- Home

- »

- Medical Devices

- »

-

Subcutaneous Drug Delivery Devices Market Report, 2030GVR Report cover

![Subcutaneous Drug Delivery Devices Market Size, Share & Trends Report]()

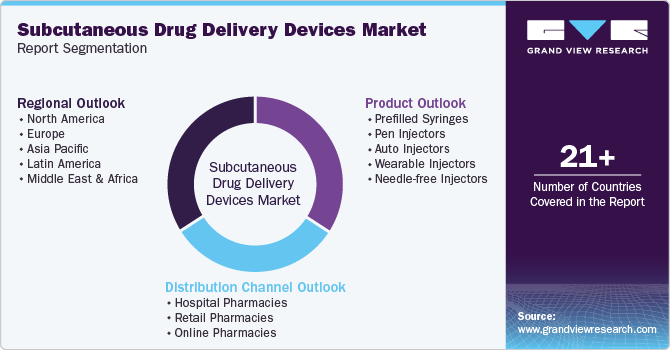

Subcutaneous Drug Delivery Devices Market Size, Share & Trends Analysis Report By Product (Prefilled Syringes, Pen Injectors), By Distribution Channel (Retail Pharmacies, Online Pharmacies), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-039-7

- Number of Report Pages: 170

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

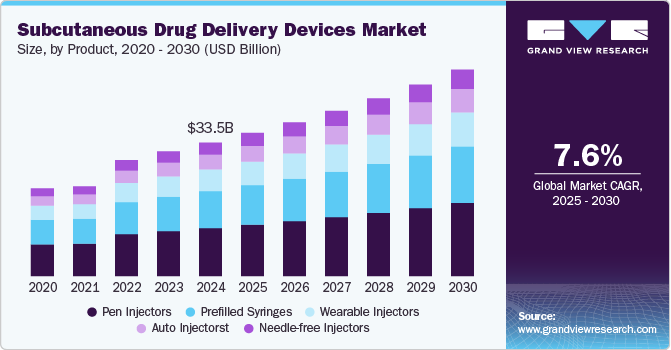

The global subcutaneous drug delivery devices market size was estimated at USD 33.5 billion in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The demand for advanced minimally invasive drug delivery devices has surged due to the increasing prevalence of diabetes and cardiovascular diseases (CVD), along with the rise in biologic drug development. According to the International Diabetes Federation (IDF), the global diabetic population is projected to grow by 48% annually from 2017 to 2045. IDF notes a significant increase in diabetes cases in low and middle-income countries compared to developed nations.

In addition, the World Heart Federation reports that adults with type 2 diabetes have a heightened risk of developing CVD compared to non-diabetics.

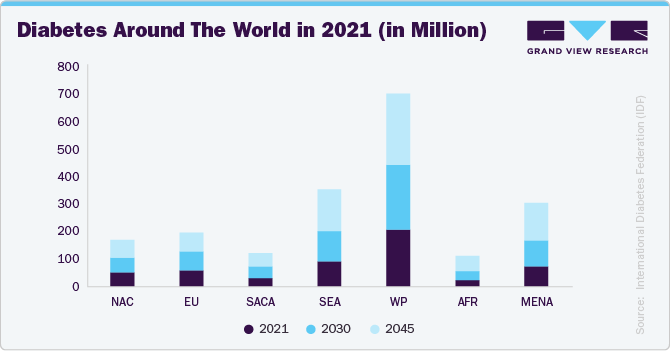

The adoption of drug-device delivery systems for managing chronic diseases such as diabetes, cardiovascular diseases, multiple sclerosis, and asthma can significantly alleviate healthcare burdens. According to the International Diabetes Federation (IDF), an estimated 537 million adults aged 20 to 79 had diabetes in 2021, projected to increase to 783 million by 2045. IDF notes that 90% of people with diabetes are at risk of type 2 diabetes. Three in four adults in low- and middle-income countries suffer from diabetes, as per IDF. The diagram below illustrates the regional distribution of the diabetic population:

To tackle the increasing diabetes burden, companies are executing strategic initiatives to develop and bring to market prefilled syringes like insulin autoinjectors. For instance, in December 2022, Biocorp received FDA 510(k) clearance for its Mallya device for diabetes treatment. This device also holds CE mark approval in Europe as a Class IIb medical device. These regulatory approvals encourage new entrants to innovate drug-device combination products and broaden their market presence.

