- Home

- »

- Homecare & Decor

- »

-

Surfing Equipment Market Size, Share, Industry Report 2030GVR Report cover

![Surfing Equipment Market Size, Share & Trends Report]()

Surfing Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Surfing Boards, Apparel & Accessories), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-671-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surfing Equipment Market Summary

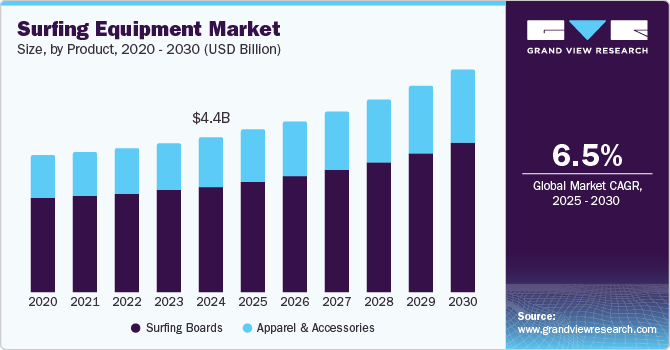

The global surfing equipment market size was estimated at USD 4.40 billion in 2024 and is projected to reach USD 6.32 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The rising popularity of surfing, both as a hobby and a competitive sport, has steadily increased demand for the required gear, including surfboards and surfing apparel worldwide.

Key Market Trends & Insights

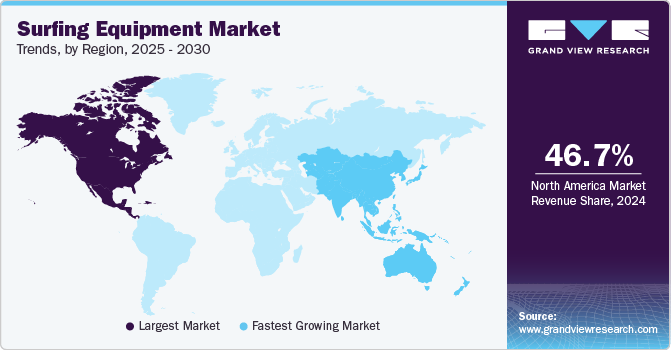

- In terms of region, North America was the largest revenue generating market in 2024.

- This growth is aided by the rising popularity of surfing as a recreational activity in regional economies, particularly the U.S. and Mexico.

- In terms of product, surfing boards accounted for the largest revenue share of 68.0% in 2024.

- Apparels & accessories is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.40 Billion

- 2030 Projected Market Size: USD 6.32 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

The activity is closely associated with beach communities and outdoor adventure, which appeals to various demographics. Individuals are increasingly turning to surfing for both its athletic aspect and the sense of freedom, connection to nature, and lifestyle it promotes. This has led companies to launch basic and advanced surfing equipment to cater to the rising demand, creating growth opportunities for the market.

Surfing has witnessed a rapid growth in its audience over the past few years, aided by the extensive promotion of several regional and global championships and the presence of several notable surfers with significant social media following. The sport has notably been part of the 2020 and 2024 Summer Olympics in Tokyo and Paris, respectively, with expectations to make it a permanent event from the 2028 event onwards. This highlights a significant interest in surfing globally, which is anticipated to generate healthy demand for related equipment among consumers willing to try this activity. The increasing number of tourists visiting coastal destinations presents another notable avenue for expanding the surfing equipment industry. Well-known locations such as Bali, Malibu, Hawaii, and the Gold Coast have a high volume of surfing stores and professionals that encourage visitors to experience surfing. This is a significant demand driver for rental gear and equipment sales, especially in locations where surfing is a major tourist attraction.

Materials science and design advancements have greatly improved surf equipment’s performance and functionality. Lighter, stronger, and more durable surfboards and high-performance wetsuits that provide better insulation and flexibility in various water temperatures have become popular among surfing enthusiasts and professionals. Moreover, companies frequently partner with leading surfers to launch offerings that can help improve visibility and sales. For instance, in December 2024, Rip Curl announced its collaboration with women’s surfing icon Stephanie Gilmore, launching the Rip Curl x Stephanie Gilmore collection for its customers. This range includes various surfing essentials, including swimwear, wetsuits, and boardshorts, with Steph Gilmore Dawn Patrol wetsuits and SG One Piece Swim being some notable products in this collection. Similar initiatives by other companies are expected to generate strong competition in the market in the coming years.

