- Home

- »

- Communications Infrastructure

- »

-

Satellite Communication Market Size, Industry Report, 2033GVR Report cover

![Satellite Communication Market Size, Share & Trends Report]()

Satellite Communication Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Equipment, Service), By Satellite Constellations, By Frequency Band, By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-975-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Communication Market Summary

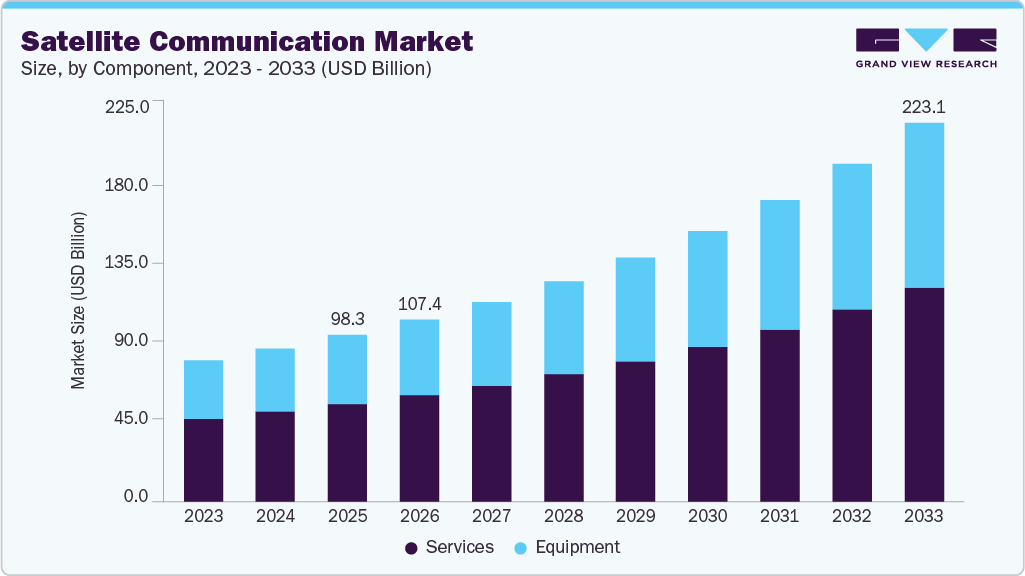

The global satellite communication market size was estimated at USD 98.28 billion in 2025 and is projected to reach USD 223.06 billion by 2033, growing at a CAGR of 11.0% from 2026 to 2033. The promising growth prospects of the market can be attributed to the growing demand for High-throughput Satellite (HTS) systems, which provide significantly increased capacity and data speeds compared to traditional systems.

Key Market Trends & Insights

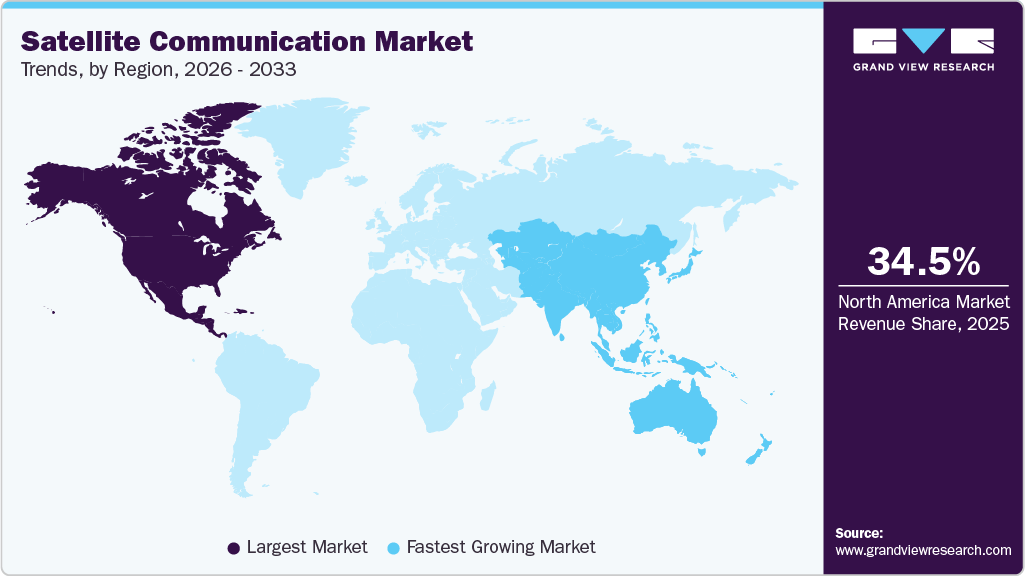

- The North America satellite communication market accounted for a 34.5% share of the overall market in 2025.

