- Home

- »

- Next Generation Technologies

- »

-

Tax Management Software Market Size & Share Report 2030GVR Report cover

![Tax Management Software Market Size, Share & Trends Report]()

Tax Management Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Type, By Tax Type, By Deployment, By End-user, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-127-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tax Management Software Market Summary

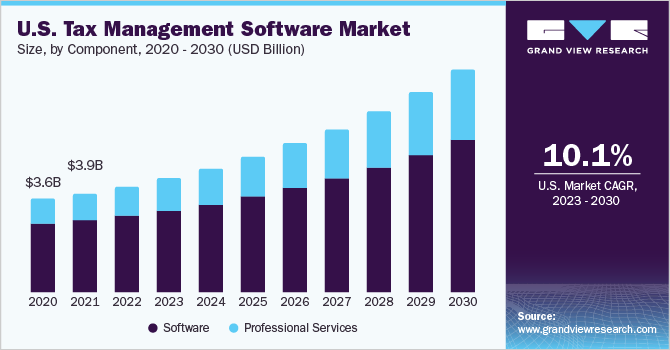

The global tax management software market size was estimated at USD 18.74 billion in 2022 and is projected to reach USD 39.71 billion by 2030, growing at a CAGR of 10.1% from 2023 to 2030. The market growth can be attributed to various factors, such as the evolving regulatory landscape and frequent changes in tax laws.

Key Market Trends & Insights

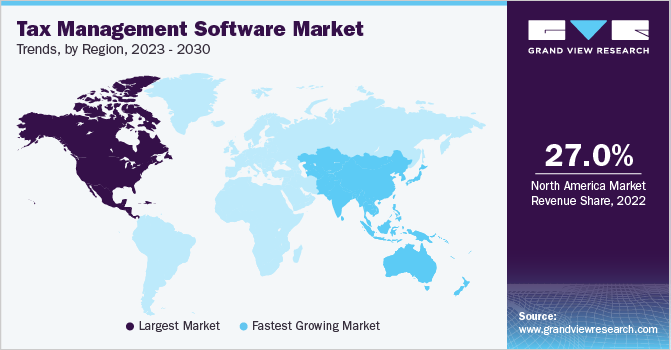

- North America tax management software market dominated with a revenue share of over 27% in 2022.

- Asia Pacific tax management software market is expected to register the fastest growth during the forecast period.

- By component, software segment accounted for the largest revenue share of over 72% in 2022.

- By type, tax compliance software segment held the largest share of over 26% in 2022.

- By deployment, on-premise segment dominated with a share of over 51% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 18.74 Billion

- 2030 Projected Market Size: USD 39.71 Billion

- CAGR (2023–2030): 10.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

To cope with these challenges, businesses and professionals demand tax compliance and tax preparation software for up-to-date tax rules, real-time compliance monitoring, and automated tax calculations. Hence, tax management software ensures that users can accurately prepare their taxes and minimize the risk of errors or penalties. The adoption of cloud computing has substantially impacted the expansion of tax management software positively.

Cloud-based platforms offer many benefits, including scalability, flexibility, and remote accessibility. Users can securely store their tax data in the cloud, eliminating the necessity for physical storage and manual backups. In addition, cloud-based tax software enables seamless integration with other financial systems, providing an organization with a comprehensive solution for tax management. As businesses across the globe increasingly embrace cloud technology, the demand for cloud-based tax management software is poised to soar. The rapid technological advancements in the areas, including Artificial Intelligence (AI) and Machine Learning (ML), have brought about a transformative change in the market.

These cutting-edge technologies have empowered software platforms to automate monotonous tasks, analyze vast amounts of data, and offer valuable tax planning and optimization insights. Through harnessing the power of AI and ML, tax management software has become increasingly intelligent, precise, and effective, fueling its extensive adoption and proliferation within the business landscape worldwide. Furthermore, the increasing internet and smartphone penetration across the globe is also anticipated to fuel the market’s growth over the forecast period. The escalating emphasis on compliance and risk management has emerged as a significant catalyst for expanding tax management software.

