- Home

- »

- Next Generation Technologies

- »

-

System Integration Market Size, Share & Trends Report 2030GVR Report cover

![System Integration Market Size, Share & Trends Report]()

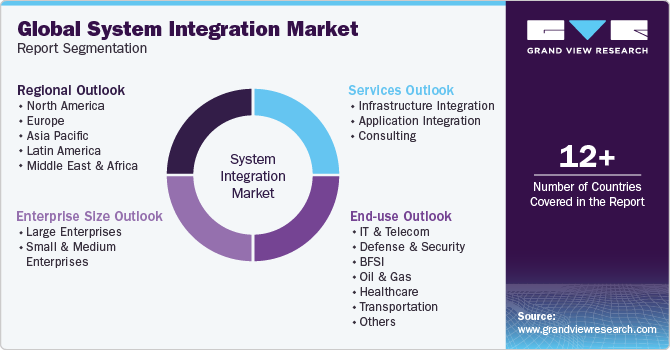

System Integration Market Size, Share & Trends Analysis Report By Services (Infrastructure Integration, Application Integration, And Consulting), By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-310-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

System Integration Market Size & Trends

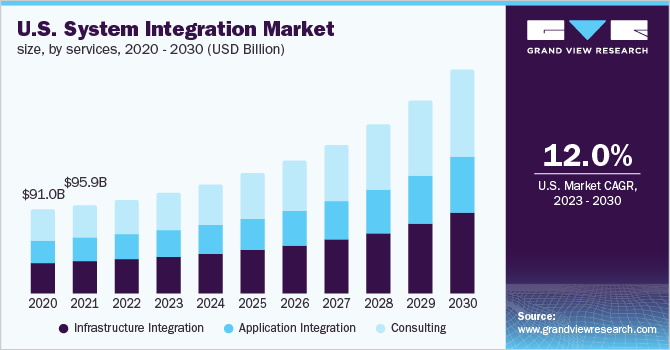

The global system integration market was valued at USD 385.95 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.8% from 2023 to 2030. Rising public and private investments in system integration solutions for the enhancement of Information Technology (IT) infrastructure are driving the system integration market growth. The increasing need for eradicating the diversity, and heterogeneity, of vital applications used in infrastructure, is expected to drive the system integration market over the forecast period. The outbreak of COVID-19 had an adverse impact on the system integration industry across the globe. However, from early 2021 onwards, rapid digitization and a rise in public & private investments in infrastructure development boosted the demand for project management and system integration solution.

System integration brings disparate processes together and enables smarter organizational operations. Organizations are realizing the importance of system integration as enterprise complexity affects their profitability and competitive ability. System integration technologies provide enterprises with cost-effective, centralized, and integrated solutions for their IT infrastructure. Increasing users of information technology is one of the key factors driving the growth of the system integration market. According to the U.S. Bureau of Labor Statistics, employment in computer-related occupations is expected to increase by 15% by 2031. Therefore, system integration is gaining popularity across various industries and sectors, such as defense, marine systems, telecommunication and IT, aviation, oil & gas, banking, and healthcare.

Various international government-authorized organizations are taking supportive initiatives to increase cross-border investments and strengthen global business operations. Global organizations such as World Trade Organization (WTO), United Nations Organization (UNO), and World Economic Forum (WEF) are launching their digital infrastructure solutions to attract foreign investment. For instance, in May 2022, World Economic Forum (WEF) collaborated with Digital Cooperation Organization (DCO) to commence the digital FDI program to attract public & private investments in developing countries and emerging markets. The company is planning to establish its first Digital FDI system in Nigeria. These initiatives by international organizations are expected to propel the demand for system integration solutions to improve the payment system and implement a flexible system framework, allowing investors to expand their business in the respective regions.

The companies operating in the system integration market are partnering with technology providers to improve their product portfolio. For instance, in October 2022, Infosys Limited announced the collaboration with CIRCOR International, a leading provider of control products and services for the industrial and aerospace & defense industries, to transform its IT infrastructure, user support applications, and service desk. With strong system integration and automation capabilities, Infosys would transform CIRCOR’s IT services by deploying Service Level Agreements (SLA)-managed IT services and bring agility into business operations to modernize the cloud landscapes and local data centers.

The challenges faced in the system integration market include difficulty integrating legacy systems with emerging technologies and a lack of technologically skilled personnel to operate sophisticated equipment. Further, system integration requires a standard network infrastructure for efficient operation. The lack of network infrastructure has resulted in the deferred demand for system integration. Moreover, significant growth in the app economy has resulted in a rapid increase of disparate applications deployed across various environments such as cloud and on-premise. These factors are expected to restrict the industry growth over the forecast period.