- The satellite communication industry in the U.S. held a dominant position in 2025.

- By component, the services segment accounted for the largest share of 58.6% in 2025.

- By satellite constellations, the LEO segment held the largest market share in 2025.

- By frequency band, the Ku-band segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 98.28 Billion

- 2033 Projected Market Size: USD 223.06 Billion

- CAGR (2026-2033): 11.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

HTS systems enable faster and more efficient data transmission, making them ideal for bandwidth-intensive applications such as video streaming, remote sensing, and Internet of Things (IoT) connectivity. New frequency bands, such as high-frequency and very high-frequency bands, are also rapidly expanding the available satcom spectrum. These bands offer improved bandwidth and increased capacity, enabling higher data rates and supporting bandwidth-intensive applications. Several solution providers across the globe are focusing on developing solutions that offer better connectivity for a myriad of use cases. For instance, in June 2023, Get SAT Ltd, a provider of miniaturized Satcom terminals, launched its latest product line, MoComm.The line of multi-orbit communication solutions features the innovative multi-orbit communication capability. This feature enables smooth and efficient switching between satellite constellations, ensuring uninterrupted connectivity. MoComm operates seamlessly in both Ku and Ka bands. The Ka-band functionality empowers users to seamlessly transfer data traffic between the O3b Medium Earth Orbit (MEO) constellation and any Geostationary Orbit (GEO) constellation. The Ku-band has received certification for compatibility with Low Earth Orbit (LEO) and any GEO constellation, further expanding its versatility and applicability.

Increasing use of Satcom in government and defense sectors is contributing to the growing demand for HTS capacity. Government agencies are increasingly relying on sensor data and ISR platforms to transform their operational environments. These platforms facilitate the sharing of real-time HD video and other valuable information obtained from Remotely Piloted Air Systems (RPAS) or Unmanned Aerial Vehicles (UAVs). In response to this growing demand, leading industry players such as Viasat, Inc., and SES S.A. are making significant investments aimed at pioneering novel solutions tailored to various government and defense applications.

The growing deployment of satellite constellations dedicated to IoT connectivity is also contributing to industry growth. These constellations consist of several small satellites working together to provide global coverage for IoT devices, LEO satellites, enabling seamless communication and data exchange across vast geographic areas. This trend is driven by the applications of IoT technology in areas such as agriculture, logistics, environmental monitoring, and asset tracking, where uninterrupted connectivity is essential.

Another emerging trend is the development of LEO satellite networks specifically designed for IoT applications. LEO satellites offer advantages such as lower latency, improved signal strength, and higher data throughput, making them well-suited for IoT data transmission. These networks leverage advanced technologies such as narrowband and low-power communication protocols to optimize IoT device connectivity, ensuring efficient utilization of satellite resources.

Furthermore, the satellite communication industry is witnessing the adoption of advanced technologies such as Artificial Intelligence (AI), which are driving the emergence of Intelligent Transport Systems (ITS). These systems enable real-time vehicle tracking, facilitating the swift exchange of information for both users and freight operators. SATCOM integration in transportation ensures continuous and seamless data transmission between vehicles and transport hubs, reducing the reliance on terrestrial networks.

Component Insights

The services segment accounted for the largest share of 58.6% in 2025. The segment growth can be attributed to the global expansion of the media and entertainment industries, coupled with the increasing demand for satellite television in emerging nations. Efforts to enable seamless data transmission to end-user locations also favor the increased demand for Satcom services across the globe. However, the high upfront costs associated with satellite acquisition often make it financially challenging for many firms to invest in the technology outright. As a result, an increasing number of companies are opting for satellite services through leasing arrangements. Domestic Direct-to-Home (DTH) operators, for instance, are typically limited to using satellites ordered by their respective space agencies or leasing capacity from foreign satellites. Technological advancements play a crucial role in reducing manufacturing costs, thereby lowering lease expenditure and driving revenue market growth.

