- Home

- »

- Network Security

- »

-

Supply Chain Security Market Size And Share Report, 2030GVR Report cover

![Supply Chain Security Market Size, Share & Trends Report]()

Supply Chain Security Market (2023 - 2030) Size, Share & Trends Analysis Report By Enterprise Size, By Component (Software), By Vertical (Retail & E-commerce), By Security Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-085-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Supply Chain Security Market Summary

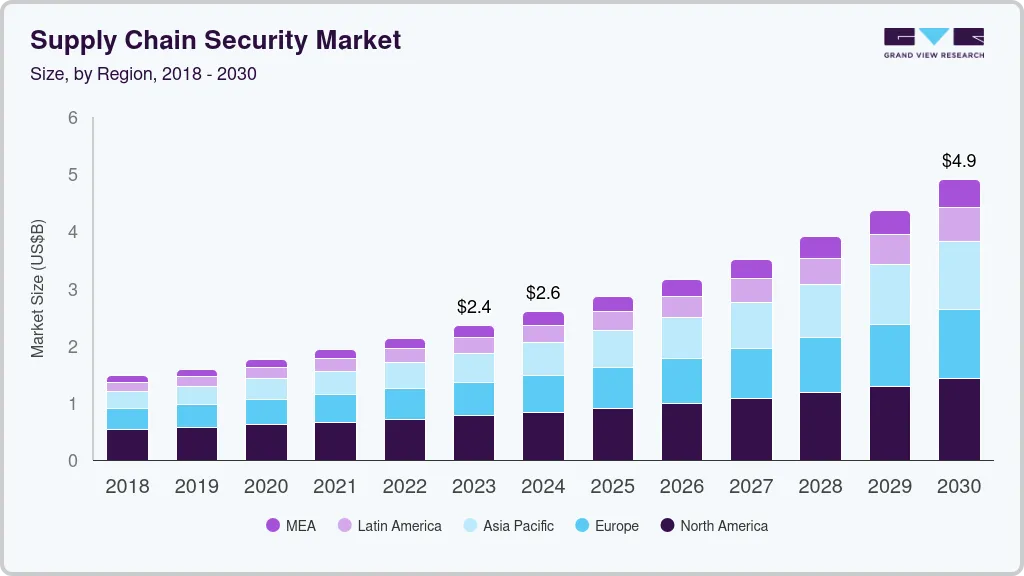

The global supply chain security market size was estimated at USD 2,350.1 million in 2023 and is projected to reach USD 4,902.8 million by 2030, growing at a CAGR of 11.1% from 2024 to 2030. The growing number of cyberattack incidents across supply chain process is expected to drive the demand for supply chain security.

Key Market Trends & Insights

- North America held major share of 32.9% of the target market in 2023.

- Asia Pacific is anticipated to register fastest CAGR of 13.3% from 2024 to 2030.

- By component, the hardware segment accounted for largest share of 53.3% of the overall revenue in 2023.

- By security type, the data locality & protection segment accounted for the largest market share of 43.2% in 2023.

- By enterprise size, the large enterprise segment accounted for a market share of around 53.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,350.1 Million

- 2030 Projected Market Size: USD 4,902.8 Million

- CAGR (2024-2030): 11.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Supply chain security solution enables customers to focus on managing external vendors, transportation, suppliers, and logistics risks. The increasing need for transparency and sustainability is further boosting market growth. However, high cost associated with deploying security solutions can hamper market growth, majorly across Small- And Medium-Sized Enterprises (SMEs). Supply chain cyberattacks refer to the vulnerabilities in software systems, such as piracy, malware attacks, unauthorized access across software, and malicious backdoor attacks.

Market Dynamics

The increasing adoption of advanced solutions and growing focus of businesses on digitization initiatives are leading to the generation of a vast amount of data in industrial sector. Industry 4.0 is gaining traction and companies across several industries are incorporating latest solutions and technologies that provide real-time insights across their operations. Moreover, the increasing need to reduce complexity in supply chain, save operational costs, increase productivity, and ensure fast and safe delivery of goods is compelling companies to deploy supply chain security solutions. The rising implementation of advanced technologies across industries is leading to the accumulation of vast volumes of rich business data that can offer a wide range of insights.

Companies’ focus on data-driven decision-making has also encouraged the use of Big Data and data analytics in the supply chain management process. Governments of several countries have announced multiple projects aimed at improving supply chain management through implementation of latest technologies. Due to the increasing adoption of such technologies, demand for supply chain analytics has spiked in recent years. At the same time, cyberattacks are getting more sophisticated, and losses stemming from cyberattacks are also increasing. While new networks are being rolled out and existing networks are being expanded, these networks are increasingly becoming vulnerable to cyber threats. These factors are contributing to the growth of supply chain security market.

