- Home

- »

- Medical Devices

- »

-

Surgical Equipment Market Size, Share, Industry Report, 2030GVR Report cover

![Surgical Equipment Market Size, Share & Trends Report]()

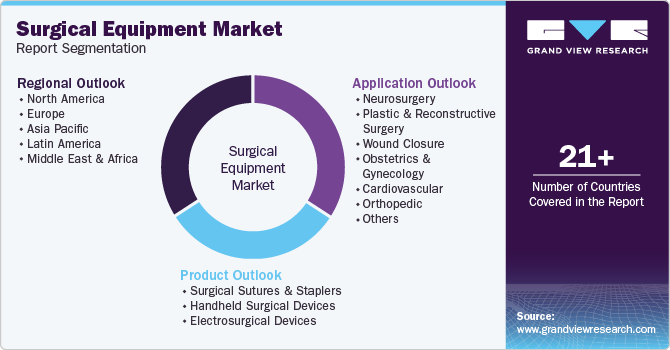

Surgical Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Surgical Sutures & Staplers, Handheld Surgical Devices), By Application (Neurosurgery, Plastic & Reconstructive Surgery), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-240-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Equipment Market Summary

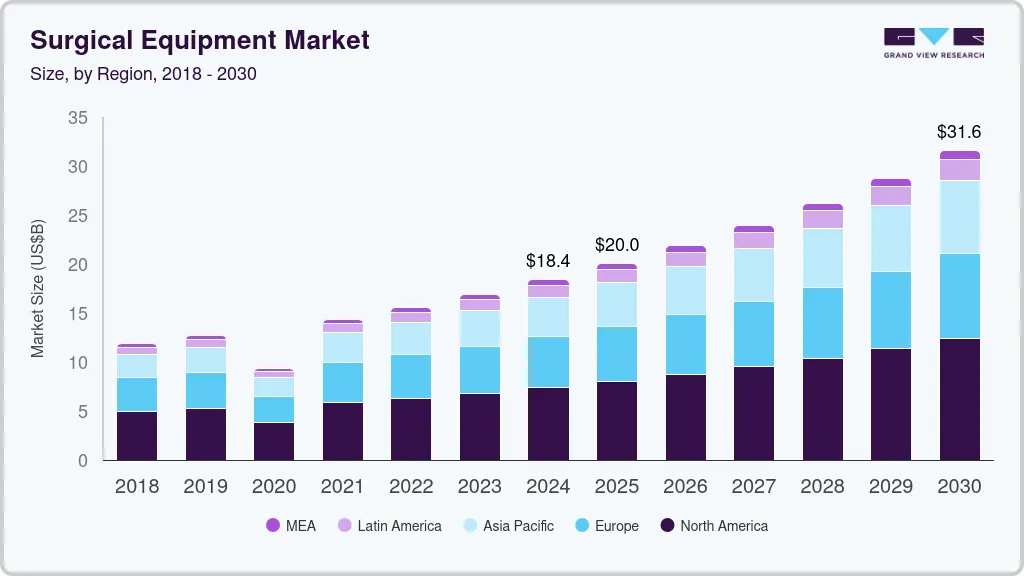

The global surgical equipment market size was estimated at USD 18.37 billion in 2024 and is projected to reach USD 31.58 billion by 2030, growing at a CAGR of 9.54% from 2025 to 2030. Factors such as an increase in the incidence of lifestyle disorders that eventually require surgery, rising healthcare costs, and large unmet surgical needs are mainly driving the market growth.

Key Market Trends & Insights

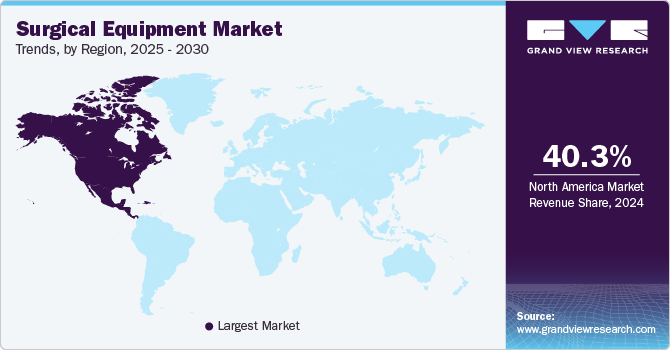

- North America surgical equipment industry dominated globally in 2024 with a revenue share of 40.31%.

- The U.S. surgical equipment industry dominated the North America market in 2024.

- The Asia Pacific surgical equipment industry is expected to witness the fastest CAGR during the forecast period.

- By product, the surgical sutures and staplers segment dominated the market with the largest revenue share of 44.93% in 2024.