Market Concentration & Characteristics

System integration helps in connecting various sub-systems of an organization. Thus, various businesses are looking for system integration tools that can enhance the quality, efficiency, and productivity of their operations. Thus, system integrators in the market are taking significant steps to drive innovation and product enhancements. For instance, in April 2023, Microsoft Corporation, a technology software, solution, and service provider, announced a strategic collaboration with a software development company to develop and integrate generative AI across healthcare by integrating the power and scale of Microsoft’s Azure OpenAI Service1 with Epic’s advanced electronic health record software. This partnership aimed at creating a co-innovation ecosystem to focus on providing a comprehensive offering of generative AI-powered solutions that can enhance patient care, increase productivity, and strengthen the financial integrity of global health systems.

The system integration services market is also witnessing a high level of merger and acquisition initiatives by various leading and emerging players. For instance, in December 2023, MDS System Integration, a part of MDS Group, announced the acquisition of a majority stake in the Smpl ID, a Middle East & Africa (MEA) based identity and access management (IAM) solution and service provider. Based on this development, MDS is aimed at minimizing intrusions, enhancing security capabilities, and ensuring secure integration services for its existing and potential system integration customers in the MEA region.

The market is also subject to rules and regulations set by international, regional, and country-level regulatory bodies. Various international regulatory bodies have drafted regulations for the safe and secure integration of software and technologies to avoid the misuse of consumer data and protect it from unauthorized users. Market players are focusing on obtaining various certifications such as EU-U.S. Privacy Shield, TRUSTe Certified Privacy, and Swiss-U.S. Privacy Shield for regulatory and security compliance.

The conventional method adopted by businesses is a direct substitute for the system integration services. However, the lack of efficiency and outdated systems coupled with growing trends, including system integration industry 4.0, digitization, and rapid technology innovations, is creating favorable demand for robust technology integration systems among all the major industries.

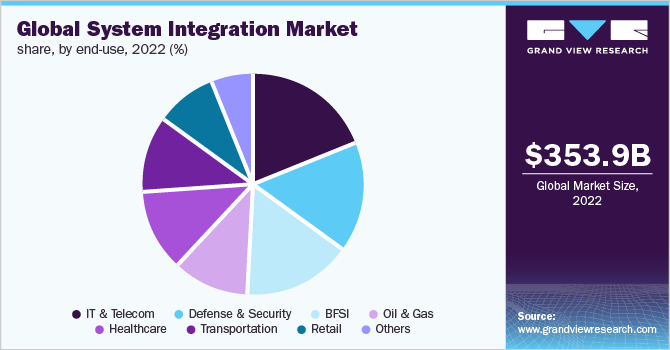

The system integrators serve a broad spectrum of industry verticals, such as it & telecom, defense & security, BFSI, oil & gas, healthcare, transportation, retail, and others. For instance, in April 2023, IBM Corporation, a global system integration service company, announced a strategic partnership with Riyadh Air, an airline company, based on while IBM Consulting, a consulting arm of IBM Corporation, will work as a lead systems integrator to support design, develop, and orchestrating the technologies that can help Riyadh Air digitally native airline operations which can ensure seamless and hassle-free travel experiences. Thus, the following factors are expected to drive the growth of system integration services market growth.

Services Insights

The infrastructure integration segment accounted for a market share of over 36% in 2022. Infrastructure integration is estimated to witness healthy growth over the next few years, ascribing to the rising need to provide a unified IT infrastructure that is resilient, agile, and secure while keeping a close eye on costs. In addition, the complex business environment has prompted enterprises to continually evolve and adapt to new IT infrastructure. This is expected to drive demand for infrastructure integration over the coming years. Various market players are collaborating with engineering services providers for the development of effective infrastructure integration solutions in smart city projects. These players are outsourcing their infrastructure integration testing services to improve the overall system performance.

The consulting segment is expected to expand at a significant CAGR of 14.6%. This can be attributed to the rising need for enterprises to assist users in designing their Business Continuity & Disaster Recovery Planning (BCP & DRP) as well as conducting rehearsals for effective and efficient workflow. The system integration solution provider offers consulting services to assist clients in the effective digital integration of their services and modernizing their IT systems. For instance, in October 2022, Kyndryl Holdings, Inc., an IT infrastructure industry players to expand service provider, launched Kyndryl Consult, consulting services which their services & solutions help its existing & new customers in complex technology integrations portfolio in their business models and accelerate their business outcomes.

