- Home

- »

- Healthcare IT

- »

-

Surgical Instrument Tracking Systems Market Size ReportGVR Report cover

![Surgical Instrument Tracking Systems Market Size, Share & Trends Report]()

Surgical Instrument Tracking Systems Market Size, Share & Trends Analysis Report By Product (Hardware, Software, Services), By Technology (Barcodes, RFID), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-770-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range:

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global surgical instrument tracking systems market size was valued at USD 205.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. This growth is driven by the need to automatically track critical equipment, such as surgical instruments, comply with the FDA Unique Device Identification (UDI) program, ensure the right tools are available in time for each surgical procedure, and improve patient outcomes. The growing number of surgical procedures, owing to sports injuries, accidents, and cardiac surgeries, due to the increased frequency of cardiovascular illnesses and other chronic disorders, where surgery is mandatory, is driving the market growth. Furthermore, there is immense potential for surgical instrument tracking system manufacturers in emerging economies, such as India, China, and Brazil.

Rising healthcare investments coupled with the rapidly growing healthcare infrastructure in these countries are set to offer lucrative growth opportunities for market players. Surgical instrument tracking systems facilitate the automatic identification of medical devices, including instruments to adhere to the U.S. FDA's new UDI tracking requirements. As the number of devices falling under UDI will keep expanding, it is expected to fuel the demand for solutions that enable compliance, such as surgical instrument tracking systems. In addition to U.S. FDA, several other government bodies have specified regulatory requirements related to traceability from manufacturer to patient. These regulations include the EU Medical Device Regulation 2017/745 and In Vitro Diagnostic Medical Device Regulation 2017/746, which match those of the FDA.

China's UDI program focuses on verifying the authenticity of medical devices and monitoring where they are located. In 2018, the China Food and Drug Administration (CFDA) released a draft of the UDI regulation that would incorporate linear or two-dimensional barcodes, RFID tags, or Near-Field Communication (NFC) tags. This, in turn, drives the adoption of automation identification and tracking technologies, such as surgical instrument tracking systems. The COVID-19 pandemic significantly impacted the market. According to a 2020 report by Censis Technologies, Inc., many elective surgeries were postponed due to the pandemic. However, when they resumed, operating rooms and technicians had to deal with a huge backlog while continuing to work around COVID.

This unveiled the need for effective surgical instrument tracking systems as sterile supply processing and equipment shortages increasingly became an issue.Moreover, several incidences of retained surgical items inside patients’ bodies after surgery occur due to the lack of tracking guidelines. These could vary from clamps and sponges to needles and other items. Responding to these mistakes can be very costly. Significant incidences of retained surgical instruments in the human body after surgery and instrument misplacement contribute to market growth. For instance, according to the 2021 article published in the Radiological Society of North America (RSNA), the estimated incidence of Retained Surgical Items (RSI) is 1.32 events per 10,000 procedures.

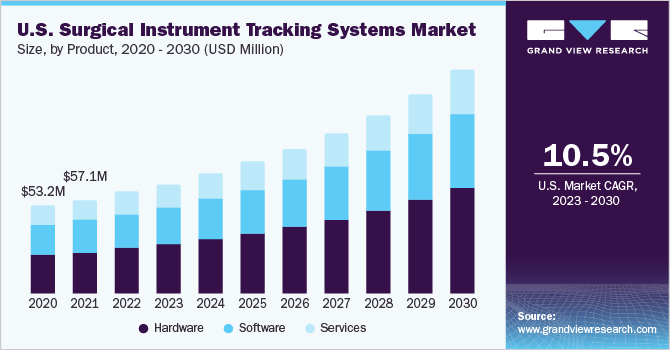

Product Insights

Based on product, the market is segmented into hardware, software, and services. The hardware segment accounted for the largest share of 45.4% in 2022 and is projected to maintain its dominance during the forecast period. Technological advancements in hardware, such as RFID chips and barcode tags, are major factors driving the adoption of these systems for inventory as well as surgical instrument management. For instance, the Wyss Institute at Harvard University and clinicians at Brigham and Women's Hospital have collaborated to develop a method of incorporating RFID chips onto metal surgical instruments.