Incorporating sustainability in equipment to cater to eco-conscious consumers is another major strategy companies adopt to boost sales. Consumers are increasingly looking for products made from sustainable, recycled, or biodegradable materials, such as surfboards made from eco-resins, recycled foam, and natural fibers. In the apparel space, the use of neoprene alternatives, such as plant-based materials in wetsuits, appeals to consumers. In December 2024, Notox Surfboards announced a partnership with Libeco, part of the Alliance for European Flax-Linen and Hemp, launching a range of sustainable surfboards designed for Clément Roseyro, a French professional big wave surfer. These boards utilize sustainable materials, including flax fiber-woven reinforcements from Libeco, upcycled carbon fiber by Airbus, Sicomin’s greenPoxy 56 bio-resin, and agave-based foam cores. The boards have been developed specifically for the 2025 Nazaré Big Waves Challenge event in Portugal. Similar strategies are becoming more common among major surfing equipment brands, thus creating positive advancements in the overall market.

Product Insights

The surfing boards segment accounted for the largest revenue share of 68.0% in the global surfing equipment industry in 2024. Increasing popularity and participation in surfing, coupled with growing interest in this sport among younger demographics, has driven the demand for surfboards, particularly in economies with extensive shorelines and favorable conditions for waves. Moreover, the use of innovative materials to manufacture surfboards in recent years has led to the development of light, durable, and performance-oriented boards. Introducing epoxy, carbon fiber, and other high-performance materials has resulted in a growing market for premium boards that appeal to recreational surfers and professionals. Technological advancements that improve board performance, such as advanced shapes, fin configurations, and tail designs, cater to professional surfers looking for boards that match specific wave conditions and performance objectives.

Meanwhile, the apparel & accessories segment is expected to advance at the highest CAGR during the forecast period in the market. The expansion of surfing activities globally has created a strong demand for apparel such as wetsuits, boardshorts, and rash guards that help improve performance while making the experience safer for individuals. For instance, wetsuits are essential for surfing in colder waters, as they provide thermal protection and comfort. Their demand is mainly influenced by water temperature, with more extreme cold-water locations increasing the need for thicker, more insulated wetsuits. On the other hand, in warm water conditions, surfers require boardshorts and rash guards to protect against the sun, surfboard chafing, and irritation. These products are lightweight, breathable, and essential for comfort, particularly for surfers in tropical or warm regions. Advances in materials and design for surf apparel, including moisture-wicking fabrics, UV protection, quick-drying technology, and sustainable technology, further play a key role in boosting segment demand.

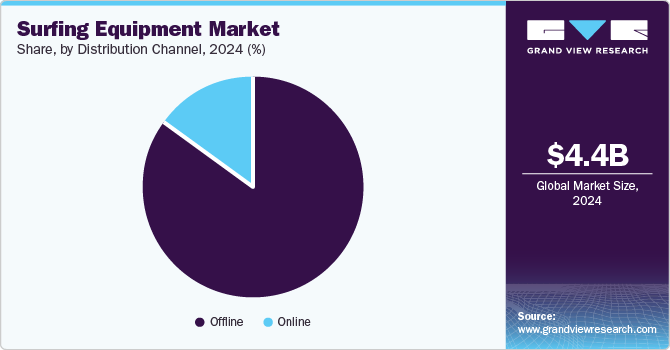

Distribution Channel Insights

The offline segment accounted for a dominant revenue share in the global market for surfing equipment in 2024. Consumers generally prefer physical stores while purchasing surfboards, wetsuits, and other surfing accessories, as these outlets provide a hands-on experience to evaluate the fit, feel, and performance of these products. Moreover, surf shops offer expert advice and recommendations, especially for new surfers or those looking to upgrade their gear. The availability of knowledgeable staff can help guide customers through the various types of surfboards and accessories based on their experience level, preferred wave conditions, and personal choices, enabling them to make informed purchasing decisions. Many stores also collaborate with local surf schools to offer packages that include equipment rentals, lessons, and accessories. These partnerships help drive sales by allowing new surfers to try different equipment in a real-world setting and purchase their gear.

