- Home

- »

- Advanced Interior Materials

- »

-

Structural Core Materials Market Size, Industry Report, 2030GVR Report cover

![Structural Core Materials Market Size, Share & Trends Report]()

Structural Core Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Honeycomb, Foam, Balsa), By Skin (GFRP, CFRP, NFRP), By End-use (Aerospace, Automotive, Wind Energy), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-317-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Structural Core Materials Market Trends

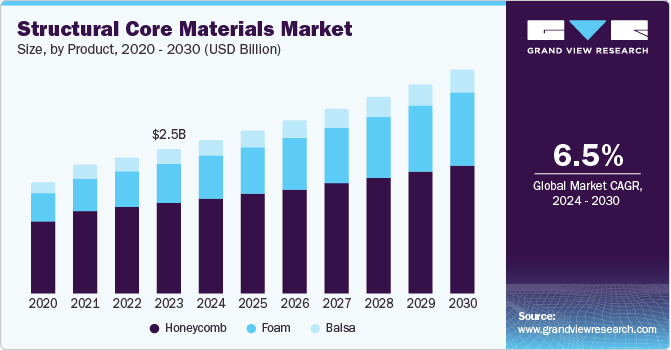

The global structural core materials market size was valued at USD 2.5 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The growing demand for structural core materials from the wind energy industry is a major trend observed in the market. Furthermore, the rise in disposable incomes of consumers across countries such as the U.S., India, and China has led to the rapid expansion of the aerospace and automotive industries. Furthermore, the market has witnessed significant growth with the rising need for lightweight materials in cars, planes, and boats for their superior fuel efficiency.

In addition, the market growth was stimulated by the aerospace industry as these materials are widely used in UAVs, planes, airships, rockets, and other key components. The increased utilization of structural core materials can be attributed to their inherent properties such as high strength, flexibility, radar transparency, low maintenance, and more. Raw materials such as honeycombs, and balsa wood are extensively used for structural fabrication operations including wet lamination, infusion, press bonding, vacuum bagging, and more. These methods are utilized for the manufacturing of various aircraft components such as landing gear doors, flight control surfaces, interior panels, fuselages, floor beams, floorboards, and interior components.

In addition, innovations in core materials, such as the development of high-performance foam, honeycomb, and balsa materials, have significantly enhanced the performance and functionality of these materials. Moreover, the increasing focus on sustainability and the need for lightweight materials have been significant market drivers. Governments and regulatory bodies worldwide have implemented stringent regulations to reduce carbon emissions and promote the use of eco-friendly materials. This has led to a surge in demand for lightweight core materials that can help reduce the overall weight of structures, thereby improving energy efficiency and reducing environmental impact. For instance, the automotive industry has increasingly adopted lightweight core materials to manufacture fuel-efficient vehicles that comply with emission standards.

Product Insights

The honeycomb segment accounted for the dominant share of 62.8% in 2023. This growth is attributable to the increased demand for this raw material in the aerospace, automotive, marine, and construction industries. Honeycomb core materials are known for their high strength, lightweight, good energy absorption, and damage resistance properties. These structures can be used with most adhesives, and they offer excellent dielectric properties and strength-to-weight ratio -- crucial for improving fuel efficiency and reducing emissions. The ramp-up in production rates of key aircraft programs, such as the Airbus A320 family and Boeing 737 Max, along with the introduction of new models such as the COMAC C919, has significantly boosted the demand for honeycomb core materials.

Foams are anticipated to grow substantially during the forecast period due to their increased utilization in the automotive industry. These core materials offer properties such as high strength-to-weight ratio, low density, noise reduction, and impact resistance. Foams can be manufactured from various materials such as polyurethane, polystyrene, phenolic, and more. With the increasing emphasis on fuel efficiency and emission reduction, manufacturers have adopted these lightweight materials to produce more efficient vehicles. These core materials are used in various automotive components, including body panels and interior parts, to reduce weight without compromising strength.

