- Home

- »

- Healthcare IT

- »

-

Surgical Instrument Tracking Systems Market Report, 2033GVR Report cover

![Surgical Instrument Tracking Systems Market Size, Share & Trends Report]()

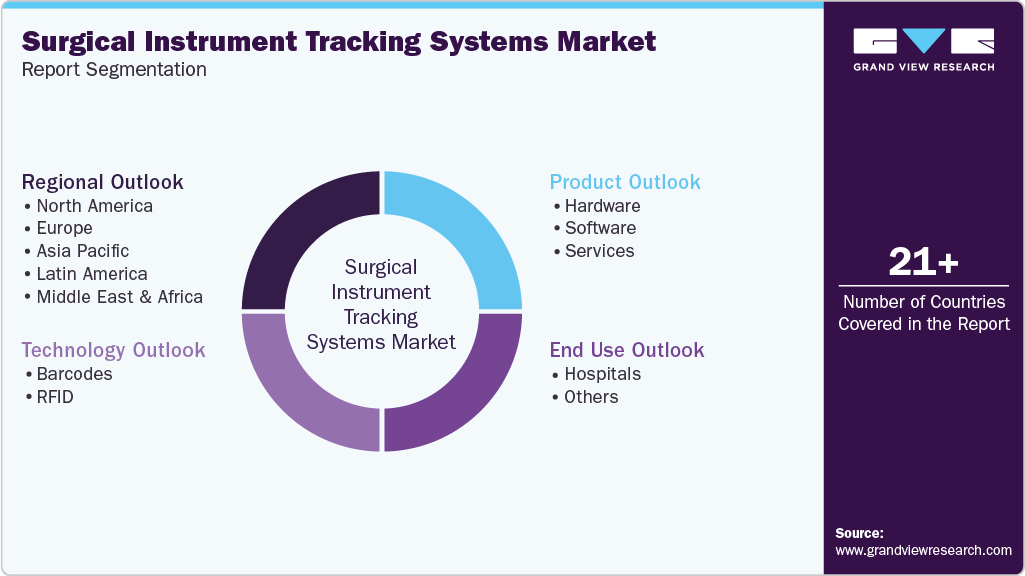

Surgical Instrument Tracking Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Hardware, Software, Services), By Technology (Barcodes, RFID), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-770-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Instrument Tracking Systems Market Summary

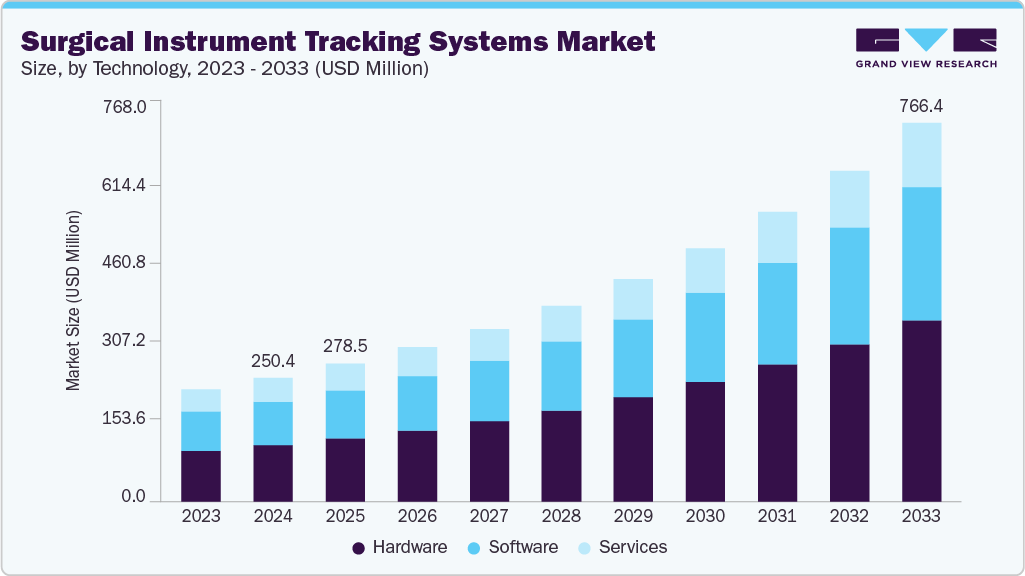

The global surgical instrument tracking systems market size was estimated at USD 250.36 million in 2024 and is projected to reach USD 766.36 million by 2033, growing at a CAGR of 13.49% from 2025 to 2033. This growth is primarily driven by the increasing number of surgeries performed globally, including routine, emergency, and specialized procedures.

