- Home

- »

- Medical Devices

- »

-

Surgical Stapling Devices Market Size & Share Report, 2030GVR Report cover

![Surgical Stapling Devices Market Size, Share & Trends Report]()

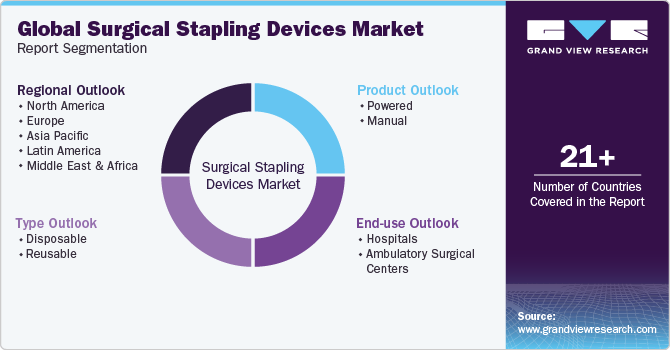

Surgical Stapling Devices Market Size, Share & Trends Analysis Report By Product (Powered, Manual), By Type (Disposable, Reusable), By End-use (Hospitals, Ambulatory centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-027-9

- Number of Pages: 225

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Surgical Stapling Devices Market Trends

The global surgical stapling devices market size was estimated at USD 5.30 billion in 2023 and is projected to grow at a CAGR of 9.33% from 2024 to 2030. The market growth is due to the rising preference for staples compared to sutures. Improved technological capabilities have led numerous market participants to commercialize staplers tailored for endoscopic surgeries. These tools are utilized in diverse medical fields, including gynecology, thoracic, and gastrointestinal surgeries, as well as tissue and wound management procedures.

Moreover, the surge in bariatric procedures and the adoption of advanced technology for endoscopic procedures are anticipated to increase the demand for staplers used in surgeries. Furthermore, the growing need for tissue and wound management and the introduction of powered surgical devices can propel the adoption of surgical staplers.

In the past, sutures were the primary choice for wound closure surgeries. However, the adoption of staples has increased owing to numerous advantages associated with it. Unlike the time-consuming process of suturing, which may result in wound leakage and separation, surgical staplers provide superior speed, precision, and effective wound closure.

In addition, the increasing incidence of chronic disorders is anticipated to boost the demand for stapling devices. There has been a surge in the prevalence of chronic conditions such as urological disorders, cancer, cardiovascular disorders, and neurovascular conditions. According to an article published by the WHO in September 2023, non-communicable diseases are responsible for the death of about 40 million individuals, denoting 74% of deaths annually worldwide. Moreover, cardiovascular disorders (CVD) account for most non-communicable disease deaths, as 17.9 million individuals die due to CVD each year. Thus, the availability of a large patient pool suffering from chronic disorders is anticipated to support the stapling market growth in the coming years.

The increasing preference for minimally invasive procedures is anticipated to drive market growth. Minimally invasive surgeries are becoming increasingly preferred due to their lower risk and reduced trauma. With smaller incisions, there is a decreased likelihood of postoperative pain and faster recovery, thus contributing to the widespread adoption of these procedures.

Market Concentration & Characteristics

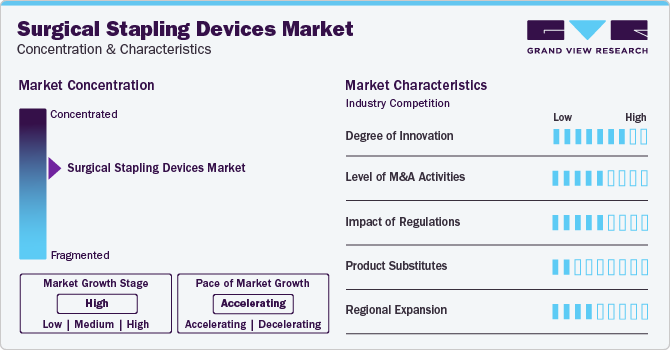

The market growth stage is high, and the pace is accelerating due to the rising novel product launches, the presence of major players offering stapling devices, and numerous initiatives undertaken by them.

The degree of innovation is high due to the rising development of advanced products. Emerging and Established companies such as Johnson & Johnson and Intuitive Surgical are innovating continuously to offer advanced and novel products. For instance, in June 2021, Intuitive India, a part of Intuitive, introduced SureForm, the first robotic-assisted stapler that can used in surgeries. This product features Smart Fire technology. Moreover, in December 2020, a key industry participant, Medtronic introduced the EEA Circular Stapler with Tri-Staple Technology. It is useful in colorectal operations, where safer anastomosis is needed to avoid leaks. This stapler from Medtronic comes with enhanced audible and tactile feedback that allows clinicians to make better decision-making during procedures. Such technological advancements and associated developments are anticipated to propel the launches of innovative products.