- By appliaction, the others segment held the largest revenue share of over 22.53% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.37 Billion

- 2030 Projected Market Size: USD 31.58 Billion

- CAGR (2025-2030): 9.54%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Lowered hospital stays post-surgery and increased ambulatory surgical centers are projected to fuel the market growth during the forecast period. In addition, the growing geriatric population can support market expansion as older people are at higher risk of acquiring chronic diseases and injuries. According to the India Ageing Report 2023, the number of older people across the globe is expected to double to 2.1 billion by 2050. Out of these, around 1.3 billion elderly people are expected to be from Asia.

Furthermore, the increase in the prevalence of diseases like cardiovascular and cancer that necessitate surgeries is anticipated to propel industry growth. According to the article published by WebMD LLC in January 2024, open-heart surgery in the U.S. is the most common, with nearly 400,000 procedures done every year. Thus, the large number of surgical procedures conducted across developed and developing countries is anticipated to propel the demand for surgical equipment.

Moreover, the manufacturers and industry participants are focusing on developing advanced products in the market. For instance, in August 2023, Healthium Medtech, a major medical technology firm, introduced a range of sutures, TRUMASTM, invented to address challenges encountered during suturing in minimal access surgeries. Such product launches are anticipated to support the industry’s growth over the forecast period.

The increasing geriatric population is a key factor contributing to market growth. Individuals that are aged 60 and above are at a higher risk of developing disorders that require surgery compared to the younger population. According to the Centers for Disease Control and Prevention, the number of hip replacements among people 45 and over was 310,800 in 2021.

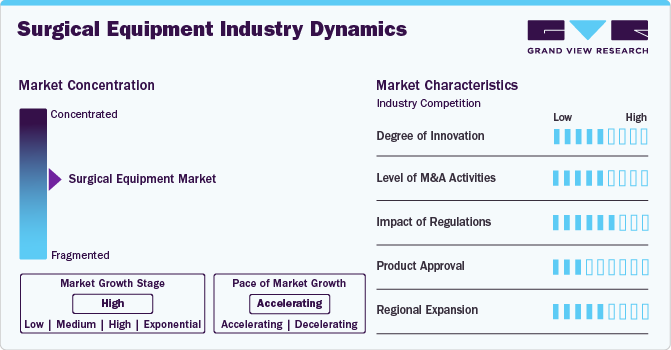

Market Concentration & Characteristics

The rate of industry growth is high at an accelerating pace due to the rising development of advanced products and increased adoption of minimally invasive procedures.

Companies and manufacturers are innovating continuously to provide advanced products. In addition, the regulatory bodies are also supporting innovative products by providing approvals for clinical trials and marketing. For instance, in December 2023, Acclarent announced the FDA approval for its AERA Eustachian Tube Balloon Dilation System, used in the treatment of children affected with persistent obstructive Eustachian tube dysfunction.

The market is also characterized by several merger and acquisition activities. Companies are undertaking acquisitions & mergers to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. For instance, in January 2025, JUNE MEDICAL announced a strategic collaboration with Aspen Surgical Products, Inc. to distribute the Galaxy II retractor system across the U.S. market. This partnership will use Aspen Surgical’s sales network to increase JUNE MEDICAL’S Galaxy II Retractor System, which is a versatile surgical device used in multiple specialties such as orthopedics, gynecology, and others.

Regulations for medical devices, including surgical equipment, are overseen by regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. and similar agencies globally. The authorities have published a regulatory framework and guidance documents to assure product effectiveness, safety, and quality standards. Furthermore, the authorities are updating their regulations for surgical instruments. For instance, in October 2022, the Central Drugs Standard Control Organization (CDSCO) published a notice about the classification of non-powered, non-sterile, hand-held, or hand-manipulated surgical instruments for general use planned to be utilized in diverse general surgical procedures.

In the surgical equipment industry, tissue adhesives and Hemostats serve as substitutes. This equipment can be used to control bleeding during surgery or wound closure.

Key market players such as Johnson & Johnson, BD, Zimmer Biomet Holdings Inc., and Medtronic hold substantial shares in the market. Their dominant presence is largely due to their well-established brands, financial position, product portfolio, and extensive distribution networks. For instance, Stryker offers diverse products like Non-Stick Bipolar Forceps, dual-directional expandable retractors, Biters, Graspers, and Scissors, among others.

The companies are significantly focusing on increasing the reach of their products in several countries. They are forming distribution partnerships to distribute their products across numerous markets. For instance, in April 2022, KitoTech Medical partnered with Corza Medical to sell and market microMend's wound closure products, including an array of miniature staples.

Product Insights

The surgical sutures and staplers segment dominated the market with the largest revenue share of 44.93% in 2024. The dominance of this segment can be due to the high adoption rate of staplers and sutures owing to their growing usage in wound closure processes. In addition, the adoption of staplers is expected to increase due to the advantages offered by staplers are superior to those offered by sutures. These advantages include rapid wound healing and a low risk of infection. Moreover, the companies are launching novel products in this segment. For instance, in June 2022, a major industry player, Johnson & Johnson’s Ethicon, launched a next-gen Echelon 3000 stapler.