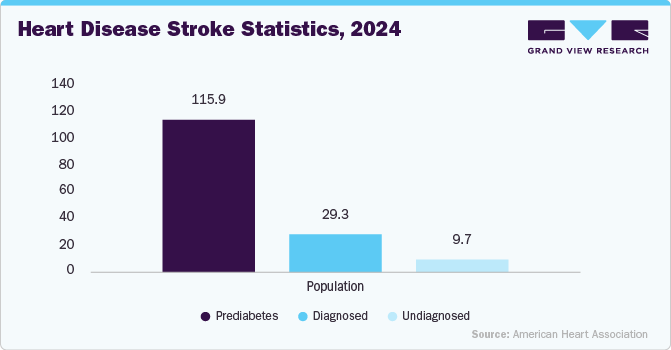

The rising elderly population has heightened the need for subcutaneous drug delivery devices for diagnosing and treating various chronic health conditions. Studies indicate that individuals aged 65 and older face increased risks of serious ailments such as heart disease, asthma, respiratory infections, COPD, diabetes, and other disorders, as aging weakens the immune system. Consequently, the growing elderly demographic and its burden of chronic illnesses are driving hospitalization rates. According to two American Heart Association data published in June 2024, researchers predict that by 2050, the prevalence of cardiovascular disease will rise to 15% of the population, up from 11.3% in 2020, excluding individuals with high blood pressure. This includes a projected doubling of stroke rates. The expressions that support our sayings are,

"The last decade has seen a surge of cardiovascular risk factors such as uncontrolled high blood pressure, diabetes, and obesity, each of which raises the risks of developing heart disease and stroke; it is not surprising that an enormous increase in cardiovascular risk factors and diseases will produce a substantial economic burden. The last of the Baby Boomers will hit 65 in 2030, so about 1 in 5 people in the U.S. will be over 65, outnumbering children for the first time in U.S. history. Since cardiovascular risk increases with age, the aging population increases the total burden of cardiovascular disease in the country. By 2060, more than two-thirds of children will belong to underserved, disenfranchised populations, which traditionally have higher rates of cardiovascular disease and risk factors."

- Dr. Dhruv S. Kazi, vice chair of the advisory writing group

The increased use of subcutaneous drug delivery devices has reduced dosage errors and minimized needlestick injuries. Devices with simple drug administration protocols enhance treatment adherence. According to the Annals of Internal Medicine, about half of patients who are prescribed chronic medications stop taking them within the first year, leading to significant healthcare consequences: 125,000 deaths, 10% of hospitalizations, and annual costs of USD 17 billion in the U.S. Therefore, pain-free subcutaneous drug delivery devices can effectively manage numerous chronic medical conditions.

Needle-free injectors are promising alternatives to traditional drug delivery methods, eliminating needlestick injuries and reducing treatment costs. Annually, the Occupational Safety and Health Administration reports 384,000 needlestick injuries and sharps-related incidents among healthcare personnel in the U.S. PATH Vaccine Resource Library surveys highlight needlestick injuries causing 21 million hepatitis B, 260,000 HIV, and 2 million hepatitis C infections, contributing to 1.3 million premature deaths worldwide.

The demand for pain-free drug delivery options is driving the market growth. For instance, insulin has to be administered into the diabetic patient's body regularly through injections, which can lead to pain and an increased risk of other chronic diseases. Thus, to reduce pain and other risks, the adoption of subcutaneous drug delivery devices, such as pen needles, has increased significantly over recent years. These factors drive the market growth over the forecast period.