The market is also represented by moderate merger and acquisition (M&A) activity. This is due to several aspects, including the urge to gain a competitive edge in the industry and the requirement to consolidate in a rapidly growing market. Major companies are purchasing emerging players developing staplers for various surgeries. For instance, in September 2022, Teleflex purchased surgical stapler maker Standard Bariatrics for USD 170 million upfront. With the deal, Teleflex gained Standard Bariatrics’ Titan SGS system that can deliver a long, continuous line of staples in a single firing. Such acquisitions of stapler makers are anticipated to boost the market growth.

Regulations are supervised by regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. and equivalent agencies globally. The authorities have issued a regulatory framework to assure product effectiveness, safety, and quality standards. Moreover, the regulatory bodies are also involved in clinical trials and marketing authorization of surgical stapling devices. For instance, in December 2021, the FDA cleared the SureForm 30 Curved-Tip Stapler and reloads from Intuitive Surgical, Inc. It is a fully wristed, 8 mm stapler used in thoracic, general, urologic, gynecologic, and pediatric surgery.

There are limited external substitutes such as gastric balloon systems for surgical stapling devices.Key industry players such as Johnson & Johnson, Medtronic, and Medtronic hold significant shares in the stapling devices market. Their predominant presence is primarily due to their financial position, well-established brands, vast distribution networks, and product portfolio. For instance, Johnson & Johnson provides stapling devices such as the ECHELON CIRCULAR Powered Stapler, ETHICON Circular Stapler, PROXIMATE PX Fixed-Head Skin Stapler, and ECHELON FLEX ENDOPATH Staplers.

The market is witnessing robust global expansion due to the increasing launches of products in developed countries like the U.S. and developing economies such as India. Furthermore, the growing focus of industry players on enhancing the accessibility of products in myriad countries is expected to drive market growth.

Products Insights

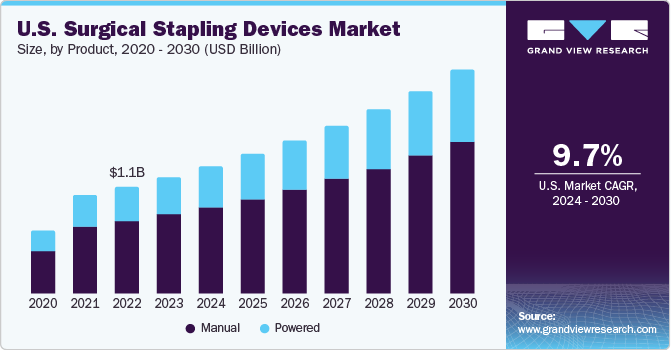

The manual segment accounted for the largest revenue share of in 2023. These staplers are quick and efficient, which can certainly reduce the time required for surgical procedures. Furthermore, manual surgical stapling delivers higher precision than conventional suturing procedures. Moreover, the adoption of manual staplers is anticipated to increase due to the high costs of powered staplers.

The powered segment is anticipated to grow at the fastest CAGR of 9.65% over the forecast period. The segment's growth can be attributed to the rising number of surgical procedures being performed across the globe. The major advantage of powered stapling is the ease of wound closure without requiring manual firing force. The powered surgical stapling devices are available in different sizes, offering medical practitioners’ greater choice when choosing a circular or powered linear system to perform complex surgical procedures. Increasing adoption of powered surgical stapling devices is anticipated to propel segment growth.

Type Insights

Based on type, the disposable segment accounted for the largest revenue share of in 2023. It is also anticipated to grow at the fastest CAGR of 9.56% from 2024 to 2030. The rising concerns over communicable infections and support from the regulatory and government authorities are anticipated to support the segment growth. The Centers for Disease Control and Prevention (CDC) encourages the usage of disposable devices, comprising disposable surgical stapling devices, and provides protocols to control the spread of pathogens. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have also phrased some measures to ensure that protocols for sterilizing medical devices are strictly obeyed to avoid infections.