This technique involves vapor deposition and a biocompatible sealant. The complete system is composed of the aforementioned method, RFID chips, an antenna, and a visual display that can be wirelessly tracked and counted, all of which are built to tolerate multiple sterilizations. On the other hand, the services segment is expected to grow at a lucrative CAGR during the forecast period. The U.S., Germany, the UK, France, and Japan are projected to record the maximumconsumption of surgical instrument tracking systems. Well-developed healthcare infrastructure and a rising number of surgical procedures are anticipated to contribute to this growth.

Technology Insights

The technology segment is segmented into barcodes and RFID. Barcode technology accounted for the largest revenue share of 81.9% in 2022. It is the most commonly used type of tracking technology, and its increased adoption in the medical devices industry is the key element contributing to its high revenue share. 2D barcodes, such as data matrices and QR Codes, are more popular in the market due to their advantages, which include low cost, robust build, and 360° readability. In addition, the low installation cost of these products has resulted in rising applications in healthcare facilities, including hospitals and Ambulatory Surgery Centers (ASCs).

The RFID segment is anticipated to register the highest growth rate over the forecast period. RFID tags can provide invaluable asset-tracking benefits in the healthcare industry due to their robustness, which allows them to stand up to the most rigorous sterilization processes. Furthermore, RFID tags can store additional information and track each instrument’s vital statistics, such as repair history and location. RFIDs also have a benefit over barcodes in that they do not require line-of-sight scanning, which is expected to drive the adoption rate for this technology.

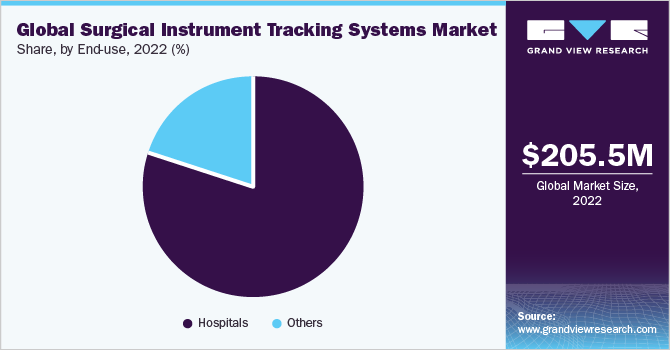

End-use Insights

The end-use segment is categorized into hospitals and others. The hospitals end-use segment led the market in 2022 and accounted for the maximum share of more than 79% of the overall revenue. The increasing demand for tracking solutions within hospitals can be attributed to the high number of patients they receive and the variety of medical equipment and instruments employed in larger numbers. In addition, the undertaking of more surgical procedures than other end-users has added to this demand.

Moreover, the healthcare expenditure and greater investment in new hospitals as well as expansion of established ones, are projected to fuel the growth of the segment over the forecast period. According to the American Hospital Association (AHA) data for 2023, there has been an upsurge in the number of functional hospitals in the United States between 2016 (5,534) and 2023 (6,129). Furthermore, the AHA statistics also highlighted that in 2023, the U.S. hospitals witnessed around 34.01 million admissions. Thus, a rise in the number of hospitals is expected to boost the segmentgrowth.

