- Home

- »

- Healthcare IT

- »

-

Surgical Planning Software Market Size & Share Report 2030GVR Report cover

![Surgical Planning Software Market Size, Share & Trends Report]()

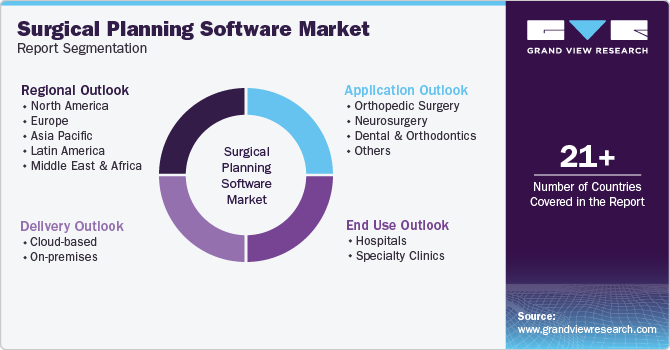

Surgical Planning Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Delivery (Cloud-based, On-premise), By Application (Orthopedic Surgery, Neurosurgery), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-017-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Planning Software Market Summary

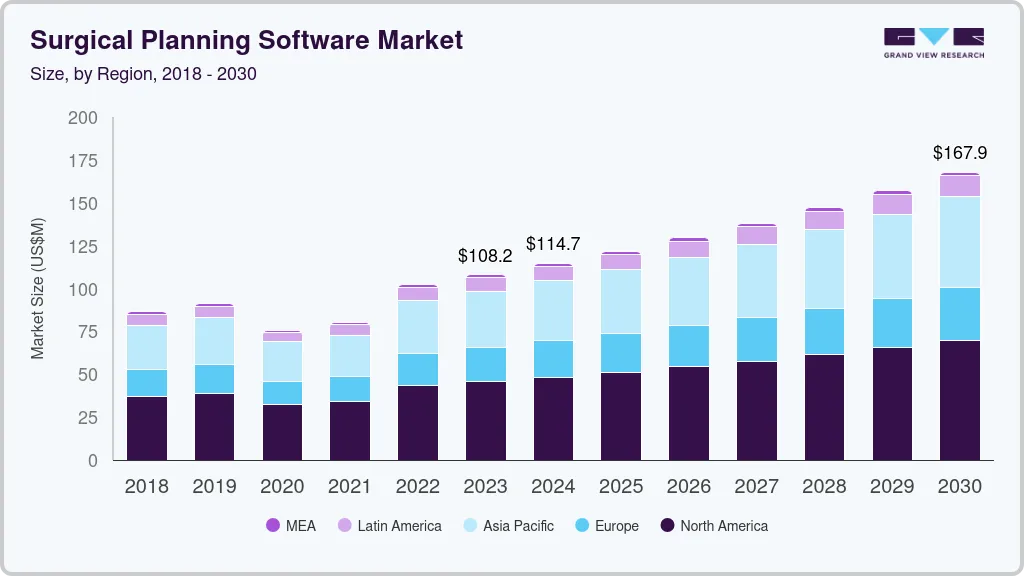

The global surgical planning software market size was estimated at USD 108.2 million in 2023 and is projected to reach USD 167.8 million by 2030, growing at a CAGR of 6.6% from 2024 to 2030. Surgical planning software assists surgeons in determining the optimal surgical approach by generating precise digital data for pre-surgical evaluation.

Key Market Trends & Insights

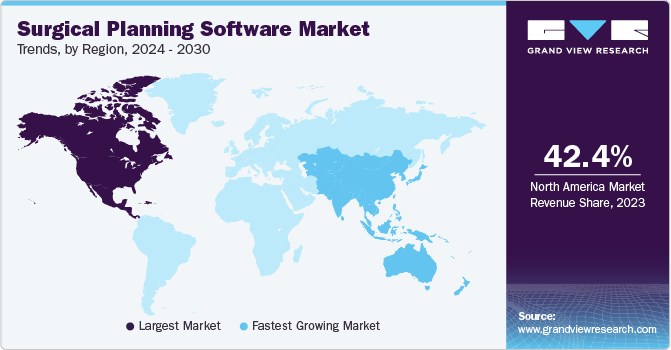

- North America surgical planning software marketaccounted for the largest revenue share of 42.4% in 2023.

- The surgical planning software market in the U.S. is anticipated to grow at a CAGR of 6.3% over a forecast period.

