- Home

- »

- Medical Devices

- »

-

Tattoo Removal Devices Market Size Report, 2022-2030GVR Report cover

![Tattoo Removal Devices Market Size, Share & Trends Report]()

Tattoo Removal Devices Market (2022 - 2030) Size, Share & Trends Analysis Report By Device (Laser Devices, Radiofrequency Devices), By End Use (Dermatology Clinics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-989-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

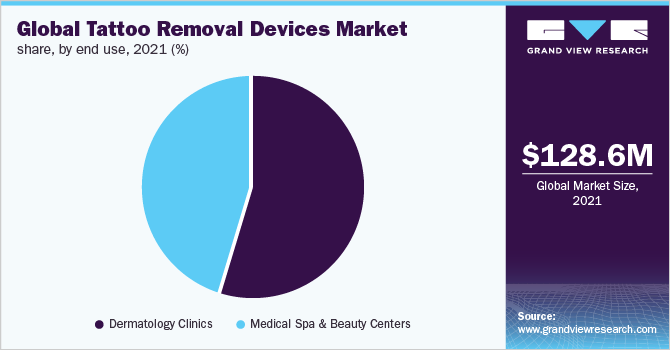

The global tattoo removal devices market size was estimated at USD 128.6 million in 2021 and is expected to expand at a CAGR of 9.6% from 2022 to 2030. Increasing adoption of laser treatments for aesthetic procedures and high demand for tattoo removal are the major market drivers. Growing demand for non-invasive procedures for aesthetics is also fueling the market growth. The market saw a significant setback due to the COVID-19 pandemic. The pandemic resulted in a reduction of various aesthetic procedures as they were not medical necessities, leading to the closure of medical aesthetic centers and dermatology clinics. However, after the second quarter of 2020, aesthetic procedures like tattoo removal started resuming and this might boost the market growth.

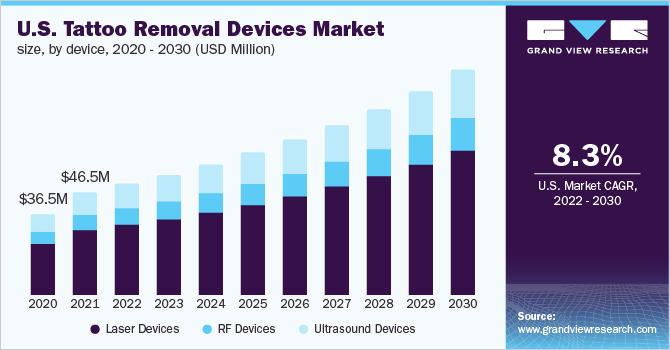

The high prevalence of ‘tattoo regret’ among millennials is expected to propel the demand for tattoo removal devices. For instance, according to an article published by B&T MAGAZINE, nearly 28.6% of females and around 29.7% of males wish to remove their tattoos while more than 35.0% of the population in the age group of 18-21 who have been inked, regret their tattoos. The U.S. Laser Devices Segment held the highest CAGR of 9.6% in 2021. A wide range of techniques, such as laser therapy, pulsed light therapy, dermabrasion, plastic surgery, and chemical peels, are used for tattoo removal. The majority of these techniques are effective, safe, and non-invasive.

Thus, an increase in popularity of these techniques coupled with growing demand for non-invasive procedures is expected to boost the tattoo removal market in the forecast period. Most U.S. companies refrain from hiring candidates with a tattoo, especially in the areas such as below the wrist, above the collar, and face. For instance, as per a study conducted by Pew Research Center, nearly 76% of the study participants believed that visible tattoos reduce the hiring chances of a candidate during an interview, while, around 42% of the participants believe that visible tattoos are inappropriate at the workplace. Thus, such social issues related to tattoos are anticipated to increase the demand for tattoo removal.

The advent of COVID-19 led to the closure of many aesthetic facilities as they are close contact services and the risk of transmission was high leading to the faster spread of the virus. However, many aesthetic clinics like MedSpas and dermatology centers witnessed a gradual increase in the second quarter of 2020 and the professionals witnessed high demand for aesthetic services. Many dermatologists believe that the pandemic may act as a springboard for aesthetic treatments like tattoo removal which is going to increase the market growth during the forecast period.

Device Insights

The laser devices segment held the highest market share of 62.8% in 2021 and is expected to witness the highest growth during the forecast period. Based on device, the market is categorized into laser, radiofrequency, and ultrasound devices. Amongst these, the laser device segment held the highest market share due to the fact that it is currently deemed as a gold standard device for efficient and safe tattoo removal services. Laser devices can remove black as well as colored tattoo stains with overall good results and a relatively low degree of adverse effects.