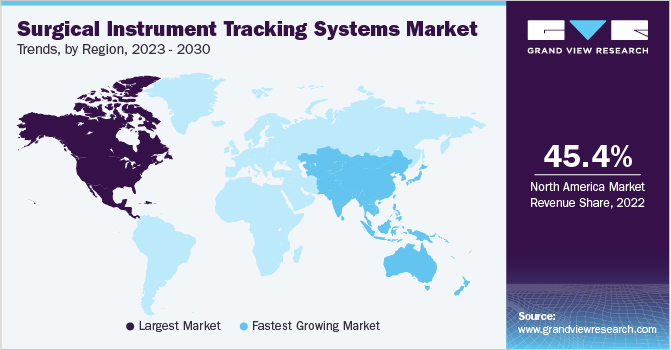

Regional Insights

Based on regions, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2022, North America led the globalindustryand accounted for ashare of 45.4% of the overall revenue. The introduction of the UDI system by the U.S. Food and Drug Administration (FDA) for the effective identification of medical devices and instruments is one of the major factors attributed to the dominance of this region. In addition, the presence of a highly developed healthcare infrastructure and rapid adoption of advanced technology and products is anticipated to drive regional market growth.

Asia Pacific is projected to expand at the fastest CAGR during the forecast period owing to untapped opportunities in this region. Moreover, an increasing number of surgical procedures, coupled with rapidly developing healthcare infrastructure in Asian countries, such as China, Indonesia, and India, is projected to propel regional market growth over the forecast period. The introduction of technologically advanced software and hardware products is anticipated to boost the usage of surgical instrument tracking devices.

Key Companies & Market Share Insights

The leading companies are undertaking several strategic initiatives, such as product developments or launches, collaborations, and mergers & acquisitions, along with regional expansions for gaining market share. For instance, in January 2023, BD launched a new robotic track system for its BD Kiestra microbiology laboratory solution. It automates specimen processing, reducing manual labor and result time. The track-based configuration eliminates manual sorting and walking, ensuring culture integrity and streamlined workflows.Some of the prominent players in the global surgical instrument tracking systems market include:

-

Fortive

-

Spatrack Medical Ltd.

-

Xerafy Singapore Pte Ltd.

-

Fingerprint Medical Ltd.

-

Getinge AB

-

B. Braun Melsungen AG

-

BD

-

Avery Dennison Corp.

-

TechnoSource Australia

-

Ternio Group LLC

Surgical Instrument Tracking Systems Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 226.2 million

The revenue forecast in 2030

USD 513.1 million

Growth rate

CAGR of 12.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Sweden; Norway; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Fortive; Spatrack Medical Ltd.; Xerafy Singapore Pte. Ltd.; Fingerprint Medical Ltd.; Getinge AB; B. Braun Melsungen AG; BD; Avery Dennison Corp.; TechnoSource Australia; Ternio Group LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Instrument Tracking Systems Market Segmentation

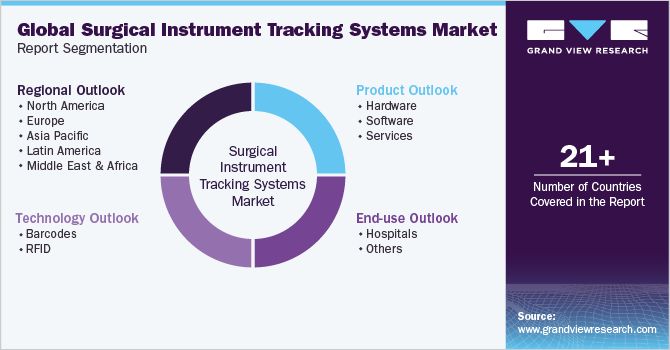

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the surgical instrument tracking systems market based on product, technology, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Barcodes

-

RFID

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical instruments tracking systems market size was estimated at USD 205.5 million in 2022 and is expected to reach USD 226.2 million in 2023.

b. The global surgical instruments tracking systems market is expected to advance at a compound annual growth rate of 12.4% from 2023 to 2030 to reach USD 513.1 million by 2030.

b. The hardware segment dominated the surgical instruments tracking systems market and accounted for the largest revenue share of 45.4% in 2022. The segment is projected to maintain its dominance during the study period.

b. The barcode technology segment dominated the surgical instruments tracking systems market and accounted for the largest revenue share of more than 80% in 2022.

b. The hospital segment led the surgical instruments tracking systems market in terms of end-use and accounted for the largest revenue share of over 75% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."