- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Sugar Substitutes Market Size, Share & Trends Report, 2030GVR Report cover

![Sugar Substitutes Market Size, Share & Trends Report]()

Sugar Substitutes Market Size, Share & Trends Analysis Report By Type (High-intensity Sweeteners, High Fructose Syrup), By Application (Food, Beverages), By Region (North America, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-092-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Sugar Substitutes Market Size & Trends

The global sugar substitutes market size was estimated at USD 7.01 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Key factors driving market growth include the changing consumer preferences for healthier and low-calorie foods. This can be considered as a response to rising prevalence of as well as awareness about obesity-related issues derived mainly from diabetes, cardiovascular diseases, and high cholesterol levels. Moreover, the fear of an increasing number of animal-borne diseases has raised health concerns among populations worldwide, resulting in reduced intake of animal products.

The awareness regarding plant-based sugar substitutes is growing due to their acknowledged health advantages, which include the potential prevention of non-communicable diseases, digestive problems, and obesity. Low-calorie sweeteners (LCSs) are sugar substitutes that have a higher sweetening effect for each gram than sugar compared to sweeteners with higher calorie counts. LCSs are found in various foods and beverages, including gums, frozen desserts, gelatins, candy, baked goods, breakfast cereals, pudding, and yogurt. Sugar substitutes can be used in the food and beverage industries without compromising taste or quality. They are becoming increasingly popular as people are now more aware of fitness, health, appearance, and body image than earlier.

This rapidly increasing demand for healthier food products and substitutes for sugar has led to awareness about maintaining a low-calorie, healthy diet. Artificial sugar is almost 200 times sweeter than regular sugar. Artificial sweeteners are recommended by both the American Heart Association and American Diabetes Association as a sugar substitute to lower the risk of diabetes, obesity, heart disease, and metabolic disorders, as well as to manage calorie intake. Increasing calorie consumption, decreased physical activity, and excessive sweet food consumption all contribute to the issues related to obesity, which will drive product demand. Sugar substitutes are subjected to stringent safety and health inspections.

Regulatory bodies have conducted numerous studies to measure and assess the effects of these products on humans. Products are classified based on results, and the daily intake allowance (DIA) is established. Standards established by agencies for usage levels and classification often differ with respective authoritative bodies. This poses a serious problem for companies seeking streamlined product development. European laws regarding artificial sweeteners are strict, whereas U.S. regulations favor the advent of novel sweeteners regardless of origin. Stringent regulatory rules on the manufacture, usage, intake, and labeling of sugar substitutes hinder market growth.

Market Characteristics

The sugar substitutes market demonstrates a medium to high degree of innovation, with companies consistently introducing new flavors, formulations, and functional ingredients to align with evolving consumer preferences. Sugar substitutes with added functional benefits, such as prebiotic fibers and vitamins, have been introduced to meet the demand for sweetening options that offer additional health benefits beyond sweetness

The mergers and acquisitions are in the range of medium to high in the sugar substitutes market. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage on each other’s strengths. Moreover, the competitive nature of this industry has led to further encouraging players to explore synergies, leading to occasional M&As aiming to gain a competitive edge and achieving economies of scale in the market

Regulations govern the types of health claims that can be made about sugar substitutes, as well as the marketing and advertising of products containing these sweeteners. This ensures that consumers receive accurate information about the benefits and potential risks associated with sugar substitutes

The presence of a significant population seeking sugar-based foods and beverages is driving the sales and demand for sugar ingredients. In addition, the presence of a displeasing aftertaste by some sugar substitutes is likely to drive the demand for sugar