End-use Insights

The Banking, Financial Services, and Insurance (BFSI) segment held a market share of over 19% in 2022. System integration enables safe, quick, and smooth banking operations by building an IT infrastructure to address critical requirements of the banking sector. Various companies operating in BFSI sectors collaborate with system integrators to expand their banking services & enrich their brand representation, thereby driving the system integration demand in the BFSI sector. Further, the proliferation of neo-banking services, rising fintech startups, significant demand for banking-as-a-service (BaaS), and shifting various governments' focus toward the digital economy are vital factors accelerating the system integration market growth in the BFSI sector. The COVID-19 pandemic has propelled the adoption of digital payment systems due to the adverse impact on offline banking services, contributing towards market expansion.

The IT & telecom segment is anticipated to grow at a significant CAGR of 16.2% over the forecast period. The surge in system integration solutions’ expenditure by key players has enhanced the management of IT infrastructure and has considerably exterminated redundancies. Furthermore, system integration aids the integration of hardware and software solutions sourced from a large pool of IT players. Increasing demand for telecommunications systems to improve network coverage is encouraging various telecom companies to enrich their business operations. For instance, February 2022, Cisco Systems, Inc. signed an agreement with Rakuten Mobile, Inc.’s subsidiary Rakuten Symphony, Inc. to develop infrastructure solutions for Open RAN technology-powered 45G/5G mobile networks. Cisco Systems, Inc. would leverage its expertise in cloud computing to develop mobile networks equipped with cloud-native Open Radio Access Network (ORAN) technology and help the company improve its brand value in the IT and telecom sectors.

Regional Insights

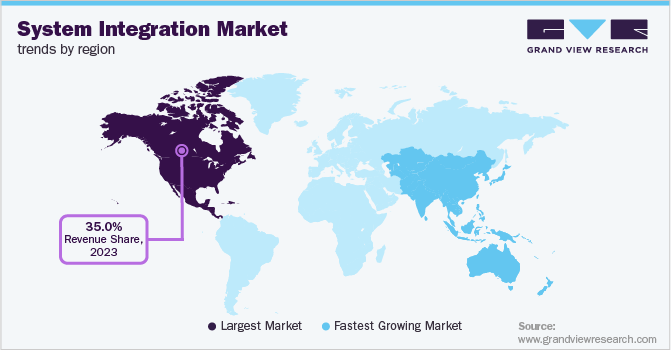

North America held a market share of over 35% in 2022, owing to the rising use of IoT in industrial automation and the growing adoption of cloud-based services among large organizations. Moreover, the BFSI sector in the region has embraced modern-day technology, which presents significant growth prospects for the system integration market in North America. To this end, banks are taking considerable care to ensure they meet every client’s requirement. For instance, according to Bank of America, 70% of its customers use digital services for their financial needs. It can help the bank to develop its client base and stay competitive in the market. The migration of organizations to these services will increase the demand for system integration services in the region during the forecast period.

Europe System Integration Market

The European system integration market was estimated to be valued at USD 93.36 billion in 2022. The growth of the system integration market in Europe can be attributed to increased partnership/collaboration activities, which have enabled the companies operating in the European region to have access to advanced system integration solutions. For instance, in December 2023, Infosys and LKQ Europe, a European distributor of automobile aftermarket components, established a five-year cooperation. Following LKQ's recent strategic acquisitions, the Bengaluru-based strategic partnership seeks to improve product availability, expedite end-to-end delivery, and optimize business operations. When it comes to standardizing and integrating systems and procedures for effectiveness and advantages, Infosys will set the standard.

U.K. System Integration Market

The U.K. system integration market was estimated to grow at a CAGR of around 15% over the forecast period. The growth of the system integration market in the U.K. can be attributed to factors such as expansion activities carried out by several companies in the system integration market. For instance, in October 2023, NeoDyne signals its growth and advancement in the U.K. by opening a new headquarters. A SolutionsPT partner is setting up shop in Chesterfield to serve its existing clients and use the region's engineering talent. NeoDyne, an AVEVA Endorsed Systems Integrator and a dependable partner of SolutionsPT, AVEVA Select Partner Ireland & U.K., has expanded with its new U.K. headquarters situated in Chesterfield, Derbyshire.

Germany System Integration Market

The German system integration market was estimated to hold a market share of around 32.8% in 2022 in the European system integration market. The growth of the system integration market in Germany can be attributed increasing investment in the country aimed at creation of technological industrial complex. For instance, in July 2023, Siemens announced plans to establish a blueprint for an industrial metaverse in the Nuremberg metropolitan area and invest ~USD 1.10 billion (EUR 1 billion) in Germany. Siemens is positioning its base in Erlangen as the center of global technological activities for the industrial metaverse and as a hub for research and development. Siemens will be able to spur innovation, strengthen its resilience, and accelerate its overall growth with these actions.

