- Home

- »

- Medical Devices

- »

-

Ostomy Care And Accessories Market Size Report, 2030GVR Report cover

![Ostomy Care And Accessories Market Size, Share & Trends Report]()

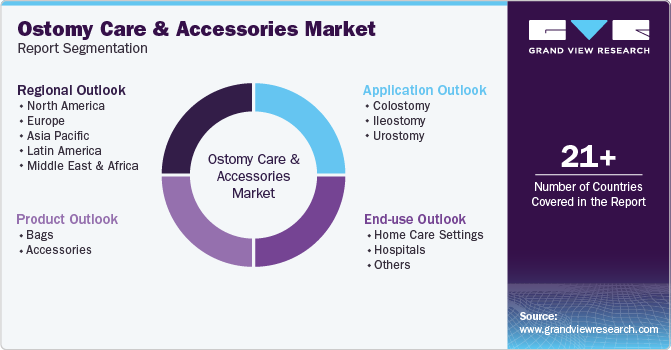

Ostomy Care And Accessories Market Size, Share & Trends Analysis Report By Product (Bags, Accessories), By Application (Colostomy, Ileostomy, Urostomy), By End-use (Home Care Settings, Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-338-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Ostomy Care And Accessories Market Trends

The global ostomy care and accessories market size was estimated at USD 3.69 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. The demand for ostomy care and accessories is anticipated to upsurge owing to an increase in the number of patients suffering from urological diseases and ostomy surgeries. The rising geriatric population base is further expected to drive the demand for ostomy care and accessories over the forecast period. Rising initiatives undertaken by various private players and non-profit organizations to raise awareness regarding ostomy care across the globe are anticipated to drive the demand for ostomy care products.

The European Ostomy Association arranges World Ostomy Day (WOD) every year which aims at educating the global population about the rehabilitation of ostomates by bringing them together. In the U.S., the Centers for Medicare and Medicaid Services developed a “guidance” for urinary incontinence care in nursing homes and provided web-based education to staff.

The increasing incidence of colorectal cancer is expected to drive the demand for ostomy care and accessories industry. According to the American Cancer Society, Inc., in 2023 colorectal cancer stood as the third primary contributor to cancer-linked fatalities among males and females in the U.S. When considering combined statistics for both genders, it emerges as the second most prevalent reason behind cancer-related deaths. According to the same source, colorectal cancer is predicted to cause about 52,550 deaths in 2023. Moreover, the prevalence of colorectal cancer is increasing in Asian countries such as India, China, and Japan. Thus, increasing risk of bladder cancer and colorectal cancer are expected to increase the demand for ostomy care products and accessories over the forecast period.

The rising elderly population is one of the significant factors boosting the market. According to the American Medical Association, the number of ostomy procedures is higher among the geriatric population than among adults. According to the United Ostomy Association of America (UOAA), the number of elderly people in the U.S. is likely to increase to 24% of the overall population by 2050, which is anticipated to increase the number of ostomy cases in the country. As per NCBI, patients aged 70 years & above undergo permanent ostomy procedures more often than younger people, with extended hospital stays and higher mortality, which is anticipated to drive the demand for ostomy care products & accessories. Therefore, with the constant increase in the geriatric population, an increase in the short and long-term healthcare needs will drive the ostomy care and accessories industry growth at the global level.

The American Cancer Society estimates that in 2023, there might be around 82,290 new cases of bladder cancer in the U.S. Out of these, about 62,420 could be in men and around 19,870 in women. Additionally, they also estimated that 16,710 people died from bladder cancer in 2023. Thus, the increasing number of patients suffering from bladder cancer and other urology-related diseases is primarily driving the growth of the ostomy care & accessories industry in the U.S. Moreover, the rising aging population and increasing awareness about ostomy care among healthcare professionals & patients also contribute to market growth.

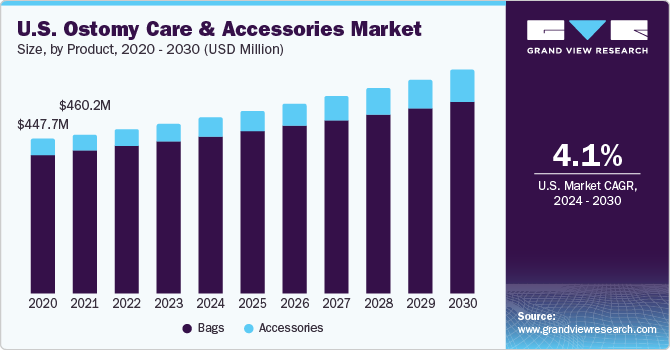

Product Insights

Based on product, the market is segmented into bags and accessories. The bags segment dominated the market with a revenue share of around 84.60% in 2023. Ostomy bags are further sub-segmented into two-piece and one piece-bags. Ostomy bags are used to collect urine or stool in different end-uses such as homecare settings, hospitals, and clinics. It includes a pouch to collect waste and a faceplate that attaches to abdominal skin using adhesives. These pouches are air and water-tight, which allows users to continue leading a normal lifestyle. They are most used with ileostomies, urostomies, & colostomies. Key market players offer ostomy bags with various features. Coloplast provides ostomy bags with a soft gray fabric and flexible sticky material that fits well with different body shapes.