Key Market Trends & Insights

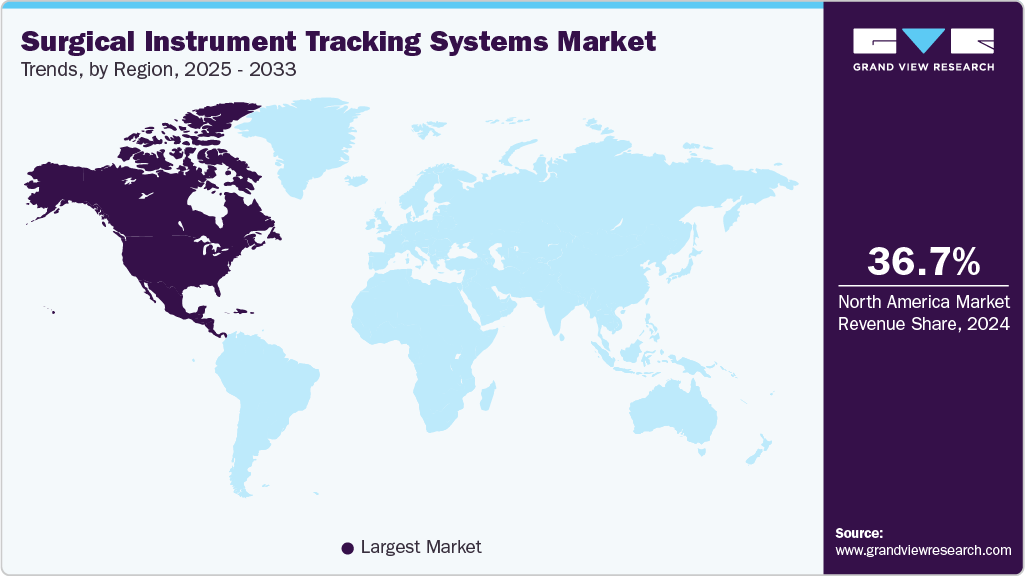

- North America surgical instrument tracking systems market held the largest share of 36.66% of the global market in 2024.

- The surgical instrument tracking systems industry in the U.S. is expected to grow significantly over the forecast period.

- Based on technology, the barcodes segment held the highest market share of 81.72% in 2024.

- Based on product, the hardware segment held the highest market share in 2024.

- By end use, the hospital segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 250.36 Million

- 2033 Projected Market Size: USD 766.36 Million

- CAGR (2025-2033): 13.49%

- North America: Largest market in 2024

The growing surgical volume is increasing the need for efficient tracking and management of surgical instruments. In addition, rapid technological advancements, such as the integration of RFID, barcode systems, and real-time data analytics, are revolutionizing how surgical tools are tracked, sterilized, and maintained, driving the market's growth. Technological advancements are a major driver of growth in the surgical instrument tracking systems industry. Innovations such as RFID technology, 2D barcoding, cloud-based platforms, and AI-powered data analytics are transforming how surgical instruments are tracked and managed throughout their lifecycle. These technologies enable real-time visibility into instrument location, usage history, and sterilization status, significantly reducing the risk of errors, infections, and procedural delays. By leveraging artificial intelligence technology, institutions can automate the tracking and monitoring of surgical instruments throughout their lifecycle, ensuring seamless and accurate record-keeping processes, thereby reducing the likelihood of errors or oversights in inventory management.For instance, in December 2024, Mazowiecki Specialist Hospital in Radom implemented the SYNAPSIS system, transforming its Central Sterilization Department into a fully digital, paperless environment. SYNAPSIS is a surgical instrument tracking and management system that helps hospitals efficiently track the usage, location, and status of surgical instruments throughout the hospital. The upgrade included 22 dedicated workstations, integration of Belimed sterilizers and washers, STERIS endoscopic equipment, and a chemical management system.