- Based on delivery, the cloud-based segment accounted for the largest market share of 64.6% in 2023.

- In terms of application, the orthopedic surgery segment held the largest market share of 41.5% in 2023.

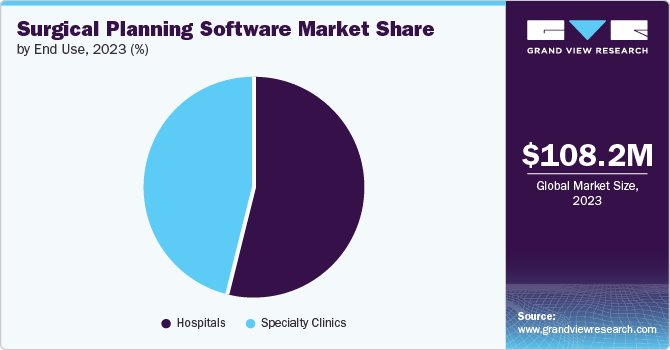

- By end use, hospitals dominated the market in 2023 with a 53.9% share.

Market Size & Forecast

- 2023 Market Size: USD 108.2 Million

- 2030 Projected Market Size: USD 167.8 Million

- CAGR (2024-2030): 6.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The global rise in surgical procedures, coupled with the software's benefits-such as improved patient outcomes, pre-planned surgeries, and enhanced surgical efficiency-are key factors driving market growth. In addition, elderly individuals frequently develop conditions like osteoporosis, necessitating surgeries such as knee and hip replacements. According to the American Joint Replacement Registry's 2020 annual report, around 2 million hip and knee procedures were performed in the U.S. in 2020, marking a 24.4% increase from the previous year. Furthermore, the growing incidence of sports and accident injuries also contributes to the increasing number of surgeries.

Market players are dedicated to developing and enhancing existing surgical planning software, which boosts the availability of advanced options. This continuous innovation is driving increased adoption of surgical planning software. For instance, in October 2023, Bausch + Lomb Corporation announced the launch of the Eyetelligence platform, a new surgical planning software that helps streamline information flow and surgical planning. Moreover, it also allows the diagnosis device and Electronic Medical Record (EMR) integration, which lets the surgeon simplify complex surgical planning procedures. The development of novel technologies that simplify complex surgical procedures and enhance accuracy is contributing to market growth.

Market Concentration & Characteristics

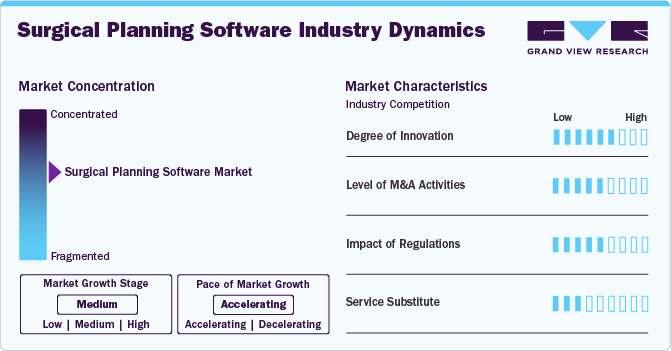

The market is experiencing moderate growth at an accelerating pace. This growth is driven by increasing demand for technologically advanced solutions in surgical procedures, improved patient outcomes, and a rising number of surgeries globally.

The market is characterized by a high degree of innovation owing to the increasing focus of market players on developing various technologies and software that offer better assistance and platforms for surgical planning. For instance, in April 2024, Materialise launched 3D planning software, Mimics Enlight CMF. This software's design and planning tools enhance the precision, ease of use, and speed of surgical planning, which helps improve surgical outcomes and decision-making.

Key players are implementing strategic initiatives, such as product launches, geographical expansion, mergers and acquisitions, collaborations, partnerships, and R&D activities, to strengthen their market presence. For instance, in December 2022, Paragon 28 acquired Disior Oy, a foot and ankle anatomy-focused 3D analytics pre-op planning software company. This acquisition aimed to combine the company's broad product portfolio with Disior Oy's software to eventually improve patient outcomes.

Regulations play a crucial role in the market for surgical planning software. The U.S. FDA has established a clear pathway for examining the use of medical devices and software as a medical device premarket clearance (510(k)), De Novo classification, or premarket approval based on the risk to the patient.