Tax authorities across the globe have heightened their scrutiny to ensure organizations' adherence to tax regulations, making it imperative for businesses to establish robust systems. Tax management software provides important functionalities, including real-time monitoring of tax positions, risk assessment, and comprehensive reporting. By leveraging these capabilities, businesses can effectively comply with tax laws and regulations, mitigating potential risks and ensuring adherence to tax requirements. Thus, this emphasis on compliance and risk management is projected to fuel the market’s growth over the forecast period. While the market is poised for growth in the forecast period, certain challenges are expected to hinder the market's growth.

One notable restraining factor is the apprehension surrounding data security and privacy. Businesses and individuals have become increasingly cautious about safeguarding their sensitive financial information in an era marked by numerous high-profile data breaches and stringent privacy regulations. Any perceived vulnerabilities in tax software platforms can deter potential users from embracing them. Consequently, it is paramount for industry stakeholders to address these concerns by implementing robust security measures, employing state-of-the-art encryption protocols, and ensuring compliance with data protection regulations. The tax management software industry can foster trust, bolster confidence, and pave the way for sustained growth by actively addressing data security and privacy concerns.

COVID-19 Impact Analysis

The COVID-19 pandemic has positively impacted the market. Several governments have implemented relief measures and tax policy changes in response to the crisis, and businesses and individuals faced complex tax implications and reporting requirements. This increased the demand for reliable and efficient tax management software solutions that could adapt to these rapidly changing regulations. The pandemic also highlighted the need for remote work and digital collaboration. This led to a greater emphasis on cloud-based tax software platforms that enable seamless access to tax information and facilitate remote tax preparation and filing.

In addition, the economic uncertainties caused by the pandemic prompted businesses to focus more on cost optimization and tax planning, driving the adoption of advanced tax management software with features, such as tax forecasting, scenario analysis, and compliance automation. While the long-term effects of the pandemic on the market are still unfolding, it has undoubtedly accelerated the digital transformation of tax processes and highlighted the importance of agile and robust software solutions in navigating the complexities of tax management during challenging times.

Component Insights

The software segment accounted for the largest revenue share of more than 72.0% in 2022. The COVID-19 pandemic has accelerated the adoption of digital solutions, including tax management software, as remote work and digital collaboration become the norm. Furthermore, the increasing launches and the pilot programs related to the new offering for tax management software are anticipated to fuel the growth of the segment. For instance, in May 2023, the Internal Revenue Service (IRS) announced its plans to launch a pilot program for the year 2024 for free e-filing system. As a result of this launch, it will help taxpayers in filing their taxes directly to the IRS for free.

The professional services segment is poised to experience rapid growth in the forecast period, emerging as the fastest-growing segment within the market. The growing adoption of tax management software forces clients to avail of various professional services, such as training & education, consulting & implementation, and other support-related services. Furthermore, the services segment growth can also be attributed to the rising complexity of tax regulations leading to the need for consulting and implementation services. Moreover, the globalization of business operations has expanded the need for international tax expertise, thereby driving the growth of the segment over the forecast period.

Type Insights

The tax compliance software segment accounted for the largest revenue share of more than 26.0% in 2022. The growth of the tax compliance software segment can be attributed to various factors, such as the increasing complexity of tax regulations and reporting requirements. For instance, governments worldwide are constantly introducing new tax laws and regulations, making it essential for businesses to have robust systems in place to ensure compliance. Furthermore, the compliance software offers advanced features, such as automated calculations, real-time updates, and comprehensive reporting capabilities, enabling businesses to navigate the intricacies of tax compliance efficiently and accurately.

In addition, the shift towards digitalization and the increasing reliance on technology in business processes have further propelled the growth of the tax compliance software segment. The tax preparer software segment is poised to experience rapid growth in the forecast period, emerging as the fastest-growing segment within the market. Due to various factors, such as the rising use of the internet & smartphones and growing tax complexity, the tax preparer software segment is anticipated to grow over the forecast period. Tax preparer software offers advanced functionalities, including automated data entry, error checking, and real-time updates on tax laws. These features empower users to streamline their tax preparation processes, mitigate the risk of errors, and enhance overall accuracy.