Patients are expressing significant concern regarding the control of their healthcare and self-administering of their medications. Subcutaneous drug delivery devices offer a convenient and self-administered drug delivery method, allowing patients to manage their pain treatment without the need for assistance from healthcare professionals. Thus, a rising preference for self-administration of drugs for better patient compliance is expected to boost the market over the coming years.

Market Concentration & Characteristics

The market for subcutaneous drug delivery devices exhibits moderate industry concentration with a mix of established players and emerging companies. Key characteristics include a focus on technological advancements such as smart connectivity and biocompatible materials to enhance usability and patient outcomes. The market is driven by the increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders, prompting demand for efficient drug delivery solutions. Regulatory approvals play a critical role in market entry, influencing competitive dynamics. Major players like Insulet Corporation, Ypsomed AG, and others dominate through extensive R&D investments and strategic partnerships, aiming to expand their market presence globally.

The subcutaneous drug delivery devices industry is characterized by a high degree of innovation driven by advancements in technology and increasing demand for patient-centric solutions. Innovations include the integration of smart features for remote monitoring and personalized therapy, the development of biocompatible materials to enhance safety and efficacy, and the miniaturization of devices for ease of use. For instance, in May 2024, the BD Libertas Wearable Injector, a novel device, is designed for self-administration of subcutaneous injections at home or in clinical settings. It enhances patient experience by removing assembly and filling requirements and includes automated needle insertion and retraction, ensuring a user-friendly experience.

Regulations significantly impact the subcutaneous drug delivery devices industry by ensuring product safety, efficacy, and quality. Stringent regulatory frameworks, such as FDA approvals in the U.S. and CE marking in Europe, govern market entry and compliance standards. These regulations necessitate extensive clinical trials, documentation of manufacturing processes, and ongoing post-market surveillance. Compliance challenges can delay product launches and increase costs, while adherence assures market confidence and patient safety. Regulatory landscapes, particularly biologics and combination products, further shape industry dynamics, influencing innovation paths and market strategies among manufacturers.

Mergers and acquisitions in the subcutaneous drug delivery devices industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in August 2023, Novo Nordisk A/S acquired Inversago Pharma to develop new treatments for obesity, diabetes, and other metabolic conditions. The deal is a cash deal valued at up to 1.075 billion US dollars, subject to meeting specific targets.

In the subcutaneous drug delivery devices industry, product substitutes refer to alternative technologies or methods that serve similar therapeutic purposes. These substitutes may include oral medications, intravenous (IV) therapies, or other non-invasive drug delivery systems. Factors influencing the choice of substitutes include patient preference, efficacy, safety, and cost-effectiveness compared to subcutaneous devices. Despite advancements in alternative delivery methods, subcutaneous devices remain preferred for their direct delivery, patient convenience, and reduced risk of systemic side effects. Market dynamics, regulatory approvals, and technological innovations continually shape the landscape of substitutes in the industry.

Regional expansion in the subcutaneous drug delivery devices industry involves strategic initiatives by companies to penetrate new geographic markets beyond their existing presence. This expansion is driven by opportunities in emerging economies with increasing healthcare infrastructure and rising chronic disease burden. Companies focus on adapting products to local regulatory requirements, healthcare practices, and patient needs. For instance, in April 2023, Ypsomed is building a new production facility in the Changzhou National Hi-tech District, China, with an investment of over USD 38.97 million. Set to begin operations in the second half of 2024; the plant will manufacture injection systems to meet the growing demand in the Chinese market. This expansion aims to shorten supply chains and reduce carbon footprint by producing locally.

Product Insights

The pen injectors segment held the largest revenue share of 36.0% in 2024 due to their convenience, ease of use, and ability to improve patient compliance. These devices are widely used for administering insulin in diabetes management, as well as for other chronic conditions. The rising prevalence of chronic diseases, coupled with advancements in pen injector technology, further drives market growth. In addition, regulatory approvals and the increasing demand for home-based treatments contribute to the segment's leading market position. For instance, in February 2023, Phillips-Medisize, a subsidiary of Molex and a leader in designing and manufacturing drug delivery, diagnostic, & MedTech devices, expanded its product portfolio with the introduction of a disposable pen injector. This expansion shows the continuous commitment of market players to innovate and broaden their product portfolios in response to changing market needs.