The electrosurgical devices segment is anticipated to register the fastest CAGR of 10.77% over the forecast period. The growth of the segment can be attributed to the increasing demand for these devices in minimally invasive surgeries. Moreover, major market players such as Medtronic and Stryker offer electrosurgical devices. Thus, the availability of products from top companies is anticipated to support the segment growth.

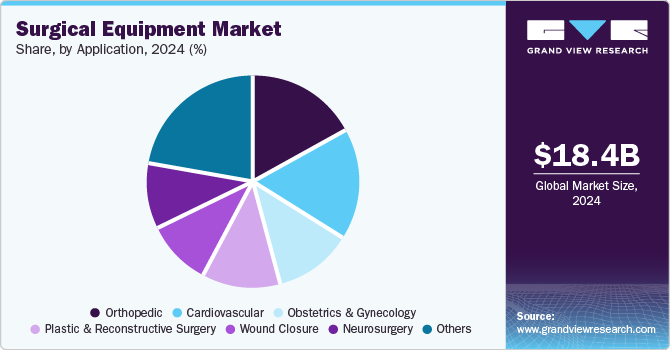

Application Insights

The others segment held the largest revenue share of over 22.53% in 2024. The other segments include radiosurgery, urological, and general surgeries. The increasing prevalence of cancer across the globe is anticipated to propel the demand for radiosurgery, which is expected to drive the need for surgical equipment. According to the article published by the American Cancer Society in January 2023, an estimated 609,820 individuals in the U.S. are expected to die from cancer in 2023.

The wound closure segment is expected to witness the fastest CAGR over the forecast period. This is due to the growing incidences of chronic wounds, the rising number of surgeries worldwide, and technological advancements in wound closure, and also the significantly improved patient outcomes and recovery times. For instance, in May 2023, the engineers at the Massachusetts Institute of Technology (MIT) designed smart sutures or sutures with smart applications, which are made of purified collagen from cows and are coated with a layer of hydrogel, which is embedded with types of cargo - microparticles that can sense inflammation, drug molecules, or living cells. These sutures can be adopted to heal wounds or surgical incisions in the body.

Regional Insights

North America surgical equipment industry dominated globally in 2024 with a revenue share of 40.31%. This is due to the high prevalence of chronic diseases such as orthopedic diseases, cancer, and cardiovascular disorders, which drive the demand for advanced medical equipment. In addition, the presence of major product providers in the region, such as STERIS and KLS Martin Group is projected to improve the accessibility of products.

U.S. Surgical Equipment Market Trends

The U.S. surgical equipment industry dominated the North America market in 2024 due to the presence of key players, increased ambulatory surgical centers, and significant investments in novel developments of equipment. The major market participants like Stryker, Aspen Surgical, Zimmer Biomet, and Medtronic are present in the U.S.

Europe Surgical Equipment Market Trends

The Europe surgical equipment industry was identified as a lucrative region in this industry due to the growing elderly population coupled with the rising surgical procedures across the region. Moreover, the increasing launches of medical devices and instruments by industry players are expected to drive regional growth.

The surgical equipment industry in the UK is expected to grow over the forecast period, majorly due to the increasing availability of equipment used in surgeries like forceps, spatulas, sutures, dilators, and retractors, among others, across the country.

France surgical equipment industry is expected to grow over the forecast period due to the growing geriatric population in the country, as older people are at higher risk of undergoing surgeries. The increase in the number of surgeries in France due to rising sports activities along with rising injuries is also anticipated to boost the demand for surgical equipment in the country.

The Germany surgical equipment industry is expected to grow over the forecast period due to increased surgeries and the rising prevalence of chronic diseases. Moreover, the Germany-based industry product provider like KLS Martin Group is anticipated to support the market expansion.

Asia Pacific Surgical Equipment Market Trends

The Asia Pacific surgical equipment industry is expected to witness the fastest CAGR during the forecast period. This progress is driven by advancements in healthcare infrastructure, the rising prevalence of chronic diseases, and an increasing geriatric population. In addition, developing countries such as India and China and the rising focus of industry participants in these countries are projected to propel the regional industry.

Japan surgical equipment industry is expected to witness significant growth in the coming years. The rising older population across Japan is projected to boost market growth. According to the article published by the World Economic Forum in September 2023, over 1 in 10 individuals in Japan are aged 80 or older. In addition, around 33.33% of the country’s population is aged 65 or more. Thus, the presence of a large potential patient pool is expected to propel the demand for surgical equipment.

