- Home

- »

- Medical Devices

- »

-

Super Absorbent Dressings Market Report, 2022-2030GVR Report cover

![Super Absorbent Dressings Market Size, Share & Trends Report]()

Super Absorbent Dressings Market Size, Share & Trends Analysis Report By Product (Adherent, Non-adherent), By Application (Chronic Wounds, Acute Wounds), By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-919-2

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The global super absorbent dressings market size was valued at USD 95.88 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.69% from 2022 to 2030. The demand for super absorbent dressings is expected to increase due to an increase in the number of chronic diseases across the globe. For instance, according to the Government of Canada, 44% of Canadian adults have at least one of the ten most common chronic conditions. According to a similar source, 11% of Canadians suffer from diabetes, whereas 8% have cancer. Furthermore, a rise in the geriatric population is one of the major driving factors in the market. For instance, according to the Canadian Institute for Health Information, in 2017, the geriatric population comprised 6.2 million, which was expected to reach 10.4 million by 2037. Therefore, an increase in the number of chronic diseases, along with the growth of the geriatric population, is anticipated to propel the market growth during the forecast period.

Super absorbent dressings are designed to minimize the adherence to wounds and manage exudate. These dressings can be used over surgical incisions, burns, lacerations, exudating wounds, or grafts. Thus, an increase in the number of surgical procedures is expected to propel market growth during the forecast period. For instance, according to OMICS Group Conference, about 51.4 million surgical procedures are carried out in UAE, whereas this number increases to 234 million worldwide. Hence, due to the aforementioned factors, the market is anticipated to grow over the forecast period.

Furthermore, the outbreak of COVID-19 is expected to have a negative impact on the market growth globally. This can be attributed to the escalation in the number of hospitalizations due to COVID-19. This increased the pressure on hospitals and clinics to reprofile their patients and treat patients with COVID-19 on priority. However, the introduction of the vaccine is expected to normalize the situation, therefore the number of surgeries performed is expected to increase. Moreover, companies are undergoing strategic changes such as mergers & acquisitions, collaborations, and partnerships. For instance, in February 2022, Cardinal Health partnered with Kinaxis to optimize digital supply chain planning. The company expects Kinaxis to enhance Cardinal Health’s supply chain with concurrent planning and end-to-end network transparency and visibility. This is expected to expand the company’s reach and enhance its supply chain, thereby providing super absorbent dressings.

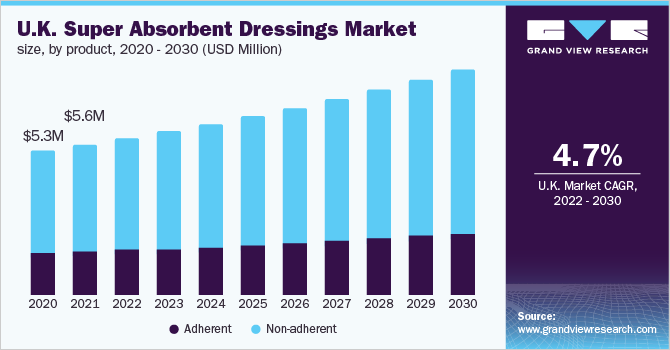

The U.K. is anticipated to register a significant growth rate of 4.73% during the forecast period. This growth can be attributed to the increase in the number of chronic wounds and a rise in the geriatric population in the region. For instance, as per the House of Commons Library, around one-fifth of the U.K. population was aged more than 65 years or above in 2019. This comprises 12.3 million people i.e., 19% of the total population. Moreover, the older population is projected to observe growth, making up 24% of the total population by 2043. As the geriatric population is more susceptible to chronic wounds, the use of super absorbent dressings is expected to witness significant growth during the forecast period. Thus, the market is anticipated to witness growth due to a rise in the geriatric population and its susceptibility to chronic diseases.

Moreover, an increase in the number of patients suffering from diabetic foot ulcers in the U.K. is estimated to help the market grow. For instance, according to data published by the United Kingdom National Health Service, 4.5 million people in the U.K. suffer from diabetes, out of which 10% of the population i.e., 450,000 people suffer from diabetic foot ulcers. This, in turn, is expected to drive the market in the years to come.

