Cell Therapies

-

Hematopoietic Stem Cell Therapies

-

Mesenchymal Stem Cell Therapies

-

-

Autologous Stem Cell Therapies, by Type

-

BM, Blood, & Umbilical Cord-derived Stem Cells

-

Adipose-Derived Cells

-

Others

-

-

-

Therapeutic Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disease (CVD)

-

Musculoskeletal Disorders

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Switzerland

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Rest of Asia Pacific

-

-

Rest of World

-

Frequently Asked Questions About This Report

b. The global stem cell therapy market size was estimated at USD 456.0 million in 2024 and is expected to reach USD 542.2 million in 2025.

b. The global stem cell therapy market is expected to witness a compound annual growth rate of 25.23% from 2025 to 2030 to reach USD 1,670.1 million by 2030.

b. The allogeneic stem cell therapies segment dominated the market with a share of 69.22% in 2024. The large share is propelled by several factors contributing to its expansion, including the increasing research landscape and clinical trials within the allogenic stem cell field.

b. Some of the key players operating in the stem cell therapy market include Bluebird bio, Inc., NIPRO, Kyowa Kirin, Pharmicell Co., Ltd., CorestemChemon Inc., ANTEROGEN.CO., LTD., Holostem S.r.l., Vertex Pharmaceuticals, Inc., Cleveland Cord Blood Center, and Highbridge Capital Management

b. One of the primary driving factors of the market is the increasing incidence of chronic diseases and degenerative disorders, such as cancer and cardiovascular diseases, which has led to a search for new treatment options. Stem cell therapy offers the potential to regenerate damaged tissues and organs, providing hope for patients suffering from these debilitating conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.