The auto injectors segment is anticipated to witness the fastest CAGR over the forecast period. These devices are used by patients to self-administer medications prescribed for various conditions, such as autoimmune diseases, allergic reactions, and hormone deficiencies. With the growing demand for these devices, market players are scaling up their production and supply to meet the rising market needs. For instance, in September 2023, Ypsomed signed a long-term deal with Novo Nordisk to supply autoinjectors for drugs treating metabolic conditions. Novo Nordisk will invest significantly in expanding Ypsomed's manufacturing capacity. These autoinjectors will be available by 2025 for Novo's new GLP-1 drugs, currently in clinical trials. This deal highlights the growing demand in the obesity treatment market.

Distribution Channel Insights

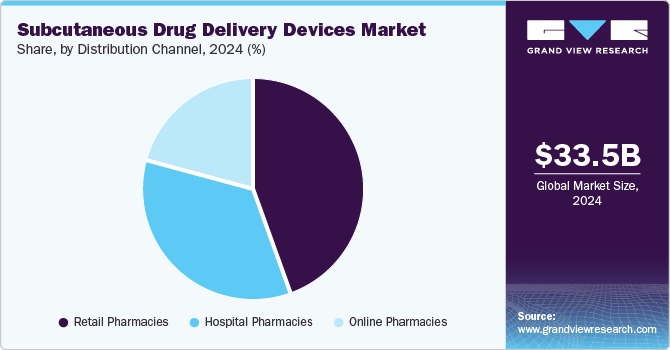

The retail pharmacies segment held the largest market share of 44.4% in 2024. This dominance is attributed to the increasing availability and accessibility of subcutaneous drug delivery devices in retail pharmacies. Retail pharmacies offer a convenient point of purchase for patients managing chronic conditions, such as diabetes, who require regular medication. In addition, the personalized assistance and support provided by pharmacists enhance patient compliance and overall treatment outcomes, contributing to the segment's significant market share.

The online pharmacies segment is anticipated to register the fastest CAGR over the forecast period. This growth is driven by the increasing preference for the convenience of purchasing medications online, especially among patients with chronic conditions. Online pharmacies offer discreet, home-delivered access to a wide range of subcutaneous drug delivery devices. The expansion of digital health services, combined with competitive pricing and the availability of detailed product information, further boosts the segment’s market share, catering to the needs of a tech-savvy patient population seeking efficient healthcare solutions.

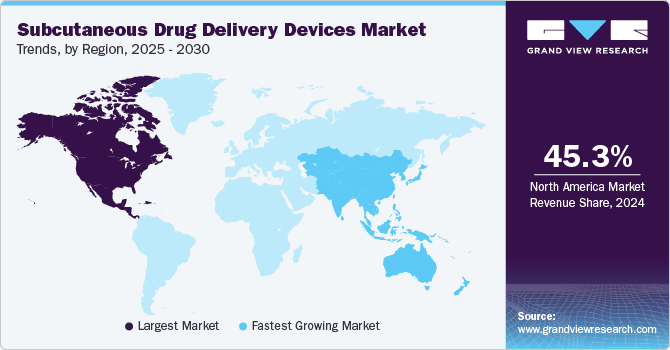

Regional Insights

North America subcutaneous drug delivery devices market dominated overall globally with a revenue share of 45.3% in 2024. This is due to a well-established healthcare sector, dedication to innovation, advanced infrastructure, strong R&D focus, and high prevalence of chronic conditions like diabetes, autoimmune disorders, and cardiovascular diseases. The American Diabetes Association reported in 2021 that 38.4 million Americans (11.6% of the population) had diabetes, underscoring the need for accessible and effective management tools, including subcutaneous drug delivery devices.