In January 2023, BD introduced a new robotic track system for its laboratory solution, the BD Kiestra microbiology. The track-based setup speeds up results by eliminating manual effort and automating specimen processing. Processes are expedited, and cultural integrity is guaranteed, which removes the need for human sorting and walking.

Moreover, emerging economies like India and China, as well as countries in the Middle East, Latin America, and Southeast Asia, are likely to provide major growth possibilities for surgical instrument tracking systems manufacturers. Growing healthcare spending and increasing healthcare infrastructure are likely to provide growth possibilities for market players in these economies.

For instance, the e-Bharat initiative is focused on making India’s healthcare system more digital, efficient, and patient-friendly. As part of this effort, surgical instrument tracking systems with technologies like RFID and barcodes can help hospitals work better and more safely. By adding these tools to hospital computer systems, e-Bharat can help improve surgeries, follow safety rules, and bring better care to people in both government and private hospitals.

Many large hospitals experience several incidences of surgical items left inside patients after surgery. These could vary from clamps and sponges to needles and other items. Rectifying these mistakes can be very costly. Typically, after surgery, a team may conduct careful counts manually to ensure the post-op inventory of instruments and materials is the same as before the operation. In case the numbers do not match, costly x-rays must be taken to look for stray instruments, which could add to complications. Significant incidences of retained surgical instruments in the human body after surgery and instrument misplacement are other factors contributing to the market growth.

Some of the top companies in surgical instrument tracking systems are as follows:

Company

Product/System

Key Feature

Technology Used

Notable Clients/Use Cases

Getinge AB

T-DOC

Offers complete traceability of surgical instruments, integrating with sterile supply workflows and hospital IT systems.

RFID

Implemented in European healthcare facilities

BD (Becton, Dickinson and Co.)

BD SurgiCount

Provides sponge and instrument counting solutions to prevent retained surgical items, enhancing patient safety.

Barcode

Utilized in various surgical settings

Steris

SPM Surgical Asset Management

Enables tracking of surgical instruments throughout their lifecycle, ensuring compliance and efficiency.

Barcode, RFID

Deployed in numerous hospitals globally

The following table highlights four hospitals that implemented AI and smart tracking systems between 2021 and 2023, achieving significant reductions in instrument misplacement and notable improvements in surgical efficiency and operational flow.

Hospital Name

Surgical Instrument Tracking Improvement

Reduction in Misplacement

Efficiency Gain

Year Implemented

Prominent Medical Center

AI-driven inventory management system

40%

N/A

2022

Teaching Hospital

AI-based tracking solution

N/A

30% faster retrieval times

2021

Community Surgical Center

Automated tracking system

25%

20% decrease in surgery duration

2023

Regional Health Center

Smart inventory technologies

35%

15% improvement in operational flow

2021

Market Dynamics

The surgical instrument tracking systems industry is witnessing steady innovation, with manufacturers increasingly incorporating technologies such as RFID, barcode scanning, and cloud-based data analytics. These advancements improve real-time tracking, sterilization compliance, and inventory management in surgical environments. Connecting hospital information systems (HIS) with automated workflows helps hospitals work more efficiently and makes it easier to track everything. New technologies that use easy-to-use software and artificial intelligence (AI) to predict when instruments need maintenance are also improving. These innovations give healthcare workers more control, accuracy, and safety during surgeries.

The level of mergers and acquisitions in surgical instrument tracking systems is significant, as established players are acquiring innovative startups and software firms to expand their technological capabilities and product portfolios. These strategic collaborations aim to achieve vertical integration, enter new geographic markets, and offer end-to-end surgical tracking solutions. The industry consolidation is also fostering standardization and broader adoption of tracking systems across developed and emerging healthcare markets.

