- Home

- »

- Next Generation Technologies

- »

-

Super High Frequency Communication Market Report, 2030GVR Report cover

![Super High Frequency Communication Market Size, Share & Trends Report]()

Super High Frequency Communication Market Size, Share & Trends Analysis Report By Technology Type (5G sub-6 GHz, 5G mm Wave), By Frequency Range, By Radome Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-026-4

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

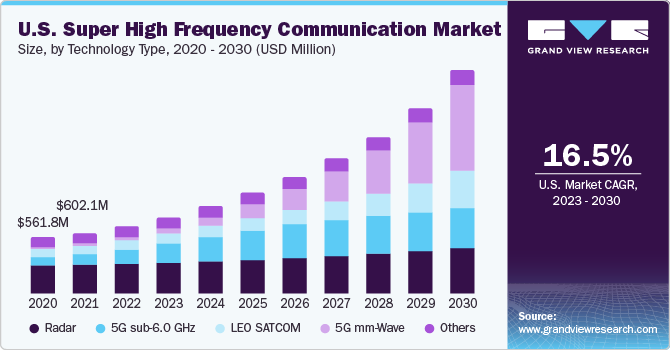

The global super high frequency communication market size was valued at USD 2.17 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 16.5% from 2023 to 2030. Rapidly rising deployment of 5G radio antennas across various countries, including the U.S., South Korea, Japan, and China, and the growing demand for high-frequency communications in a wide range of military applications is expected to drive the global super high frequency (SHF) communication market’s growth during the forecast period. Super high-frequency communication is used in radar transmitters, satellite communications, microwave radio relay links, and wireless LANs. The growing use of these technologies globally is expected to fuel the market’s growth throughout the forecast period.

The demand for low earth orbit (LEO) satellite constellations is significantly rising across the globe to ensure adequate bandwidth for various use cases across different end-use verticals. These verticals include defense agencies, government bodies, healthcare, telecom, media and entertainment, and others. The significant investments made by the leading satellite service providers in deploying LEO satellites are expected to support the global market during the forecast period. Key market players are taking strategic initiatives to launch LEO satellites, which is expected to drive the demand for SHF communication systems.

Initiatives regarding LEO satellite launches are expected to boost the market's growth owing to the increasing adoption of SHF communication systems in the satellites. For instance, in May 2021, One Web launched 36 new LEO satellites. The LEO satellites launch was part of the "five to 50 program", which would help deliver broadband internet connectivity across key countries like the U.S., U.K., Alaska, Iceland, Northern Europe, Greenland, Canada, and the Arctic seas.

Additionally, the company has increased its LEO satellite counts to 218. However, the company has planned to launch 648 LEO satellites in the coming years. Moreover, Space X was planning to launch 1,500 Star Link LEO satellites by the end of 2021, thus increasing the demand for super high-frequency communication systems.

Leading telecom operators across several countries, such as the U.S., China, Japan, and others, are aggressively investing in obtaining sub-6.0 GHz and millimeter wave (mm-Wave) frequency spectrum bands. This, in turn, boosts the overall deployment of 5G radio antennas across these nations. For instance, in July 2021, Ericsson made a multi-year agreement with Verizon worth USD 8.3 billion. The strategic deal aims to deploy Ericsson's 5G Massive MIMO sub-6.0 GHz and mm-Wave solutions for Verizon in the U.S. Therefore, the swiftly growing 5G network infrastructure installations globally are expected to accelerate the adoption of super-high frequency communications during the forecast period.

However, designing and developing SHF communication systems tends to be a highly complex process that involves considerations over several pointers, such as size, weight, environmental conditions, aerodynamic parameters, and electromagnetic functionality. This complex process is a potential challenge for the market. Moreover, SHF communication systems still require regular maintenance for uninterrupted operations.

Inadequate maintenance may result in better signals and better communication. The operational complexities of SHF communication systems pose a challenge to market growth. However, key market players are focusing on streamlining these processes, which creates a future opportunity for the market.