The equipment segment is expected to grow at the fastest CAGR during the forecast period, owing to the growing need for uninterrupted communication across industries and the increasing use of connected and autonomous vehicles. Satcom equipment ensures the smooth functioning of diverse applications, such as telecommunications, navigation, weather monitoring, and surveillance systems, by enabling effective communication with satellites orbiting the Earth. The introduction of LEO satellites and satellite constellations for telecommunication purposes is also expected to drive the equipment segment growth.

Satellite Constellations Insights

The low Earth orbit (LEO) satellites segment held the largest market share in 2025. The increasing demand for global internet coverage, particularly in underserved or remote areas where traditional broadband infrastructure is either too costly or challenging to deploy, is driving the growth of low-earth-orbit satellites for communication. LEO satellites, positioned closer to Earth than geostationary satellites, enable faster data transmission speeds and reduced latency, making them ideal for high-speed internet.

The geostationary equatorial orbit (GEO) satellites segment is expected to grow at a significant CAGR during the forecast period. Geostationary equatorial orbit satellites are ideal for broadcasting, as they ensure continuous, reliable service, which is critical for television and radio networks, broadcasts, and direct-to-home (DTH) services. With no need for complex tracking systems, stationary GEO satellites provide stable, high-quality signals to fixed-ground antennas, supporting media distribution to vast audiences with minimal disruption.

Frequency Band Insights

The Ku-band segment dominated the market in 2025. The Ku-band frequency segment covers frequencies ranging from 10.7 to 14.5 GHz. The application of Ku-band frequencies in fixed satellite television data services drives market growth. The Ku-band is ideal for delivering high-quality broadcast signals, making it an ideal choice for fixed satellite television services. This frequency band allows for strong, stable connections that can transmit data over long distances with minimal interference, providing reliable television broadcasts.

The Ka-band is projected to grow at the fastest CAGR over the forecast period. The Ka-band frequency segment covers frequencies ranging from 17.3 to 30 GHz. The capability of the Ka-band to support high data rates drives the growth of the segment in the market. The higher frequencies in the Ka-band allow for greater bandwidth, which translates to faster internet speeds and enhanced data throughput compared to lower-frequency bands such as Ku and C-band.

Application Insights

The broadcasting segment dominated the market in 2025. This segment growth can be attributed to the growing demand for satellite communications in pay-TV and radio applications. DTH providers use satcom to deliver services to customers and ensure seamless connectivity, even in remote and inaccessible areas. Growing consumer expectations for high-quality audio and video content have driven significant advancements in Satcom equipment.

Airtime is projected to grow at the fastest CAGR over the forecast period, owing to the rising demand for reliable and affordable communication services for flights and aircraft. Satcom solutions offer seamless connectivity and high-speed internet access onboard aircraft, catering to the needs of both the crew and business applications. The growing use of satcom for aircraft navigation and remote troubleshooting is also expected to contribute to the segment's promising growth prospects.

