- Home

- »

- Medical Devices

- »

-

Sterility Indicators Market Size, Share, Industry Report, 2030GVR Report cover

![Sterility Indicators Market Size, Share & Trends Report]()

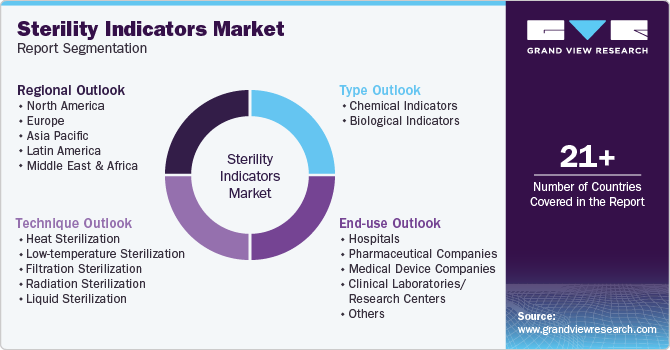

Sterility Indicators Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Chemical Indicators, Biological Indicators), By Technique (Heat, Low Temperature, Filtration, Radiation, Liquid), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-487-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sterility Indicators Market Summary

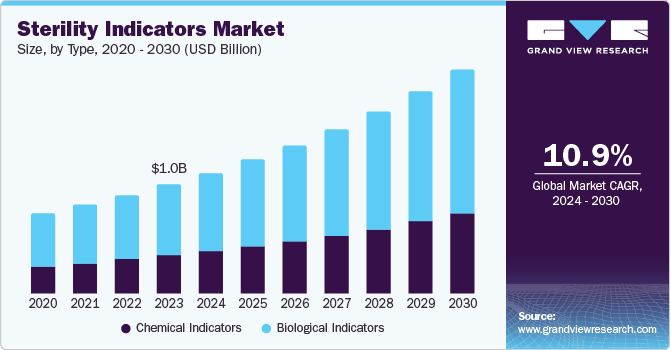

The global sterility indicators market size was valued at USD 1.02 billion in 2023 and is projected to reach USD 2.10 billion by 2030, growing at a CAGR of 10.9% from 2024 to 2030. The increasing demand for sterile medical devices is largely attributed to the rising number of surgical procedures, which necessitate using sterile equipment to prevent infections and ensure patient safety, driving the market growth.

Key Market Trends & Insights

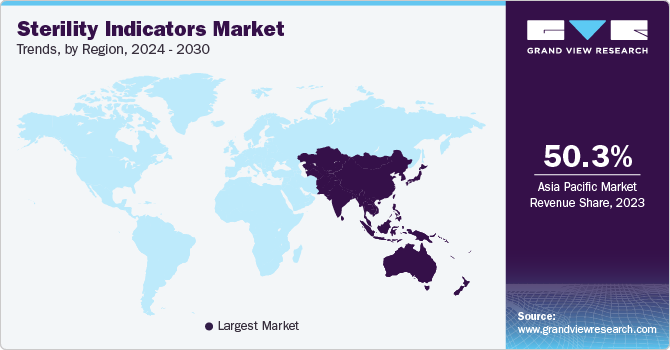

- North America sterility indicators market held the largest revenue share of 50.33% in 2023.

- The sterility indicators market in the U.S. dominated the regional market in 2023.

- By type, biological indicators segment accounted for the largest revenue share of 65.2% in 2023.

- By technique, the heat sterilization segment accounted for the largest market revenue share in 2023.

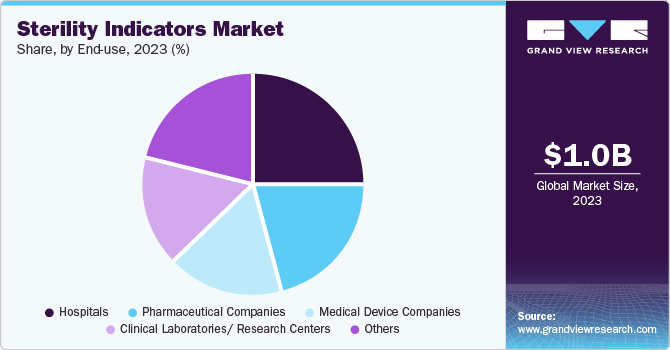

- By end use, the hospital segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.02 Billion

