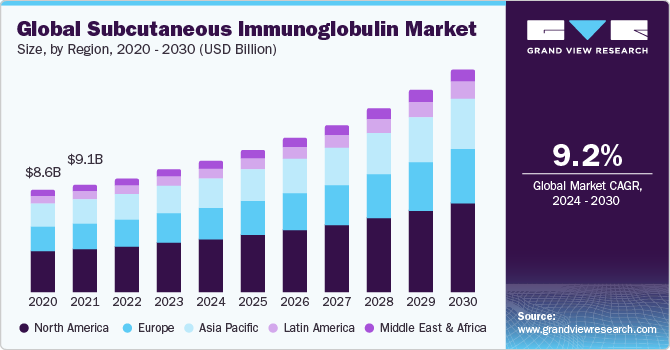

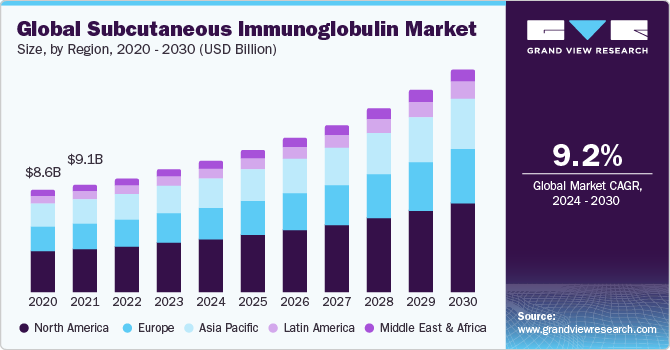

Market Size & Trends

The global subcutaneous immunoglobulin market size was valued at USD 10.34 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.22% from 2024 to 2030. The market is set for rapid expansion, driven by various industry participants' growing adoption of organic and inorganic strategies. In January 2022, Octapharma disclosed an expanded indication for Cutaquig, a subcutaneously administered human therapy, within the European Union. This expanded indication offers more flexible treatment alternatives to a broader spectrum of patients dealing with acquired deficiencies.

The subcutaneous immunoglobulin market was negatively affected by the COVID-19 pandemic. Global plasma collection witnessed a significant reduction due to stringent lockdown measures and challenging circumstances. This led to the accumulation of plasma and delayed plasma fractionation. The most significant decline in transfusion was observed in the surgery department, particularly for fresh frozen plasma, making it challenging for major players to collect plasma for fractionation. Consequently, a severe shortage of plasma products, including subcutaneous immunoglobulin, hindered patient access and impeded market growth.

The increasing incidence of immunodeficiency disorders can be linked to sedentary lifestyles, characterized by the consumption of excessive sugars, saturated fats, high alcohol intake, and reduced physical activity. This has led to increasing lifestyle-related disorders, including obesity.

Product Type Insights

Based on the product, the market is segmented into IgG, IgA, and IgM. The IgG segment held the largest market share in 2023 which can be attributed to the rising adoption of immunoglobulins and an increasing frequency of product launches. For instance, Argenx SE stated the approval of VYVGART by Japan's Ministry of Health, Labour and Welfare (MHLW) in January 2022. VYVGART is administered via intravenous infusion and is indicated for the treatment of patients with generalized myasthenia gravis (gMG).

Application Insights

On the basis of application, the market is segmented into primary immunodeficiency disease and secondary immunodeficiency disease. The primary immunodeficiency segment accounted for the largest revenue share in 2023.Subcutaneous immunoglobulin is utilized to enhance the immune system in primary immunodeficiency disorder. Administered via subcutaneous injections, SCIG provides a steady supply of essential antibodies, reducing the risk of infections. It offers convenience and fewer side effects, making it a preferred option for many patients.

End-use Insights

Based on the end use, the market is segmented into hospitals, homecare, clinics, and others. Hospitals held the largest market share in 2023. The expansion of healthcare facilities addressing the needs of both developed and emerging nations has contributed to an increased number of patients seeking hospital care.

Regional Insights

North America held the largest market share in 2023. The growth of the market is attributed to a high incidence of neurological, immunological, and various disorders, an increased local supply of intravenous immunoglobulin products, substantial reimbursement coverage, and the presence of prominent market leaders. The expansion is further fueled by advancements in antibody therapy, growing public health awareness, and ongoing medical innovations.

Competitive Insights

Key players operating in the market are Baxter International Inc., Johnson & Johnson (Omrix Biopharmaceuticals Inc.), Pfizer Inc., Takeda Pharmaceutical Company Limited, Grifols SA, Kedrion S.p.A, CSL Behring, Biotest AG, Octapharma AG, ADMA Biologics, Inc., Shanghai RAAS Blood Products Co. Ltd. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In April 2023, Takedas’s HYQVIA received approval by the U.S. FDA to treat primary immunodeficiency in children aged 2-16 years. This initiative is expected to boost the company’s subcutaneous immunoglobulin offerings.

-

In March 2022, Grifols SA received European approval for its 20% subcutaneous immunoglobulin XEMBIFY to launch in UK, France, and Spain for primary and secondary immunodeficiencies.