- Home

- »

- Renewable Energy

- »

-

Sustainable Aviation Fuel Market Size & Share Report, 2030GVR Report cover

![Sustainable Aviation Fuel Market Size, Share & Trends Report]()

Sustainable Aviation Fuel Market Size, Share & Trends Analysis Report By Fuel Type (Biofuel, Hydrogen Fuel, Power To Liquid Fuel, Gas-to-Liquid), By Technology, By Aircraft Type, By Platform, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-133-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Sustainable Aviation Fuel Market Size & Trends

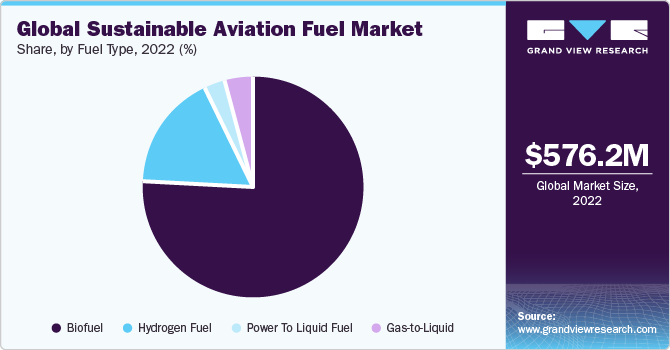

The global sustainable aviation fuel market size was estimated at USD 576.18 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 57.50% from 2023 to 2030. The rise in environmental concerns, regulatory support, and increasing demand for clean, sustainable fuels in the commercial and military aviation industries are projected to push the market growth in the coming years. The U.S. sustainable aviation fuel (SAF) industry is projected to expand due to awareness regarding environmental concerns, technological improvements, regulatory measures, and the shift in consumer preferences for sustainable products. Sustainable fuel offers high viscosity, and high density in the aviation industry. They comprise a wide range of energy sources and carriers derived from renewable or low-carbon feedstocks.

The growing demand for sustainable aviation solutions, together with sustainable aviation fuel improvements and improving economies of scale, is likely to fuel the expansion of the U.S. SAF market in the coming years. Moreover, various firms and government agencies are actively pioneering innovative manufacturing procedures in the global sustainable aviation fuel market.

The increasing intervention of the U.S. Department of Energy’s Bioenergy Technologies and other organizations is projected to further fuel the growth over the forecast period. For instance, in September 2021, the U.S. Department of Agriculture (USDA) merged with the sustainable aviation fuels grand challenge by the government to promote the production of sustainable aviation fuels to around 3 billion gallons per annum by 2030.

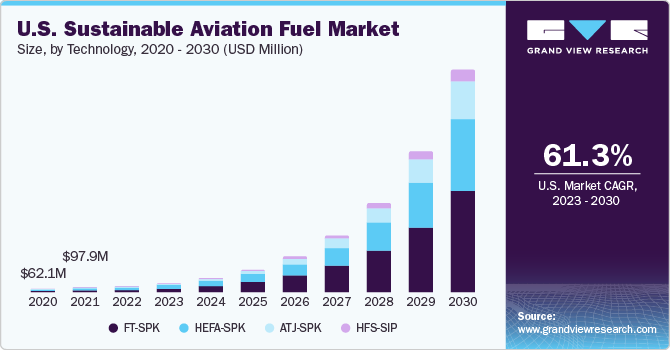

Technology Insights

The FT-SPK type accounted for the largest market share of over 48.0% in terms of revenue in 2022.The Fischer-Tropsch (FT) Synthetic Paraffinic Kerosene (SPK) technology plays a vital role in the market for (SAF). It is a process that converts diverse feedstocks into synthetic aviation fuels, such as natural gas, coal, biomass, and municipal solid waste. Due to its adaptability and potential to reduce greenhouse gas emissions, FT-SPK is seen as a promising technology for manufacturing SAF.

The FT-SPK system is used in a variety of feedstocks, including biomass, trash, and natural gas. The Fischer-Tropsch Synthetic Paraffinic Kerosene technique provides a potential route to creating sustainable aviation fuel. Its adaptability, lower emissions, compatibility with existing infrastructure, and government and industry stakeholder support all contribute to its rise in the sustainable aviation fuel market.

