- Home

- »

- Medical Devices

- »

-

Structural Heart Devices Market Size, Industry Report, 2033GVR Report cover

![Structural Heart Devices Market Size, Share & Trends Report]()

Structural Heart Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Surgical Aortic Valve Replacement, Transcatheter Aortic Valve Replacement, Mitral Repair, Left Atrial Appendage Closure), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-785-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Structural Heart Devices Market Summary

The global structural heart devices market size was estimated at USD 16.13 billion in 2024 and is projected to reach USD 50.99 billion by 2033, growing at a CAGR of 13.5% from 2025 to 2033. Rising valvular heart diseases drive the growth of the market.

Key Market Trends & Insights

- The North America structural heart devices market dominated the global market in 2024, accounting for the largest revenue share of 52.5%.

- The Canada structural heart devices market is anticipated to register the fastest growth rate during the forecast period.

- In terms of type segment, the TAVR (Transcatheter Aortic Valve Replacement) segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.13 Billion

- 2033 Projected Market Size: USD 50.99 Billion

- CAGR (2025-2033): 13.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to an Oxford Academic article published in January 2025, the global age-standardized prevalence of cardiovascular disease stands at approximately 7,179 cases per 100,000 individuals, highlighting the substantial and persistent global burden of heart-related conditions. The rising prevalence of cardiovascular conditions highlights the need for timely interventions. Structural heart devices are key in managing valvular and congenital heart diseases. With a focus on early diagnosis and personalized care, technologies such as transcatheter valves and septal closure devices are improving outcomes and minimizing the need for invasive surgeries.

The rising prevalence of cardiovascular diseases (CVDs) in the U.S., including conditions such as arrhythmias and heart failure, is significantly driven by several key factors. A sedentary lifestyle has become increasingly common, with many individuals engaging in insufficient physical activity, which contributes to obesity and related health issues. According to the America Heart Association, in January 2024, the U.S. reported 931,578 deaths linked to cardiovascular disease, nearly 3,000 higher than the previous year, with the age-adjusted death rate climbing to 233.3 per 100,000 people, reflecting a 4.0% increase. These statistics underscore a growing need for advanced treatment options, such as transcatheter heart valves and left atrial appendage closure devices, to manage high-risk patients and reduce mortality linked to structural heart conditions.

Key Facts on Cardiovascular Disease and Related Events in the U.S. (2024)

Statistic

Value

Total CVD deaths per day

2,552

Deaths from heart disease per day (including heart attacks)

1,905

Average time between heart attacks

Every 40 seconds

New heart attacks each year

Approximately 605,000

Recurrent heart attacks each year

Approximately 200,000

Silent heart attacks

Estimated 170,000

Average age at first heart attack (males)

65.6 years

Average age at first heart attack (females)

72.0 years

Source: American Heart Association, Inc. in January 2024 & GVR

Increasing initiatives by the government and research bodies to advance structural heart interventions drives the market's growth. For instance, in September 2023, the National Heart, Lung, and Blood Institute (NHLBI) awarded a USD 650,000 research grant to the University of California, Irvine to develop a novel echocardiographic imaging system called V‑Echo PIV. This volumetric flow-mapping technology aims to provide noninvasive and highly accurate quantification of mitral regurgitation severity. Improving diagnostic capabilities for mitral valve disorders directly contributes to early detection and appropriate referral for device-based interventions such as repair or replacement. These initiatives by U.S. government bodies reflect a broader trend of strengthening research and innovation to expand the structural heart devices market through more accurate diagnostics and enhanced procedural guidance.

Technologically advanced products launched by key players drive the market's growth. For instance, in October 2024, Medtronic secured CE mark approval for its Evolut FX+ transcatheter aortic valve replacement (TAVR) system to treat patients with symptomatic severe aortic stenosis. This European clearance follows earlier approval from the U.S. Food and Drug Administration in March. The Evolut FX+ system introduces significant design upgrades to improve coronary reaccess. Notably, it features coronary access windows approximately four times larger than those in previous Evolut models. This design enhancement offers better catheter maneuverability, especially critical for patients needing future coronary procedures. Physicians are increasingly focused on long-term patient care as TAVR becomes more common in younger populations. Improved coronary accessibility supports rapid intervention in urgent cases such as heart attacks, potentially improving patient outcomes and procedural efficiency.