The reusable segment is expected to grow at a significant CAGR over the forecast period. This growth can be attributed to the introduction of surgical stapling devices along with absorbable staplers. Reusable surgical stapling devices can be used on several patients after the sterilization process. Industry players such as Stryker Corporation, Intuitive Surgical, Inc., and Medtronic provide a wide range of reusable surgical staplers, equipping surgeons with various reusable devices. Thus, the availability of reusable products from key market players is anticipated to support the segment growth in the coming years. Moreover, industry players are launching reusable staplers. For instance, in November 2020, Dolphin Sutures, a Bengaluru-based medical device manufacturing company, introduced the Reusable, Reloadable, and Autoclavable stapler DURAMATE in the Indian market.

End-use Insights

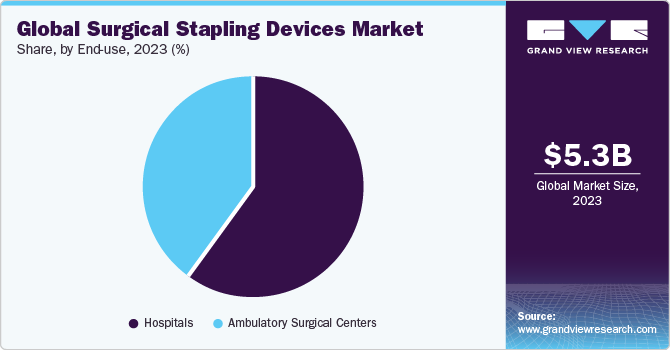

Based on end-use, the hospital segment accounted for the largest revenue share of in 2023. This high revenue share is due to the favorable reimbursement scenario for various surgeries and the rising number of hospitals. According to the American Hospital Association, as of 2024, there were 6,120 hospitals in the U.S. In 2020, there were around 6,090 hospitals in the U.S.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR of 9.54% during the forecast period, due to the growing number of ambulatory surgical centers, increasing R&D investments by key players, and several benefits associated with these healthcare facilities compared to hospitals. Some of the benefits associated with the ASCs include cost-effective treatment, shorter stays during procedures, and large volumes of surgeries in a short period.

Regional Insights

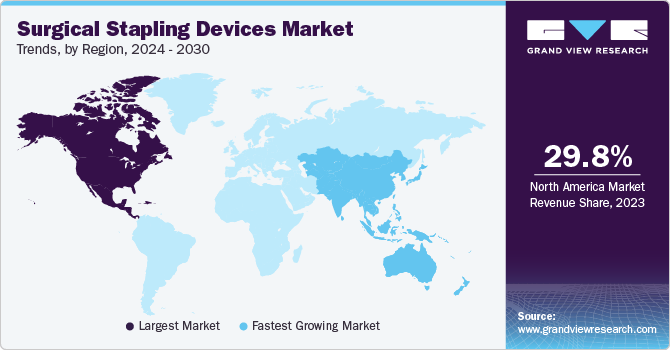

North America dominated the surgical stapling devices market with the revenue share of 29.85% in 2023. This is due to the high prevalence of chronic diseases such as cardiovascular disorders and the presence of major market players such as CONMED Corporation, 3M, Medtronic, and Intuitive Surgical.

U.S. Surgical Stapling Devices Market Trends

The surgical stapling devices market in U.S. accounted for a significant share of the North American market in 2023, due to the presence of major players, rising focus on improving treatment efficiency, and significant investments in research and development. Major market participants like Johnson & Johnson, Intuitive Surgical, 3M, CareFusion Corporation, and a Becton Dickinson Company are present in the U.S.

Europe Surgical Stapling Devices Market Trends

The surgical stapling devices market in Europe is anticipated to grow at a lucrative CAGR during the forecast period, due to the high expenditure on healthcare and the rising emphasis of industry participants on launching technologically advanced products.

The UK surgical stapling devices market is anticipated to grow at the fastest CAGR over the forecast period, due to the increasing incidences of chronic disorders, rising awareness about bariatric surgeries, and growing demand for minimally invasive surgeries.

The surgical stapling devices market in France is expected to grow at a significant CAGR over the forecast period, due to the rising adoption of minimally invasive surgeries and the growing focus of the government on improving healthcare infrastructure.

The Germany surgical stapling devices market is expected to grow at the rapid CAGR over the forecast period, due to the rising awareness about bariatric surgeries, growing demand for minimally invasive surgeries, and increasing need for wound and tissue management devices.

Asia Pacific Surgical Stapling Devices Market Trends

The surgical stapling devices market in Asia Pacific region is anticipated to witness at the fastest CAGR during the forecast period. This growth is anticipated to be driven by the rising burden of chronic diseases, growing incomes, and increasing aging populations.

The Japan surgical stapling devices market is expected to grow at a significant CAGR over the forecast period. The rising number of older individuals and continuous demands for advanced medical technologies can drive the demand for market products.