HEFA-SPK is another type with a significant market penetration and growth rateas it produces the majority of commercially accessible biofuels. To degrade the lipid molecules into hydrocarbons, the HEFA-SPK sector uses vegetable oil that is first oxygenated and then hydrogenated. Furthermore, continued R&D initiatives to improve the efficiency of HEFA-SPK production processes, reduce costs, and extend feedstock possibilities are projected to drive market expansion.

Aircraft Type Insights

The fixed wings segment and accounted for the largest revenue share of over 40.0% in 2022.Several dynamic factors impact the growth trajectory of the sustainable aviation fuel (SAF) market for fixed-wing aircraft. As the general population becomes more conscious of climate change and the environmental impact of aviation, it is expected to boost the demand for more environment-friendly air travel options.

The market for sustainable aviation fuel (SAF) for rotorcraft (helicopters) is expected to grow significantly over the forecast period. Rotorcraft are utilized for a variety of activities such as emergency services, tourism, and cargo transportation. SAF manufacturing process advancements, such as the use of alternate feedstocks and synthetic fuels, can improve sustainability and lower costs, making SAF more appealing to rotorcraft operators.

Platform Insights

The commercial sector dominated with the largest revenue share of over 30.0% in 2022.The sustainable aviation fuel market in the commercial aviation sector has been steadily rising, driven by a combination of environmental concerns, regulatory demands, and industry initiatives. Increased public awareness of climate change and environmental issues is projected to increase the adoption of sustainable practices.

Several driving factors influence the regional transport aircraft sector's growth in the SAF market, which includes smaller passenger planes and turboprop aircraft utilized for shorter itineraries. Environmental restrictions and emissions reduction targets set by governments and international aviation organizations are projected to boost the industry in the future years.

Fuel Type Insights

The biofuel segment dominated with the largest revenue share of over 76.0% in 2022.Biomass, including plant matter and animal waste, is used to make biofuels either directly or indirectly. The majority of the raw materials utilized in the production of biofuels are traditional natural biomass, including fuelwood, charcoal, and animal manure. Growing emphasis on renewable energy sources, environmental sustainability, and the goal to lower greenhouse gas emissions are some of the causes driving the rise of the biofuels market.

Moreover, the growing number of ecologically conscious consumers is predicted to propel the adoption of biofuel-powered vehicles and products. This demand stimulates the use and expansion of biofuel production. The biofuels industry is predicted to grow as a result of technological advancements and a shift in consumer behavior toward sustainable energy alternatives. These development factors are projected to drive additional expansion of the biofuels industry in the future years.

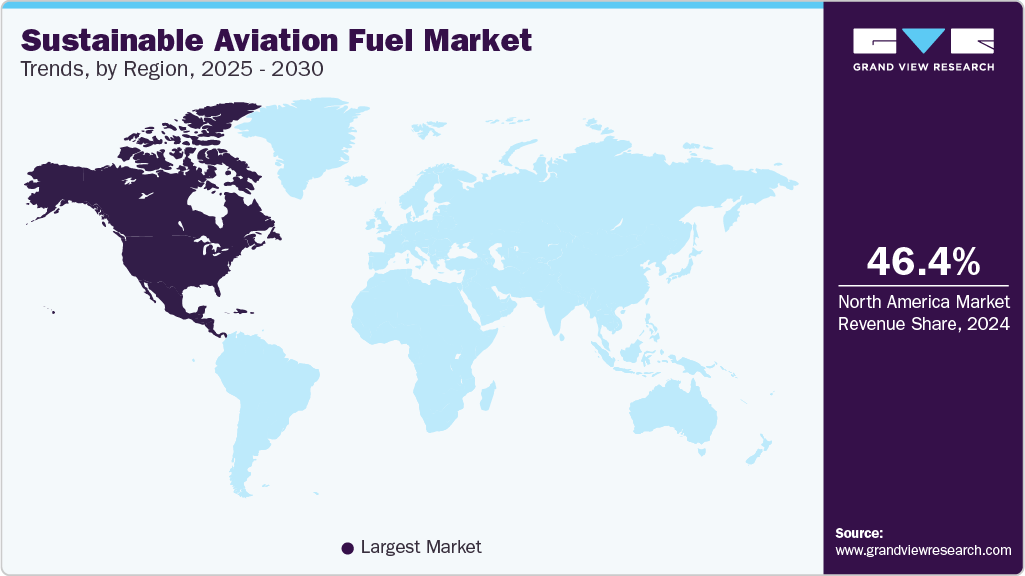

Regional Insights

North America dominated the market and accounted for the largest regional share of over 44.0% in 2022. To meet the requirement for reduced carbon footprints as air traffic and passengers increase, countries such as the U.S. and Canada are focusing on several projects to utilize renewable aviation fuel. North America is expected to witness considerable growth accounting to the presence of centers for sustainable aviation fuel, owing to supportive legislation, and attempts to reduce aviation emissions.

