- Home

- »

- Healthcare IT

- »

-

Technology Solutions In U.S. Healthcare Payer Market, 2030GVR Report cover

![Technology Solutions In The U.S. Healthcare Payer Market Size, Share & Trends Report]()

Technology Solutions In The U.S. Healthcare Payer Market (2024 - 2030) Size, Share & Trends Analysis Report By Application, By Solution Type (Standalone, Integrated), By Payer Type (Government, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-195-5

- Number of Report Pages: 149

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

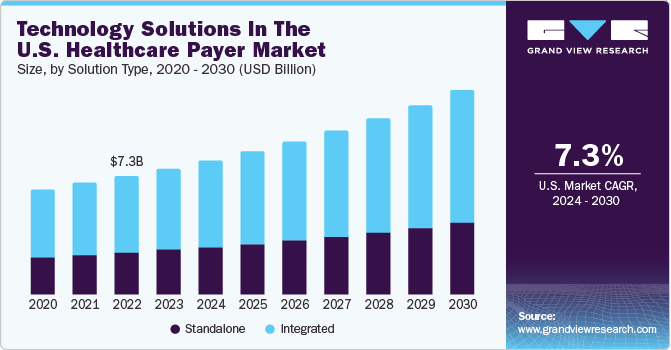

The technology solutions in the U.S. healthcare payer market size was estimated at USD 7.8 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. Market growth is driven by the modernization of enrollment and billing processes, increased acquisitions by market leaders, rising investor and venture capitalist interests, and the transformative impact of innovative technologies in healthcare. For instance, in July 2021, CitiusTech expanded its payer services business by acquiring SDLC Partners. This strategic move was driven by SDLC's established capabilities and a highly skilled team renowned for delivering impactful solutions to clients.

In addition, the demand for operational optimization to streamline administrative processes, reduce costs, and enhance efficiency is expected to propel market growth over the forecast period. In the healthcare payer sector, strategic acquisitions have been on the rise post the COVID-19 pandemic, aiming to expand market reach, diversify service offerings, and leverage innovative technologies. For instance, in October 2022 UnitedHealth Group's Optum concluded a USD 13 billion acquisition of Change Healthcare. This strategic move integrates Change Healthcare into the OptumInsight business, aligning with the goal of providing revenue cycle management, data analytics, research, advisory services, software, and technology-enabled services offerings to enhance healthcare efficiency for end users.

Furthermore, introducing AI-enabled products in the healthcare payer industry is anticipated to drive market expansion in the forecast period. For example, in August 2022, Codoxo, a provider of artificial intelligence solutions for healthcare payers, agencies, and pharmacy benefits managers (PBMs), launched its innovative generative AI product, ClaimPilot. This product is designed to enhance the efficiency of healthcare cost containment and payment integrity programs significantly, addressing challenges in the healthcare workforce.

“Codoxo is investing deeply in groundbreaking AI applications to create a more affordable and efficient healthcare system. Our generative AI tackles the industry’s most complex and relatively untouched frontier of healthcare claims, fueling a future where manual, resource-intensive tasks are automated.”

- Musheer Ahmed, CEO and Founder, CodoxoMarket Concentration & Characteristics

The technology solutions in the U.S. healthcare payer market exhibit a high degree of innovation. Key players continually invest in new product development to meet the increasing demand for solutions such as clinical data analytics.

The level of M&A activities in the market is high. Several market players such as Zyter (Zyter|TruCare) and HealthEdge Software, Inc are involved in merger and acquisition activities. Through M&A activity, these companies are expected to expand their geographic reach and enter new territories.

The market experiences moderate regulatory influence, primarily addressing fraud and abuse in healthcare to mitigate provider misconduct and recover misappropriated funds from healthcare programs. Key market players are strategically investing in the development of solutions that align with these regulations.

In addition, major players are expanding their solutions to meet growing market demand. For instance, Oracle integrates AI-powered workforce management capabilities into Oracle Fusion Cloud HCM to address staffing requirements for healthcare organizations.