The surgical stapling devices market in China is expected to grow at the fastest CAGR over the forecast period, due to rising healthcare expenditures and the availability of domestic and international companies offering staplers for numerous surgeries. For instance, Changzhou Haida Medical Co. Ltd is a Chinese manufacturer and seller of surgical staplers, including circular staplers, endo cutter staplers, and curved cutter staplers.

The India surgical stapling devices market is expected to grow at a lucrative CAGR over the forecast period, due to the increasing manufacturing facilities in India, a rising aging population, and the presence of several local players across the country.

Middle East & Africa Surgical Stapling Devices Market Trends

The surgical stapling devices market in Middle East & Africa is anticipated to have a steady CAGR during the forecast period. Significant investments in healthcare infrastructure by governments and private institutions across the MEA region is projected to drive the market growth. Rising adoption of minimally invasive surgeries (MIS) due to faster recovery times and improved patient outcomes and growing prevalence of chronic diseases requiring surgical intervention aim to positively contribute towards the regional expansion.

The Saudi Arabia surgical stapling devices market is anticipated to grow at the fastest CAGR over the forecast period, due to technological innovations and the country's growing older population. Moreover, the rise in the number of surgeries can boost the market demand.

The surgical stapling devices market in Kuwait is expected to grow at a significant CAGR over the forecast period, due to the rising prevalence of chronic disorders, growing preference for minimally invasive surgeries, and increasing focus on investments in the private sector.

Key Surgical Stapling Devices Company Insights

Both emerging and established companies fuel competition within the global market. These players are employing diverse strategies including forming partnerships, introducing innovative products, and engaging in mergers & acquisitions. Moreover, the growing number of approvals from regulatory bodies like the FDA for industry offerings is expected to intensify market rivalry further.

Key Surgical Stapling Devices Companies:

The following are the leading companies in the surgical stapling devices market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc

- Medtronic

- Smith + Nephew

- B. Braun SE

- Intuitive Surgical Operations, Inc.

- 3M

- CONMED Corporation

- BD (CareFusion Corporation)

- BioPro, Inc.

- Frankenman International Ltd

Recent Developments

-

In January 2024, Teleflex Incorporated made the Titan SGS Stapler available with Staple Line Reinforcement. This stapler is helpful for bariatric surgeons who choose to buttress on every staple fire during the sleeve gastrectomy. The company made it available for pre-order

-

In October 2023, Teleflex Incorporated received the FDA 510(k) clearance for its Titan SGS Standard Staple Line Reinforcement

-

In November 2023, TÜV Rheinland, a Germany-based testing, certification, and inspection service provider, issued an MDR certificate to the Powered Endoscopic Stapler from Ezisurg Medical. This stapler is useful in tissue resection, transection, and creating anastomoses in minimally invasive and open surgery

-

In June 2022, Johnson & Johnson's subsidiary, Ethicon, launched the ECHELON 3000 Stapler in the U.S., It offers surgeons enhanced access and control during procedures, particularly in confined spaces and on difficult tissue

Surgical Stapling Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.77 billion

Revenue forecast in 2030

USD 9.89 billion

Growth rate

CAGR of 9.33% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Johnson & Johnson Services, Inc.; Medtronic; Smith + Nephew; B. Braun SE; Intuitive Surgical Operations, Inc.; 3M; CONMED Corporation; BD (CareFusion Corporation); BioPro, Inc.; Frankenman International Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Stapling Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical stapling devices market report based on product, type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powered

-

Manual

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical stapling devices market size was estimated at USD 5.30 billion in 2023 and is expected to reach USD 5.77 billion in 2024.

b. The global surgical stapling devices market is expected to grow at a compound annual growth rate of 9.33% from 2024 to 2030 to reach USD 9.89 billion by 2030.

b. North America dominated the surgical stapling devices market with a share of 29.85% in 2023. This is attributable to the use of advanced technologies and non-invasive methods in increasing the number of total surgeries performed.

b. Some key players operating in the surgical stapling devices market include Covidien plc; Ethicon Endo-Surgery, Inc.; Cardica, Inc.; Zimmer Holdings, Inc.; Stryker Corporation; Smith & Nephew plc; Conmed Corporation; and CareFusion Corporation.

b. Key factors that are driving the surgical stapling devices market growth include the increasing need for wound and tissue management devices, the introduction of advanced technologies, increasing demand for minimally invasive surgery and robotic surgery, increasing obesity and awareness about bariatric surgeries, and increasing incidence rate of cancer.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."