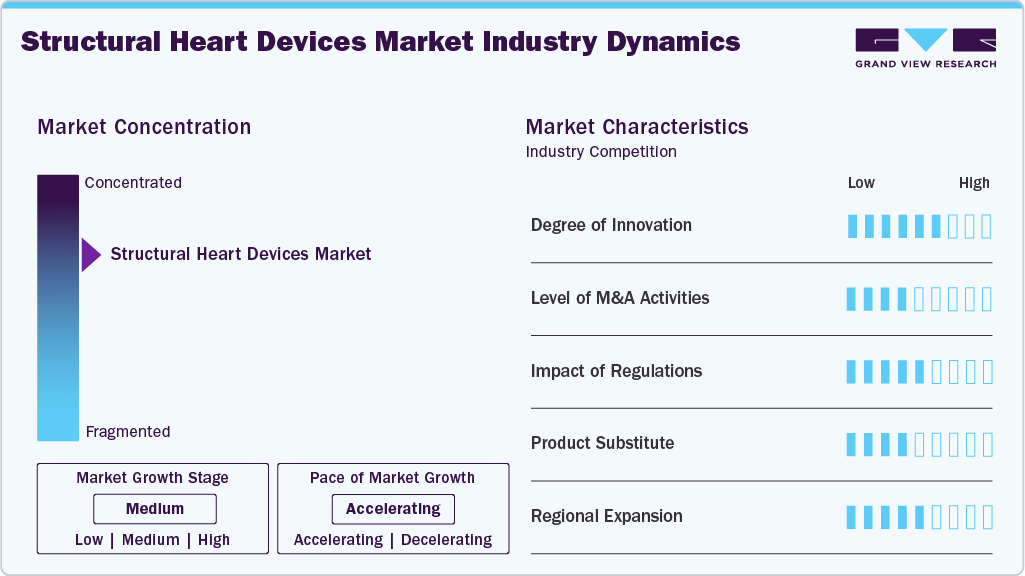

Market Concentration & Characteristics

The global structural heart devices market is advancing rapidly in the mitral repair segment, particularly in minimally invasive annuloplasty solutions. For instance, in January 2024, CardioMech AS closed a USD 13 million funding round, building on earlier investment to advance its MVRS platform toward first-in-human use in the U.S. The device leverages transcatheter chordal replacement technology to replicate surgical repair outcomes, offering potential benefits for younger and higher-risk patients who might otherwise face watchful waiting or major surgery.

Key players in the structural heart devices industry, including Boston Scientific Corporation, Medtronic, and Edwards Lifesciences Corporation, actively engage in mergers and acquisitions to enrich their structural heart portfolios, support innovation, and gain geographical access. For instance, in September 2024, Edwards Lifesciences revealed plans to acquire JenaValve Technology and Endotronix in a combined deal valued at around USD 1.2 billion, aiming to strengthen its structural heart portfolio by advancing its transcatheter valve and hemodynamic monitoring technologies.

Regulatory bodies like the FDA, EMA, and PMDA ensure the safety and efficacy of structural heart devices through strict clinical and post-market requirements. While this can extend approval timelines, programs such as the FDA’s Breakthrough Devices accelerate access to advanced transcatheter solutions, balancing innovation with patient safety.

There are no direct substitutes for structural heart devices. While medications can manage symptoms, they do not correct structural defects. Less invasive treatments such as surgical repair may help in early cases, but in severe conditions such as advanced valve stenosis or regurgitation, structural heart devices remain the only practical solution.

Leading players in the structural heart devices market such as Edwards Lifesciences, Medtronic, and Abbott are accelerating their presence in emerging markets with growing cardiovascular needs. These companies invest in local infrastructure, forging distribution partnerships, and aligning product portfolios with regional clinical practices and regulations across Asia Pacific, Latin America. The MEA to drive adoption and accessibility.

Type Insights

By Type, the TAVR (Transcatheter Aortic Valve Replacement) segment dominated the market with the largest revenue share of 53.4% in 2024. Increasing cardiovascular disease, government initiatives, and technological advancements drive the market's growth. For instance, in December 2024, Sahajanand Medical Technologies (SMT) took a significant step forward in strengthening its international footprint by launching its Hydra Transcatheter Aortic Valve Replacement (TAVR) system in Mexico. This strategic expansion reflects the company’s vision to bring advanced, minimally invasive cardiac therapies to patients across global markets. The introduction of the Hydra TAVR system is a part of SMT’s ongoing efforts to provide innovative and accessible solutions for the treatment of structural heart diseases, particularly severe aortic stenosis.