The growing vulnerabilities across the supply chain process could lead to inefficient delivery timelines, uncontrolled expenses, and loss of intellectual assets. These growing system breaches can disrupt, damage, and destroy multiple-level operations. Various SMEs and large enterprises have increased the adoption of security solutions to avoid such system breaches and help protect the process in a more efficient & secure way to overcome any rapid event of a disruption. In addition, many large enterprises are investing heavily in adopting technologies, such as Internet of Things (IoT), blockchain, and Artificial Intelligence (AI), to enhance transparency of supply chain activities. The data collected through IoT devices helps end users enhance efficiency, make accurate resource allocations, and reduce data waste.

Furthermore, AI technology allows vendors real-time monitoring and forecasting of inventory stages ensuring proper flow of products throughout the warehouse. AI technology technology also enhances demand forecasting, risk planning, customer & supplier management, and warehouse & logistics management. Moreover, the blockchain minimizes involvement of third parties, thereby reducing transaction time and improving transparency across supply chain activities. However, high cost of security is one of the major factors hampering market growth. The majority of SMEs have budget constraints to overcome cybersecurity challenges and adopt high-end technology solutions for enhancing the efficiency of supply chain process. This limited capital requirement can be a major restraint factor for SMEs, including supply chain security model.

Component Insights

Hardware segment accounted for largest share of 53.3% of the overall revenue in 2023. Supply chain security has been a growing concern among governments & businesses around the globe, owing to the growing complexity of operations and international trade of goods & services. These complexities have emerged in the threat of cyberattacks as there is a huge involvement of various countries, vendors, and logistics processes. Hardware solutions play a vital role in improving the security of supply chain process through real-time visibility, monitoring, and traceability capabilities.

Service segment is anticipated to grow at the fastest CAGR of 12.3% during forecast period. Supply chain security services include a wide range of offerings that enable businesses to detect, assess, and overcome cybersecurity threats during process flow. Security audits & compliance, risk assessment & consulting, and supplier & vendor management are a few of the services promoting market growth.

Security Type Insights

Data locality & protection segment accounted for the largest market share of 43.2% in 2023 and will remain dominant throughout forecast years. Growing database associated with supply chain activities has increased the complexity of securing data sets across various businesses, such as healthcare and financial sectors. Data locality & protection security type enables businesses to manage & secure data, which is stored, used, exchanged, and managed in compliance with government and industry standards varying depending on regions in which they operate.

Data visibility & governance segment is anticipated to grow at a CAGR of 12.2% during the forecast period. Data visibility & governance in this market help track different products and goods in transit, providing a clear analysis of activities and inventory. The growing need to enhance customer service and reduce cost spending through managing inventory in the process, reducing risks, limiting disruption, and updating status of transit activities has boosted demand for data visibility & governance.

Enterprise Size Insights

Large enterprise segment accounted for a market share of around 53.1% in 2023. The growth in large enterprises increases overall complexity of supply chain activity, which involves numerous vendors, suppliers, customers, logistics, and partners. This growing involvement of various parties throughout the process increases risk of cyber attacks, thereby introducing additional risks and vulnerabilities. The growing need to manage and mitigate these risks across supply chain process has fueled the demand for supply chain security market among large enterprises.

Small- and medium-sized enterprises segment is expected to grow at a CAGR of 11.8% during forecast period. While small and medium-sized enterprises have smaller supply chain processes as compared to large enterprises, there are still threats of vulnerabilities and risks that can impact supply chain process, thereby damaging complete business operations. The growing need among SMEs to enhance data protection, supplier & customer management, and provide continuous monitoring and incident response has propelled market demand.

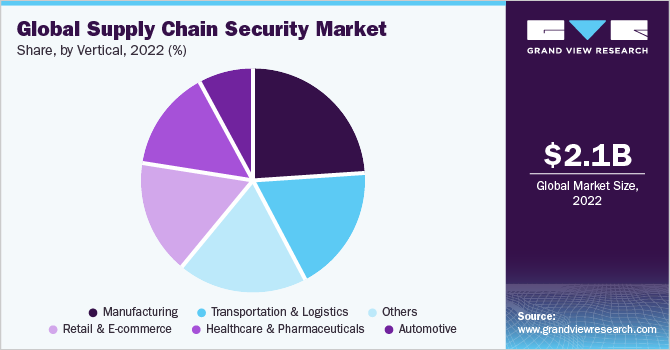

Vertical Insights

Manufacturing segment accounted for the largest market share of 24.2% in 2023. The growing importance among manufacturing industries to enhance supply chain activities and secure them against potential vulnerabilities has emerged the need for supply chain security. The industry relies on complex supply chain processes as the manufacturing process involves development of critical products and solutions suitable for different application areas. Supply chain security enables industry to protect product development lifecycle by encouraging secure hardware and software development practices among suppliers. Therefore, it has become vital for all manufacturing industries to implement secured operations and offer guidelines to mitigate future risks across supply chain process, thereby boosting market growth.