- 2030 Projected Market Size: USD 2.10 Billion

- CAGR (2024-2030): 10.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growing awareness about infection control practices among healthcare professionals and patients has led to a heightened emphasis on using sterile devices. Emerging markets present significant opportunities for growth, driven by expanding healthcare infrastructure and increasing access to medical services, which fuels the demand for sterile medical devices. The sterility indicators market is a specialized segment within the healthcare and medical device market involving products that ensure the efficacy of sterilization techniques. These indicators are important in ascertaining that medical instruments, laboratory equipment, and other items are free from viable microorganisms before being used for clinical or research purposes. The market of sterility indicators includes biological indicators, chemical indicators, and integrators.

Regulatory bodies such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) impose stringent requirements on healthcare facilities regarding sterilization practices. Compliance with these regulations necessitates using reliable sterility indicators, propelling the market growth. Also, Innovations in sterility indicator technology have improved their reliability and ease of use. Advancements in biological indicator formulations have enhanced their sensitivity and specificity, making them more effective at detecting failures in sterilization processes.

Type Insights

Biological indicators dominated the market and accounted for the largest revenue share of 65.2% in 2023. The pharmaceutical sector is expanding rapidly due to increased research and development activities, particularly in biologics and biosimilars. This growth increases the demand for sterilization methods, thereby driving demand for biological indicators that can effectively monitor these processes. Moreover, compliance with international standards such as ISO 11138 (which specifies requirements for biological indicators) is essential for manufacturers in the healthcare sector. This compliance drives the adoption of biological indicators as they provide a reliable means of demonstrating adherence to these standards.

The chemical segment is expected to grow at the fastest CAGR of 11.3% during the forecast period. The rise in healthcare-associated infections (HAIs) has led to stricter regulations and standards for sterilization practices. Regulatory bodies such as the FDA and Centers for Disease Control and Prevention (CDC) emphasize the need for effective sterilization monitoring , which propels demand for reliable chemical indicators. In addition, increased global health initiatives aimed at improving infection control practices contribute to market growth. Organizations worldwide are investing in better sterilization techniques to combat infectious diseases, thus driving demand for chemical indicators.

Technique Insights

The heat sterilization segment accounted for the largest market revenue share in 2023. This can be attributed to the rising demand for sterile medical products and devices, driven by an aging population and increasing prevalence of chronic diseases, which has led to a greater emphasis on sterilization processes. Hospitals and healthcare facilities prioritize infection control measures, necessitating reliable sterilization methods. As healthcare continues evolving with a focus on safety and efficacy, heat sterilization is projected to dominate over the forecast period, supported by ongoing innovations and regulatory frameworks.

The low-temperature sterilization segment is expected to grow at the fastest CAGR in the coming years. These techniques, which include ethylene oxide sterilization, hydrogen peroxide gas plasma, and ozone sterilization, are advantageous for materials that cannot withstand high temperatures. The growth of this segment can be attributed to a combination of technological advancements, increasing demand for effective sterilization methods in healthcare settings, and regulatory pressures for enhanced safety protocols. There is a growing emphasis on sustainability within the medical field. Low-temperature sterilization techniques utilize less harmful chemicals than traditional methods, making them more environmentally friendly.

End Use Insights

The hospital segment dominated the market with the largest revenue share in 2023. Surgical procedures are common in hospitals, which present significant challenges in maintaining sterility in post-operative wound complications. The rise in elective surgeries and complex procedures increases the demand for systems monitoring sterilization processes, thereby driving demand for sterility indicators. Health departments and regulatory bodies have circulated specific guidelines that have to be followed in the hospital environment for sterilization. Compliance with these regulations is facilitated by the sterility Indicators, which help determine that even the most complex surgical instruments are well sterilized before being used. As important as it is for the safety of the patients, compliance is also necessary to retain accreditation and avoid getting into legal trouble.