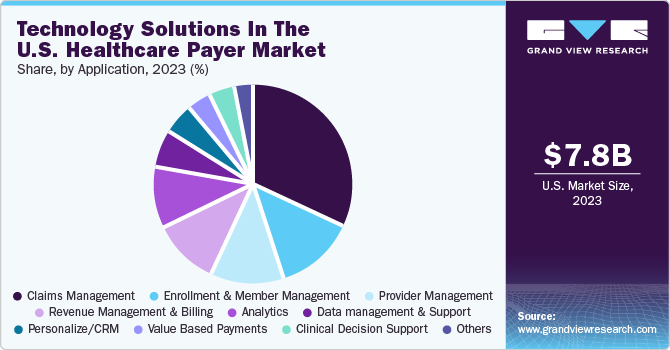

Application Insights

Based on application, the market is segmented into enrollment and member management, provider management, claims management, value-based payments, revenue management and billing analytics, personalized/CRM, clinical decision support, data management and support, and others. The claims management segment held the majority of the market share of 32.2% in the application segment in 2023. Timely reimbursement, cost reduction, fraud prevention, and provider relationships depend on efficient claim processing. As the population of insured individuals and the demand for healthcare services continue to increase, insurance claims are also rising. According to a report published by the U.S. Census Bureau in September 2022, titled Health Insurance Coverage in the United States: 2021, 8.3% of the population, equivalent to 27.2 million individuals, were without health insurance in 2021. This indicates a reduction in the rate of uninsured individuals and the total number of uninsured people compared to the figures from 2020, which stood at 8.6% or 28.3 million, respectively.

On the other hand, the revenue management and billing segment is poised for rapid growth throughout the forecast period. These solutions enable payers to identify and recover lost revenue by detecting denied or underpaid claims. Additionally, they offer automation and streamlining of billing and collection processes, leading to staff efficiency and error reduction. For instance, Oracle Insurance Revenue Management and Billing demonstrates the capability to process premium bills for over 50 million individual policies in a single day, nearly three times the total number of individual policies in the US. Furthermore, Blue Shield of California, with over four million health plan members, opted for Oracle ERP Cloud to streamline numerous application interfaces, resulting in overall monthly cost savings.

On the other hand, the revenue management and billing segment is expected to witness the fastest growth rate over the forecast period. These solutions enable payers to identify and recover lost revenue by detecting denied or underpaid claims. Additionally, they offer automation and streamlining of billing and collection processes, leading to staff efficiency and error reduction.

For instance, Oracle Insurance Revenue Management and Billing demonstrates the capability to process premium bills for over 50 million individual policies in a single day, nearly three times the total number of individual policies in the U.S. Furthermore, Blue Shield of California, with over four million health plan members, opted for Oracle ERP Cloud to streamline numerous application interfaces, resulting in overall monthly cost savings.

-“We now have 8,500 Fusion ERP customers with revenue growing 35% and 28,400 NetSuite ERP customers with revenue growing 29%.” - Safra Catz, CEO, Oracle.Solution Type Insights

Based on solution type, the market is segmented into standalone and integrated. The integrated segment held most of the market share in the solution-type segment in 2023 and is expected to witness the fastest growth during the forecast period. Integrated systems reduce administrative burdens, foster effective collaboration, streamline data management, and yield substantial cost savings, providing members with a unified healthcare platform. Zyter's TruCare Connected Health solutions are one of the examples. This integrated solution aids healthcare organizations in complying with CMS interoperability regulations, encompassing patient access APIs, provider directory APIs, and data exchange between payers, streamlining compliance efforts. Furthermore, integrating data analytics supports informed decision-making and enhances member care, contributing to segment growth in the forecast period. The increasing focus on value-based care and population health management further propels the market's expansion.

Integrated solutions streamline data collection, analysis, and sharing, simplifying outcome tracking, reducing costs, and enhancing patient care. The evolving healthcare regulatory landscape, encompassing reporting and compliance requirements, has driven the adoption of integrated healthcare payer solutions.

Payer Type Insights

Based on payer type the market is segmented into government and commercial. The commercial segment held the largest market share in 2023 and is anticipated to witness fastest growth over the forecast period. Commercial payers, including Aetna, UnitedHealth, Humana, Anthem, and Cigna, specialize in providing group and individual health insurance policies. While employers commonly offer these insurance plans to individuals, they can also be directly purchased or acquired through insurance marketplaces. The growing adoption of health insurance within the population leads commercial healthcare payers to adopt technologically advanced solutions for operational optimization.

Key Technology Solutions In The U.S. Healthcare Payer Company Insights Oracle, Cognizant (Trizetto Business Line), and Pegasystems Inc. are the dominant players in the market.

-

Oracle’s Oracle Cloud covers 46 interconnected geographic regions, providing a comprehensive range of Oracle Cloud Applications and over 100 Oracle Cloud Infrastructure services.