Healthcare & life sciences segment is anticipated to grow at a CAGR of 10.4% during forecast period. The manufacturing process of healthcare & life sciences products and services involves complex supply chain activities, given the critical nature of pharmaceutical, patient insights, and medical data. As healthcare & life science sector is expected to grow, there is an increasing demand for prioritizing security to enhance the safety of patient data and maintain integrity of products and services. Thus, the healthcare & life science segment is expected to boost market demand.

Regional Insights

North America held major share of 32.9% of the target market in 2023. The market in North America is driven by the increasing cyberattacks and the need for data security across various SMEs and large-scaleenterprises. For instance, the cyberattack on SolarWinds, Network Management System is one of the biggest cybersecurity incidents in the past few years. The U.S. is expected to hold the largest share of the market during this period due to the high adoption of security solutions and the presence of major supply chain security vendors in the region. North America is dominated by several key players, including NXP Semiconductors N.V., Oracle Corp., and International Business Machines Corporation. These companies offer various security solutions that help organizations perform effective supply chain activities and secure their data from cyber threats.

Asia Pacific is anticipated to register fastest CAGR of 13.3% from 2024 to 2030. Asia Pacific has seen a rapid increase in the technology adoption supporting security services, along with growth in government initiatives to support cybersecurity compliances to protect data from threats, resulting in the need for supply chain security solutions. Moreover, the demand for security solutions across SMEs is expected to boost growth of the Asia Pacific market as organizations look for scalable and cost-effective solutions. The healthcare, transportation, manufacturing, and retail sectors are expected to be major end-users of supply chain security solutions in the Asia Pacific region due to high demand among vendors to protect their data and enhance process transparency.

Supply Chain Security Market Share Insights

Industry players utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions, to broaden their product offering. In February 2022, Oracle Corporation launched new logistic capabilities within Oracle Fusion SCM. These new capabilities enable the customers to reduce risks, navigate disruptions, minimize costs, and enhance customer experience. Some of the prominent players in the global supply chain security market include.

-

Altana

-

Dickson, Inc.

-

ELPRO-BUCHS AG

-

Emerson Electric Co.

-

International Business Machines Corporation

-

Hanwell Solutions

-

Monnit Corporation

-

NXP Semiconductors N.V.

-

Oracle Corporation

-

ORBCOMM

-

Rotronic Instrument Corp.

-

SafeTraces

-

Sensitech Inc.

-

Tagbox Solutions

-

Testo SE & Co. KGaA

Recent Development

-

In June 2023, Emerson Electric Co. launched its new ASCO Series 641, 642, and 643 Aluminum Filter Regulators. These new products are designed to reduce unplanned downtime and maximize process efficiency in a wide range of process applications.

-

In May 2023, NXP Semiconductors N.V. introduced a new i.MX 91 application processor series to deliver a powerful blend of features, security capability, and energy-efficient performance across the next generation Linux-enabled IoT and industrial applications.

-

In February 2023, ELPRO-BUCHS AG announced the shifting of its sales and service office to a large premise in Singapore. This initiative is expected to support the company’s growth strategy in Asia Pacific.

-

In June 2022, IBM Corporation acquired Randori a cyber security company to strengthen its hybrid cloud strategy, along with expanding its portfolio of AI-enabled cybersecurity products and services.

Supply Chain Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,589.8 million

Revenue forecast in 2030

USD 4,902.8 million

Growth rate

CAGR of 11.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, security type, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Altana; Dickson, Inc.; ELPRO-BUCHS AG; Emerson Electric Co.; International Business Machines Corp.; Hanwell Solutions; Monnit Corp.; NXP Semiconductors N.V.; Oracle Corp.; ORBCOMM, Rotronic Instrument Corp.; SafeTraces; Sensitech Inc.; Tagbox Solutions; Testo SE & Co. KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Supply Chain Security Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global supply chain security market report based on component, security type, enterprise size, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Locality & Protection

-

Data Visibility & Governance

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium-sized Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare & Pharmaceuticals

-

Retail & E-commerce

-

Automotive

-

Transportation And Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global supply chain security market size was estimated at USD 2.13 billion in 2022 and is expected to reach USD 2.35 billion by 2023.

b. The global supply chain security market is expected to grow at a compound annual growth rate of 11.1% from 2023 to 2030 to reach USD 4.90 billion by 2030.

b. Hardware dominated the supply chain security market with a share of 53.5% in 2022. This is attributable to growing concern among governments & businesses around the globe, owing to the growing complexity of operations and international trade of goods & services.

b. Some key players operating in the supply chain security market include Altana, Dickson, Inc., ELPRO-BUCHS AG, Emerson Electric Co., International Business Machines Corporation, Hanwell Solutions, Monnit Corporation, NXP Semiconductors N.V., Oracle Corporation, ORBCOMM, Rotronic Instrument Corp., SafeTraces, Sensitech Inc., Tagbox Solutions, and Testo SE & Co. KGaA.

b. Key factors that are driving the supply chain security market growth include, the growing number of cyberattack incidents across the supply chain process and increasing need for transparency and sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.