France System Integration Market

The France system integration market was estimated to grow at a CAGR of 14.3% over the forecast period. The growth of the system integration market in France can be attributed to initiatives by the government which has been pushing the growth of the market in the country. For instance, in September 2023, the French government porposed the mandates for B2B e-invoicing mandates. The new e-Invoicing platform is a joint project of the Direction Générale des Finances Publiques (DGFIP), the French directorate of public finances, and the Agence pour l'informatique financière de l'Etat (AIFE), the state financial information agency. At this point, the DGFIP and AIFE's recommended revised schedule should still be regarded as preliminary. It will be verified once the government announces the 2024 Finance Act in October 2023 at the latest.

Asia Pacific System Integration Market

The Asia Pacific system integration market is anticipated to rise as the fastest developing regional market at a CAGR of 16.2%, owing to the rapid growth of the Asian economies resulting in increasing investments in system integration. Furthermore, there is a growing demand for network integration services due to the expanding IT & telecom sector in India, Singapore, South Korea, and China. Key market players in the region are establishing a strategic partnership for business development which is expected to propel industry growth. For instance, in March 2022, tech Mahindra Limited announced a partnership with Bharti Airtel, a telecommunication service provider, to build innovative solutions for India’s economy. With this partnership, both companies bring enterprise-grade private networks, which would focus on Ariel’s integrated connectivity portfolio of 5G mobile network, SDWAN, fiber, and IoT, along with Tech Mahindra’s system integration capabilities.

China System Integration Market

China's system integration market was estimated to be valued at USD 34.49 billion in 2022. The growth of the system integration market in China can be attributed to factors such as increasing investment in the country for various projects. For instance, in February 2023, GCL System Integration Technologies, a Chinese firm, declared that it would invest around ¥2 billion (~$292 million) to construct a high-efficiency solar module factory capable of producing 12 GW of electricity annually. A combination of money from self-raised funds, commissions from government building projects, loans from financial institutions, and project industry funds will be used to finance the project.

India System Integration Market

India system integration market was expected to register a CAGR of over 17% over the forecast period. The government of India has taken action to support the industrial sector and increase both local and international investment in India, which has contributed to the expansion of the system integration market in that country. A few of these are the Phased Manufacturing Programme (PMP), the introduction of the Goods and Services Tax, the reduction of corporate tax, the reforms of the FDI policy, the steps taken to lessen the burden of compliance, the introduction of interventions to make doing business easier, and the policy measures to increase domestic manufacturing through public procurement orders.

Japan System Integration Market

Japan's system integration market was estimated to be USD 28.67 billion in 2022. The growth of the system integration market in India can be attributed to factors such as increasing strategic initiatives undertaken by the system integration solution providers in the country. For instance, in September 2023, Boomi, a pioneer in intelligent connection and automation, today announced a new alliance with Sazae Japan, Inc. ("Sazae"), a well-known supplier of consulting services for digital transformation. Boomi is Sazae's first partner in Japan for an integration platform as a service (iPaaS). Sazae Pty Ltd's Japanese affiliate is well-established in Singapore, Vietnam, and Japan. Sazae plans to integrate the user-friendly, low-code Boomi platform into its extensive range of upstream IT consulting services for various sectors of the economy.

Middle East & Africa System Integration Market

The Middle East & Africa system integration market held a market share of around 4% in 2022 in the global system integration market. The growth of the system integration market in the Middle East & Africa can be attributed to factors such as the increasing number of strategic initiatives in the region, which helps enable the clients in the region to have access to advanced system integration solutions. For instance, in June 2023, GitLab was named as a focal partner in a Strategic Partnership deal released by MDS System Integration Group. As the firm expands, MDS SI and its affiliates want to provide solutions to improve GitLab client acceptance and promote the advantages of a unified DevSecOps platform.

Saudi Arabia System Integration Market

Saudi Arabia's system integration market is expected to witness high growth during the forecast period. The growth of the system integration market in Saudi Arabia can be attributed to strategic initiatives and activities put forth by the government in KSA, which has been a major factor in pushing for growth. For instance, in October 2022, The Saudi Information Technology Company (SITE) and NIL Ltd, a division of Conscia Group, recently announced their strategic alliance to form a national business that will be focused on creating and managing systems integration projects, including establishing infrastructures, data centers, and operations centers, as well as developing and localizing systems integration capabilities.

Key Companies & Market Share Insights

Some of the key players operating in the market include Microsoft Corporation, IBM Corporation, and Oracle Corporation.

-

Microsoft Corporation is a global technology company providing comprehensive solutions that connect applications and services seamlessly across on-premises and cloud environments. Further, the integrated solutions help unify business workflows to achieve consistent and scalable outcomes along with exposing APIs for developers, fostering opportunities for innovative business models.