Theimpact of regulations is significant in the market. Guidelines from bodies such as the U.S. FDA, which require Unique Device Identification (UDI), prompt healthcare providers to implement comprehensive tracking solutions. Compliance with sterilization standards, infection control protocols, and accountability requirements further drives demand. These regulations ensure patient safety and incentivize hospitals and surgical centers to adopt automated tracking systems to minimize human errors and improve overall surgical outcomes.

Product expansion in the surgical instrument tracking systems industry is accelerating as companies seek to address the growing complexity of surgical procedures and regulatory compliance requirements. Manufacturers are expanding their product lines by integrating advanced features such as cloud-based data management, real-time analytics, and AI-driven tracking to enhance system performance. By broadening their offerings, companies aim to improve usability, ensure regulatory adherence, and meet the diverse demands of global healthcare providers, ultimately driving greater adoption of surgical instrument tracking technologies.

Product Insights

Based on product, the market is segmented into hardware, software, and services. The hardware accounted for the largest revenue share of over 45% in 2024 and is projected to maintain its dominance during the forecast period. Technological advancements in hardware, such as RFID chips and barcode tags, are a major factor driving the adoption of these systems for inventory as well as surgical instrument management.

The services segment is expected to grow at a lucrative rate during the forecast period. The U.S., Germany, the UK, France, and Japan are projected to account for the highest usage of surgical instrument tracking systems. Well-developed healthcare infrastructure and a rising number of surgical procedures are anticipated to contribute to this growth. As hospitals and surgical centers continue to adopt advanced tracking technologies, there is a growing need for expert services to ensure smooth implementation, staff training, regulatory compliance, and ongoing system optimization. In addition, government initiatives to promote digital healthcare solutions and stringent regulatory guidelines regarding surgical instrument sterilization and traceability are fueling market growth in the region.

Technology Insights

The technology segment is divided into barcodes and RFID. Barcode technology accounted for the largest revenue share of over 80% in 2024. It is the most commonly used type of tracking technology, and its increased adoption in the medical devices industry is the key element contributing to its high revenue share. 2D barcodes such as data matrices and QR Codes are more popular in the market due to their advantages, which include low cost, robust build, and 360-degree readability. In addition, the low installation cost of these products has resulted in rising applications in healthcare facilities, including hospitals and ambulatory surgery centers.

The RFID segment is anticipated to register the fastest growth over the forecast period. This is owing to the ability of RFID tags to withstand the rigorous healthcare environment, such as harsh sterilization processes, in addition to storing additional information and documenting each instrument’s vital statistics, for instance, repair history and location. RFIDs also have a benefit over barcodes in that they do not require line-of-sight scanning, which is expected to drive the adoption rate for this technology.