-

Cognizant (Trizetto Business Line) offerings include interoperability solutions, core administration, provider reimbursement solutions, provider solutions, optimization software products, connected health solutions, business process-as-a-service, and other related solutions.

HealthEdge Software, Inc., ZeOmega., Hyland Software, Inc., Zyter. (Zyter|TruCare), Medecision, OSP, Open Text Corporation, and MedHOK, Inc. (MHK) are some of the emerging players functioning in the clinical data analytics solutions market.

-

HealthEdge Software, Inc.’s offerings include care management, healthcare payer solutions, account management, integration kit, business intelligence, portal solutions, and other related products & services.

-

The team at HealthEdge is working toward more standardized processes and a more integrated experience for customers of multiple HealthEdge solutions, including ‘GuidingCare’ for care management, ‘Source’ for payment integrity, and ‘Wellframe’ for digital member engagement. As more integration points across these solutions become available, customers will have a more seamless experience working with HealthEdge.

“I have been through multiple claims systems, and HealthRules Payor is by far one of the best claims systems that I have seen in the marketplace. The ease of use and ease of configuration have been amazing”

- Vice President, August 2021

-

Hyland Software, Inc. company provides solutions for various industries, such as healthcare, financial services, government, insurance, media & entertainment, education, manufacturing, CPG & retail, and other related industries.

Key Technology Solutions In The U.S. Healthcare Payer Companies:

The following are the leading companies in the technology solutions in the U.S. healthcare payer market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these technology solutions in the U.S. healthcare payer companies are analyzed to map the supply network.

- HealthEdge Software, Inc.

- Cognizant (Trizetto Business Line)

- ZeOmega.

- Oracle

- Pegasystems Inc.

- Hyland Software, Inc.

- Zyter. (Zyter|TruCare)

- Medecision

- OSP

- Open Text Corporation.

- MedHOK, Inc. (MHK)

Recent Developments

-

In October 2023, Prime Therapeutics LLC/Magellan Rx Management, LLC expanded its partnership with MedHOK, Inc. to manage member enrollment with the MarketProminence platform.

-

In August 2023, ZeOmega integrated Jiva Population Health Enterprise Management Platform's solution with Microsoft Cloud for healthcare. It maximizes the efficiency of health plans with enhanced workflow automation and improves patient engagement.

-

In June 2023, Cognizant (Trizetto Business Line) expanded its collaboration with Microsoft to deliver cloud-based technology solutions for the healthcare sector, enabling business transformation.

-

In April 2023, Medecision launched the Aerial Social Care Coordinator to offer health plans and healthcare providers immediate & valuable information about individuals' social determinants of health barriers.

Technology Solutions In The U.S. Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.3 billion

Revenue forecast in 2030

USD 12.6 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Application, solution type, payer type

Key companies profiled

Oracle; Cognizant (Trizetto Business Line), Pegasystems Inc.; HealthEdge Software, Inc.; ZeOmega.; Hyland Software, Inc.; Zyter. (Zyter|TruCare); Medecision; OSP; Open Text Corporation; MedHOK, Inc. (MHK)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Technology Solutions In The U.S. Healthcare Payer Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the technology solutions in the U.S. healthcare payer market report based on application, solution type, and payer type:

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Enrollment and Member Management

-

Provider Management

-

Claims Management

-

Value based Payments

-

Revenue Management and Billing

-

Analytics

-

Personalize/CRM

-

Clinical Decision Support

-

Data management and support

-

Others

-

-

Solution Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Standalone

-

Integrated

-

-

Payer Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Government

-

Commercial

-

Frequently Asked Questions About This Report

b. The technology solutions in the U.S. healthcare payers market was estimated at USD 7.8 billion in 2023 and is expected to reach USD 8.3 billion in 2024.

b. The technology solutions in the U.S. healthcare payers market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 12.6 billion in 2030.

b. Claims management dominated the technology solutions in the U.S. healthcare payers market, with a share of 32.2% in 2023. This is attributable to the increasing adoption of claims management solutions for timely reimbursement, cost reduction, and fraud prevention.

b. Some of the key players operating the technology solutions in the U.S. healthcare payers market include Oracle, Cognizant, Pegasystems Inc., HealthEdge Software, Inc., ZeOmega., Hyland Software, Inc., Zyter. (Zyter|TruCare), Medecision, OSP, Open Text Corporation, and MedHOK, Inc. (MHK).

b. key factors that are driving the market growth includes modernization of enrollment and billing processes, increased acquisitions by market leaders, rising investor and venture capitalist interests, and the transformative impact of innovative technologies in healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.