-

IBM Corporation specializes in providing technological solutions and enterprise software. Organizations across the world are realizing the need for digital transformation as it brings innovation and accelerates time to market. However, during this transformation, data frequently becomes confined in silos, hindering users, both internal and external, from accessing essential information. The integrated solutions offered by IBM Corporation help businesses to establish connections among various applications and systems, facilitating the rapid and secure discovery of critical data.

Mavenir, Livares Technologies Pvt Ltd., and Boomi are some of the emerging market participants in the system integration market.

-

Mavenir is a software-based cloud-native network software company. The company is helping businesses in pioneering advanced technology and building the future of networks. Further, the company focuses on software-based automated networks that run on any cloud environment. Mavenir is among the only end-to-end, cloud-based network software companies focused on transforming the way global business connects.

-

Boomi is an intelligent integration and automation solution provider to help businesses focus more on innovation and less on maintenance aspects. The platform offered by the company allows customers to be self-managing, self-learning, and self-scaling.

Key System Integration Companies:

- Accenture

- NEC Corporation

- Atos SE

- Boomi

- Capgemini

- Cisco Systems, Inc.

- Cognizant

- Deloitte Touche Tohmatsu Limited

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- Livares Technologies Pvt Ltd.

- MDS SI

- Mavenir

- Oracle Corporation

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Wipro

Recent Developments

-

In February 2023 Schneider Electric, Capgemini, and Qualcomm Technologies, Inc. announced a revolutionary 5G-enabled automated hoisting solution. The project involved the replacement of traditional wired connections with a cutting-edge wireless 5G Private Network solution, streamlining digital technology deployment at scale across industrial sites. this collaboration simplifies and optimizes digital technology deployment across industrial sites, showcasing significant advancements in system integration

-

In June 2023, Cisco launched a new Security Service Edge (SSE) solution enabling seamless and secure access across any location, device, and application. The service addresses challenges like inconsistent access experiences and enhances productivity by intelligently steering traffic to both private and public destinations, eliminating the need for end-user intervention and streamlining access management for enhanced efficiency

-

In February 2023, Cisco Systems, Inc., a digital communications conglomerate, announced a partnership with NEC Corporation, an information technology company. This partnership involves integrating systems and exploring potential opportunities in the realms of 5G xHaul and private 5G. This collaboration aims to assist customers in transforming their architecture, enabling them to connect to a broader spectrum of people and things.

-

In April 2023, Oracle Corporation, a global technology company, announced the launch of new capabilities across the Oracle Fusion Cloud Applications Suite. It is expected to help customers strengthen their supply chain planning, improve financial accuracy, and increase operational efficiency. The innovations comprise usage-based pricing, introducing advanced planning and rebate management capabilities within Oracle Fusion Cloud Supply Chain & Manufacturing.

-

In June 2023, IBM Corporation announced the acquisition of Apptio, a financial and operational IT management and optimization software company. To manage the significant rise in complexity, businesses are switching towards Apptio's solutions for simplified and integrated visibility into technology spending across the multi-cloud and hybrid-cloud environments, associated resources, and labor. Thus, this acquisition will strengthen IBM Corporation's IT automation capabilities and help business leaders deliver greater business value across their technology investments.

System Integration Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 385.95 billion

Revenue forecast in 2030

USD 955.21 billion

Growth rate

CAGR of 13.8% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Services, Enterprise Size, End-Use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K., France, Italy, China, Japan, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, and South Africa

Key companies profiled

Accenture; NEC Corporation; Atos SE; Boomi; Capgemini; Cisco Systems, Inc.; Cognizant; Deloitte Touche Tohmatsu Limited; HCL Technologies Limited; IBM Corporation; Infosys Limited; Livares Technologies Pvt Ltd.; MDS SI; Mavenir; Oracle Corporation; Tata Consultancy Services Limited; Tech Mahindra Limited; and Wipro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global System Integration Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global system integration market report based on services, enterprise size, end-use, and region:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrastructure Integration

-

Application Integration

-

Consulting

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

Defense & Security

-

BFSI

-

Oil & Gas

-

Healthcare

-

Transportation

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global system integration market size was estimated at USD 353.92 billion in 2022 and is expected to reach USD 385.95 billion in 2023.

b. The global system integration market is expected to grow at a compound annual growth rate of 13.8% from 2023 to 2030 to reach USD 955.21 billion by 2030.

b. North America dominated the system integration market with a share of over 35% in 2022. This is attributable to huge investments made by the government for the adoption of innovative solutions within various departments.