The accessories segment is expected to grow at the highest CAGR over the forecast period. It includes seals/barrier rings, pouch closures, pouch covers, stoma caps, and others. They help to prevent leakage, odor, and skin rashes. An increasing number of stoma surgeries and ostomates are the major factors contributing to accessories segment growth. The accessories segment also includes customized solutions for specific needs or body shapes. Moreover, advancements in paste formulations have resulted in extended wear time and improved longevity, thereby surging its demand. It also reduces friction and offers an additional cushioning layer, minimizing skin damage & irritation. Thus, the above-mentioned factors are anticipated to augment the overall segment growth.

Application Insights

Based on application, the ostomy care and accessories industry is segmented into colostomy, urostomy, and ileostomy. The colostomy segment dominated the market with a revenue share of 45.16% in 2023 owing to the rise in the geriatric population and high prevalence of colon cancer as well as associated colostomy procedures. In addition, the availability of different types of colostomy bags, such as drainable or closed system bags, which are suitable for specific patient needs, is also contributing to the segment growth over the forecast period.

The ileostomy segment is expected to grow at the highest CAGR over the forecast period owing to the high prevalence of Inflammatory Bowel Diseases (IBDs), such as Crohn’s disease & ulcerative colitis. Patients with severe symptoms of IBD, such as frequent diarrhea, bowel obstructions, rectal bleeding, and persistent abdominal pain, may surge the need for ostomy surgery along with ostomy care products & accessories. Ostomy products are designed to provide a secure seal around the stoma, minimizing the risk of leakage and ensuring waste containment. This is important in individuals with IBD who may experience high output, changes in bowel habits, and liquid stools. Therefore, the rise in IBD cases requiring ostomy care products is predicted to further augment the segment growth.

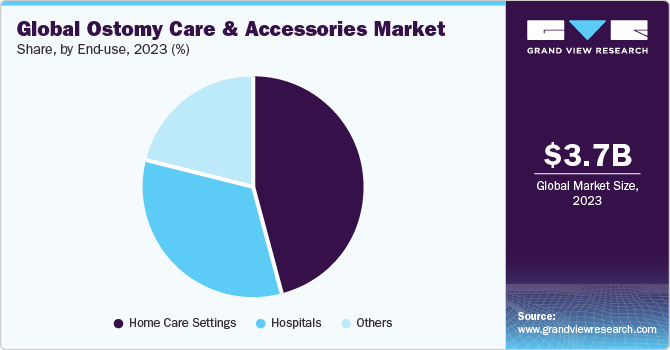

End-use Insights

The home care settings segment held the largest market share of 46.12% in 2023 and is expected to grow at the highest CAGR over the forecast period. A rise in demand for home healthcare services is expected to drive this segment’s growth. Home care services ensure ongoing ostomy care by skilled nurses and provide proper care to patients. This significantly reduces the risk of ostomy-related complications, thereby reducing emergency visits to hospitals. Home healthcare services for ostomy care include maintaining a healthy stoma and changing & emptying ostomy bags. Availability of trained nurses and growing preference for home care in developed as well as emerging countries are expected to drive the segment over the forecast period.

Hospitals are less preferred for ostomy than other health centers, owing to the lack of ongoing ostomy care. Hospitals only ensure post-operative stoma care, which is beneficial for temporary stoma patients. Long waiting times and high cost of hospital admissions also reduce preference for hospitals. Colostomy for patients not covered by health insurance can cost from USD 20,000 to over USD 60,000 depending on the hospital, geographical location, and the case. Such high costs for admission are expected to lower the demand for hospitals over the forecast period.