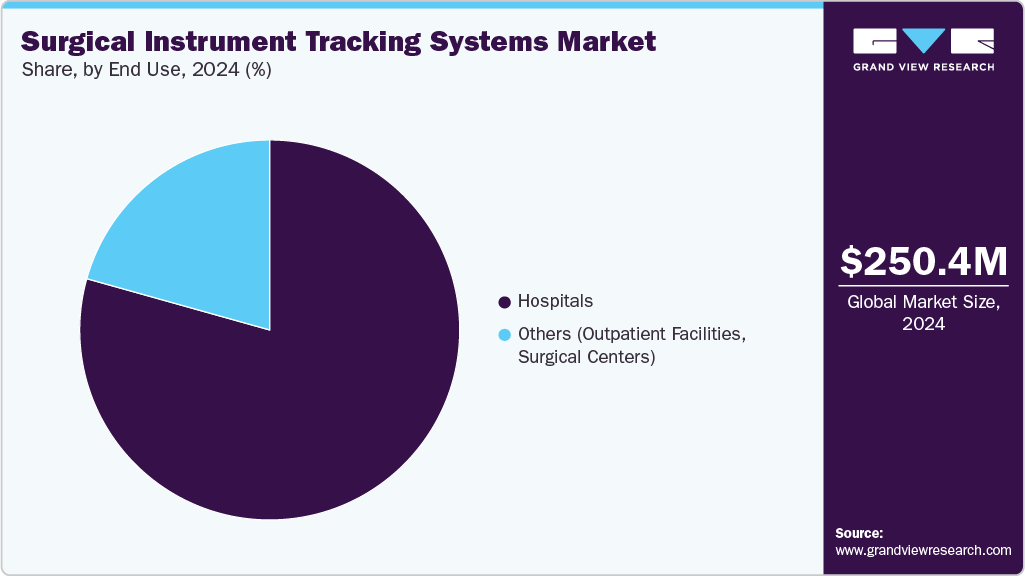

End Use Insights

The end use segment is categorized into hospitals and others. Hospitals led the overall market with a share of over 79% in 2024. Factors contributing to this share include the rising need to reduce the incidence of surgical instruments being left in the body during surgeries and effective inventory management. It is estimated that around 20% of hospital devices, supplies, or equipment are misplaced or lost owing to inefficiency in supply chain management.

Hospitals are also expected to witness the fastest growth over the forecast period due to the rising adoption of these products by hospitals for inventory management and tracing of medical instruments during work cycles such as sterilization procedures and surgery. This growing adoption is driven by the need to improve patient safety, reduce the risk of instrument loss or contamination, enhance operational efficiency, and comply with strict healthcare regulations. In addition, hospitals are increasingly investing in advanced technologies to streamline surgical workflows and ensure accurate, real-time tracking of instruments throughout all stages of the surgical process.

Regional Insights

North America surgical instruments tracking systems industry led the overall market in terms of revenue share of 36.66% in 2024. The growth is attributed to its advanced healthcare infrastructure, high surgical volumes, and stringent regulatory frameworks, such as the FDA’s UDI (Unique Device Identification) mandate. Hospitals are quick to adopt new technologies to improve patient safety and comply with infection control standards. The presence of key market players and frequent product innovations further contributes to growth.

U.S. Surgical Instruments Tracking Systems Market Trends

The U.S. surgical instruments tracking systems industry is growing due to a mature healthcare system, early technology adoption, and mandatory regulatory requirements. Large hospital networks and increasing investments in healthcare IT contribute to the widespread deployment of tracking systems. Rising awareness of surgical safety and high hospital accreditation standards also boosts demand.

Europe Surgical Instruments Tracking Systems Market Trends

The surgical instruments tracking system industry in Europe exhibits strong growth potential due to supportive government policies, emphasis on healthcare quality, and rising surgical procedures. Countries like Germany and France are investing heavily in hospital digitization, creating a favorable environment for adopting surgical tracking systems. Compliance with MDR (Medical Device Regulation) further supports market growth.

The UK surgical instruments tracking systems industry is well-established but continues to grow steadily, supported by the country’s advanced healthcare infrastructure and strict regulatory standards. Increased emphasis on patient safety, infection control, and compliance with guidelines set by the NHS and other healthcare authorities is driving the adoption of tracking solutions in hospitals and surgical centers. In addition, the rising number of surgical procedures, integration of digital health technologies, and the need to improve workflow efficiency are contributing to the demand for real-time surgical instrument monitoring in the region.

Asia Pacific Surgical Instruments Tracking Systems Market Trends

The surgical instruments tracking systems industry in Asia Pacific is projected to expand at the fastest CAGR during the forecast period, owing to untapped opportunities in this region. Moreover, an increasing number of surgical procedures coupled with rapidly developing healthcare infrastructure in Asian countries such as China, Indonesia, and India, is projected to propel the regional market over the forecast period. The introduction of technologically advanced software and hardware products is anticipated to increase the usage of surgical instrument tracking devices shortly.

The China surgical instrument tracking systems industry shows strong potential due to government-led healthcare reforms, rising surgical procedures, and expanding public and private hospitals. Adoption of smart healthcare solutions is growing, particularly in urban areas. Local companies are entering the market with affordable and technologically competitive tracking systems, aiding widespread adoption.

Latin America Surgical Instruments Tracking Systems Market Trends

The surgical instruments tracking systems industry in Latin America is emerging but gaining traction, especially in countries modernizing their healthcare systems. Increased awareness of patient safety, hospital accreditation, and the need to reduce medical errors encourages regional hospitals to consider instrument tracking solutions. In addition, government initiatives, rising healthcare expenditure, and the growing adoption of advanced healthcare technologies are further accelerating the demand for efficient surgical instrument management across public and private healthcare facilities.