Increased expenditure by commercial organizations such as Fulcrum BioEnergy, Inc.; Aemetis, Inc.; Gevo, Inc.; Alder Fuels; and government key agencies in the country is likely to increase the production of sustainable fuels, thus propelling market growth during the forecast period.

Asia Pacific is expected to grow at a significant CAGR in the coming years owing to the growing emphasis on sustainability, environmental concerns, and the aviation industry's commitment to reduce greenhouse gas emissions. The proliferation of low-cost airlines and the rapid progress of infrastructure in emerging economies are expected to propel the use of sustainable fuel in the Asia Pacific aviation industry. Furthermore, increased public and private spending on developing aviation facilities in developing countries will boost market expansion throughout the forecast period.

Key Companies & Market Share Insights

The global sustainable aviation fuel market is highly competitive due to the presence of major industries across the globe. These companies are comparatively concentrated and fiercely competitive and engage in acquisitions, mergers, and collaborations, among other business strategies.For Instance, Shell and Delta signed a two-year agreement with Los Angeles International Airport (LAX) in April 2023, serving as the hub to purchase 10 million gallons of sustainable aviation fuel (SAF) from Shell Aviation. The international airline plans to fulfill its target of utilizing 35% of sustainable aviation fuel by 2035 and meet its goal of consuming 10% SAF per year by 2030 with over 200 million gallons of SAF committed. Some prominent players in the global sustainable aviation fuel market include:

-

Aemetis Inc.

-

AVFUEL CORPORATION

-

Fulcrum BioEnergy

-

Gevo

-

TotalEnergies

-

LanzaTech

-

Neste

-

Preem AB

-

Sasol Limited

-

SkyNRG B.V.

-

World Energy, LLC

Sustainable Aviation Fuel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 658.18 million

Revenue forecast in 2030

USD 15.85 billion

Growth rate

CAGR of 57.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million liters, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fuel Type, technology, aircraft type, platform, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Aemetis Inc.; AVFUEL CORPORATION; Fulcrum BioEnergy; Gevo; TotalEnergies; LanzaTech; Neste; Preem AB; Sasol Limited; SkyNRG B.V.; World Energy; LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Aviation Fuel Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the global sustainable aviation fuel market report based on fuel type, technology, aircraft type, platform, and region:

-

Fuel Type Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Biofuel

-

Hydrogen Fuel

-

Power to Liquid Fuel

-

Gas-to-Liquid

-

-

Technology Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

HEFA-SPK

-

FT-SPK

-

HFS-SIP

-

ATJ-SPK

-

-

Aircraft Type Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Fixed Wings

-

Rotorcraft

-

Others

-

-

Platform Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Regional Transport Aircraft

-

Military Aviation

-

Business & General Aviation

-

Unmanned Aerial Vehicles

-

-

Regional Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sustainable aviation fuel market size was estimated at USD 576.18 million in 2022 and is expected to reach USD 658.18 million in 2023.

b. The global sustainable aviation fuel market is anticipated to propel at a growth rate of 57.50% from 2023 to 2030 to reach USD 15.85 billion by 2030.

b. Biofuel, under fuel type segmentation, accounted for the highest market share across the sustainable aviation fuel market. Growing emphasis on renewable energy sources, environmental sustainability, and the goal to lower greenhouse gas emissions are some of the causes driving the rise of the biofuels market.

b. The key global players across the sustainable aviation fuel market include Aemetis Inc., AVFUEL CORPORATION, Fulcrum BioEnergy, Gevo, TotalEnergies, LanzaTech, Neste, Preem AB, Sasol Limited, SkyNRG B.V., World Energy, LLC.

b. The rise in environmental concerns, regulatory support, and increasing demand for clean, sustainable fuels in the commercial and military aviation industries are projected to fuel the sustainable aviation fuel market growth in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."