The threat of substitutes for surgical planning software is expected to be low due to regular advancements in the software, which enhance surgical performance and patient outcomes.

Delivery Insights

The cloud-based segment accounted for the largest market share of 64.6% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Surgical planning software gathers extensive data during the planning process. Cloud-based solutions offer secure data backup and professional management from service providers, ensuring better data integrity and security. This has increased the popularity of cloud-based surgical planning software. In addition, the shortage of skilled professionals to operate and manage this software in healthcare facilities further drives the preference for cloud-based options. On-premises software is expected to grow at a lucrative rate over the forecast period.

Application Insights

The orthopedic surgery segment held the largest market share of 41.5% in 2023. The rise in the global geriatric population and injuries caused due to various reasons such as sports injuries, accidents, and others are increasing bone and muscle injuries globally, thereby contributing to the rise of orthopedic surgeries. The elderly population is more vulnerable to different types of injuries and conditions, such as osteoarthritis, which increases their chances of undergoing orthopedic surgeries. According to the World Health Organization (WHO), the number of people aged above 60 years outnumbered the number of children aged below five years. Furthermore, the proportion of people aged above 60 years is expected to increase from 12% to 22% between 2015 to 2050. This increase in the geriatric population, vulnerable to orthopedic surgeries has been a major contributor to the segment’s growth.

The neurosurgery segment is expected to grow at the fastest CAGR over the forecast period. Neurosurgery has progressed into the finest and most sophisticated surgical field due to technology implementation. The development of software that can help improve surgical outcomes using advanced technologies has further increased the focus on surgical planning software. For instance, in July 2023, Stryker announced the commercial launch of its Q Guidance System with its Cranial Guidance Software. This software offers neurosurgeons groundbreaking guidance and planning capabilities using its active and passive tracking technology. The development of such advanced software is expected to drive the growth of the neurosurgery segment.

End Use Insights

Hospitals dominated the market in 2023 with a 53.9% share and are expected to grow at the fastest rate over the forecast period. The increasing focus of hospitals on optimizing surgical workflows, the increasing number of hospitals globally, and the growing adoption of advanced technologies are some of the major factors driving the segment growth. Efficient surgical planning software can help hospitals and clinics increase operational efficiency, automate patient communication, and deliver consistent and transparent perioperative care paths for patients.

Specialty clinics are expected to grow significantly over the forecast period. This can be attributed to patients' increasing preference for surgery in specialized clinics. For instance, according to the OR Manager, in January 2020, around half of the surgical procedures performed in hospitals are expected to move to Ambulatory Surgical Centers (ASCs) by 2027. This increasing shift of patients towards surgery-dedicated facilities is expected to fuel the segment growth.