b. Some key players operating in the system integration market are Accenture, Capgemini, Fujitsu Limited, Oracle Corporation, Infosys Limited, Cisco Systems, Inc., Cognizant, Computer Sciences Corporation (CSC), Deloitte Touche Tohmatsu Limited, Hewlett Packard Company, IBM Corporation, Tata Consultancy Services Ltd., and HCL Technologies

b. The rising advancements in cloud technologies, increasing use of the Internet of Things (IoT), and rising investment in distributed information technology systems (telecommunication networks and real-time process control), are a few factors contributing to the growth of this market.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. System Integration Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. System Integration Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. System Integration Market: Services Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. System Integration Market: Services Movement Analysis, USD Billion, 2023 & 2030

4.3. Infrastructure Integration

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Application Integration

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5. Consulting

4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. System Integration Market: Enterprise Size Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. System Integration Market: Enterprise Size Movement Analysis, USD Billion, 2023 & 2030

5.3. Large Enterprises

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Small & Medium Enterprises

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. System Integration Market: End-Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. System Integration Market: End-Use Movement Analysis, USD Billion, 2023 & 2030

6.3. IT & Telecom

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. Defense & Security

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.5. BFSI

6.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.6. Oil & Gas

6.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.7. Healthcare

6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.8. Transportation

6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.9. Retail

6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.10. Others

6.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. System Integration Market: Regional Estimates & Trend Analysis

7.1. System Integration Market Share by Region, 2023 & 2030 (USD Billion)

7.2. North America

7.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.2.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.2.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.2.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.2.5. U.S.

7.2.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.2.5.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.2.5.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.2.5.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.2.6. Canada

7.2.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.2.6.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.2.6.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.2.6.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.3. Europe

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.3.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.3.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.3.5. U.K.

7.3.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.5.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.3.5.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.3.5.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.3.6. Germany

7.3.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.6.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.3.6.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.3.6.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.3.7. France

7.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.7.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.3.7.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.3.7.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.3.8. Italy

7.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.8.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.3.8.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.3.8.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.4. Asia Pacific

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.4.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.4.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.4.5. China

7.4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.5.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.4.5.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.4.5.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.4.6. India

7.4.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.6.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.4.6.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.4.6.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.4.7. Japan

7.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.7.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.4.7.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.4.7.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.4.8. Australia

7.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.8.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.4.8.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.4.8.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.4.9. South Korea

7.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.9.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.4.9.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.4.9.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.5. Latin America

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.5.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.5.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.5.5. Brazil

7.5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.5.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.5.5.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.5.5.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.5.6. Mexico

7.5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.6.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.5.6.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.5.6.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.6. Middle East & Africa

7.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.1.1. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.6.1.2. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.6.1.3. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.6.2. UAE

7.6.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.2.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.6.2.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.6.2.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.6.3. Saudi Arabia

7.6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.3.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.6.3.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.6.3.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

7.6.4. South Africa

7.6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.4.2. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

7.6.4.3. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

7.6.4.4. Market Size Estimates and Forecasts by End-Use, 2018 - 2030 (USD Billion)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Participants