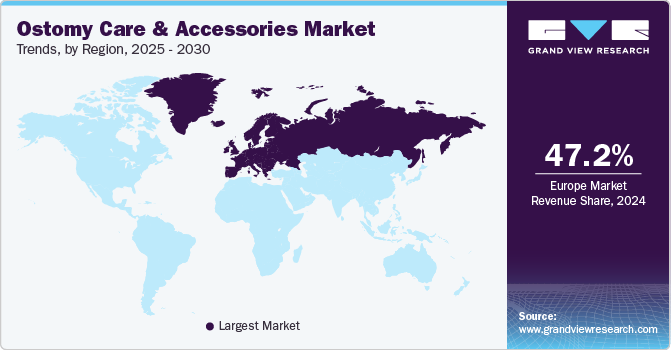

Regional Insights

Europe dominated the market in 2023 with the largest revenue share of around 47.23%. This is attributed to factors such as an increase in the number of stoma patients due to ulcerative colitis, or Crohn’s disease, and rising awareness initiatives related to ostomy care or stoma surgical procedures. According to NCBI, IBD comprises ulcerative colitis or Crohn’s disease, and its occurrence in European countries is gradually rising. In Europe, around 731,000 people are living with an ostomy and about 0.3% of the total population suffers from IBD. As per the Colostomy Association Ltd., trading as Colostomy UK, one in every 500 people in the UK is an ostomate. Such factors are contributing to the growth of the ostomy care and accessories industry in Europe.

Asia Pacific is expected to grow at the highest CAGR over the forecast period. Increasing awareness among consumers is expected to boost demand for ostomy care products and accessories in this region. In addition, there is a huge demand for colostomy in countries such as India and China as a large number of people suffer from bladder issues. Mostly geriatric population is prone to stomas and goes for ileostomy and colostomy surgeries. Thus, the increasing number of people living with bladder problems coupled with the rising geriatric population are boosting the demand for ostomy care products and accessories in Asia Pacific, driving the growth of the market in the region.

Key Companies & Market Share Insights

The key players are focusing on growth strategies, such as new product launches, regulatory approvals, expansion, collaborations, acquisitions, etc. In June 2023, Swift Medical Inc. entered a strategic collaboration with Corstrata with the aim to improve and increase access to quality wound care. By utilizing the Swift Medical Inc. AI-powered wound treatment platform that provides complete documentation, wound imaging, partnership, and decision-making tools, the joint customers will have access to Corstrata's staff of registered WOC (Wound, Ostomy, Continence) nurses. This initiative is expected to boost the market for ostomy care and accessories during the forecast period.

Key Ostomy Care And Accessories Companies:

- Coloplast Corp

- ConvaTec Inc.

- Hollister Incorporated

- Marlen Manufacturing & Development Company

- Perma-Type Company, Inc.

- Nu-Hope Laboratories, Inc.

- Perfect Choice Medical Technologies

- Fortis Medical Products

- Safe n' Simple

- AdvaCare Pharma

- Schena Ostomy Technologies, Inc.

- Cymed

- TG Eakin Limited

- Alcare Diagnostic Research Center Pvt. Ltd.

Ostomy Care And Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.87 billion

Revenue forecast in 2030

USD 5.31 billion

Growth rate

CAGR of 5.4 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Coloplast Corp; ConvaTec Inc.; Hollister Incorporated; Marlen Manufacturing & Development Company; Perma-Type Company, Inc.; Nu-Hope Laboratories, Inc.; Perfect Choice Medical Technologies; Fortis Medical Products; Safe n' Simple; AdvaCare Pharma; Schena Ostomy Technologies, Inc.; Cymed; TG Eakin Limited; Alcare Diagnostic Research Center Pvt. Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ostomy Care And Accessories Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ostomy care and accessories market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags

-

One Piece

-

Two Piece

-

-

Accessories

-

Seals/Barrier Rings

-

Pouch Cover

-

Pouch Closures

-

Stoma Caps/Hat

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Colostomy

-

Ileostomy

-

Urostomy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Care Settings

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ostomy care and accessories market size was estimated at USD 3.69 billion in 2023 and is expected to reach USD 3.87 billion in 2024.

b. The global ostomy care and accessories market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 5.31 billion by 2030.

b. The ostomy bags segment, which is sub-segmented into one-piece and two-piece bags, dominated the market for ostomy care and accessories in 2023 and accounted for the largest revenue share of around 84.60%.

b. The home care settings segment dominated the ostomy care and accessories market and held the largest revenue share of 46.12% in 2023, and is expected to witness the highest CAGR over the forecast period.

b. The colostomy segment dominated the market for ostomy care and accessories in 2023 and accounted for the largest revenue share of 45.16%, owing to an increase in the geriatric population and the high prevalence of colon cancer as well as associated colostomy procedures.

b. Europe dominated the ostomy care and accessories market and accounted for the largest revenue share of 47.23% in 2023. This is attributed to factors such as an increase in the number of stoma patients due to Crohn’s disease or ulcerative colitis, and rising awareness initiatives related to ostomy care or stoma surgical procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."