Case Study

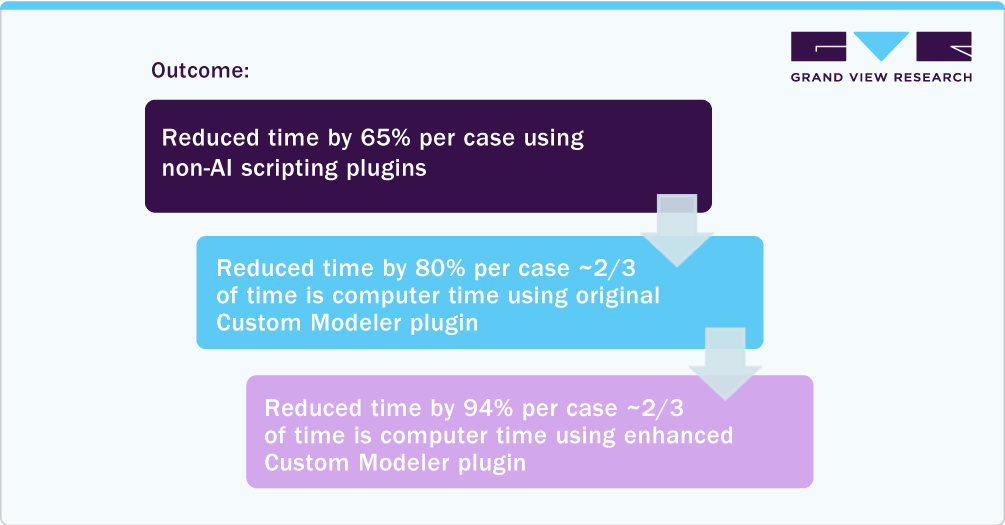

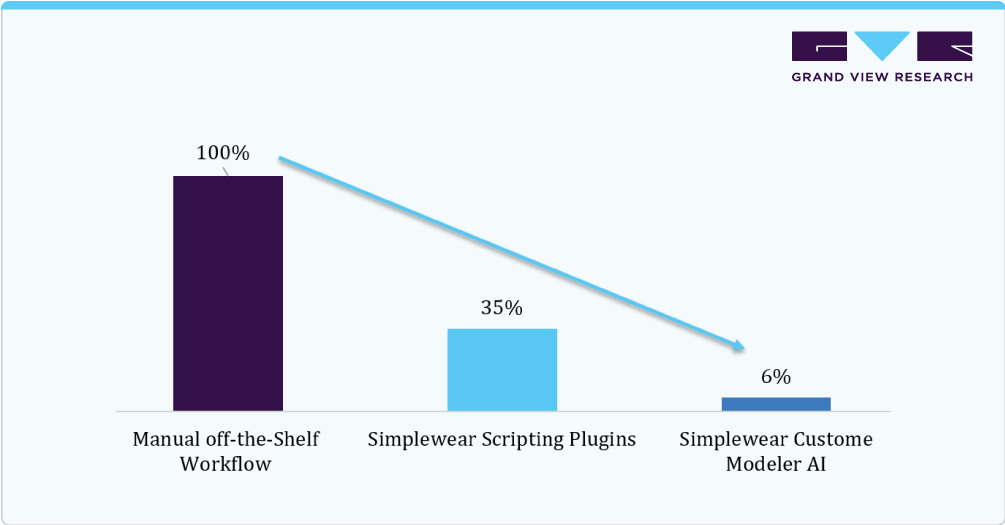

Streamlining Orthopedic Surgical Planning with Simpleware Software

Objective: Streamline the Optimized Positioning System (OPS) workflow to identify bottlenecks and eliminate segmentation in patient-specific total hip arthroplasties (THAs).

Solution: Corin partnered with Synopsys to utilize Simpleware’s scripting API, allowing them to develop custom plugins. These plugins tailored and streamlined Simpleware software for their workflow, significantly reducing processing time for knee, hip, and ankle procedures.

Regional Insights

North America surgical planning software marketaccounted for the largest revenue share of 42.4% in 2023. The highly developed healthcare infrastructure in the region and the rapid adoption of advanced technologies are some of the major factors driving the region’s growth. In addition, the developed infrastructure increases the focus of global market players on the opportunities offered by the region's healthcare sector. For instance, in May 2023, Formus Labs, a medical technology startup based in New Zealand, announced the FDA approval for its hip replacement preoperative planning 3D software. This approval allowed the company to commercialize its software in the U.S. market.

U.S. Surgical Planning Software Market Trends

The surgical planning software market in the U.S. is anticipated to grow at a CAGR of 6.3% over a forecast period. This can be attributed to the increasing demand for advanced surgical technologies and the compatible regulatory framework of the country. The advanced healthcare infrastructure in the country drives demand for innovations in surgical technologies, increasing the adoption of advanced surgical planning software. In June2023, SMAIO announced that its customized surgery planning software, developed in partnership with NuVasive, received FDA 510(k) clearance. This software is anticipated to aid surgeons in planning and performing spine surgeries, thereby improving patient outcomes.

The Canada surgical planning software market is anticipated to grow at a significant rate owing to increasing emphasis on adoption of advanced surgical technologies and the increasing number of surgeries performed in the country. For instance, according to the Government of Saskatchewan, a province in Canada, more than 95,700 surgeries were performed in the province between April 1, 2023, to March 31, 2024, which is the highest annual surgical volume recorded. Such an increase in surgical volume in the country is expected to fuel the demand for surgical planning software in the country.

Asia Pacific Surgical Planning Software Market Trends

Asia Pacific is anticipated to experience the fastest CAGR during the forecast period. Key factors driving market growth in the region include increasing healthcare investments and a growing geriatric population. Moreover, the increasing awareness about the advantages of using surgical planning software, such as enhanced accuracy, better patient outcomes, and minimized operating time, is further anticipated to increase the popularity of surgical planning software in the region.

The surgical planning software market in Japan is expected to grow significantly over the forecast period. This can be attributed to the rapidly increasing geriatric population of the country and the high adoption rate of advanced healthcare technologies by the country’s healthcare sector. According to the Japan External Trade Organization, the population of people aged above 65 in Japan is anticipated to increase from 35.89 million in 2019 to 37.16 million in 2030. This increase in the geriatric population of the country can increase the surgeries performed in the country, thereby driving market growth.