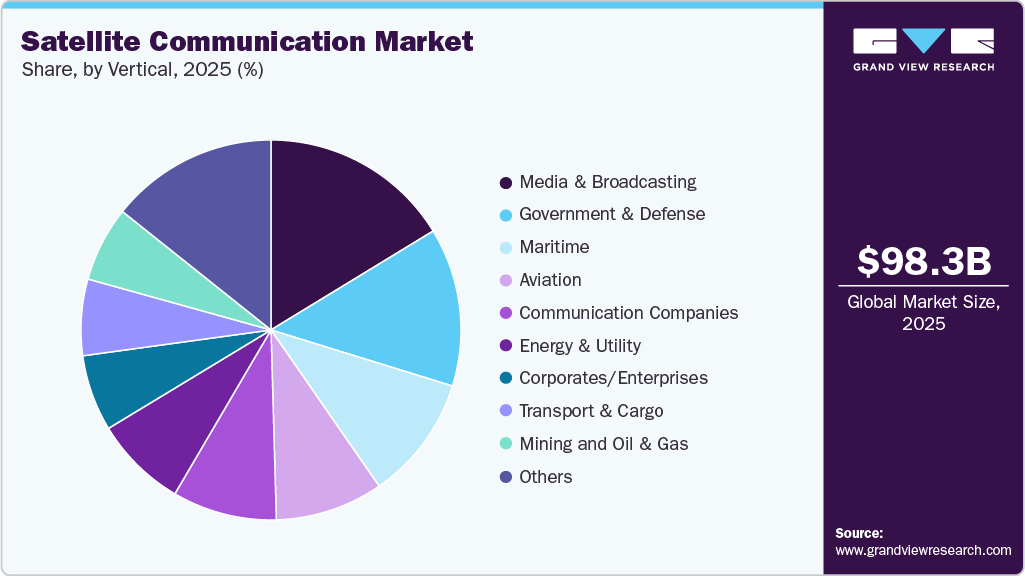

Vertical Insights

The media & broadcasting segment dominated the market in 2025. The media & broadcasting industry is one of the leading consumers of satellite communication technology. Media and broadcasting businesses leverage the technology to transmit live news, satellite television and radio, sports events, concerts, and various other programs to their audience. Moreover, satellites are used to broadcast video channels that can be received by both broadcast networks and cable operators, benefitting consumers globally.

The government & defense segment is projected to grow at the fastest CAGR over the forecast period. Increasing emphasis on secure and resilient satcom solutions to meet the evolving needs of government agencies and defense organizations is a key factor contributing to the growth of the segment. This includes the adoption of advanced encryption techniques, anti-jamming capabilities, and robust cybersecurity measures to safeguard sensitive data and ensure uninterrupted communication in critical situations.

Regional Insights

The North America satellite communication market accounted for a 34.5% share of the overall market in 2025. Growing demand for satellite broadband services, especially for providing reliable connectivity in remote, hard-to-reach, and underserved regions of North America, is likely to drive regional growth over the forecast period. The region is also home to key industry players such as Viasat, Inc., Intelsat, Telesat, and Harris Technologies, Inc. Their strong focus on innovations and investments in research and development, advanced technologies, and strategic partnerships is fueling the expansion of the industry in the region.

U.S. Satellite Communication Market Trends

The satellite communication market in the U.S. held a dominant position in 2025, supported by its advanced space infrastructure, strong presence of leading satellite operators, and continuous investments in next-generation satellite technologies. The market is characterized by large-scale deployment of LEO and hybrid satellite constellations aimed at enhancing broadband coverage, network resilience, and latency performance across commercial and government applications. Strategic partnerships between satellite service providers, technology companies, and public institutions continue to play a critical role in market expansion. Initiatives focused on student connectivity, distance learning, and rural broadband access, powered by satellite internet, are accelerating adoption and strengthening digital inclusion efforts across underserved regions. In parallel, rising demand for secure communications across defense, emergency response, aviation, and maritime sectors, along with sustained government funding for space and defense programs, reinforces the U.S. position as a global leader in the market.

Europe Satellite Communication Market Trends

The satellite communication market in Europe emerged as a high-potential region in 2025, supported by strong institutional backing, defense modernization programs, and growing demand for secure and resilient connectivity across civil, commercial, and government applications. A shift toward technological self-reliance and long-term sustainability increasingly characterizes the regional market. European governments and space agencies are advancing sovereign satellite initiatives, multi-orbit architectures, and public-private partnerships to strengthen strategic autonomy and reduce reliance on non-European satellite operators. Rising investments in low Earth orbit (LEO) and hybrid GEO-LEO constellations, along with policy-driven support for secure communications and broadband coverage in remote areas, continue to enhance the region’s SATCOM ecosystem.

The UK satellite communication market is expected to grow at a robust pace over the forecast period, driven by rising investments in research and development, defense-oriented satellite programs, and commercial broadband initiatives. Active collaboration with international partners and private space companies is accelerating innovation across satellite manufacturing, ground infrastructure, and next-generation payload technologies. Government-backed programs aimed at strengthening national space capabilities, combined with increasing demand for maritime, aviation, and secure government communications, are reinforcing the UK’s position as a key European SATCOM hub.