The surgical equipment industry in China is expected to grow over the forecast period due to the rising healthcare expenditure in China. In addition, the increasing approvals from the regulatory body and rising product launches are anticipated to support the market in China. For instance, in September 2023, China’s National Medical Products Administration (NMPA) approved the antibacterial sutures from Genesis MedTech.

The surgical equipment industry in India is expected to grow over the forecast period due to the rising focus of industry participants in the Indian market, growing investments in medical instruments, and increasing expansion activities for medical devices in India. For instance, in January 2024, the UK-based Surgical Instruments Group Holdings (SIGH) revealed that the company would establish a medical device manufacturing facility in Hyderabad. Thus, the increasing manufacturing of medical devices is anticipated to create opportunities for equipment providers in the country market.

MEA Surgical Equipment Market Trends

The surgical equipment industry in MEA is expected to grow over the forecast period.

The surgical equipment industry in Saudi Arabia is expected to grow over the forecast period due to the rising number of individuals undergoing surgeries. According to the article published by the Saudi Gazette report in March 2023, over 290,000 non-critical surgeries were conducted within various regions of Saudi Arabia in 2022.

The surgical equipment industry in Kuwait is expected to grow over the forecast period due to the significant increase in the number of surgeries being performed in the country. For instance, according to the article released by the Emirates Health Services (EHS) in August 2022, Kuwait Hospital in Sharjah conducted 939 surgeries and received 15,040 patients in the initial half of 2022, which shows an increase from the 573 surgeries and 10,992 patients recorded during the same period in the previous year.

Key Surgical Equipment Company Insights

The competitive scenario in the surgical equipment industry is driven by both new entrants and established players, with partnerships, market expansion, and innovative product launches being key strategies. Companies are developing advanced products that can increase the patient’s comfort. In addition, the rising investments are influencing the development of industry products.

Key Surgical Equipment Companies:

The following are the leading companies in the surgical equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson (Ethicon Inc.)

- Zimmer Biomet

- B. Braun SE

- GPC Medical

- IndoSurgicals Private Limited

- Smith + Nephew

- Stryker

- Aspen Surgical

- Medtronic

- BD

Recent Developments

-

In January 2025, JUNE MEDICAL announced a strategic collaboration with Aspen Surgical Products, Inc. to distribute the Galaxy II retractor system across the U.S. market. This partnership will use Aspen Surgical’s sales network to increase JUNE MEDICAL’S Galaxy II Retractor System, which is a versatile surgical device used in multiple specialties such as orthopedics, gynecology, and others.

-

In September 2023, PainTEQ, the U.S.-based firm, introduced a new Surgery-Ready Instrument set and provided a cost-effective and safe option for interventional pain physicians.

-

In June 2023, SURE Retractors Inc., a medical device firm, launched single-use, sterile retractors for trauma, orthopedic, and spinal surgery.

-

In April 2023, Orthofix Medical (Orthofix), a spine and orthopedics company, introduced the Fathom pedicle-based retractor system and the Lattus lateral access system for spine procedures.

Global Surgical Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.02 billion

Revenue forecast in 2030

USD 31.58 billion

Growth rate

CAGR of 9.54% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Johnson & Johnson (Ethicon Inc.); Zimmer Biomet; B. Braun SE; GPC Medical; IndoSurgicals Private Limited; Smith + Nephew; Stryker; Aspen Surgical; Medtronic; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Sutures & Staplers

-

Handheld Surgical Devices

-

Forceps & Spatulas

-

Retractors

-

Dilators

-

Graspers

-

Auxiliary Instruments

-

Cutter Instruments

-

Others

-

-

Electrosurgical Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery

-

Plastic & Reconstructive Surgery

-

Wound Closure

-

Obstetrics & Gynecology

-

Cardiovascular

-

Orthopedic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical equipment market size was estimated at USD 18.37 billion in 2024 and is expected to reach USD 20.02 billion in 2025.

b. The global surgical equipment market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 to reach USD 31.58 billion by 2030.

b. North America dominated the surgical equipment market with a share of 40.3% in 2024. This is attributable to rising healthcare expenditure in the U.S. resulting in well-established hospital infrastructure and the availability of high skilled surgeons.

b. Some key players operating in the surgical equipment market include Zimmer Biomet Holdings, Inc.; Becton, Dickinson and Company; B. Braun Melsungen AG; Smith & Nephew plc; Stryker Corporation; Aspen Surgical Products, Inc.; Ethicon, Inc.; Medtronic; and Alcon Laboratories, Inc.

b. Key factors that are driving the surgical equipment market growth include the Increasing prevalence of chronic diseases, growing geriatric population base, rise in the number of surgical procedures, and introduction of technologically advanced products.

b. The surgical sutures & staplers product segment held the maximum market share of almost 44.9% in 2024 in the surgical equipment market, due to large usage in wound closure procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.