The various types of lasers used in the market include Q-switched Nd-YAG laser, Q-switched ruby laser, and Q-Switched Alexandrite laser. These devices efficiently remove the black as well as colored tattoos. Features of laser devices such as the reduced risk of infection and minimal damage to nearby skin cells, no side effects, and ease of use are anticipated to fuel segment growth.

End-use Insights

The dermatology clinic segment held the highest market share of 54.6% in 2021. On the basis of end-use, the market is divided into dermatology clinics, and medical spas & beauty centers. The dermatology clinics segment dominated the market in 2021. This can be attributed to the presence of skilled and certified professionals in such clinics. Dermatologists have proper medical training to ensure avoidance of scarring, change in the skin’s texture, and burns and other wounds during or after the removal treatment, thus increasing the procedure safety and facilitating segment growth.

The medical spa and beauty centers segment is expected to witness the highest growth over the forecast period owing to speedy approvals from local authorities. This can be attributed to the increasing popularity of these centers since such medical spas and beauty centers are generally located alongside coffee shops, clubs, and other youth attraction places. Increasing demand for safe and effective tattoo removal procedures globally is prompting medical spas and beauty centers to adopt innovative removal techniques. The techniques adopted by medical spas are extremely hygienic and safe. Moreover, these treatments are only performed by licensed experts, thus facilitating segment growth.

Regional Insights

North America dominated the global tattoo removal devices market and accounted for a revenue share of 43.0% in 2021. The market is anticipated to grow at a significant rate over the forecast period. This can be attributed to the increasing number of tattoo parlors and a growing number of individuals getting inked and the availability of advanced tattoo removal devices. Europe followed North America in terms of market share in 2021 due to growing innovations in laser tattoo removal techniques and speedy adoption of laser technology in the region. In addition, a high consumer preference for laser treatment as compared to other treatments is fueling market growth in the region.

Asia Pacific is estimated to be the fastest-growing region over the forecast period owing to an increase in the number of individuals getting inked, in countries such as Japan and India. In addition, increasing disposable income especially in developing countries is anticipated to fuel market growth. Continuous technological advancements in the industry and a growing preference for non-invasive procedures are factors that are likely to drive the market in the region.

Key Companies & Market Share Insights

Key players are actively involved in the enhancement of existing technologies, new product launches, product portfolio expansion, and others. In August 2020, Lumenis Ltd announced the launch of its latest innovation, the NuEra Tight with FocalRF technology. This is a non-invasive RF body treatment platform and is available in the U.S., Europe, Asia, and the Middle East. Lutronic, one of the leading players in the market, announced the U.S. FDA clearance for the Lutronic Genius device in February 2019. Some of the prominent players in the global tattoo removal devices market include:

-

Lutronic Corporation

-

Hologic (Cynosure, Inc.)

-

Alma Lasers, Ltd.

-

Syneron candela

-

Astanza, EL.En. S.p.A

-

Cutera Inc.

-

Lumenis Ltd.

Tattoo Removal Devices Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 139.4 million

Revenue forecast in 2030

USD 289.6 million

Growth rate

CAGR of 9.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Lutronic Corporation; Hologic (Cynosure, Inc.); Alma Lasers, Ltd.; Syneron candela; Astanza; EL.En. S.p.A; Cutera Inc.; Lumenis Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global tattoo removal devices market report on the basis of device, end-use, and region:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser Devices

-

Radiofrequency Devices

-

Ultrasound Devices

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology Clinics

-

Medical Spa & Beauty Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global tattoo removal devices market size was estimated at USD 128.6 million in 2021 and is expected to reach USD 139.4 million in 2022.

b. The global tattoo removal devices market is expected to grow at a compound annual growth rate of 9.6% from 2022 to 2030 to reach USD 289.6 million by 2030.

b. North America dominated the tattoo removal devices market with a share of 33.5% in 2021. This is attributable to rising increasing number of tattoo parlors and individuals getting inked coupled with the availability of advanced procedures.

b. Some key players operating in the tattoo removal devices market include Lutronic Corporation; Hologic (Cynosure, Inc.); Alma Lasers, Ltd.; Syneron candela; Astanza; EL.En. S.p.A; Cutera Inc.; and Lumenis Ltd.

b. Key factors that are driving the tattoo removal devices market growth include the high prevalence of ‘tattoo regret’ among millennials and social issues such as reduced job prospects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.