- Home

- »

- Communications Infrastructure

- »

-

Substation Automation Market Size, Industry Report, 2030GVR Report cover

![Substation Automation Market Size, Share & Trends Report]()

Substation Automation Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Type, By Technology (New, Retrofit), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-089-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Substation Automation Market Summary

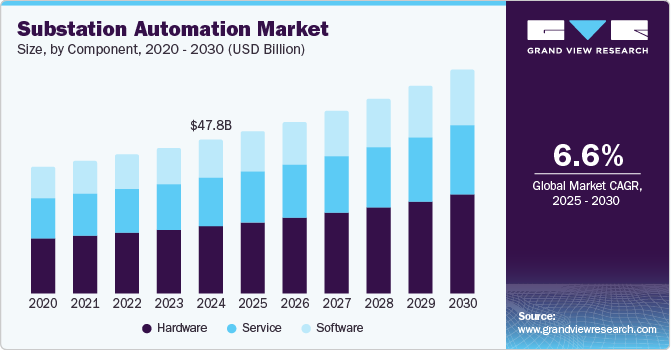

The global substation automation market size was valued at USD 47.76 billion in 2024 and is projected to reach USD 69.29 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. A primary driver is the increasing demand for reliable and efficient power distribution systems, essential as electricity consumption rises globally due to urbanization and industrial growth.

Key Market Trends & Insights

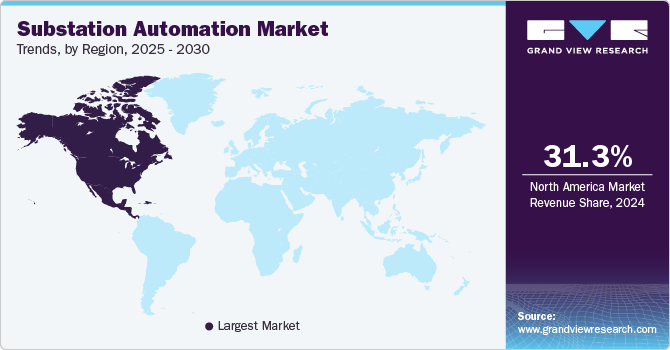

- North America substation automation market dominated the global market with a revenue share of 31.3% in 2024.

- By component, the hardware segment dominated the market with a share of 44.0% in 2024.

- By type, the transmission substation segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 47.76 Billion

- 2030 Projected Market Size: USD 69.29 Billion

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2024

In addition, the integration of advanced technologies such as IoT and artificial intelligence into substation operations has enhanced monitoring and control capabilities, leading to improved operational efficiency.

Governments and private entities increasingly prioritize the development of smart cities, necessitating advanced energy management systems for efficient power distribution. The rising global population and increased electricity demand drive the need for more robust and automated substations. This trend is supported by the adoption of digital twins and advanced communication technologies, which facilitate real-time data analysis and informed decision-making.

Moreover, the shift toward decentralized energy generation presents additional opportunities for the substation automation market. As more industries adopt renewable energy solutions, there is a heightened need for automation systems capable of managing complex energy flows and enhancing grid reliability. The evolution of industry standards and regulatory frameworks that promote sustainable practices significantly shapes market dynamics. This transition encourages the integration of advanced technologies, such as smart inverters and energy storage systems, which are essential for optimizing the performance of decentralized energy resources. For instance, Tesla's deployment of its Powerwall battery storage system allows homeowners with solar panels to store excess energy for later use, thereby enhancing grid reliability and reducing dependence on traditional power sources.

Component Insights

The hardware segment dominated the market with a share of 44.0% in 2024 due to the essential role that hardware components play in ensuring the reliability and efficiency of power distribution systems. Key hardware elements, such as Intelligent Electronic Devices (IEDs), digital relays, and programmable logic controllers, are critical for automating operations and enhancing monitoring capabilities within substations. For instance, Hitachi Energy's IEDs play a crucial role in substation automation systems, providing protection and control functionalities. Together with Substation Automation Systems (SAS), these devices enable advanced power system management and real-time monitoring of equipment conditions during operation.