The online segment is expected to advance at the highest CAGR in the global surfing equipment industry from 2025 to 2030. Online sales of surfing equipment have seen significant growth in recent years, driven by the increasing adoption of e-commerce, changes in consumer buying behaviors, and the global reach of online platforms. The convenience of shopping from home and thus avoiding the need to visit physical stores appeals to consumers with busy schedules or those living in areas without access to specialized surf shops. Furthermore, these platforms offer a wider variety of surfing equipment, including surfboards, wetsuits, accessories, and clothing from numerous brands. This makes it easier for consumers to compare products, check different specifications, and find items that fit their requirements. Social media also plays a vital role in driving online sales, with many surfers and brands using platforms such as Instagram and YouTube to showcase products, share tutorials, and provide personal recommendations.

Regional Insights

The North America surfing equipment market accounted for the largest global revenue share of 46.7% in 2024, aided by the rising popularity of surfing as a recreational activity in regional economies, particularly the U.S. and Mexico. The younger demographic in North America is increasingly turning to surfing as a hobby due to its thrill and excitement, thus creating a substantial demand for surfboards and surfing gear. Furthermore, the region has a number of popular coastal locations that attract tourists, many of whom want to experience surfing or engage in the sport during vacations. This has resulted in an extensive demand for rental equipment and beginner-friendly surfboards. Surfing destinations such as Malibu (U.S.), Oahu (Hawaii), and Tofino (Canada) are major tourist hubs, generating substantial sales for both seasonal and year-round surfing products and accessories.

U.S. Surfing Equipment Market Trends

The surfing equipment market in U.S. accounted for the largest revenue share in the regional market for in 2024. The presence of several notable locations on the East Coast and West Coast, such as Malibu, Ventura, Santa Cruz, and Huntington Beach (California); Montauk (New York); Narragansett (Rhode Island); Newport (Oregon); and Cocoa Beach (Florida), has led to a notable surge in surfing activities in the country. According to the latest Surf Industry Members Association (SIMA) report, the surfing population in the U.S. increased by 28% from 2019 to 2020, translating to around 3.8 million individuals. Moreover, the core surfing population increased by 34% during this period, with 71% of the overall surfing population belonging to the age group of 6–34 years. These numbers have sustained steady growth in the following years, owing to the presence of notable surfing brands and the incorporation of innovations and sustainability in this industry.

Europe Surfing Equipment Market Trends

Europe accounted for a substantial revenue share in the global surfing equipment industry in 2024. Surfing is increasingly being perceived as both a sport and a lifestyle among the regional population, especially in the economies of France, Spain, Portugal, and the UK, which have notable coastlines and favorable environments for this activity. The sport has become more mainstream in recent years, with a rise in both participation and fanbase, particularly among younger generations. Europe is additionally well-known among locals and international tourists for popular surfing destinations along its coastlines, such as Biarritz and Hossegor (France), Peniche and Nazaré (Portugal), and the Canary Islands (Spain). Major surfing competitions, such as the Quiksilver Pro France, the European Surfing Championships, and various local events across Portugal and Spain, have helped boost this sport’s popularity, thus driving the regional market.

Asia Pacific Surfing Equipment Market Trends

The surfing equipment market in Asia Pacific region is expected to advance at the highest CAGR in the global market from 2025 to 2030. Surfing and other forms of watersports are highly popular in economies such as Australia and New Zealand, while they are also gaining significant traction in other major markets such as China, India, and Japan. The increasing number of surf schools, particularly in popular locations such as Bali, Sri Lanka, and Thailand, is driving healthy demand for entry-level equipment. Many tourists and locals are learning to surf, encouraging first-time equipment purchases. Surfing instructors, surf camps, and training facilities are linked to the sale and rental of surfing gear, boosting market expansion in the region. Furthermore, increased exposure, especially via social media and international surfing competitions, has created significant interest in the sport. Platforms such as Instagram and YouTube have enabled surfers and brands to showcase their experiences and products, influencing market advancements.