The pharmaceutical companies’ segment is projected to experience the fastest CAGR during the forecast period. This is primarily due to stringent regulations imposed by authorities such as FDA and EMA. These regulations mandate that all pharmaceutical products be sterile when administered to patients. As a result, there is a growing need for effective sterility indicators to verify the sterility of products throughout their lifecycle-from manufacturing to distribution and ultimately to patient administration. Moreover, the consequences of product contamination are severe, including financial losses, reputational damage, and potential harm to patients. Sterility indicators help prevent product recalls by verifying the effectiveness of sterilization processes.

Regional Insights

North America sterility indicators market held the largest revenue share of 50.33% in 2023. Growing prevalence of hospital-acquired infections (HAIs), which leads to surging demand for advanced medical devices and pharmaceutical technologies, is expected to propel the market growth in the coming years.

U.S. Sterility Indicators Market Trends

The sterility indicators market in the U.S. dominated the regional market in 2023. The increasing investment in R&D by pharmaceutical companies, which has enhanced therapeutic solutions and produced reliable products, is one of the key drivers for the market growth. Expanding healthcare infrastructure in the country, including outpatient surgical centers, has increased the adoption of rigorous sterilization protocols.

Europe Sterility Indicators Market Trends

The Europe sterility indicators market was identified as a lucrative region in 2023. The growth of the market in the region is influenced by the growing focus on infection prevention protocols since COVID-19, that has driven effective sterilization practices, thus shaping the market positively. Moreover, the growing geriatric population has resulted in increasing cases of cardiovascular disorders, diabetes, and cancer, therefore impacting surgical procedure demand.

Asia Pacific Sterility Indicators Market Trends

The Asia Pacific sterility indicators market is anticipated to grow at the fastest CAGR of 11.7% during the forecast period. The growth of the sterility indicators market in the region is attributed to the growing number of diseases such as cancer, cardiovascular conditions, diabetes, and other chronic diseases. Additionally, the growing economies in the region have increased investments in healthcare industries, resulting in advanced sterilization technologies, therefore encouraging market growth.

Key Sterility Indicators Company Insights

Some of the key companies in the sterility indicators market include Getinge, STERIS, 3M, Liofilchem S.r.l., and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

- STERIS focuses on infection prevention and other procedural products and services, primarily serving healthcare, pharmaceutical, and medical device customers. It offers a comprehensive range of sterility assurance products, including biological indicators for steam and vaporized hydrogen peroxide sterilization.

Key Sterility Indicators Companies:

The following are the leading companies in the sterility indicators market. These companies collectively hold the largest market share and dictate industry trends:

- Getinge

- STERIS

- 3M

- Cardinal Health

- MATACHANA group

- Mesa Labs, Inc.

- Andersen Sterilizers

- PMS Healthcare Technologies

- Propper Manufacturing Co., Inc.

- Liofilchem S.r.l.

Recent Developments

- In April 2024, the MATACHANA introduced an innovative format for integrating chemical indicators. It is aimed at maximizing sustainability of environment in sterilization industry.MATACHANA has redefined resource management efficiency and has established new sustainability benchmarks in the medical sector.

Sterility Indicators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.13 billion

Revenue forecast in 2030

USD 2.10 billion

Growth Rate

CAGR of 10.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technique, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait.

Key companies profiled

Getinge; STERIS; 3M; Cardinal Health; MATACHANA group; Mesa Labs, Inc.; Andersen Sterilizers; PMS Healthcare Technologies.; Propper Manufacturing Co., Inc. and Liofilchem S.r.l.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sterility Indicators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sterility indicators market report based on type, technique, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical Indicators

-

Class 1

-

Class 2

-

Class 3

-

Class 4

-

Class 5

-

-

Biological Indicators

-

Spore Ampoules

-

Spore Suspensions

-

Self-contained vials

-

Spore Strips

-

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat sterilization

-

Low-temperature sterilization

-

Filtration sterilization

-

Radiation sterilization

-

Liquid sterilization

-

-

End-Use Outlook (Revenue, USD Million, 2018 – 2030)

-

Hospitals

-

Pharmaceutical companies

-

Medical device companies

-

Clinical laboratories/ Research centers

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.