The China surgical planning software market held a significant market share in 2023 owing to the increasing healthcare expenditure of the country and the increasing acceptance of advanced technologies in the country's healthcare sector. According to the World Bank, healthcare expenditure in China increased from 4.94% of GDP in 2015 to 5.59% in 2020. This focus on enhancing healthcare infrastructure is expected to drive demand for advanced technologies like surgical planning software over the forecast period.

The surgical planning software in India is anticipated to grow at a significant rate over the forecast period. This growth can be attributed to advancements in healthcare infrastructure and an increasing number of orthopedic surgeries due to various factors.

Key Surgical Planning Software Company Insights

Notable players such as Bausch + Lomb Corporation, Materialise, Paragon 28, Stryker, Formus Labs, SMAIO, Sira Medical, Realize Medical, and Intellijoint Surgical are adopting strategies like new software launches, partnerships, geographical expansions, and mergers & acquisitions to increase their market share. For instance, in February 2024, Stryker launched its Tornier Perform Humeral System in India for simple to complex shoulder arthroplasty cases. The Blueprint planning software of the system allows the surgeon to plan their surgeries in advance and offers precise virtual surgery before stepping foot in operation rooms.

Key Surgical Planning Software Companies:

The following are the leading companies in the surgical planning software market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Zimmer Biomet.

- Medtronic

- Materialise

- Brainlab AG

- 3D Systems Inc.

- mediCAD Hectec GmbH

- DePuy Synthes (Johnson & Johnson Medical Devices Companies)

- CANON MEDICAL SYSTEMS USA, INC.

- General Electric Company

- Renishaw Plc.

Recent Developments

-

In February 2024, Sira Medicalreceived the U.S. FDA 510(k) approval for its augmented reality surgical planning software. This AR software allows surgeons to make virtual cuts, manipulate anatomical models, and simulate corrections, thereby improving surgical efficiency and patient outcomes.

-

In January 2023, Realize Medicalannounced the U.S. FDA 510(k) approval for its virtual reality software Elucis. This software allows the surgeons to create and understand complex patient anatomy from MRIs and CTs in a 3D environment.

-

In October 2021, Intellijoint Surgicallaunched its Intellijoint VIEW, a surgical planning software that allows surgeons preoperative planning for total hip arthroplasty without the need for CT imaging. This easy-to-use software offers additional value for surgeons to do both patient-specific acetabular component position planning and pre-operative implant templating.

Surgical Planning Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 114.7 million

Revenue forecast in 2030

USD 167.8 million

Growth Rate

CAGR of 6.6% from 2024 to 2030

Actual Data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Stryker; Zimmer Biomet; Medtronic; Materialise; Brainlab AG; 3D Systems Inc.; mediCAD Hectec GmbH; DePuy Synthes (Johnson & Johnson Medical Devices Companies); CANON MEDICAL SYSTEMS USA, INC.; General Electric Company; Renishaw Plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Planning Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical planning software market report based on delivery, application, end use, and region.

-

Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

Neurosurgery

-

Dental and Orthodontics

-

Others (cardiology, gastroenterology, gynecology)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical planning software market size was estimated at USD 108.2 million in 2023 and is expected to reach USD 114.69 million in 2024.

b. The global surgical planning software market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 167.8 million by 2030.

b. North America dominated the surgical planning software market with a share of 42.20% in 2023. Robust healthcare infrastructure and the presence of major medical device companies in North America support the development and adoption of advanced surgical technologies. Moreover, supportive government policies and funding for healthcare IT solutions encourage the implementation of advanced surgical planning software, thereby driving the market.

b. Some key players operating in the surgical planning software market include Stryker, Zimmer Biomet., Medtronic, Materialise, LLC., Brainlab AG, 3D Systems Inc., mediCAD Hectec GmbH, DePuy Synthes (Johnson & Johnson Medical Devices Companies), Cannon Medical Systems USA, Inc., General Electric Company, Renishaw plc.

b. Key factors driving market growth include continuous improvements and innovations in surgical software that enhance accuracy, efficiency, and outcomes; increasing cases of chronic diseases such as osteoporosis and arthritis; and favorable government policies, funding, and initiatives that encourage the implementation and integration of surgical software.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.