Type Insights

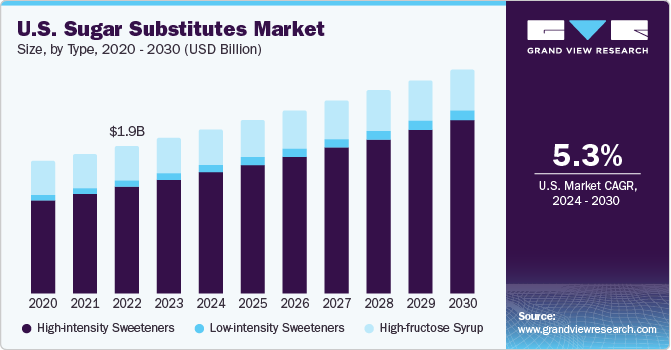

The high-intensity sweeteners segment led the market with a revenue share of 70.41% in 2023. High-intensity sweeteners have a much higher sweetness than table sugar (sucrose), so fewer sweeteners are required to achieve the same sweetness. The growing health and wellness trend globally is expected to boost the application scope of high-intensity sweetness. The low-intensity sweeteners segment is expected to witness substantial growth from 2024 to 2030 due to the increasing consciousness about oral health. Many low-intensity sugar substitutes do not cause tooth decay as they do not leave a residual of enamel-degrading acid as sugar does.

Several low-intensity sweeteners, including xylitol, erythritol, mannitol, and sorbitol, have desirable characteristics and are used in a wide range of foods to decrease glycemic levels, which is anticipated to drive segment growth. High-fructose syrups are widely used in the food and beverage industry as they are easy to handle and do not crystallize in solution. High-fructose syrups are used mainly to produce flavors and textures using less energy and retypes during manufacturing than alternative products, which also saves overall costs.

Application Insights

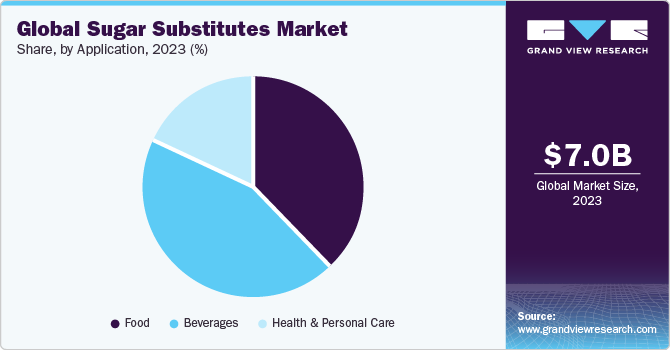

The beverage segment held the largest share of 44.27% in 2023. This was due to the growing demand for low as well as no-calorie formulations among consumers. Furthermore, the market for sugar substitutes, particularly natural sweeteners derived from monk fruit, agave, and stevia, is anticipated to grow as consumers are more inclined toward organic, natural, convenient, and functional beverages. In addition, rising demand for sports and health drinks with enhanced nutritional value is expected to boost market growth.

The food segment is expected to grow at a CAGR of 5.8% from 2024 to 2030 due to changing consumer habits and increased awareness about low-calorie food and dairy products. Sugar substitutes are widely used in canned foods, baked goods, powdered drink mixes, and soft drinks. Non-nutritive sweeteners are used to sweeten food products instead of sugars, such as sucrose, honey, agave nectar, and corn syrup. They can be used in smaller amounts to flavor meals as these ingredients are sweeter than sugar.

Regional Insights

North America dominated the global industry with the largest revenue share in 2023 due to high awareness of the adverse effects of sugar, the advantages of its substitutes, and high per capita income levels in the region. In addition, the regional market has grown due to supportive government initiatives. For instance, the FDA has allowed the use of high-intensity sweeteners like aspartame, saccharin, acesulfame potassium (Ace-K), advantame, and neotame, which has increased the demand for sugar substitutes. Moreover, American consumers look for calorie-free sweeteners derived from plants due to increased awareness.

Asia Pacific is expected to grow at a significant CAGR of 6.5% from 2024 to 2030. The regional market is expected to proliferate due to a rise in the prevalence of diabetes in countries like India and China. According to the World Health Organization, nearly 110 million people in China, which is 10% of the country’s entire population, have diabetes. As a result, the consumption of artificial sweeteners and sugar substitutes for sucrose is becoming increasingly common in China.