The satellite communication market in Germany is anticipated to witness steady and strategic growth, supported by the country’s strong industrial base, advanced engineering capabilities, and emphasis on secure digital infrastructure. Germany is prioritizing the development of sovereign and dual-use satellite systems to support defense communications, disaster management, and critical infrastructure connectivity. Increased funding for space research, coupled with close cooperation between government agencies, aerospace companies, and research institutions, is driving innovation in satellite payloads, ground stations, and data processing technologies. Growing demand for high-reliability SATCOM solutions across government, automotive, industrial IoT, and mobility applications further strengthens Germany’s role as a central contributor to Europe’s market.

Asia Pacific Satellite Communication Market Trends

The satellite communication market in the Asia Pacific accounted for 23.9% share of the overall market in 2025. This can be attributed to the relentless pursuit of innovation, research and development, and strategic initiatives by prominent market players aimed at enhancing their market presence. Growing reliance on satcom-dependent services in sectors such as telecommunications, media and broadcasting, agriculture, and energy and utility is also a notable driver of market growth. Moreover, the region is home to numerous organizations dedicated to advancing satellite communications.

India satellite communication market is expected to grow rapidly over the forecast period, driven by rising demand for satellite-based broadband and connectivity solutions across rural, remote, and underserved regions. Policy reforms encouraging private sector participation, along with growing collaboration between domestic players and national space agencies, are accelerating the deployment of new satellite systems and ground infrastructure. Increasing use of SATCOM for disaster management, maritime connectivity, defense communications, and enterprise networking further supports market growth, positioning India as a fast-emerging SATCOM hub in Asia.

The satellite communication market in China held a substantial market share in 2024 and continues to expand at a strong pace. The market is characterized by large-scale satellite constellation rollouts, rapid adoption of advanced payload and launch technologies, and a high level of state-backed investment. A strong emphasis on military, defense, and secure government communications, combined with expanding commercial applications such as broadband, navigation, and remote sensing, reinforces China’s strategic importance in the global satellite communication landscape.

Japan satellite communication market is expected to witness steady growth, supported by the country’s focus on technological precision, resilience, and space-based disaster preparedness. Japan is actively investing in next-generation satellite systems to strengthen national security, emergency response capabilities, and high-reliability communications for aviation and maritime sectors. Close coordination between government bodies, research institutions, and leading technology companies is driving innovation in satellite payloads, ground systems, and data services, establishing Japan as a technologically advanced and reliable SATCOM market in the Asia-Pacific region.

Key Satellite Communication Company Insights

Some of the key companies in the market include Viasat, Inc., SES S.A., L3 Harris Technologies, Inc., EchoStar Corporation, and SKY Perfect JSAT Group. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Viasat, Inc. is engaged in providing communications technologies and services. The company offers end-to-end platforms for ground infrastructure, Ka-band satellites, and user terminals to provide high-speed, high-quality broadband solutions to enterprises, governments, and consumers across the globe.

-

Intelsat S.A. offers satcom services for transmitting data, video, and voice signals. The company provides these services to various media companies, wireless & fixed telecom operators, data networking service providers, ISPs, and multinational corporations.

Key Satellite Communication Companies:

The following are the leading companies in the satellite communicationg market. These companies collectively hold the largest market share and dictate industry trends.

- Viasat, Inc.

- SES S.A

- Intelsat S.A.

- Telesat Corporation

- EchoStar Corporation

- L3Harris Technologies, Inc.

- Thuraya Telecommunications Company (Yashat)

- SKY Perfect JSAT Holdings Inc.

- Gilat Satellite Networks Ltd.

- Cobham Limited

Recent Developments

-

In May 2025, Intelsat expanded its partnership with AXESS Networks to deliver seamless satellite connectivity across the Americas. The collaboration integrates Intelsat and Hispasat satellite assets, enabling multi-satellite services with enhanced coverage, reliability, and service quality for enterprise and mobility customers.

-

In April 2025, SpinLaunch, a space technology company, announced a USD 12 million strategic investment from Kongsberg Defence & Aerospace to support the development and commercialization of its revolutionary Low-Earth Orbit (LEO) satellite broadband constellation, Meridian Space. This partnership highlights SpinLaunch’s commitment to delivering affordable and sustainable satellite communication services globally.

-

In March 2025, Orange Africa and the Middle East partnered with Eutelsat to accelerate satellite internet deployment across Africa and the Middle East. Using the EUTELSAT KONNECT satellite, the initiative targets rural and underserved regions with high-speed, secure broadband connectivity for consumers and enterprises.