Skin Insights

Carbon Fiber Reinforced Polymer (CFRP) registered the largest market share in 2023. These polymers considerably outperform glass and other fibers in terms of tensile strength, low thermal expansion, and high stiffness. Their inherent properties such as high rigidity, fatigue resistance, thermal stability, and corrosion resistance make them a preferred choice for manufacturers. These foams are extensively used in aircraft components such as fuselages, wings, and interior structures as they help reduce the overall weight of the aircraft, leading to improved fuel efficiency and reduced emissions. The ongoing production of new aircraft models and the replacement of older fleets with more fuel-efficient planes are projected to boost the demand for CFRP.

Glass Fiber Reinforced Polymer (GFRP) is expected to grow at a CAGR of 7.7% during the forecast period. Fiberglass is a robust, lightweight, and strong material that is cost-effective and sturdier than carbon fiber, thereby witnessing increased usage in composite manufacturing. These polymers are extensively used in reinforcing concrete structures, bridges, and buildings with high tensile strength and resistance to corrosion. This makes it suitable for use in harsh environments, such as coastal areas, where traditional materials including steel degrade faster. In addition, technological advancements such as the development of new resin systems and improved fabrication techniques have made GFRP more accessible and attractive to a wider range of industries.

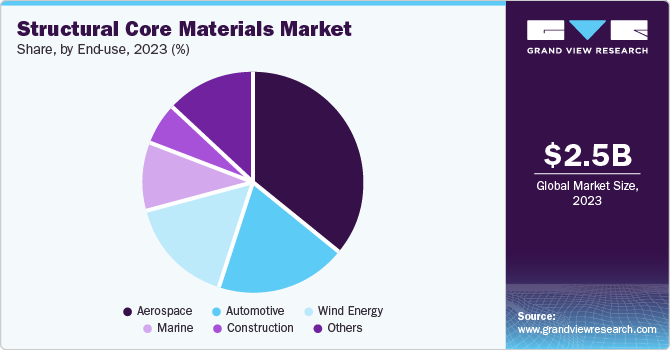

End-use Insights

Aerospace held a dominant share of 36.4% in 2023 primarily due to the alarming need for fuel efficiency and emission reduction. Structural core materials, such as honeycomb and foam cores, are extensively used in the construction of aircraft components including fuselages, wings, and interior panels. These materials help reduce the overall weight of the aircraft, leading to significant fuel savings and lower carbon emissions. Moreover, air travel between major business hubs has been consistently increasing over the years and this trend is expected to continue over the forecast period. In addition, technological innovations such as the development of new composite materials and improved fabrication techniques have made these materials favorable in the aerospace industry. For instance, the use of advanced resin systems and automated manufacturing processes has improved the strength-to-weight ratio and durability of core materials.

Wind energy is expected to grow at the fastest CAGR over the forecast period. Structural core materials, known for their lightweight and high-strength properties, are essential in the construction of wind turbine blades and other components, contributing to the efficiency and durability of wind energy systems. As a result, they are now increasingly being used in windmills for wind energy generation. They are used in both traditional and offshore windmills and this trend is expected to continue over the forecast period. The use of lightweight cores enables blade manufacturers to achieve increased quality levels and reduced cycle times with the help of an optimized infusion process.

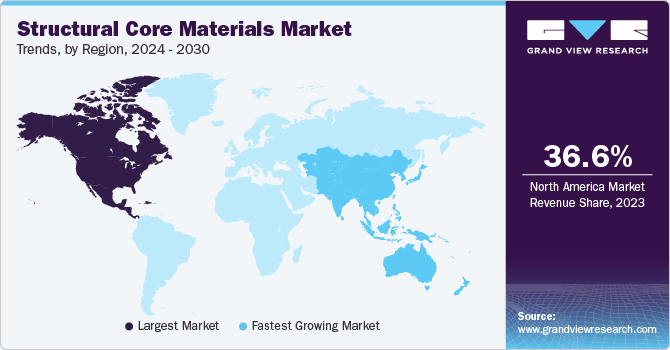

Regional Insights

The North America structural core materials dominated the market with a share of 36.6% in 2023 owing to the region’s industrial landscape and technological advancements. The presence of major aerospace and automobile industries in the region has led to an increased demand for structural core materials for the manufacturing of aircraft components such as wings, control surfaces, fuselages, and more. Furthermore, increased focus on renewable energy has led to growth in the wind and solar energy industry resulting in increased demand for these materials.