The software segment is projected to grow at a significant CAGR during the forecast period, driven by the increasing need for sophisticated management and control solutions. As the substation automation industry evolves, software applications that facilitate real-time data analysis, predictive maintenance, and remote monitoring are becoming essential. The integration of artificial intelligence and machine learning into software solutions is expected to enhance operational efficiencies further, making them indispensable for modern substations aiming to optimize performance and reduce downtime.

Type Insights

The transmission substation segment dominated the market with the largest revenue share in 2024 due to its critical role in managing high-voltage electricity transmission. As global electricity demand continues to rise, there is an increasing need for robust transmission infrastructure capable of accommodating the integration of renewable energy sources such as wind and solar power. This integration necessitates modern transmission systems that can handle variable power flows and enhance grid reliability.

The distribution substation segment is projected to grow at a significant CAGR during the forecast period as utilities focus on enhancing their distribution networks. The shift toward decentralized energy generation, driven by the proliferation of Distributed Energy Resources (DERs) such as rooftop solar panels and battery storage systems, necessitates advanced automation solutions to effectively manage these diverse energy inputs. Moreover, as urbanization accelerates and electricity consumption increases in residential and commercial sectors, utilities are investing in modernizing distribution substations to improve service reliability and operational efficiency.

Technology Insights

The new segment dominated the market with the largest revenue share in 2024. This segment encompasses modern automation systems that enhance operational efficiency, reliability, and safety within substations. Factors such as the increasing adoption of smart grid technologies and the growing emphasis on renewable energy integration have driven demand for these advanced solutions. Investments in new automation technologies have become essential as utilities strive to modernize their infrastructure and improve service delivery.

The retrofit segment is anticipated to grow at a significant CAGR during the forecast period as utilities focus on upgrading existing substations instead of building new ones. Retrofitting enables the incorporation of modern technologies into aging infrastructure, improving performance while minimizing costs. This trend is particularly relevant in regions with established grids facing budget constraints, making retrofitting a strategic choice for utilities aiming to optimize operations within the substation automation industry.

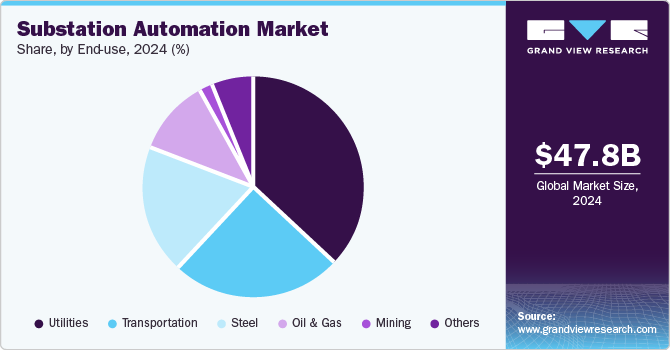

End Use Insights

The utilities segment dominated the market with the largest revenue share in 2024. As utilities strive to enhance grid reliability and efficiency, they are increasingly adopting advanced automation technologies that facilitate better monitoring and control of electrical systems. The focus on improving service quality and reducing operational costs has made utilities key players in shaping the growth trajectory of the substation automation industry. Moreover, government initiatives promoting renewable energy integration further bolster demand for automation solutions tailored to utility needs.

The mining segment is expected to grow at the highest CAGR over the forecast period as mining operations increasingly rely on automated systems for efficient energy management. The integration of substation automation technologies allows mining companies to optimize their energy consumption while ensuring operational safety in remote locations. As mining activities expand globally, reliable power supply becomes critical, further driving demand for advanced automation solutions tailored specifically to this sector.

Regional Insights

North America substation automation market dominated the global market with a revenue share of 31.3% in 2024 due to significant investments in smart grid technologies and infrastructure modernization initiatives. The region’s focus on integrating renewable energy sources into existing grids has also spurred growth in substation automation solutions. As North American utilities seek to enhance grid resilience and efficiency through advanced technologies such as IoT and AI, demand for comprehensive substation automation solutions remains strong.

U.S. Substation Automation Market Trends

The U.S. substation automation market dominated the regional market in 2024 due to its robust infrastructure and early adoption of innovative technologies. The regulatory environment encourages investments in smart grid initiatives that support modernization efforts across various states. As U.S. utilities continue to upgrade their operations with advanced automation technologies, demand for reliable and efficient power management solutions is expected to remain high.