U.S. Subcutaneous Drug Delivery Devices Market Trends

The subcutaneous drug delivery devices market in the U.S. held a significant share of the North American region in 2024. The U.S. market is heavily impacted by the high prevalence of diabetes and prediabetes, with approximately 136 million adults affected as of November 2023, according to the CDC. Leading companies in this market, such as Insulet Corporation, Enable Injections, Amgen, BD, Consort Medical Plc, Ypsomed AG, Eli Lilly, Novo Nordisk, Sanofi, Merck, and AstraZeneca, are actively developing and marketing innovative subcutaneous drug delivery devices to meet the increasing demand driven by chronic diseases, particularly diabetes.

Europe Subcutaneous Drug Delivery Devices Market Trends

The subcutaneous drug delivery devices market in Europe is witnessing dynamic growth, supported by technological innovations and increasing healthcare needs. In 2023, Europe held the second-largest revenue share in the global market. Major markets include the UK, France, Germany, Italy, and Spain. This growth is driven by the rising prevalence of chronic diseases like diabetes, which necessitate regular medication. The International Diabetes Federation reported that approximately 56.6 million adults in Europe had diabetes in 2022, with numbers expected to rise significantly in the next decade. This increasing patient population is projected to boost demand for subcutaneous drug delivery devices, enhancing medication compliance and treatment outcomes.

The UK subcutaneous drug delivery devices market is experiencing notable growth, driven by the presence of an established healthcare system and a significant number of healthcare professionals. Furthermore, the presence of well-trained & skilled surgeons, technological advancements, favorable government initiatives, rising healthcare expenditure, and high adoption of minimally invasive surgeries are expected to contribute to market growth.

The subcutaneous drug delivery devices market in France is anticipated to grow significantly during the forecast period due to increasing infectious disease prevalence, rapid technological advancements, and rising consumer awareness. According to the World Bank, over 21.7% of France's population was over 65 in 2022, totaling over 67 million individuals. The geriatric population's growth rate was 1.8%, nearly four times the population growth. This growing and aging population, along with lifestyle and environmental changes, is expected to drive the prevalence of chronic diseases such as cancer, cardiovascular ailments, diabetes, hypertension, and respiratory conditions, thereby increasing the demand for subcutaneous drug delivery devices.

The Germany subcutaneous drug delivery devices market is experiencing notable growth as the German manufacturers have established a strong reputation for producing high-quality medical devices. The country’s rigorous quality control standards and adherence to safety regulations further enhance this reputation. As a result, healthcare providers trust German-made medical devices leading to increased sales and market dominance.

Asia Pacific Subcutaneous Drug Delivery Devices Market Trends

The Asia Pacific subcutaneous drug delivery devices market is growing rapidly due to rising disposable incomes, improving healthcare infrastructure, and strong economic growth in emerging economies such as Japan, China, and India. The large population with low per capita income has driven high demand for affordable treatments. Multinational companies are investing in developing economies, such as India and China, to strengthen their market presence. Consequently, numerous collaborative partnerships and strategic alliances among key companies in the region are expected to create lucrative growth opportunities.

The subcutaneous drug delivery devices market in Japan is set for rapid growth due to the substantial elderly population with chronic health conditions, increasing the demand for efficient, patient-friendly drug delivery methods. According to the World Economic Forum, over 1 in 10 people in Japan were aged 80 and above in 2023. This demographic shift boosts the prevalence of chronic diseases like COPD and heart failure due to high comorbidities. Consequently, the adoption of subcutaneous drug delivery devices is rising, supported by Japan's healthcare system, which prioritizes technological advancements and patient-centric care.

The China subcutaneous drug delivery devices market is expected to experience significant growth over the forecast period due to the unmet needs of its growing population. According to the National Bureau of Statistics of China, individuals aged 60 and above accounted for approximately 19.8% of the population by 2022. In addition, various healthcare reforms in China are expected to drive substantial market growth.