-

In January 2025, ReOrbit signed a memorandum of understanding with Ananth Technologies to explore the design and development of GEO communication satellites. The collaboration focuses on integrating software-enabled satellite platforms with advanced manufacturing and AIT capabilities to strengthen the secure communications infrastructure.

-

In December 2024, Parsons and Globalstar announced an exclusive partnership and successfully demonstrated a software-defined satellite communication solution using Globalstar’s LEO constellation. The milestone supports resilient, mission-critical communications for public, government, and defense sectors, particularly in RF-congested and operationally complex environments.

-

In April 2023, SES S.A. and Corporación Nacional de Telecomunicaciones (CNT), a telecommunications provider, partnered to support Ecuador's digital inclusion efforts in the Galapagos Islands. They have announced a significant expansion agreement for medium Earth orbit satellite capacity. This expansion aims to provide enhanced broadband connectivity and 3G/4G/5G mobile services to businesses, residents, and tourists across the isolated Galapagos Islands in the eastern Pacific Ocean, contributing to the development and connectivity of the region.

Satellite Communication Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 107.44 billion

Revenue forecast in 2033

USD 223.06 billion

Growth rate

CAGR of 11.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, satellite constellations, frequency band, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; China; Japan; India; Australia; South Korea; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Viasat, Inc.; SES S.A; Intelsat S.A.; Telesat Corporation; EchoStar Corporation; L3Harris Technologies, Inc.; Thuraya Telecommunications Company; SKY Perfect JSAT Holdings Inc.; Gilat Satellite Networks Ltd.; Cobham Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Satellite Communication Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global satellite communication market report based on component, satellite constellations, frequency band, application, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Equipment

-

Satcom Transmitter/Transponder

-

Satcom Antenna

-

Satcom Transceiver

-

Satcom Receiver

-

Satcom Modem/Router

-

Others (Block-up converters, controllers)

-

-

Services

-

-

Satellite Constellations Outlook (Revenue, USD Billion, 2021 - 2033)

-

Low Earth Orbit (LEO) Satellites

-

Medium Earth Orbit (MEO) Satellites

-

Geostationary Equatorial Orbit (GEO) Satellites

-

-

Frequency Band Outlook (Revenue, USD Billion, 2021 - 2033)

-

L-band

-

S-band

-

C-band

-

X-band

-

Ku-band

-

Ka-band

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Asset Tracking/Monitoring

-

Airtime

-

M2M

-

Voice

-

Data

-

-

Drones Connectivity

-

Data Backup and Recovery

-

Navigation and Monitoring

-

Tele-medicine

-

Broadcasting

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Energy & Utility

-

Government & Defense

-

Government (Civil Uses)

-

Emergency Responders

-

Defense

-

-

Transport & Cargo

-

Fleet Management

-

Rail services

-

-

Maritime

-

Mining and Oil & Gas

-

Oil & Gas

-

Mining

-

-

Agriculture

-

Communication Companies

-

Corporates/Enterprises

-

Media & Broadcasting

-

Events

-

Aviation

-

Environmental & Monitoring

-

Forestry

-

End User - Consumer

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global satellite communication market size was estimated at USD 98.28 billion in 2025 and is projected to reach USD 223.06 billion by 2033.

b. The global satellite communication market is expected to grow at a compound annual growth rate of 11.0% from 2026 to 2033 to reach USD 223.06 billion by 2033.

b. North America dominated the market for satellite communication in 2025. Growing demand for satellite broadband services, especially for providing reliable connectivity in remote, hard-to-reach, and underserved regions of North America, is likely to drive regional growth over the forecast period.

b. Some key players operating in the SATCOM market include SES S.A.; Viasat, Inc.; Intelsat; Telesat; EchoStar Corporation; L3 Technologies, Inc.; Thuraya Telecommunications Company; SKY Perfect JSAT Group; GILAT SATELLITE NETWORKS; Cobham Limited.

b. Key factors that are driving the satellite communication market growth include the escalating demand for small satellites for earth observation services in various industries such as oil & gas, energy, agriculture, and defense and the increasing use of satellite communications by companies to collect operational data to improve efficiency and to realize sustainable ways of conducting business.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.