The Surgical Aortic Valve Replacement (SAVR) segment is anticipated to grow significantly over the forecast period. Rising CVD cases, increasing geriatric population, and technological advancements drive the market growth. For instance, in March 2025, Corcym achieved a notable milestone with the U.S. FDA approval of an enhanced version of its Perceval Plus sutureless surgical aortic valve, marking a significant advancement in surgical heart valve technology. This newly redesigned valve incorporates several vital improvements to optimize the implantation process and long-term valve performance. Key enhancements include the integration of laser-cut leaflets, which offer greater precision and uniformity in leaflet structure, and refined thread holes that contribute to improved surgical handling and durability. Moreover, the valve utilizes a zero-pressure fixation process, a novel technique that minimizes mechanical stress on the valve leaflets during manufacturing. This approach helps preserve leaflet integrity and may enhance valve longevity and performance.

Regional Insights

North America dominated the structural heart devices market with a revenue share of 52.5% in 2024, driven by rising CVD disease, increasing heart valve cases, and government funding and awareness campaigns, fueling growth in the prosthetic heart valve market. According to the American Heart Association, Inc., article published in October 2024, the CDC awarded USD 8.4 million in grants to the American Heart Association to launch national campaigns focused on heart valve disease education. These initiatives will include educational outreach targeting patients, healthcare providers, and women, an underserved high-risk group. The program stems from the bipartisan CAROL Act, signed into law in December 2022, to prioritize HVD research and awareness.

U.S. Structural Heart Devices Market Trends

The U.S. dominated North America's structural heart devices market in 2024. Increasing CVD disease, rising heart valve cases, and technologically advanced products offered by the key player drive the market's growth. For instance, in October 2024, the announcement of findings from Edwards Lifesciences' EARLY TAVR Trial assessed outcomes in patients with asymptomatic severe aortic stenosis. The study revealed that early transcatheter aortic valve replacement (TAVR) significantly reduced adverse events reported in 26.8% of treated patients compared to 45.3% under clinical monitoring, over a median follow-up period of 3.8 years. These results, presented at the TCT symposium and published in The New England Journal of Medicine, underscore the growing preference for early intervention and the continued clinical validation of TAVR technologies across the region.

Europe Structural Heart Devices Market Trends

Europe's structural heart devices market is expected to grow significantly over the forecast period. Increasing CVD prevalence, rising heart valve cases, and technological advancement drive the market's growth. For instance, in October 2024, Medtronic received CE certification for its Evolut FX+ Transcatheter Aortic Valve Replacement (TAVR) system. This latest iteration introduces significantly larger coronary access windows, four times wider than those in earlier models, enabling easier future catheter-based interventions and improving long-term patient care and follow-up treatment strategies.

The structural heart devices industry in the UK is expected to grow significantly during the forecast period. Rising premature mortality associated with cardiovascular diseases (CVD) in the UK drives the growth of the market. According to a Guardian News & Media Limited article published in January 2024, the UK recorded a premature death rate of 80 per 100,000 individuals due to CVD in 2022, signaling a growing public health concern. This trend has intensified the demand for advanced cardiac interventions, including structural heart devices such as transcatheter and surgical valve replacements. The increasing burden of early CVD-related deaths is prompting healthcare providers and policymakers to adopt innovative treatment technologies that offer improved outcomes and reduce the need for invasive procedures, thereby boosting market growth.

Italy structural heart devices industry is expected to grow significantly during the forecast period. Increasing CVD cases and technological advancement drives the growth of the market. According to a Frontiers article published in April 2024, the incidence of CVD in Italy is approximately 12.9% nearly double the global average of 6.6%. This elevated disease burden is driven by lifestyle and metabolic risk factors, including high rates of smoking, physical inactivity, and poor adherence to the traditional Mediterranean diet. In addition, the widespread presence of hypertension, dyslipidemia, and obesity further accelerates the onset of structural heart conditions. These trends fuel demand for advanced cardiac interventions, such as transcatheter and surgical valve replacements.