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis

8.5. Company Heat Map Analysis

8.6. Strategy Mapping

8.6.1. Expansion

8.6.2. Mergers & Acquisition

8.6.3. Partnerships & Collaborations

8.6.4. New Product Launches

8.6.5. Research And Development

8.7. Company Profiles

8.7.1. Accenture

8.7.1.1. Participant’s Overview

8.7.1.2. Financial Performance

8.7.1.3. Product Benchmarking

8.7.1.4. Recent Developments

8.7.2. Atos SE

8.7.2.1. Participant’s Overview

8.7.2.2. Financial Performance

8.7.2.3. Product Benchmarking

8.7.2.4. Recent Developments

8.7.3. Capgemini

8.7.3.1. Participant’s Overview

8.7.3.2. Financial Performance

8.7.3.3. Product Benchmarking

8.7.3.4. Recent Developments

8.7.4. Cisco Systems, Inc.

8.7.4.1. Participant’s Overview

8.7.4.2. Financial Performance

8.7.4.3. Product Benchmarking

8.7.4.4. Recent Developments

8.7.5. Cognizant

8.7.5.1. Participant’s Overview

8.7.5.2. Financial Performance

8.7.5.3. Product Benchmarking

8.7.5.4. Recent Developments

8.7.6. Deloitte Touche Tohmatsu Limited

8.7.6.1. Participant’s Overview

8.7.6.2. Financial Performance

8.7.6.3. Product Benchmarking

8.7.6.4. Recent Developments

8.7.7. DXC Technology Company

8.7.7.1. Participant’s Overview

8.7.7.2. Financial Performance

8.7.7.3. Product Benchmarking

8.7.7.4. Recent Developments

8.7.8. HCL Technologies Limited

8.7.8.1. Participant’s Overview

8.7.8.2. Financial Performance

8.7.8.3. Product Benchmarking

8.7.8.4. Recent Developments

8.7.9. IBM Corporation

8.7.9.1. Participant’s Overview

8.7.9.2. Financial Performance

8.7.9.3. Product Benchmarking

8.7.9.4. Recent Developments

8.7.10. Infosys Limited

8.7.10.1. Participant’s Overview

8.7.10.2. Financial Performance

8.7.10.3. Product Benchmarking

8.7.10.4. Recent Developments

8.7.11. Livares Technologies Pvt Ltd.

8.7.11.1. Participant’s Overview

8.7.11.2. Financial Performance

8.7.11.3. Product Benchmarking

8.7.11.4. Recent Developments

8.7.12. MDI SI

8.7.12.1. Participant’s Overview

8.7.12.2. Financial Performance

8.7.12.3. Product Benchmarking

8.7.12.4. Recent Developments

8.7.13. Mavenir

8.7.13.1. Participant’s Overview

8.7.13.2. Financial Performance

8.7.13.3. Product Benchmarking

8.7.13.4. Recent Developments

8.7.14. NEC Corporation

8.7.14.1. Participant’s Overview

8.7.14.2. Financial Performance

8.7.14.3. Product Benchmarking

8.7.14.4. Recent Developments

8.7.15. Oracle Corporation

8.7.15.1. Participant’s Overview

8.7.15.2. Financial Performance

8.7.15.3. Product Benchmarking

8.7.15.4. Recent Developments

8.7.16. Tata Consultancy Services Limited

8.7.16.1. Participant’s Overview

8.7.16.2. Financial Performance

8.7.16.3. Product Benchmarking

8.7.16.4. Recent Developments

8.7.17. Tech Mahindra Limited

8.7.17.1. Participant’s Overview

8.7.17.2. Financial Performance

8.7.17.3. Product Benchmarking

8.7.17.4. Recent Developments

8.7.18. Wipro

8.7.18.1. Participant’s Overview

8.7.18.2. Financial Performance

8.7.18.3. Product Benchmarking

8.7.18.4. Recent Developments

List of Tables

Table 1 System integration market 2018 - 2030 (USD Billion)

Table 2 Global system integration market estimates and forecasts by region, 2018 - 2030 (USD Billion)

Table 3 Global system integration market estimates and forecasts by services, 2018 - 2030 (USD Billion)

Table 4 Global system integration market estimates and forecasts by enterprise size, 2018 - 2030 (USD Billion)

Table 5 Global system integration market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

Table 6 Services market by region, 2018 - 2030 (USD Billion)

Table 7 Infrastructure integration market by region, 2018 - 2030 (USD Billion)

Table 8 Application integration market by region, 2018 - 2030 (USD Billion)

Table 9 Consulting market by region, 2018 - 2030 (USD Billion)

Table 10 Enterprise size market by region, 2018 - 2030 (USD Billion)

Table 11 Large enterprises market by region, 2018 - 2030 (USD Billion)

Table 12 Small & medium enterprises market by region, 2018 - 2030 (USD Billion)

Table 13 End use market by region, 2018 - 2030 (USD Billion)

Table 14 BFSI market by region, 2018 - 2030 (USD Billion)

Table 15 Defense & Security market by region, 2018 - 2030 (USD Billion)

Table 16 BFSI market by region, 2018 - 2030 (USD Billion)

Table 17 Oil & Gas market by region, 2018 - 2030 (USD Billion)

Table 18 Healthcare market by region, 2018 - 2030 (USD Billion)

Table 19 Transportation market by region, 2018 - 2030 (USD Billion)

Table 20 Retail market by region, 2018 - 2030 (USD Billion)

Table 21 Others market by region, 2018 - 2030 (USD Billion)

Table 22 North America system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 23 North America system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 24 North America system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 25 U.S. system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 26 U.S. system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 27 U.S. system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 28 Canada system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 29 Canada system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 30 Canada system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 31 Europe system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 32 Europe system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 33 Europe system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 34 U.K. system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 35 U.K. system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 36 U.K. system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 37 Germany system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 38 Germany system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 39 Germany system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 40 France system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 41 France system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 42 France system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 43 Italy system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 44 Italy system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 45 Italy system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 46 Asia Pacific system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 47 Asia Pacific system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 48 Asia Pacific system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 49 China system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 50 China system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 51 China system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 52 India system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 53 India system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 54 India system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 55 Japan system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 56 Japan system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 57 Japan system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 58 South Korea system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 59 South Korea system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 60 South Korea system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 61 Australia system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 62 Australia system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 63 Australia system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 64 Latin America system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 65 Latin America system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 66 Latin America system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 67 Brazil system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 68 Brazil system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 69 Brazil system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 70 Mexico system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 71 Mexico system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 72 Mexico system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 73 MEA system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 74 MEA system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 75 MEA system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 76 UAE system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 77 UAE system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 78 UAE system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 79 Saudi Arabia system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 80 Saudi Arabia system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 81 Saudi Arabia system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