Key Sugar Substitutes Company Insights

The global sugar substitutes market comprises many major companies operating on regional and global levels. Leading market players are focusing on new product development through significant R&D expenditures, utilizing innovative technologies to manufacture products of the finest quality at the most affordable prices. Some of the initiatives taken are:

-

In March 2022, Cargill introduced its stevia products with EverSweet + ClearFlo technology along with a more refined flavor. This innovative sweetener system combines stevia sweetener with a distinct flavor and offers a number of advantages, including flavor modification, improved dispersion, increased solubility and stability in compositions

-

In April 2022, Tate & Lyle expanded allulose production to fulfill an elevated sharp rise in crystalline allulose demand, that gained prominence after the FDA settled for excluding it from the added and total sugar declarations on the panel of Nutrition Facts. As per Tate & Lyle, allulose has been utilized in a variety of products, with bars as the most popular

Key Sugar Substitutes Companies:

The following are the leading companies in the sugar substitutes market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these sugar substitutes companies are analyzed to map the supply network.

- Tate & Lyle

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Roquette Freres

- Ajinomoto Co.

- JK Sucralose Inc.

- The NutraSweet Company

- PureCircle

- E. I. DuPont De Nemours

Sugar Substitutes Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 7.44 billion

The revenue forecast in 2030

USD 10.42 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, regions

Regional scope

U.S.; Mexico; UK; Germany; UK; France; Italy; Spain; China; India; Japan; Australia, Indonesia; Brazil; Argentina,Turkey, South Africa

Key companies profiled

Tate & Lyle.; Cargill; Inc.; Archer Daniels Midland Company; Ingredion Inc.; Roquette; Ajinomoto Co., Inc.; JK Sucralose Inc.; PureCircle; The NutraSweet Company; E. I. DuPont De Nemours

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sugar Substitute Market Report Segmentation

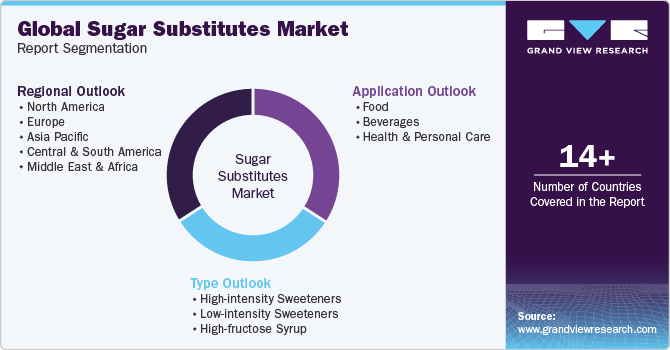

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sugar substitutes market report based on type, application, and region:

-

Type Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

High-intensity Sweeteners

-

Natural

-

Stevia Extracts

-

Licorice Root Extracts

-

Monk Fruit Extracts

-

-

Artificial

-

Aspartame

-

Cyclamate

-

Saccharin

-

Sucralose

-

Others

-

-

-

Low-intensity Sweeteners

-

Xylitol

-

Sorbitol

-

Maltitol

-

Mannitol

-

Trehalose

-

Isomaltulose

-

Others

-

-

High-fructose Syrup

-

-

Sugar Substitute Application Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Bakery

-

Confectionery

-

Dairy

-

Others

-

-

Beverages

-

Juices

-

Functional Drinks

-

Carbonated Drinks

-

Non-Dairy

-

Milk and Dairy

-

Others

-

-

Health & Personal Care

-

-

Sugar Substitute Regional Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

RONA

-

-

Europe

-

U.K

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Turkey

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sugar substitute size was estimated at USD 7.01 billion in 2023 and is expected to reach USD 7.44 billion in 2024.

b. The global sugar substitutes market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 10.42 billion by 2030.

b. High-intensity sweeteners led the market in terms of revenue with a market share of 70.41% in 2023. High-intensity sweeteners have a much higher sweetness than table sugar (sucrose), so fewer quantities of these sweeteners are required to achieve the same sweetness as sugar. The growing health and wellness trend globally is predicted to drive the application of high-intensity sweetness in the coming years.

b. Some key players operating in white Sugar Substitutes market are Tate & Lyle, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Roquette Freres, Ajinomoto Co., JK Sucralose Inc.,The NutraSweet Company, PureCircle, E. I. DuPont De Nemours

b. The increased incidences of health problems associated with sugar intake such as diabetes and obesity in developing markets are driving the market growth. Furthermore, sugar substitutes are expected to benefit from fluctuating supply as well as pricing of sugar.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."