Germany structural heart devices market is expected to grow significantly during the forecast period. Increasing CVD cases and heart surgical procedures drive the market's growth. According to a Georg Thieme Verlag KG article, in 2022, the number of heart surgeries reached 93,913, 2022 marking a slight increase from 92,838 procedures performed in 2021. Although the rise is modest, it reflects a steady and consistent demand for cardiac interventions. This trend underscores the growing need for advanced structural heart devices and technologies to support effective treatment of cardiovascular diseases, ensuring improved patient outcomes and addressing the evolving burden of heart-related conditions.

Asia Pacific Structural Heart Devices Market Trends

The Asia Pacific structural heart devices industry is expected to grow fastest over the forecast period. Increasing CVD cases, rising geriatric population, and technological advancement drive the market's growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, the Asia Pacific region has around 697 million individuals aged 60 and above, accounting for nearly 60% of the global elderly population. This significant and rapidly growing geriatric segment is a major contributor to the rising demand for structural heart devices, as age-related cardiovascular conditions, particularly heart valve diseases, become increasingly common. Moreover, with expanding healthcare infrastructure, rising investments in cardiac care, and improved access to minimally invasive treatment options, the region is witnessing accelerated adoption of transcatheter and surgical heart valve interventions.

China's structural heart devices industry is expected to grow significantly over the forecast period. Rising CVD prevalence, increasing heart valve cases, rising healthcare expenditure, and technological advancement drive the market's growth. For instance, in December 2024, Chinese company MicroPort CardioFlow received marketing approval from South Korea’s Ministry of Food and Drug Safety (MFDS) for its second-generation VitaFlow Liberty Transcatheter Aortic Valve and Retrievable Delivery System. This advanced TAVI platform, featuring a hybrid-density self-expanding frame, bovine pericardial leaflets, and a dual-layer PET sealing skirt, highlights China's growing capability to deliver high-precision and minimally invasive cardiovascular solutions. Such international recognition not only boosts the credibility of Chinese cardiac technologies but also signals strong potential for broader adoption and regulatory success within the domestic market.

Japan structural heart devices market is expected to register the significant growth rate over the forecast period. Increasing CVD cases, rising healthcare expenditure, and strategic initiatives by the key player drive the market's growth. For instance, in October 2023, Meril Life Sciences entered into an exclusive 10-year distribution agreement with Japan Lifeline to promote its Myval Octacor transcatheter heart valve in Japan, contingent upon regulatory approval from the Pharmaceuticals and Medical Devices Agency (PMDA). This advanced balloon-expandable TAVR valve offers a vast size matrix to accommodate a broader patient base and utilizes a distinct octagonal cell frame to enhance placement accuracy during implantation.

India structural heart devices market is expected to register the significant growth rate over the forecast period. Increasing CVD burden in India is driving the growth of the market. According to the Economic Times article published in February 2024, India experiences a notably high burden of cardiovascular disease (CVD), with an age-standardized mortality rate of 272 deaths per 100,000 people well above the global average of 235 per 100,000. This disparity highlights the increasing prevalence of CVD within the country. It underscores the critical need for enhanced arrhythmia monitoring and management technologies to address better the escalating cardiovascular health challenges affecting the population.

Latin America Structural Heart Devices Market Trends

The Latin America structural heart devices industry is witnessing a gradual shift toward minimally invasive procedures, driven by rising adoption of transcatheter valve technologies. Growing awareness, improved healthcare infrastructure, and increased cardiovascular care investment support market expansion. Countries such as Brazil and Argentina see rising demand for TAVR and mitral repair solutions, reflecting broader regional efforts to modernize cardiac treatment approaches.

The Brazilian structural heart devices market is witnessing steady growth, driven by the country’s high prevalence of cardiovascular diseases, and government initiatives are driving the market growth. For instance, in September 2023, the Brazilian government, in collaboration with institutions such as Mount Sinai and the Brazilian Clinical Research Institute (BCRI), launched several initiatives to enhance care and research for cardiovascular disease (CVD) patients. Under this partnership, Mount Sinai and BCRI signed a memorandum of understanding to establish joint international clinical trials, research programs, and educational exchanges focused on preventing and treating heart disease. The initiative also includes training for Latin American physicians in the U.S., covering areas like interventional cardiology and structural heart therapies, which aims to help elevate standards of care within Brazil.