Table 82 South Africa system integration market, by services, 2018 - 2030 (Revenue, USD Billion)

Table 83 South Africa system integration market, by enterprise size, 2018 - 2030 (Revenue, USD Billion)

Table 84 South Africa system integration market, by end-use, 2018 - 2030 (Revenue, USD Billion)

List of Figures

Fig. 1 System Integration Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 System Integration Market: Industry Value Chain Analysis

Fig. 12 System Integration Market: Market Dynamics

Fig. 13 System Integration Market: PORTER’s Analysis

Fig. 14 System Integration Market: PESTEL Analysis

Fig. 15 System Integration MarketShare by Services, 2023 & 2030 (USD Billion)

Fig. 16 System Integration Market, by Services: Market Share, 2023 & 2030

Fig. 17 Infrastructure Integration Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Application Integration Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Consulting MarketShare by Operating System, 2023 & 2030 (USD Billion)

Fig. 20 System Integration MarketShare by Enterprise Size, 2023 & 2030 (USD Billion)

Fig. 21 System Integration Market, by Enterprise Size: Market Share, 2023 & 2030

Fig. 22 Large Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Small & Medium Enterprises Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 System Integration MarketShare by End-Use, 2023 & 2030 (USD Billion)

Fig. 25 System Integration Market, by End-Use: Market Share, 2023 & 2030

Fig. 26 IT & Telecom Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 27 Defense & Security Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 28 IBFSI Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Oil & Gas Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Healthacare Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Transportation Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 32 Retail Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 33 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 Regional Marketplace: Key Takeaways

Fig. 35 North America System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 36 U.S. System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 37 Canada System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 38 Europe System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 39 U.K. System Integration Market Estimates and Forecasts, 2018 - 2030,) (USD Billion)

Fig. 40 Germany System Integration Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 41 France System Integration Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 42 Italy System Integration Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 43 Asia Pacific System Integration Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 44 China System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 Japan System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 India System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 South Korea System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Australia System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 49 Latin America System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 50 Brazil System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 Mexico System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 52 MEA System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 53 Saudi Arabia System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 UAE System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 South Africa System Integration Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 Key Company Categorization

Fig. 57 Company Market Positioning

Fig. 58 Key Company Market Share Analysis, 2022

Fig. 59 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- System Integration Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- System Integration Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- System Integration End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- System Integration Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- North America System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- North America System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- U.S.

- U.S. System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- U.S. System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- U.S. System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- U.S. System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Canada

- Canada System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Canada System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Canada System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Canada System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- North America System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe

- Europe System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Europe System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Europe System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Germany

- Germany System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Germany System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Germany System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Germany System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- UK

- UK System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- UK System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- UK System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- UK System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- France

- France System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- France System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- France System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- France System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Italy

- Italy System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Italy System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Italy System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Italy System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific

- Asia Pacific System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Asia Pacific System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Asia Pacific System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- China

- China System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- China System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- China System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- China System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Japan

- Japan System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Japan System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Japan System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Japan System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- India

- India System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- India System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- India System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- India System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Australia

- Australia System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Australia System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Australia System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Australia System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- South Korea

- South Korea System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- South Korea System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- South Korea System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- South Korea System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Latin America

- Latin America System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Latin America System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Latin America System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Brazil

- Brazil System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Brazil System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Brazil System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Brazil System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Mexico

- Mexico System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Mexico System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Mexico System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Mexico System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Latin America System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Middle East and Africa

- Middle East and Africa System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Middle East and Africa System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Middle East and Africa System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Saudi Arabia

- Saudi Arabia System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- Saudi Arabia System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- Saudi Arabia System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- Saudi Arabia System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- United Arab Emirates (UAE)

- United Arab Emirates (UAE) System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- United Arab Emirates (UAE) System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- United Arab Emirates (UAE) System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- United Arab Emirates (UAE) System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- South Africa

- South Africa System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Infrastructure Integration

- Application Integration

- Consulting

- South Africa System Integration Market Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small & Medium Enterprises

- South Africa System Integration Market End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

- South Africa System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Middle East and Africa System Integration Market Services Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the system integration market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for system integration market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of system integration market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

System Integration Market Categorization:

The system integration market was categorized into three segments, namely services (Infrastructure Integration, Application Integration, Consulting), end-use (IT & Telecom, Defense & Security, BFSI, Oil & Gas, Healthcare, Transportation, Retail), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The system integration market was segmented into services, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The system integration market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into fourteen countries, namely, the U.S.; Canada; Germany; the UK.; France; Italy; China; India; Japan; South Korea; Brazil; Mexico; South Africa; and Saudi Arabia.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

System integration market companies & financials:

The system integration market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-