The COVID-19 outbreak has negatively impacted the global super high-frequency communication market. In Q2 and Q3 of 2020, the COVID-19 cases across key countries such as the U.S., U.K., China, Japan, and others rapidly increased. Therefore, federal governments across these nations temporarily imposed lockdowns in several prominent cities and sealed international borders for trade.

This hampered the global supply chain logistics industry and declined the overall market demand in 2020. However, economic incentives, coupled with increased investments in R&D and increasing adoption of advanced technologies such as 5G, are expected to boost the SHF communication market growth during the forecast period.

Technology Type Insights

The radar segment accounted for the largest revenue share of 48.4% in 2022. The high segment share is attributable to the significant deployment of SHF communication systems across the military, ship, and commercial radar applications. Further, radar systems are used in key military applications, which include target recognition, target detection, weapon guidance in a missile system, and tracking enemy locations. The growing use of radar systems in military & defense applications further drives the segment’s growth.

The 5G mm wave segment is expected to grow at the fastest CAGR of 47.1% during the forecast period. With the evolution of 5G technologies, several key market players such as Nokia, Ericsson, Huawei, Fujitsu, ZTE, Samsung, NEC, and others are heavily investing in developing and deploying new 5G small cell antenna equipment. These radio antennas support different frequency bands, such as 5G sub-6.0 GHz (Below 6.0 GHz) and millimeter-wave frequency bands (Above 24.0 GHz).

On the other hand, the significant focus on releasing mm-Wave frequency bands across key countries such as the U.S., Japan, China, and others has raised the demand for 5G mm-Wave radio antennas, thereby propelling the market’s growth.

Frequency Range Insights

The 10 - 20 GHz segment accounted for the largest revenue share of around 35.9% in 2022. The high segment market share is attributable to the extensive offerings of communication systems, supporting a frequency range between 10 and 20 GHz. Several crucial applications, such as military aircraft, airborne weather radar, fire control radar, ground mapping radar, missile tracking radar, and surface moving target identification, mainly operate on frequencies between 10 to 20 GHz.

Additionally, the rising demand for such applications across the military, commercial, and naval sectors is estimated to help the 10 - 20 GHz segment grow notably during the forecast period.

The 20 - 30 GHz segment is estimated to register the fastest CAGR of 24.4% over the forecast period. Leading telecom operators such as AT&T., Verizon, T-Systems, NTT Docomo, China Telecom, China Mobile, SK Telecom, BT Group, Vodafone, and others are substantially focused on deploying 5G sub-6.0 GHz equipment across their respective nations. This, in turn, is expected to boost the overall demand for SHF communication systems. Furthermore, the rapid increase in LEO satellite launch, supporting Ku and Ka bands of frequencies, is expected to boost the 20-30 GHz segment demand growth, notably from 2022 to 2030.

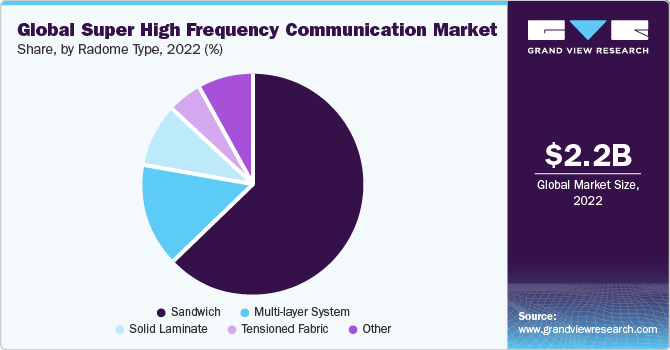

Radome Type Insights

The sandwich segment held the largest revenue share of 62.9% in 2022. The high segment share is primarily attributed to significant offerings by prominent manufacturers such as L3HARRIS, INC., Saint-Gobain, Cob Ham Limited, and others in the global market. A sandwich radome is widely adopted due to its simple structure, high broadband capabilities, and exceptional strength-to-weight ratio compared to the radome types.