Tax Type Insights

The direct tax segment accounted for the largest revenue share of more than 53.0% in 2022. The direct tax segment is witnessing substantial growth due to several factors, including the escalating complexity of tax regulations and the imperative for accurate and efficient tax management. Direct tax management software offers advanced functionalities, including automated calculations, real-time updates on tax laws, and comprehensive reporting capabilities. These features empower users to streamline their tax management processes, minimize errors, and ensure strict compliance with tax regulations. In addition, direct tax management software provides robust data analysis and forecasting tools, enabling users to make informed decisions and optimize their tax strategies.

The indirect tax segment is anticipated to witness significant growth over the forecast period. Businesses face the challenge of navigating intricate tax laws and ensuring compliance with changing regulations. With the shift towards digitalization and the globalization of businesses, there is a growing demand for software solutions that integrate with financial systems, facilitate cross-border tax compliance, and provide robust risk management functionalities. Furthermore, the increasing launches of indirect tax management software are anticipated to fuel the segment’s growth. For instance, in November 2021, Thomson Reuters, a tax management software provider, announced the launch of the indirect Tax (IDT) Determination Anywhere platform. As a result of this launch, it provided tax professionals with a tax determination engine at any point of a transaction within any channel.

Deployment Insights

The on-premise segment dominated the market with a revenue share of over 51.0% in 2022. On-premise tax management software often allows companies to have greater control over their data. As a result, on-premise tax management software is the preferred choice for many enterprises, as it offers the best way to secure and manage their data. Furthermore, companies, such as Sage Group plc, are involved in providing on-premise digital signature solutions to its users, enabling them to ensure and maintain high data security.

For instance, Sage Group plc’s Sage Intacct has a strong tax management capability and supports cloud and on-premise deployments. The cloud segment is anticipated to witness the fastest growth over the forecast period. The cloud segment growth can be attributed to the increasing adoption of cloud-based tax management software worldwide. The growing adoption can be attributed to factors including multi-device support and easy integration with other financial APIs. Furthermore, the growing cloud infrastructure across various countries is anticipated to fuel the growth of the segment over the forecast period.

End-user Insights

The large enterprises segment dominated the market with a revenue share of over 63.0% in 2022. Large enterprises adopt tax management software because it enables large enterprises to streamline and automate their intricate tax processes. With extensive amounts of financial data and intricate tax rules to navigate, manual tax management becomes time-consuming, prone to errors, and inefficient. Tax management software’s advanced features empower large enterprises to enhance accuracy, minimize errors, and strictly comply with tax regulations.

The small & medium enterprises segment is anticipated to witness the fastest growth over the forecast period. Small enterprises opt for tax management software for various compelling reasons, such as to simplify tax management for these businesses. With limited resources and personnel, small enterprises may need help in efficiently handling tax compliance. Furthermore, by leveraging tax management software, small enterprises can optimize their tax workflows, enhance accuracy, and ensure tax compliance.

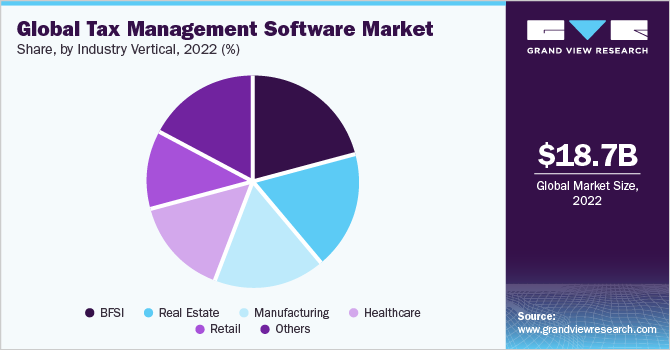

Industry Vertical Insights

The BFSI segment dominated the market with a revenue share of over 21.0% in 2022. The BFSI is experiencing swift adoption of tax management software for several reasons, including the industry being bided to a highly regulated environment where intricate tax regulations prevail. The BFSI industry can effectively streamline its tax processes and ensure strict compliance by leveraging tax management software. Furthermore, the rising digitalization across the BFSI sector is also anticipated to drive the growth of the segment over the forecast period.