Middle East and Africa Structural Heart Devices Market Trends

The market for structural heart devices in the Middle East and Africa is witnessing significant growth, driven by increasing cardiovascular disease prevalence, improving access to healthcare infrastructure, and rising awareness of minimally invasive cardiac interventions. Countries such as the UAE and Saudi Arabia are investing in advanced cardiac care centers, boosting demand for transcatheter therapies and next-generation valve repair systems. In addition, collaborations with global medtech firms and growing medical tourism in select regions further support the adoption of structural heart technologies across the MEA market.

The structural heart devices industry in Saudi Arabia is anticipated to grow considerably during the forecast period. Increasing CVD cases and technological advancement drives the growth of the market. According to the article published by BMC Cardiovascular Diseases in March 2024, Cardiovascular disease (CVD) represents a growing health challenge in Saudi Arabia, with a recent national survey reporting a prevalence of 1.6% among individuals aged 15 and older, exceeding the global average of roughly 235 per 100,000. This translates to approximately 236,800 adults diagnosed with CVD, with rates notably higher in men (1.9%) compared to women (1.4%). The close association between CVD and structural heart defects, especially in older people, the demand for advanced diagnostic tools and structural heart interventions such as transcatheter valves, mitral repair devices, and septal occluders is expected to increase significantly in Saudi Arabia.

Key Structural Heart Devices Company Insights

Key structural heart devices industry participants focus on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and business footprints.

Key Structural Heart Devices Companies:

The following are the leading companies in the structural heart devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Medtronic

- Edwards Lifesciences Corporation

- Abbott Laboratories

- ST. JUDE MEDICAL

- Biomerics

- Comed BV

- LivaNova PLC

- JenaValve Technology, Inc.

- CardioKinetix

Recent Developments

-

In April 2025, UPMC’s Heart and Vascular Institute in Central Pa. was the first in Pennsylvania to perform a valve-in-valve TAVR using a newly FDA-approved leaflet-modification device designed to reduce the risk of coronary obstruction in high-risk patients.

-

In April 2025, LUMA Vision secured FDA clearance for its VERAFEYE platform, offering real-time 360° catheter navigation support for structural heart and electrophysiology procedures.

-

In November 2024, Pi-Cardia’s innovative Shortcut system received De Novo authorization from the U.S. Food and Drug Administration (FDA). This novel device is designed to support valve-in-valve Transcatheter Aortic Valve Replacement (TAVR) procedures by addressing a critical coronary obstruction complication.

Structural Heart Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.57 billion

Revenue forecast in 2033

USD 50.99 billion

Growth rate

CAGR of 13.5% from 2025 to 2033

Actual data

2021 - 2023

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boston Scientific Corporation; Medtronic; Edwards Lifesciences Corporation; Abbott Laboratories; ST. JUDE MEDICAL; Biomerics; Comed BV; LivaNova PLC; JenaValve Technology, Inc.; CardioKinetix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Structural Heart Devices Market Report Segmentation

This report forecasts revenue growth and analyzes the latest trends in each sub-segments from 2021 to 2033 at the global, regional, and country levels. For this report, Grand View Research has segmented the global structural heart devices market report based on type and region:

-

Type Outlook (Revenue USD Million, 2021 - 2033)

-

TAVR (Transcatheter Aortic Valve Replacement)

-

SAVR (Surgical Aortic Valve Replacement)

-

Mitral Repair (Annuloplasty)

-

LAAC (Left Atrial Appendage Closure)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global structural heart devices market size was estimated at USD 16.13 billion in 2024 and is expected to reach USD 18.57 billion in 2025.

b. The global structural heart devices market is expected to grow at a compound annual growth rate of 13.5% from 2024 to 2030 to reach USD 50.99 billion by 2030.

b. North America dominated the structural heart devices market with a share of 52.5% in 2024. This is attributable to the increasing demand for minimally invasive procedures and the strategic presence of major players.

b. Some key players operating in the structural heart market include Boston Scientific Corporation; Medtronic; Edwards Lifesciences Corporation; Abbott; Biomerics; Comed BV; LivaNova PLC; JenaValve Technology, Inc.; and CardioKinetix

b. Key factors that are driving the market growth include rising prevalence of CVD diseases and favoring health reimbursement policies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.