Sandwich radome comes in three categories: A-Sandwich, B-Sandwich, and C-Sandwich. Moreover, the robust demand for sandwich radome for multiple applications such as military and civil radar, SATCOM, broadcast equipment, telecommunications, coastal surveillance, microwave, and others is anticipated to propel the segment growth during the forecast period.

The multi-layer system segment is expected to grow at the fastest CAGR of 19.3% over the forecast period. Multi-layer radome delivers high bandwidth and a long scanning range. Another benefit, such as a high strength-to-weight ratio over other radome types, is quite suitable for a few key applications, including spacecraft. Moreover, the multi-layer radome provides high thermal resistance and high bending strength. Owing to these benefits mentioned above, the multi-layer segment is anticipated to expand at a significant growth rate from 2022 to 2030.

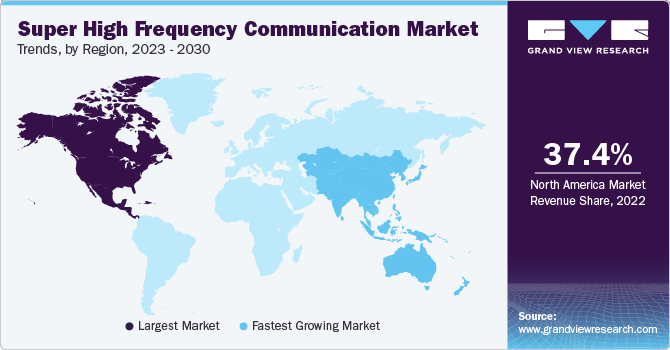

Regional Insights

North America dominated the super high frequency communication market and accounted for the largest revenue share of 37.4% in 2022. The rapidly increasing military spending in the U.S. is expected to boost the adoption of advanced technologies, such as improvements in military aircraft, SATCOM equipment, surveillance systems, and others. For instance, in the U.S., military spending arrived at USD 778.0 billion in 2020, growing at 4.4% from 2019.

Thus, it is expected to boost the overall demand for communication systems designed for the aforementioned military applications. Furthermore, several prominent players, such as SpaceX and Amazon, are heavily investing in LEO satellite launches, which are anticipated to support the market growth.

Asia Pacific is expected to grow at the fastest CAGR of 17.5% during the forecast period. The growth can be attributed to the robust investments in deploying radar antennas, SATCOM antennas, and others. In Asian countries, the deployment of both 5G sub-6.0GHz and 5G mm-wave equipment is growing at a rapid pace.

Also, the federal governments and regional telecom operators are aggressively investing in 5G projects across the nation, catering to high-speed network demands across regions such as India, China, and Japan. The growing demand for high-speed networks and increasing investments in advanced technologies such as 5G across the region are expected to fuel the market’s growth during the forecast period.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations to augment their market share. For instance, in July 2021, Inmarsat, a U.K.-based satellite operator, planned to launch a constellation of LEO satellites. The launch would mainly be aimed at combining its LEO satellite and 5G mobile to deliver enhanced capacity to aviation, maritime, and land-based customers globally.

Key Super High Frequency Communication Companies:

- Astronics Corporation

- Cobham Limited

- Raycap

- General Dynamics Corporation

- Hensoldt

- JENOPTIK AG

- L3Harris Technologies, Inc.

- Northrop Grumman

- Saint-Gobain

- The NORDAM Group LLC

Recent Developments

-

In May 2023, Thuraya and SAT Global announced a significant breakthrough in satellite IoT technology. The partners successfully conducted an over-the-air demonstration, showcasing a low-latency messaging system that enables direct-to-satellite IoT texting. Utilizing Thuraya's satellite network, specifically the Thuraya-2 Satellite (T2), they achieved the transmission of low-power IoT messages.