The retail segment is anticipated to witness the fastest growth over the forecast period. The retail industry operates in a dynamic and highly competitive environment where managing tax compliance efficiently is essential. Tax management software provides automation and accuracy in tax calculations. Furthermore, market players, such as Avalara, Inc., are involved in offering tax management software specialized for the retail sector, which bodes well for the segment's growth.

Regional Insights

North America dominated the market in 2022 and accounted for a share of over 27.0% of the global revenue. This growth can be attributed to the presence of prominent players, such as Wolters Kluwer N.V., Thomson Reuters, and Intuit, Inc., in the region Furthermore, the increasing launches of tax management software across the region are further anticipated to fuel the market’s growth. For instance, in February 2023, Avalara, Inc., a tax management software provider, announced the launch of Avalara Property Tax for businesses and accountants. As a result of this launch, the customers were enabled to leverage the software for improving tax compliance while introducing automation.

Asia Pacific is expected to witness the fastest growth over the forecast period. The growth of the region can be attributed to the increasing partnership between tax software providers and automation companies. For instance, in October 2021, Ryan, a global tax service and software-providing company, entered into a partnership with Alteryx, Inc., an analytics automation company. This partnership was aimed towards enhancing Ryan’s ability to deliver technology-enabled transformation to help customers improve their business outcomes by automating their tax process leveraging the newly launched solution.

Key Companies & Market Share Insights

The market is slightly fragmented market due to the presence of several prominent players. The market players aim at new product launches as part of their efforts to better their offerings. For instance, in April 2023, Vestmark, Inc., a wealth management software and service provider, announced the launch of VAST, an outsourced portfolio management service focusing on personalization at scale. As a result of this launch, it will offer various benefits, such as comprehensive tax management, flexible open architecture of investment options, streamlined implementation & simple-to-use advisor interface, and time savings & revenue growth, to its customers.

To further expand their global presence, several companies are working on strategic planning, such as partnerships, collaborations, mergers, and acquisitions. For instance, in February 2023, BitPay, a crypto payment application, entered into a partnership with ZenLedger, a crypto tax management software. This partnership was aimed at simplifying cryptocurrency tax filing for all Bitpay users. Some prominent players in the global tax management software market include:

-

Wolters Kluwer N.V

-

SAP SE

-

Thomson Reuters

-

Intuit, Inc.

-

Corvee, LLC

-

HRB Digital LLC

-

TaxJar

-

Vertex, Inc.

-

TaxSlayer LLC

-

Avalara, Inc.

Tax Management Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.21 billion

Revenue forecast in 2030

USD 39.71 billion

Growth rate

CAGR of 10.1% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, type, tax type, deployment, end-user, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Wolters Kluwer N.V; SAP SE; Thomson Reuters; Intuit, Inc.; Corvee, LLC; HRB Digital LLC; TaxJar; Vertex, Inc.; TaxSlayer LLC; Avalara, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tax Management Software Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the tax management software market report based on component, type, tax type, deployment, end-user, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Professional Services

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Corporate Tax Software

-

Professional Tax Software

-

Tax Preparer Software

-

Tax Compliance Software

-

Others

-

-

Tax Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Indirect Tax

-

Direct Tax

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premise

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare

-

Retail

-

Manufacturing

-

Real Estate

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tax management software market size was estimated at USD 18.74 billion in 2022 and is expected to reach USD 20.21 billion in 2023.

b. The global tax management software market is expected to grow at a compound annual growth rate of 10.1% from 2023 to 2030 to reach USD 39.71 billion by 2030.

b. North America dominated the tax management software market with a share of 27.11% in 2022. The growth of the regional market can be attributed to the presence of prominent market players such as Wolters Kluwer N.V., Thomson Reuters, and Intuit, Inc. across the region.

b. Some key players operating in the tax management software market include Wolters Kluwer N.V; SAP SE; Thomson Reuters; Intuit, Inc.; Corvee, LLC; HRB Digital LLC; TaxJar; Vertex, Inc.; TaxSlayer LLC; Avalara, Inc.

b. Key factors that are driving the market growth include the complex nature of tax systems across the globe and increasing digitalization, and rising volume of financial transactions across verticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.