Asia Pacific Substation Automation Market Trends

Asia Pacific substation automation market is anticipated to grow at the highest CAGR as developing economies invest heavily in energy infrastructure. Countries such as China and India are focusing on enhancing their power distribution networks through smart grid technologies and advanced automation systems that improve reliability and efficiency. This growing emphasis on dependable electricity supply drives significant investments in substation automation across the region.

China dominated the Asia Pacific region in 2024 due to its rapid industrialization and urbanization efforts. The country’s commitment to expanding its energy infrastructure has led to increased adoption of substation automation technologies to improve grid efficiency and reliability. As China continues its transition toward sustainable energy sources, demand for advanced automation solutions is likely to increase significantly.

Europe Substation Automation Market Trends

Europe substation automation market is expected to grow at a significant CAGR from 2025 to 2030, as countries prioritize renewable energy integration and grid modernization efforts. The European Union’s regulatory frameworks supporting sustainable energy practices prompt utilities across member states to invest in advanced automation technologies that enhance grid resilience while addressing environmental concerns. This focus on improving energy efficiency aligns with the broader goal of reducing carbon emissions within Europe’s power sector.

Key Substation Automation Company Insights

The substation automation market features several key players that shape its landscape. Siemens integrates digital technologies into energy management and industrial automation solutions, while Schneider Electric focuses on energy efficiency and smart grid technologies through its EcoStruxure platform. Mitsubishi Electric Corporation offers robust automation and energy-efficient technologies for industrial applications. General Electric Company innovates in power management systems, addressing the growing demands for reliability. These companies play a significant role in shaping the substation automation industry.

-

Siemens specializes in electrification, automation, and digitalization across various energy-related industries. In the substation automation industry, Siemens provides innovative solutions that enhance grid reliability and operational efficiency. Their offerings include Intelligent Electronic Devices (IEDs), communication networks, and advanced monitoring systems that facilitate real-time control and management of electrical substations. Siemens is committed to integrating smart grid technologies to meet the evolving demands of energy distribution.

-

Mitsubishi Electric Corporation manufactures electrical and electronic equipment, focusing on automation systems and energy-efficient technologies. In the context of substation automation, Mitsubishi Electric develops advanced systems that improve the performance and reliability of power distribution networks. Their products encompass a wide range of automation solutions, including SCADA systems and IEDs, which are essential for modernizing substations and enabling efficient energy management.

Key Substation Automation Companies:

The following are the leading companies in the substation automation market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- Schneider Electric

- Mitsubishi Electric Corporation

- General Electric Company

- ABB

- Eaton

- Cisco Systems, Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- Schweitzer Engineering Laboratories, Inc.

Recent Development

-

In December 2024, Sella Controls secured a contract to enhance the traction power systems for the Tyne and Wear Metro, utilizing equipment from Mitsubishi Electric Automation Systems. This initiative involves upgrading 47 substations within the transit network and stems from a collaboration focused on creating the Tracklink RTU, a solution designed for rail traction power management. The Tracklink system incorporates Mitsubishi Electric’s panel-mounted GOT human-machine interfaces (HMIs) and i-QR PLCs, offering a versatile and cost-effective approach to electrical substation automation.

-

In April 2024, Godrej Electricals & Electronics, a unit of Godrej & Boyce, announced the acquisition of orders exceeding USD 121 million for its Power Infrastructure and Renewable Energy (PIRE) business. These orders primarily involve air-insulated substations (AIS) and gas-insulated switchgear (GIS) substations across India, with project values ranging from USD 12 million to USD 48 million and capacities up to 765kV. The PIRE division is committed to enhancing power transmission and renewable energy integration, utilizing advanced technologies such as substation automation systems (SAS) to improve operational efficiency and align with national sustainability goals.

Substation Automation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.44 billion

Revenue forecast in 2030

USD 69.29 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, Saudi Arabia, South Africa, UAE

Key companies profiled

ABB; Siemens; Schneider Electric; General Electric Company; Eaton; Cisco Systems, Inc.; Honeywell International Inc.; Emerson Electric Co.; Schweitzer Engineering Laboratories, Inc.; Mitsubishi Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Substation Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global substation automation market report based on component, type, technology, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmission Substation

-

Distribution Substation

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

New

-

Retrofit

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Utilities

-

Steel

-

Oil & Gas

-

Mining

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.