-

In February 2023, the Thales Group secured a contract with the French Navy for the provision of Syracuse IV naval stations. This contract enables the French Navy to benefit from enhanced satellite communications capabilities, owing to the dual-band X and Ka capacity of the Syracuse IV system.

-

In February 2023, Cobham Satcom, a provider of radio and satellite communications solutions and BC Signals, a space data connectivity solutions provider announced their extended partnership. As a part of this partnership both companies aim to deploy Cobham Satcom's versatile and reliable Tracker 6000 and 3700 series ground stations. Also, through this strategic agreement, BC Signals will enhance its existing ground network by incorporating Cobham Satcom's advanced ground stations. This collaboration enables the seamless integration of communication services for Next Generation Satellite Orbits (NGSO) missions and constellations, catering to applications such as Earth Observation, Space Situational Awareness, and the Internet of Things (IoT).

-

In September 2022, Network Innovations, a prominent provider of essential communications solutions, partnered with hiSky, an advanced voice and IoT satellite communications technology provider. hiSky's innovative low data rate (LDR) network, powered by patented technology, is specifically designed for Industrialized IoT applications. Leveraging high-frequency Ka/Ku-band networks, this network facilitates affordable satellite solutions by efficiently transmitting data rates to end users.

Super High Frequency Communication Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.45 billion

Revenue forecast in 2030

USD 7.13 billion

Growth Rate

CAGR of 16.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology type, frequency range, radome type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Astronics Corporation.; Cobham Limited,; Raycap; General Dynamics Corporation; Hensoldt; JENOPTIK AG; L3Harris Technologies, Inc.; Northrop Grumman.; Saint-Gobain; The NORDAM Group LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Super High Frequency Communication Market Report Segmentation

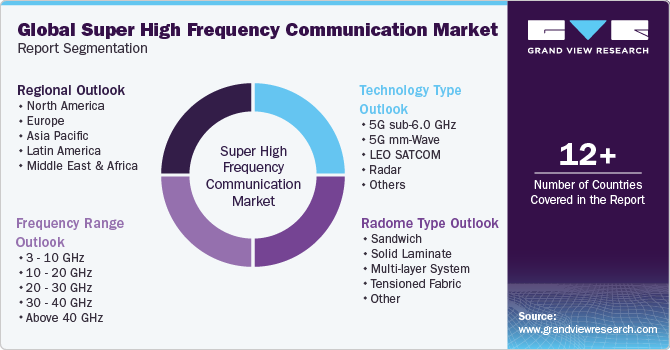

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global super high frequency communication market report based on technology type, frequency range, radome type, and region:

-

Technology Type Outlook (Revenue, USD Million, 2017 - 2030)

-

5G sub-6.0 GHz

-

5G mm-Wave

-

LEO SATCOM

-

Radar

-

Others

-

-

Frequency Range Outlook (Revenue, USD Million, 2017 - 2030)

-

3 - 10 GHz

-

10 - 20 GHz

-

20 - 30 GHz

-

30 - 40 GHz

-

Above 40 GHz

-

-

Radome Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Sandwich

-

Solid Laminate

-

Multi-layer System

-

Tensioned Fabric

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global super high frequency communication market size was estimated at USD 2.17 billion in 2022 and is expected to reach USD 2.45 billion in 2023.

b. The global super high frequency communication market is expected to grow at a compound annual growth rate of 16.5% from 2023 to 2030 to reach USD 7.13 billion by 2030.

b. North America dominated the SHF communication market with a share of over 37.4% in 2022. This is attributable to the robust investments in deploying radar antennas, SATCOM antennas, and others.

b. Some key players operating in the super high frequency communication market include Astronics Corporation, Cobham Limited, Raycap, General Dynamics Corporation, Hensoldt, JENOPTIK AG, L3Harris Technologies, Inc., Northrop Grumman, Saint-Gobain, and The NORDAM Group LLC.

b. Key factors that are driving the market growth include rapidly rising deployment of 5G radio antennas across various countries and significant investments made by the leading satellite service providers in deploying LEO satellites.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."