Product Insights

The non-adherent super absorbent dressings segment dominated the market with a share of over 70.0% in 2021. These super absorbent dressings are used for heavily draining wounds. The non-adherent super-absorbent dressings lock fluid away from the skin and help in quick wound healing. These being non-stick dressings, they don’t stick over the wounds, and require a tape or wrap to secure the pad over wounds. Highly exuding wounds such as wounds related to accidents, chronic wounds such as venous leg ulcers, and pressure ulcers may propel the segment growth. Pressure ulcers are a result of prolonged pressure on the skin. This can be caused due to prolonged hospitalization, being unable to move, which especially happens in old age, and sudden weight loss. For instance, according to the Agency for Healthcare Research and Quality, more than 2.5 million people in the U.S. develop pressure ulcers every year. Similarly, according to the NCBI, the incidence of pressure ulcers in a clinical setting may range from 4% to 38%. Thus, the increasing geriatric population, along with a high rate of hospitalization, is anticipated to boost the segment growth.

Adherent super absorbent dressings are expected to expand at a CAGR of 4.17% over the forecast period. They soak a large amount of exudate and therefore are used in chronic wound dressing such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The increasing number of such chronic wounds is expected to assist the segment growth. Hence, the growth of the diabetic population may propel the segment growth. For instance, as per Mary Ann Liebert, Inc., the diabetic population in the U.S. is expected to grow to 358,471,000 in 2030, which may further lead to diabetic foot ulcers. Therefore, the aforementioned factors are anticipated to drive the market over the forecast period.

Application Insights

The acute wounds segment dominated the market with a share of over 55.0% in 2021. This can be attributed to a rise in the geriatric population, coupled with an increase in the number of various acute wounds. Moreover, the rising number of surgical site infections (SSIs) is one of the major factors fueling the segment growth. Surgical wounds majorly occur due to SSIs. As per a study conducted by Wounds International, the incidence rate of SSI in general surgery was found to be 11.7%, which led to the re-admission of 19.2% of patients during the study period. Thus, with an increase in the number of SSIs and surgical procedures, the acute wounds segment is expected to grow during the forecast period.

The chronic wounds segment is expected to register the fastest CAGR of 4.81% during the forecast period. This growth can be attributed to an increase in the number of pressure ulcer patients. For instance, according to the Agency for Healthcare Research and Quality, more than 2.5 million people in the U.S. develop pressure ulcers every year. Similarly, according to the NCBI, the incidence of pressure ulcers in a clinical setting may range from 4% to 38%. Moreover, an increase in the geriatric population is expected to propel segment growth. For instance, according to Administration for Community Living’s profile on older Americans, the U.S. population aged 65 and above was estimated to be 54.1 million in 2019, which is about 19% of the U.S. population. As the geriatric population is more susceptible to pressure ulcers, the segment is expected to grow during the forecast period.

End-use Insights

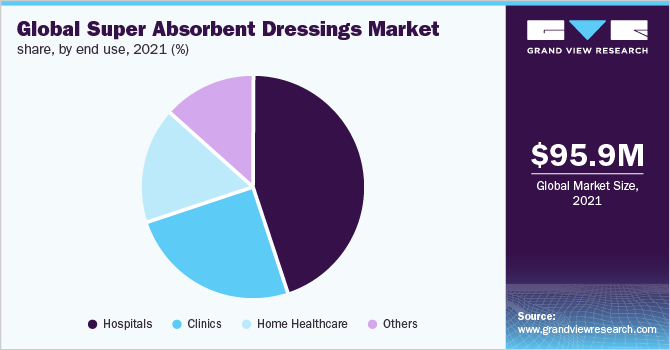

The hospitals segment held the largest revenue share of over 45.0% in 2021. The growth of this segment can be attributed to the upsurge in the number of hospitals and hospitalizations around the globe. For instance, according to the Australian Institute of Health and Welfare, the number of hospitalizations in Australia has increased. In 2019 - 2020, 11.1 million people were hospitalized in Australia, out of which 6.7 million were hospitalized in public hospitals, whereas 4.4 million were hospitalized in private hospitals, thereby helping the segment grow during the forecast period.

Moreover, there has been a rise in the number of traumatic incidents across the globe. For instance, around 50.0% of people worldwide are exposed to fire-related traumas and among them, 90.0% of the cases occur in low to moderate-income countries. Furthermore, as per the WHO, over 1,000,000 people are registered annually as moderately or severely burnt. Thus, the increase in the number of traumatic events is expected to increase the number of hospitalizations, thereby helping the market grow.