The subcutaneous drug delivery devices market in India is propelled by favorable medical device regulations and higher healthcare spending. The establishment of new corporate hospitals, structured training initiatives, and awareness campaigns on drug delivery devices are anticipated to drive market expansion. In addition, the increasing incidence of cancer, associated with elevated tobacco use, offers growth prospects. In 2022, the NIH reported around 1,461,427 new cancer cases in India, highlighting significant market potential for the foreseeable future.

Latin America Subcutaneous Drug Delivery Devices Market Trends

The Latin American subcutaneous drug delivery devices market is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for subcutaneous drug delivery devices as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

MEA Subcutaneous Drug Delivery Devices Market Trends

The subcutaneous drug delivery devices market in MEA is anticipated to expand over the forecast period. In Saudi Arabia, the growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Subcutaneous Drug Delivery Devices Insights

The scenario in market for subcutaneous drug delivery devices is highly competitive, with key players such as Gerresheimer AG, Medtronic, and Ypsomed AG holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Subcutaneous Drug Delivery Devices Companies:

The following are the leading companies in the subcutaneous drug delivery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Gerresheimer AG

- Medtronic Plc

- Ypsomed AG

- Elcam Medical Group

- Novo Nordisk

- Insulet Corporation

- Becton, Dickinson and Company

- West Pharmaceutical Services, Inc.

- PharmaJet

- Unilife Corporation

- Inolife Sciences

Recent Developments

-

In February 2024 , Novo Nordisk A/S partnered with HemoCue to enhance point-of-care diagnostic testing for children with type 1 diabetes in low- & middle-income nations.

-

In April 2024 , Ypsomed and ten23 health are collaborating to commercialize the YpsoDose patch injector. This partnership aims to enhance the development, manufacturing, and distribution of the YpsoDose device, providing an innovative solution for subcutaneous drug delivery. The collaboration leverages both companies' expertise to bring this advanced injection technology to market.

-

In March 2023 , Sanofi India received marketing approval for Soliqua, a diabetes drug, in India. Soliqua combines insulin glargine and lixisenatide to improve blood sugar control in adults with type 2 diabetes. This approval allows Sanofi to provide a new treatment option for diabetes patients in the Indian market.

-

In July 2023, Civica, Inc. partnered with Ypsomed to produce and supply an insulin injection pen. This collaboration aims to provide affordable insulin options for diabetes patients, utilizing Ypsomed's expertise in manufacturing pens. Civica plans to offer insulin in both vials and prefilled pens to enhance accessibility and affordability.

Subcutaneous Drug Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.0 billion

Revenue forecast in 2030

USD 51.8 billion

Growth Rate

CAGR of 7.6% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Gerresheimer AG; Medtronic Plc; Ypsomed AG; Elcam Medical Group; Novo Nordisk; Insulet Corporation; Becton, Dickinson and Company; West Pharmaceutical Services, Inc.; PharmaJet; Unilife Corporation; Inolife Sciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Subcutaneous Drug Delivery Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global subcutaneous drug delivery devices market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prefilled syringes

-

Pen injectors

-

Auto injectors

-

Wearable injectors

-

Needle-free Injectors

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global subcutaneous drug delivery devices market is estimated to be valued at USD 33.5 billion in 2024 and is expected to reach USD 36.0 billion in 2024.

b. The global subcutaneous drug delivery devices market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 51.8 billion by 2030.

b. North America dominated the subcutaneous drug delivery devices market with a share of 45.3% in 2024. This is attributable to developed healthcare infrastructure, local presence of major players, and continuous strategic initiatives implemented to maintain their market share.

b. Some key players present operating in the subcutaneous drug delivery devices market include Gerresheimer AG, Medtronic Plc, Novo Nordisk, Ypsomed AG, Becton, Dickinson and Company, Elcam Medical Group, Insulet Corporation, West Pharmaceutical Services, Inc., PharmaJet, Inolife Sciences, and Unilife Corporation.

b. Key factors that are driving the subcutaneous drug delivery devices market growth include the availability of advanced minimally invasive drug delivery systems, rising prevalence of diabetes and cardiovascular diseases (CVD), and the surge in biologic drug development.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."