Australia & New Zealand accounted for the largest revenue share in the Asia Pacific market for surfing equipment in 2024, and these countries are further expected to advance at the fastest CAGR during the forecast period. Australia, being an island economy, has various coastal destinations that enable casual as well as experienced individuals to enjoy surfing. Moreover, the economy has a significant number of surfboard and surf apparel manufacturers that have expanded their international operations. Surfing Australia serves as the national governing body for the sport, promoting its development and overseeing various initiatives. For instance, in January 2025, the association, in partnership with NRMA Insurance, launched the Hyundai Australian Boardriders Battle (ABB) competition, which involves 85 teams competing in eight qualifying rounds nationwide. The event is expected to boost surfing participation and activities at the grassroots level, strengthening the country’s surfing community. Such developments are expected to improve awareness regarding the sport, thereby driving apparel and accessories sales.

Key Surfing Equipment Company Insights

Some major companies involved in the global surfing equipment industry include Billabong, CHANNEL ISLANDS SURFBOARDS, and JS Industries (Madluc Pty Ltd), among others.

-

Billabong, part of the Authentic Brands Group LLC, is an Australian company specializing in surfwear and lifestyle products primarily catering to the surfing community. It develops boardshorts for men, swimwear for women, and other clothing items such as t-shirts, shirts, shorts, jackets, flannels, tops, dresses, and skirts. Billabong further provides wetsuits for both men and women, which include upcycler wetsuits, fullsuits, springsuits, and rashguards. The company also has an adventure division that sells hoodies & fleece, jackets, bottoms, tops, t-shirts, and other accessories.

-

JS Industries (Madluc Pty Ltd) is an Australian surfboard manufacturer headquartered in New South Wales that develops high-performance surfboards and innovative surfboard designs. These surfboards have been classified into three categories based on their construction: Carbotune, HYFI 3.0., and PU boards. Notable offerings include MONSTA 10, XERO GRAVITY, BIG BARON, RAGING BULL, BLACK BARON 2.1, FLAME FISH, STEP OFF, BIG HORSE, GOLDEN CHILD, and SCHOONER. The company also manufactures apparel such as boardshorts, t-shirts, jackets and fleece, track pants, caps, beanies, and utility pants, among other items. In February 2021, JS Industries opened its North American headquarters in Oceanside, California.

Key Surfing Equipment Companies:

The following are the leading companies in the surfing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Billabong

- Quiksilver

- Madluc Pty Ltd

- CHANNEL ISLANDS SURFBOARDS

- Nike, Inc.

- FIREWIRE SURFBOARDS

- Rusty Surfboards

- Rip Curl. Ltd.

- CANNIBAL SURFBOARDS

- O’NEILL

Recent Developments

-

In February 2025, Authentic Brands Group announced a partnership with Velocity Global Brands to design, manufacture, and distribute women's apparel for Authentic's Quiksilver brand. The agreement, which includes developing products such as dresses, boardshorts, denim, woven tops, outerwear, t-shirts, and swimwear, has been signed for the U.S. and Canadian markets. The apparel selection will become available across select retail outlets in the region starting in the spring of 2025.

-

In June 2024, Firewire Surfboards announced the release of the VELOX fin set to provide the brand's entire surfboard range with better drive and control capabilities. The core of the product has been designed using high density polymer with overlayed carbon veils, offering extensive strength and flexibility while ensuring better control in comparison to other fin building techniques. VELOX is available via authorized retail locations and online platforms as a 5 Fin and Thruster set in medium and large sizes, along with a Thruster set in small size.

-

In June 2024, Billabong released its cutting-edge ‘Upcycler’ project, which includes a range of premium-quality sustainable wetsuits. The initiative involves combining disposed post-consumer materials for wetsuit liners and jerseys and converting post-consumer discarded wetsuits into raw materials for the product’s internal rubber. Billabong has further transitioned from synthetic rubber to a 100%-natural and FSC-certified rubber formulation that originates from the Hevea brasiliensis tree.

Surfing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.61 billion

Revenue forecast in 2030

USD 6.32 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Portugal, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Argentina, South Africa, UAE

Key companies profiled

Billabong; Quiksilver; Madluc Pty Ltd; CHANNEL ISLANDS SURFBOARDS; Nike, Inc.; FIREWIRE SURFBOARDS; Rusty Surfboards; Rip Curl. Ltd.; CANNIBAL SURFBOARDS; O’NEILL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surfing Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surfing equipment market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surfing Boards

-

Short Board

-

Long Board

-

-

Apparel & Accessories

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Portugal

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.