The others segment consists of nursing homes and ambulatory surgical centers. The growth of this segment can be attributed to the increase in the number of nursing facilities in the U.S., along with the rise in the admission of the geriatric population to such nursing facilities. For instance, as per the Kaiser Family Foundation, as of 2020, there are 1,290,177 nursing facility residents present in the U.S. Similarly, according to a report by the Government of the U.K., there are around 2,414 nursing homes in the U.K. Thus, with the increase in the number of nursing facilities and a rise in the number of nursing facility residents, the others segment is expected to grow at a significant rate in the years to come.

Regional Insights

North America dominated the market with a revenue share of over 45.0% in 2021 and is expected to witness considerable growth over the forecast period. The presence of a large population base and expanding patient pool in countries such as the U.S. are major factors driving the market in this region. Moreover, the presence of some major players such as 3M, Coloplast Corp., HARTMANN USA, and Smith & Nephew is anticipated to help the market grow in this region.

Furthermore, an increase in the number of diabetic patients, along with an increase in road accidents and burn incidents, is anticipated to drive the market. For instance, as per the Government of Canada, there have been 104,169 road accidents in Canada in 2020. These accidents lead to acute wounds, where super absorbent dressings as used to cure such wounds. Thus, a rise in the diabetic population and an increased number of road accidents are expected to boost the market growth in North America during the forecast period.

Asia Pacific is estimated to register the highest CAGR of 5.30% over the forecast period. This can be attributed to the rising prevalence of chronic and acute diseases, along with an increase in the number of surgical procedures throughout the Asia Pacific region. For instance, according to the Australian Institute of Health and Welfare, in 2018, there were 352,000 hospital admissions, which were involved in emergency surgical procedures. Moreover, according to a similar source, there were 2.2 million admissions, which involved elective surgery in Australia. Therefore, with such an increase in the number of surgical procedures, acute wounds are expected to increase, thereby boosting the market growth in the Asia Pacific region during the forecast period.

Key Companies & Market Share Insights

The market is consolidated and small and local manufacturers are trying to enter the market. The degree of competition and competitive rivalry in the market is expected to increase over the forecast period. Furthermore, leading players are involved in adopting strategies such as mergers & acquisitions, collaborations, and product launches to strengthen their product portfolios.

For instance, in November 2021, Paul Hartmann AG invested USD 44.46 million in the Heidenheim region. This was done to develop a new production line and modernize the existing facilities and infrastructure. Thus, with various strategies acquired by the leading players, the market is expected to grow during the forecast period. Some prominent players in the global super absorbent dressings market include:

-

3M

-

Coloplast Corp.

-

Hartmann USA, Inc.

-

Molnlycke Health Care AB

-

Smith & Nephew

-

Integra LifeSciences

-

Covalon Technologies, Ltd.

-

McKesson Corporation

-

Advancis Medical

-

Medline Industries

Super Absorbent Dressings Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 99.92 million

Revenue forecast in 2030

USD 144.21 million

Growth rate

CAGR of 4.69% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

3M; Coloplast Corp.; Hartmann USA Inc.; Molnlycke Health Care AB; Smith & Nephew; Integra LifeSciences; Covalon Technologies, Ltd.; McKesson Corporation; Advancis Medical; Medline Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global super absorbent dressings market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Adherent

-

Non-adherent

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcer

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Clinics

-

Home Healthcare

-

Others (Nursing Home, ASCs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global super absorbent dressings market size was estimated at USD 95.88 million in 2021 and is expected to reach USD 99.92 million in 2022

b. The global super absorbent dressings market is expected to grow at a compound annual growth rate of 4.69% from 2022 to 2030 to reach USD 144.21 million by 2030.

b. North America dominated the super absorbent dressings market in 2021 during the forecast period and is expected to witness a growth rate of 4.71% over the forecast period. The large presence of key players, rising patient pool, and growing geriatric population, are major factors driving the market growth of super absorbent dressings in this region.

b. Prominent key players operating in the super absorbent dressings market include 3M, Coloplast Corp., Hartmann USA, Inc., Molnlycke Health Care AB, Smith & Nephew, Integra LifeSciences, Covalon Technologies, Ltd., McKesson Corporation, Advancis Medical, and Medline Industries.

b. Key factors that are driving the super absorbent dressings market growth include the increasing prevalence of chronic disorders, a growing number of surgical procedures, and the rising geriatric population. In addition, technological advancements and rising demand for home healthcare facilities are further fuelling the growth of the super absorbent dressings market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."