The Brazil surgical instruments tracking systems industry is leading the regional demand due to its large population and expanding public healthcare sector. Government initiatives to improve hospital efficiency and reduce surgical errors have opened opportunities for tracking systems. Urban hospitals are more likely to adopt such technologies than rural hospitals.

Middle East & Africa Surgical Instruments Tracking Systems Market Trends

The surgical instruments tracking systems industry in the Middle East and Africa is witnessing gradual growth. This growth is driven by several factors, including the rising investments in healthcare infrastructure and efforts to meet international standards for patient safety and hospital accreditation. In addition, expanding private healthcare facilities, growing medical tourism in countries like the UAE and South Africa, and a heightened focus on reducing surgical errors and improving operational efficiency encourage hospitals to adopt advanced tracking technologies such as RFID and barcode systems.

The Kuwait surgical instruments tracking systems industry is growing significantly as the country’s efforts to modernize its healthcare sector and implement smart hospital initiatives are increasing the adoption of surgical instrument tracking systems. Government-funded hospitals and public-private partnerships will likely play a key role in boosting demand in the coming years.

Key Surgical Instrument Tracking Systems Company Insights

The leading companies in the surgical instrument tracking systems industry are undertaking several strategic initiatives, such as product development or launch, collaborations, mergers and acquisitions, and regional expansions, to gain market share.

Key Surgical Instrument Tracking Systems Companies:

The following are the leading companies in the surgical instrument tracking systems market. These companies collectively hold the largest market share and dictate industry trends.

- Fortive

- Spatrack Medical Limited

- Xerafy Singapore Pte Ltd.

- Fingerprint Medical Limited

- Getinge AB

- B. Braun SE

- BD

- Ternio Group LLC

- ScanCARE Pty Ltd

- STERIS

Recent Developments

-

In May 2024, Crothall Healthcare and Ascendco Health announced a partnership to improve surgical instrument tracking and sterile processing quality. Integrating Crothall's data-driven processes with Ascendco's Sonar Tracking System aims to improve efficiency, reduce errors, and bolster patient safety in healthcare facilities nationwide.

-

In April 2023, Northern Digital Inc. introduced the Polaris Lyra, a compact optical tracker for tracking instruments in clinical and surgical suites. It is designed for precise procedures using smaller instruments, with a high measurement rate and accuracy for real-time tracking and visualization.

-

In January 2023, BD launched its new robotic track system for its BD Kiestra microbiology laboratory solution. It automates specimen processing, reducing manual labor and result time. The track-based configuration eliminates manual sorting and walking, ensuring culture integrity and streamlined workflows.

Surgical Instrument Tracking Systems Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 278.52 million

The revenue forecast in 2033

USD 766.36 million

Growth Rate

CAGR of 13.49% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million & CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, End Use, and region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway, Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Fortive; Spatrack Medical Limited; Xerafy Singapore Pte Ltd.; Fingerprint Medical Limited; Getinge AB; B. Braun SE; BD; Ternio Group LLC; ScanCARE Pty Ltd; STERIS; Getinge

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Instrument Tracking Systems Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global surgical instrument tracking systems market report based on product, technology, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Barcodes

-

Hospitals

-

Others

-

-

RFID

-

Hospitals

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical instruments tracking systems market size was estimated at USD 250.36 million in 2024 and is expected to reach USD 278.52 million in 2025.

b. The global surgical instruments tracking systems market is expected to advance at a compound annual growth rate of 12.4% from 2025 to 2033 to reach USD 766.36 million by 2033.

b. The hardware segment dominated the surgical instruments tracking systems market and accounted for the largest revenue share of 45.61% in 2024. The segment is projected to maintain its dominance during the study period.

b. The barcode technology segment dominated the surgical instruments tracking systems market and accounted for the largest revenue share of more than 81.72% in 2024.

b. The hospital segment led the surgical instruments tracking systems market in terms of end-use and accounted for the largest revenue share of over 79.35% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.