U.S. Structural Core Materials Market Trends

The U.S. structural core materials market is primarily propelled by the aerospace sector. The country is home to major aerospace manufacturers including Boeing and Lockheed Martin, which continuously draw innovations to improve fuel efficiency and reduce emissions. Structural core materials, such as honeycomb and foam cores, have been extensively used in aircraft components to reduce weight and enhance performance. Furthermore, increased applications of structural core materials for manufacturing of automotive parts have aided in the market growth. The rise of electric vehicles (EVs) has propelled the demand for these materials, as they help enhance battery efficiency and overall vehicle performance.

Asia Pacific Structural Core Materials Market Trends

The Asia Pacific (APAC) structural core materials market accounted for 34.3% of the global revenue share in 2023. The market growth can be credited to rapid urbanization and economic growth in countries such as China, India, and Japan, leading to rapid growth in the construction and automotive sectors. Structural core materials have been widely used in building applications such as sandwich panels, doors, and flooring, providing enhanced strength and thermal insulation, aligning with energy-efficient building codes. Additionally, rapid growth of the aerospace, automotive, and wind energy industries in the region, most notably in India and China, is expected to contribute significantly to regional growth.

Europe Structural Core Materials Market Trends

The structural core materials in Europe held 17.1% of the market share in 2023. Europe has witnessed a robust surge in wind energy installations, driven by government incentives and policies promoting clean energy. Structural core materials are essential in the construction of wind turbine blades, which require materials that are lightweight, strong, and durable.

Key Structural Core Materials Company Insights

The global structural core materials market is intensely competitive with similar product portfolios and end use industries. Some of the major companies in the structural core materials market DIAB International AB, Evonik Industries AG, Gurit Services AG, and others. Companies have focused on expansion of product portfolio with the help of heavy investments in research and development due to fierce competition among the companies offering similar products.

- DIAB International AB is a global leader in the development and production of high-performance core materials for composite structures. The company specializes in providing lightweight solutions that enhance the strength, durability, and sustainability of products across various industries, including marine, wind energy, aerospace, and transportation.

Key Structural Core Materials Companies:

The following are the leading companies in the structural core materials market. These companies collectively hold the largest market share and dictate industry trends.

- DIAB International AB

- Evonik Industries AG

- Gurit Services AG

- Schweiter Technologies AG

- Hexcel Corporation

- ARMACELL

- Changzhou Tiansheng New Materials Co. Ltd.

- The Gill Corporation

- EURO-COMPOSITES

- SABIC

Structural Core Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.64 billion

Revenue forecast in 2030

USD 3.84 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, skin, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Brazil, Saudi Arabia.

Key companies profiled

DIAB International AB; Evonik Industries AG; Gurit Services AG; Schweiter Technologies AG; Hexcel Corporation; ARMACELL; Changzhou Tiansheng New Materials Co. Ltd.; The Gill Corporation; EURO-COMPOSITES; SABIC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

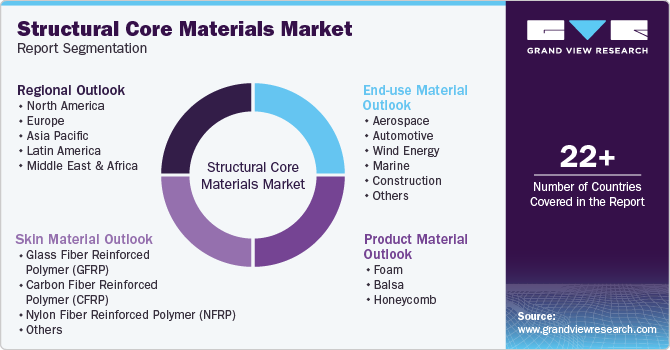

Global Structural Core Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global structural core materials market report based on product, skin, end-use, and region.

-

Product Material Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Foam

-

Balsa

-

Honeycomb

-

-

Skin Material Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Glass fiber reinforced polymer (GFRP)

-

Carbon fiber reinforced polymer (CFRP)

-

Nylon fiber reinforced polymer (NFRP)

-

Others

-

-

End-use Material Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Aerospace

-

Automotive

-

Wind Energy

-

Marine

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.